Chapter 9: Risk and return

Chapter 10: Risk and return: lessons from market history

Corporate Finance

Ross, Westerfield, and

Jaffe

Outline

1. Returns

2. Capital market returns

3. Portfolio risk statistics

Dollar return

Suppose that you bought a bond for $1050 a year ago. You have received two semiannual coupons of

$50 each. The market price of the bond today is

$1100. What is your total dollar return?

Income = 50 + 50 = $100.

Capital gain = 1100 – 1050 = $50.

Total dollar return = 100 + 50 = $150.

Total dollar return = income + capital gain (loss).

Percentage return

It is more intuitive to think of returns in terms of percentages.

Return = (ending value – beginning value) / beginning value.

Return = ((1100 + 100) – 1050) / 1050 = 14.29%.

Return = income yield (return) + capital gain yield

(return) = 100 / 1050 + 50 / 1050 = 9.52% + 4.76% =

14.29%.

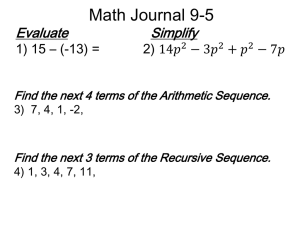

Holding period return

Holding period return: the cumulative return that an investor would obtain when holding an investment over a period of N years.

Holding period return example

Suppose that an investment yielded 4%, 7%,

8%, 0%, and 10% for the past 5 years. What is the holding period return for the 5 years?

Holding period return = (1 + 4%) × (1 + 7%) ×

(1 + 8%) × (1 + 0%) × (1 + 10%) – 1 =

32.2%.

Why capital market returns?

Examining capital market returns helps us determine the appropriate returns on nonfinancial assets (e.g., firm projects).

Lessons from capital market return history:

– There is a reward for bearing risk.

–

–

Return is positively related to risk.

This is called the “risk-return tradeoff.”

Average return, I

The simple average of a series of returns is called arithmetic average return.

Geometric average return: average compound return per period over multiple periods.

Average return example

Year Ret Arithmetic R 1 + Ret Power of 1/N Geometric R

1 0.08

0.076

1.08

1.074811381 0.07481138

2 -0.01

3 0.12

0.99

1.12

GR < AR

4 0.13

5 0.06

1.13

1.06

Multiplication term 1.4344

Average return, II

The geometric average will be less than the arithmetic average unless all the returns are equal.

The arithmetic average is overly optimistic for multiple horizons.

If the investment horizon is only 1 period, the arithmetic average is a better measure of likely return.

Arithmetic average return based on historical returns are often used as an estimate of expected return in real life.

Portfolio risk statistics

An investor cares about the return variability of her/his portfolio.

This variability at the portfolio level is usually measured by variance and/or standard deviation (std.).

Portfolio risk statistics, example

Year Ret Arithmetic R Diff

1 0.08

0.076

0.004

Diff^2

0.000016

Var Std

0.00313 0.055946

2 -0

3 0.12

-0.086

0.044

0.007396

0.001936

4 0.13

5 0.06

0.054

-0.016

Sum

0.002916

0.000256

0.01252

Historical performance, 1926-2008

Large stocks

Small Stocks

L-T Corporate Bonds

L-T Government Bonds

U.S. Treasury Bills

Inflation

Average Return Std

11.7% 20.6%

16.4% 33.0%

6.2% 8.4%

6.1% 9.4%

3.8% 3.1%

3.1% 4.2%

If normally distributed?

If we are willing to assume that asset returns are normally distributed, can you draw a return distribution based on the previous slide?

Hint: about 95% within +/ – 2 std.

End-of-Chapter

Concept questions: 1-10.

Questions and problems: 1-16 and 19-23.