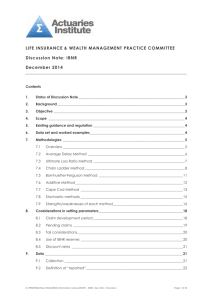

Construction Defect Claim Management and Reserving

advertisement

Buckeye Actuarial Continuing Education April 26, 2011 Construction Defect Claim Management and Reserving Presented by: Nathan Voorhis, FCAS, MAAA Robin Leibrock, JD Steven Jokerst, FCAS, MAAA 2 What is a Construction Defect Claim? CGL Policy – completed operations Builder, developer, contractor, subcontractor Construction, repair, remodel Residential and commercial buildings Resultant BI or PD, not the work itself Types of defects Faulty design, workmanship or material Roofing, flashing, soil preparation, framing, waterproofing, doors & windows, carpentry Construction defect Multiple defendants, defects and policies 3 Where is this a Problem? Rapid growth and poor construction Litigious environment and highly organized plaintiff bar Continuous trigger occurrence California and other western states Certain states in northeast and southeast 4 Legal Decisions and Statutes (1995) Montrose vs. Admiral – known and progressive loss a covered occurrence (1996) Stonewall Ins. Co. vs. City of Palos Verdes Estates Montrose applied to CD claims (1997) Calderon Process / (2002) Steinberg Bill – establish procedures for filing CD claim (2001) Presley Homes vs. American States – broad duty to defend California Statute of Limitation and Repose Patent defect – 3 years if reasonably apparent Latent defect – 10 years if not apparent (2004) L-J, Inc. vs. Bituminous F&M – no coverage for “your work” 5 Coverage Endorsements Revise policy language to clearly reflecting intended coverage Occurrence Known or continuous loss (Montrose) exclusion – must first become aware during policy period Prior work exclusion – no coverage for work completed prior to stated date Redefine “occurrence” Exclusions for specified hazards and operations EIFS, mold, subsidence, imported drywall Roofing, residential construction 6 Coverage Endorsements Additional insured endorsement – subcontractor policy covers GC for work performed on his behalf Other insurance endorsement Failure to complete your work Subrogation against third parties Abandoning the project 7 CD Claim Adjustment/Adjudication Claim made by owner, developer, builder, general contractor Multiple Tenders Named insured; additional insured Co-carrier for Named Insured Indemnitee Document intensive HO Matrix Notice of Completion dates, Close of Escrow dates Multiple policies, contracts, job and correspondence files Trigger of Coverage 8 Liability Claim vs. CD Claim Liability Claim One or few plaintiffs Few defendants Known loss date Few damages / injuries One policy period triggered Shorter Statute of Limitation (BI 1-6 years; PD 1-10 years) Typically the primary focus is on Liability, rather than Coverage or Damages 9 Liability Claim vs. CD Claim CD Claim Multiple plaintiffs – sometimes 100’s of homeowners Multiple defendants – design professional, developer, general contractor, multiple subcontractors Undetermined loss date Multiple damages Multiple policy periods Longer Statute of Limitation (breach of contract 3-20 years) Typically the primary focus is on Damages and Coverage, rather than Liability 10 Contracts, Coverage and Allocation CD claims typically involve multiple contracts (design professional/owner; owner/developer; developer/builder; builder/GC; GC/sub; Sub/sub) The coverage available and priority of coverage must be analyzed for each contract and each policy triggered Allocation of claim costs Defense expenses – each policy is obligated to answer so most courts require cost sharing by equal shares; some courts allow sharing on a prorata basis Loss – time on risk; prorata by limits; combination 11 Difficulties with Traditional Actuarial Methods Very long reporting lag – Pure IBNR dominates Not ideal to combine with other book of general liability claims. Even if premises/operations claims are excluded, development pattern is different from typical products/completed operations pattern If construction defect triangles broken out separately, exposure base for Bornhuetter-Ferguson approach is subjective as there is no “construction defect” premium since triangles broken out by cause of loss. Most companies do not have sufficient accident year data to capture tail. Tail estimation is very subjective. Legislation has calendar year effect, affecting all accident years along a given diagonal. 12 General Liability Claim Count Accident Year Reported Development – CD vs NonCD 120.0% 80.0% % Reported - CD 60.0% % Reported - General Liability NonCD 40.0% 20.0% 12 11 10 9 8 7 6 5 4 3 2 1 0.0% Ye ar s % Reported 100.0% 13 General Liability Accident Year Incurred Loss Development – CD vs NonCD 120.0% 80.0% % Incurred - CD 60.0% % Incurred - NonCD 40.0% 20.0% 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 0.0% Ye ar s % Incurred 100.0% 14 General Liability Accident Year Paid Loss Development – CD vs NonCD 120.0% 100.0% 60.0% % Paid - CD 40.0% % Paid - NonCD 20.0% 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 0.0% Ye ar s % Paid 80.0% 15 Incurred But Not Enough Analysis Case Development Existing Claims Incurred loss development approach organized in a report year format. Significantly reduced tail Must allocate estimated report year IBNR to accident year • Can choose among various methods including incurred losses, case reserves, construction contractors premium, or other basis Multiple methods can be used; for simplicity this demonstration uses only an incurred development approach. 16 Incurred But Not Enough Analysis Report Year Construction Defect Loss Development General Liability Incurred Loss Report Year Development Construction Defect 120.0% % Incurred 100.0% 80.0% % Incurred 60.0% 40.0% 20.0% 0.0% Years 1 2 3 4 5 6 7 8 9 17 Incurred But Not Enough Analysis Report Year Summary of IBNE ($ Millions) Report Year 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Incurred Loss & ALAE $2,842 $4,713 $8,709 $18,646 $19,315 $18,465 $18,695 $30,311 $14,315 $10,143 $20,117 $17,701 $10,912 $9,640 $7,063 $7,300 $218,886 Inc CLDF 1.000 1.000 1.011 1.014 1.013 1.013 1.013 1.013 1.030 1.045 1.046 1.065 1.108 1.174 1.332 1.318 Ultimate Loss & ALAE $2,842 $4,713 $8,802 $18,916 $19,568 $18,706 $18,939 $30,707 $14,741 $10,599 $21,051 $18,849 $12,090 $11,314 $9,410 $9,619 $230,867 Indicated IBNE $0 $0 $93 $270 $253 $242 $244 $396 $427 $456 $934 $1,148 $1,178 $1,675 $2,347 $2,319 $11,981 18 Incurred But Not Enough Analysis Allocation of IBNE to Accident Year ($ Millions) Selected IBNE for all Report Years Accident Year 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Total Case Reserves $37 $132 $1,895 $328 $1,860 $4,254 $611 $878 $1,058 $88 $138 $297 $523 $1,494 $1,250 $166 $15,009 Case Reserves % of Total 0% 1% 13% 2% 12% 28% 4% 6% 7% 1% 1% 2% 3% 10% 8% 1% 100% $11,981 IBNE $29 $106 $1,513 $262 $1,485 $3,396 $488 $701 $845 $70 $110 $237 $417 $1,192 $998 $132 $11,981 19 Pure Incurred But Not Reported Analysis Accident year analysis of reported claim counts Selected Loss Severity Selected ALAE / Loss Ratio Selected Claims Closed with Pay 20 Pure IBNR Analysis Accident Year Claim Count Development 120.0% % Reported 100.0% 80.0% % Reported - CD 60.0% % Reported - General Liability NonCD 40.0% 20.0% 0.0% Years 1 2 3 4 5 6 7 8 9 10 11 12 21 Pure IBNR Analysis - Summary of IBNR Claim Counts (000’s) Selected IBNR Claim Counts Accident Year Reported Claim Counts Reported Claim CLDF Ultimate Claim Counts 1995 2,800 1.030 2,884 84 1996 13,181 1.035 13,644 463 1997 20,566 1.044 21,468 902 1998 4,571 1.059 4,842 271 1999 3,175 1.101 3,494 319 2000 6,122 1.163 7,118 997 2001 2,450 1.266 3,102 652 2002 2,972 1.404 4,172 1,200 2003 963 1.587 1,528 565 2004 291 1.883 547 256 2005 214 2.253 481 267 2006 336 2.802 942 606 2007 651 4.108 2,674 2,023 2008 2,279 4.834 11,014 8,735 2009 1,911 6.501 12,423 10,512 9.783 8,937 8,023 99,268 35,876 2010 914 63,392 22 Pure IBNR Analysis Selected Loss Severity Review past historical average paid loss and/or incurred loss severity ratios Exclude unusual claims or years Incorporate IBNE into incurred severity calculation 23 Pure IBNR Analysis Selected ALAE / Loss Ratio Review past paid ALAE to paid loss and/or incurred ALAE to incurred loss ratios Ratios above 100% not uncommon Alternatively, severity analysis separately for ALAE 24 Pure IBNR Analysis Selected Claims Closed without Pay Review past claims closed without pay to total closed ratios Ratios above 75% not uncommon; significant variability by policy year 25 Pure IBNR Analysis - Summary of IBNR Accident Year 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Total IBNR Counts (000's) 84 463 902 271 319 997 652 1,200 565 256 267 606 2,023 8,735 10,512 8,023 35,876 Loss ALAE/Loss Closed With IBNR Severity Ratio Payment % ($Millions) $10,000 100.0% 20.0% $336 $10,000 100.0% 20.0% $1,853 $10,000 100.0% 20.0% $3,606 $10,000 100.0% 20.0% $1,084 $10,000 100.0% 20.0% $1,278 $10,000 100.0% 20.0% $3,986 $10,000 100.0% 20.0% $2,607 $10,000 100.0% 20.0% $4,802 $10,000 100.0% 20.0% $2,260 $10,000 100.0% 20.0% $1,026 $10,000 100.0% 20.0% $1,070 $10,000 100.0% 20.0% $2,422 $10,000 100.0% 20.0% $8,092 $10,000 100.0% 20.0% $34,940 $10,000 100.0% 20.0% $42,049 $10,000 100.0% 20.0% $32,092 $143,505 26 Summary of Construction Defect Losses ($ Millions) Accident Year 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Total Case $37 $132 $1,895 $328 $1,860 $4,254 $611 $878 $1,058 $88 $138 $297 $523 $1,494 $1,250 $166 $15,009 IBNE $29 $106 $1,513 $262 $1,485 $3,396 $488 $701 $845 $70 $110 $237 $417 $1,192 $998 $132 $11,981 IBNR $336 $1,853 $3,606 $1,084 $1,278 $3,986 $2,607 $4,802 $2,260 $1,026 $1,070 $2,422 $8,092 $34,940 $42,049 $32,092 $143,505 Total Reserves $402 $2,091 $7,014 $1,674 $4,623 $11,636 $3,706 $6,380 $4,163 $1,183 $1,318 $2,956 $9,032 $37,626 $44,296 $32,390 $170,494 27 Recent Years Most recent three years or so still very green Possible approaches • Hold loss ratio (use earned premium exposure summarizing only construction contractors classes) • B/F accident year approach (use earned premium exposure summarizing only construction contractors classes) • Same approach as described if large and stable enough book of data 28 Q&A 29 Buckeye Actuarial Continuing Education April 26, 2011