Crossover for Biz Cafe - Welcome to Prospect Learning

advertisement

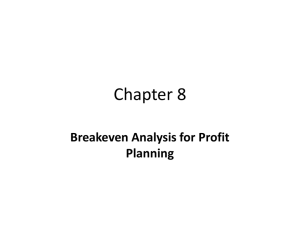

Biz-Café Breakeven and Cross-Over Bakery Strategy Ted Mitchell Biz-Café Bakery • • • • • • Sell baked goods for $2.00 each with a volume at 30% of cups sold You have three options 1) buy an oven $4,000 and variable cost of 50¢ 2) buy ready-made at $1.00 each 3) do nothing Breakeven Quantity • The cost of the oven is F=$4,000. The average selling price of the pastry is P=$2 and the cost of making a pastry is V=50¢. How many pastry items must be sold to breakeven on the cost of the oven? • Z = PQ – VQ – F • 0 = $2Q – $0.5Q – $4,000 • 4,000 = 1.5Q • Q = 4,000/1.5 = 2,667 items to breakeven Memorized the BEQ equation? • The cost of the oven is F=$4,000. The average selling price of the pastry is P=$2 and the cost of making a pastry is V=50¢. How many pastry items must be sold to breakeven on the cost of the oven? • BEQ = F/(P-V) • BEQ = 4,000/(2-0.50) = 4,000/1.5 • BEQ = 2,667 items Forecasting sales • Breakeven Quantity = 2,667 items • Biz-Café is expecting 30% of its customers to buy a pastry and the normal weekly sales of coffee is 2,100 cups. How many weeks before the oven is paid for? • Forecasted sales 30% of 2,100 cups = 630 items a week • Time required = 2,667/630 = 4.2 or 5 weeks Forecasting the Time it takes • using a Two-Factor Model • • • • • • • • Quantity sold = (quantity per week) x (# of weeks) Q = (Q/W) x W Need to know the number of weeks, W We know the anticipated quantity sold per week, (Q/W) = 630 quantity that needs to be sold to breakeven, Q = 2,667 2,667 = 630 x W W = 2,667/630 = 4.2 or 5 weeks to breakeven What if we had the option of • Renting rather than Buying the Oven • Renting the oven at F = $15 per week? The pastry sells for P = $2.00 per item and the variable cost per item is V = 50¢. What is the breakeven quantity each week? • BEQ = F/(P-V) • BEQ = $15/(2.00 – 0.50) • BEQ = 10 items a week Is it reasonable to sell 10 items a week? • Your normal weekly sales are 2,100 cups • You anticipate 30% of the cup sales will be pastry sales • Anticipated pastry sales =2,100 x 30% • Anticipated pastry sales = 630 items a week • Only need 10 sales per week to breakeven on the rental cost! Is the Breakeven Quantity for the Total Cost of the Oven Useful? • There are two numbers that could be used • 1) The Total Cost of the Oven, F = $4,000 • 2) The allocated or depreciated cost of the oven each week • The oven is depreciated over 5 years or over (52 x 5 =) 260 weeks • The cost of the Oven each week is • $4,000/260 weeks = $15.38 per week Depreciation is NOT cash • Use Depreciation when planning forward to calculate breakeven with a meaningful matching of costs and revenues each week • Do NOT use Depreciation when calculating the profit impact when dropping the bakery business • The Cost of the Oven is a Sunk Cost! Breakeven Quantity for buying ready-made pastry? • What is the breakeven volume if the Biz-Café buys the ready-made pastry for $1.00 each and sells them for $2.00 each? • BEQ = 0 items There are no fixed costs to cover! What is the Better Deal? • Option 1 Baking our own pastry each week • Profit Contribution = (Price – Variable Cost) Quantity – Fixed Cost • Z1 = ($2.00 – $0.50)Q - $15.38 • Option 2 Selling Ready-Made pastry • Z2 = ($2.00 - $1.00)Q • Depends on the Volume Sold, Q • What is the Cross-Over Quantity Cross Over Point Between two profit contributions from two strategies Profit contributed by a strategy Q* Quantity Sold Calculating the Cross-Over Quantity • • • • • • • • • • Z1 = ($2.00 – 0.50)Q - $15.38 Z2 = ($2.00 - $1.00)Q Set Profit Contributions, Z, equal to each other Z1 = Z2 ($2.00 – 0.50)Q* - $15.38 = ($2.00 - $1.00)Q* $1.5Q* - 15.38 = $1.00Q* ($1.50-$1.00)Q* = 15.38 $0.50Q* = 15.38 Q* = 15.38/0.5 Q* = 30.76 cups per week is the cross-over point Cross Over Point Between two profit contributions from two strategies Profit contributed by a strategy Z1 = Own bakery Z2 = Ready Made 31 items Quantity Sold Weekly Cross Over Point Between two profit contributions from two strategies Profit contributed by a strategy Z1 = Own bakery Z2 = Ready Made 31 items Quantity Sold 630 items forecasted • It would have been far more interesting if the crossover point was 700 items sold and the anticipated sales were 630 items • Then you can have a qualitative discussion on the value of ambiance! Any Questions • We have learned that cross-over analysis is useful and its potential for application is not obvious to most students