Capturing the Services

advertisement

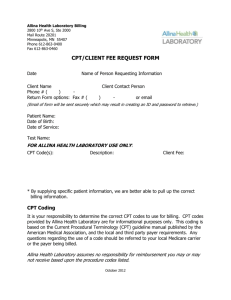

Clinical Documentation & Revenue Management: Capturing the Services Overview Prepared and Presented by Linda Hagen and Mae Regalado Presentation Outline 1. Context: Quality of Care, Revenue Optimization, and Compliance 2. Tools: Records, Systems, Templates, and Billing Forms 3. Process: Clinical Documentation and Coding 4. Question & Answer Context • Why is it important to revenue management that we capture enhanced clinical information? • Who finds it important? • What can happen if we do not capture enhanced clinical information? Clinical Documentation: Capturing the Services you Provide • Complete and Consistent – Capturing clinical documentation including all relevant diagnostic data within the treatment record improves the quality of care – Up-to-date and accurate clinical information – diagnostic and related to specific services provided enables improved billing and cash flow – Timely, accurate clinical records improve clinical and financial audit results Clinical Documentation • While billing is important, providers should not focus strictly upon capturing diagnostic and service data for reimbursement purposes only • Improved accuracy in the reporting of severity of illness and morbidity/mortality measures are critical to the overall quality of care and treatment outcomes • More accurate data supports value-based performance reporting as well as efforts aimed at cost effectiveness/efficiency. Clinical Documentation • Other Goals for Clinical Documentation: – Accurately capturing and reflecting the patient’s true severity of illness, clinician’s judgment, clinical decision-making in support of medical necessity – Enhancing interdisciplinary care team performance – Improving assessments, interventions and outcomes. Sample Copy of CMS-1500 Billing Form Sample Copy of UB04Billing Form Coding Accurate Coding is a priority for all healthcare providers and it is important to improve coding accuracy and ensure compliance with government regulations. There are two schools of thought on coding: • Some consultants recommend that clinicians do it, and others say that a billing person can handle it, using boxes checked off on a super bill. Coding • Kinds of Coding – HCPCS – CPT – ICD-9 – DSM-IV – NPI CPT Current Procedural Terminology (CPT) • CPT is maintained by the American Medical Association (AMA). The CPT code set accurately describes medical, surgical, and diagnostic services and is designed to communicate standardized information about medical services and procedures among physicians, coders, patients, accreditation organizations, and payers for administrative, financial, and analytical purposes. CPT: Units of Service • Units of service must be entered where appropriate. Examples of CPT codes requiring units of service include: – CPT 90853, 96100, 96105, 96110, 96111, 96115, 96117, 96152, 96153, 96154, 96155. HCPCS Healthcare Common Procedure Coding System (HCPCS) • Describes the specific items and services provided. HCPCS coding is necessary for Medicare and Medicaid and other health insurance programs to ensure that claims are processed in a consistent manner. With the implementation of HIPAA, use of the HCPCS for transactions involving health care information became mandatory Coding: Modifiers Modifiers • Modifiers are two-digit codes appended to procedure codes such as CPT and/or HCPCS codes, to provide additional information about the billed procedure. • In some cases, addition of a modifier may directly affect payment. ICD-9 ICD-9 • Diagnosis codes are used to group and identify diseases, disorders, symptoms, and medical signs, and are used to measure morbidity and mortality. • The International Classification of Diseases , 9th Edition (most commonly known by the abbreviation ICD-9) provides codes to classify diseases and a wide variety of signs, symptoms, abnormal findings, complaints, social circumstances, and external causes of injury or disease. • Under this system, every health condition can be assigned to a unique category and given a code, up to six characters long. ICD-10 ICD-10 Transition on October 1, 2013 • ICD-10 codes must be used on all HIPAA transactions, including outpatient claims with dates of service, and inpatient claims with dates of discharge on and after October 1, 2013. • Otherwise, your claims and other transactions may be rejected, and you will need to resubmit them with the ICD-10 codes. This could result in delays and may impact your reimbursements, so it is important to start now to prepare for the changeover to ICD-10 codes. UB04 What are UB04 Revenue Codes? • The UB-04 billing form, is a uniform institutional provider bill suitable for use in billing multiple third party payers. Because it serves many payers, a particular payer may not need some data elements. • The National Uniform Billing Committee (NUBC) maintains lists of approved coding for the form. All items on the form are described. • UB04 Field: 42 - Revenue Code (Required) The provider enters the appropriate revenue codes to identify specific accommodation and/or ancillary charges. What is a Super Bill? • Unique to every provider depending upon service mix and payer agreements • Quickly capture clinical services in “layman’s terms” that clinicians readily understand • Allows billing staff to rapidly convert checked boxes to correct codes and modifiers • Quickly identify errors Super Bill • Super Bills need to include the following basic information: • • • • • • Patient demographic information Insurance information Treating clinician information Diagnostic information Service information, including cost Release authorization Example Super Bill Next Steps • Obtain and review billing manuals from payers (Medicaid, Medicare, insurance companies) • Contact provider relations with questions • Contract with a consultant to help set up your billing process • Outsource your billing to a third party Thank You! Questions? 888-898-3280 www.ahpnet.com