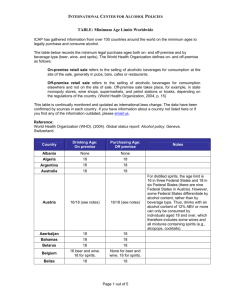

Alcohol Issues in 2012 - Food Industry Association Executives

advertisement

Food Industry Association Executives San Antonio, TX November 9, 2011 9-Liter Case Shipments (Mil.) Spirits Volume Increased 2% in 2010 2 2.0% 200 1.7% 1.4% 2.2% 4.1% 180 160 2.0% 3.0% 1.0% 140 120 100 Source: DISCUS MSDB 3.8% 4.1% 2.7% Supplier Gross Rev (Bil.) Spirits Revenues Rose 2.3% in 2010 3 20 18 16 14 12 10 8 6 4 2 0 $11.7 $12.2 Source: DISCUS MSDB $13.2 $13.9 $17.2 $16.0 $15.1 $18.2 $18.7$18.7 $19.1 Spirits Continuing to Gain Market Share 33.3% of the alcohol market (revenues) in 2010 A five point gain since 2000 10.9% increase in spirits retail licensees since 2000 …versus a 0.6% decline in beer licensees …but beer outlets still outnumber spirits 3 to 1 There’s room to grow! Volume Growth by Price Category 2002-2007 Consistent Rapid Growth By Premium+ Products 16.0% 14.0% 14.7% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% -0.2% 5.3% 5.8% 0.0% -2.0% Value 5 Premium High End Super Premium Whiskey (All Types) Accounts for 29% of industry volume 47 million cases Industry revenues $5.6 billion Volume was up 1.4% in 2010 Value brands down (-2.0%), premium flat Strong performance among high end (5%) & super (8.1%) Categories: 6 Irish whiskey up 21.5% Single Malt Scotch up 11.7% Bourbon & Tennessee up 2.5% (Super premium up 16.2%) Blended Scotch down 1.4% Vodka Accounts for 31% of industry volume 59 million 9-Liter cases, up 6.1% 25% of industry revenues ($4.8 billion) Revenues up $230 million in 2010 Performance by price segments Value: volume up 3.8%, revenue up 2.5% (+$26M) Premium: volume up 8.9%, revenue up 6.7% (+$80M ) High End: volume up 3.2%, revenue up 0.2% ($3M) Super Premium: volume up 17.7%, revenue up 13.8% (+122M) 7 Other Major Spirits Categories Rum growing slowly Case volume up 1.4% to 24.9 million cases Revenues down 0.9% to $2.2 billion Low volume growth due to weak pricing Tequila popularity continues Volume up 3.6% to 11.6 million cases Revenues up 4% to $1.7 billion High end brands lead this category, up 17% 8 2010 U.S. Spirits Market = $19.2 billion 9 Summary During recession volumes grew but revenues were flat Both volume and revenues now accelerating Recession trading down kept consumers in spirits Easier to trade up in recovery Spirits continue to gain market share Moderate growth expected Craft distiller phenomenon creating new consumer interest 10 Grocery Retailers Want in on the Action Distilled spirits and wine are high margin products Market shares are growing New products on the shelves bring new customers Beverage Alcohol Grocery Store Sales Spirits, Beer, Wine Beer and wine Beer only States Expected to Consider Grocery Sales of Alcohol in 2012 Colorado (strong beer, wine and spirits) Connecticut (wine) Kansas (wine and spirits) Kentucky (wine) Massachusetts (wine and spirits) New York (wine) Oklahoma (full-strength beer) Tennessee (wine) Distiller Concerns About Allowing Wine Only in Grocery Stores Diverts wine customers away from package stores Opportunities to purchase spirits would decrease Consumers would substitute wine “occasions” for spirits Some package stores will go out of business Availability of spirits would further decrease Promised new tax revenues would not materialize Wine tax rates are about 1/3 of spirits rates Decline in spirits tax revenues could lead to tax hikes A Complicated Situation for Distillers We have to oppose wine only in grocery stores It could seriously damage our spirits business Our studies show it would cut store traffic 20-40% We do support legislation that modernizes ABC laws Spirits growth depends on expanding market access Grocery chains are already among our biggest retailers But, we also support our independent package stores A Possible Way Forward in Massachusetts Grocers and package stores have compromise deal Current 3 license limit will grow to 9 over time Allows expansion by independents and chains alike New Jersey stores are looking at a similar solution Package store lobby can be surprisingly strong Politicians don’t want to hurt small business Best advice: Look for win-win solutions