Indian Financial System

advertisement

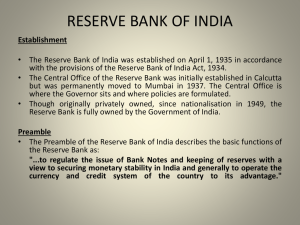

[G]Monetary Control INTRODUCTION: 1.Monetary Control is the main function of the Reserve Bank ,as it is central bank of the country. 2.Formulating and administering monetary policy involves using of instruments within it’s control to influence the level of aggregate demand for goods and services by regulation of the total money supply and credit. 3.The RBI exercises monetary regulation by influencing the availability and cost of credit by exercising different types of controls. 4.General or quantitative controls are the instruments of Bank rate,reserve requirements and open market operations.These methods affect the total money supply. Bank Rate Bank Rate is defined in Section49 of the RBI Act as the standard rate at which the Bank is prepared to buy or re- discount bills of exchange or other commercial paper eligible for purchase under the Act. In India Bank rate has been changed frequently to effect change in the cost of funds available from Central Bank to banks and financial institutions. The effectiveness of Bank Rate The effectiveness of Bank Rate as an instrument of monetary control depends on the extent of operation in the money market and also on how far the commercial banks resort to borrowing from Reserve Bank. Open Market Operations[OMO]. Section17(8) of the RBI Act authorizes the Reserve Bank to engage in the purchase and sale of securities of any maturity of the Central Governments and State Governments. OMO can be carried out by purchase and sale of a variety of assets such as Government securities ,commercial bills of exchange ,foreign exchange,gold and even company shares. In actual practice they are confined to buying and selling of Government securities.When securities are purchased from the open market ,the reserves of the banks with Reserve Bank increases and they can accordingly expand credit. Cash Reserve Section 42 of RBI Act & Section 18 of Banking Regulation Act,1949 deal with cash reserves to be kept with the Reserve Bank by scheduled banks and non-scheduled banks respectively. Scheduled banks have to maintain an average daily balance of 5% of the total demand and time liabilities in India of such banks.Further RBI is empowered to raise up to 20% of total demand and time liabilities. Statutory Liquidity Ratio(SLR) Banks are required under section [24(1)of RBI Act,1949] to maintain in India liquid assets in cash ,gold or unencumbered approved securities amounting to 25% of it’s total demand and time liabilities. RBI is empowered to raise up to 40%. Interest Rate Reserve Bank exercises direct control over the lending rate of banks by influencing cost of bank credit by increase or decrease in the lending rates rather than the Bank rate. RBI is empowered to issue direction to banks in public interest or in the interest of banking policy. Selective Credit Control “Selective Credit Control” refers to regulation of distribution or direction of bank resources to certain sectors of the economy.This is done in terms of broad national policies for achieving developmental goals. Selective credit control is exercised by RBI by stipulating… (a)minimum margins for lending against selected commodities (b)ceilings on the levels of credit, and (c) rates of interested commodities. The first two control quantum of credit and the last,the cost of credit. Indian Financial System Reserve Bank of India Introduction to Central Banking RBI, as the central bank of the country ,is the center of Indian financial and monetary system. RBI was formed in 1935 as per RBI Act 1935 as shareholders bank with a share capital of Rs 5 crores,divided in to 5 lakhs fully paid up shares of Rs 100/- each. In 1948 , RBI was nationalized by Reserve Bank (Transfer to Public Ownership)Act,1948 and the entire share capital was acquired by the Central Government. Regulation of non-banking institutions: The fast growth of non-banking institutions in the country and their accepting deposits from the public at very high rates of interest raised question of regulating their activities. As the credit from the banking sector was under the control of the Reserve Bank,the non-banking institutions had a ready market and many unhealthy practices developed in n course of time. [h] Custodian of Foreign Exchange Introduction:Regulation and conservation of foreign exchange is a major function of the Reserve Bank of India under FERA,1973. Regulation of foreign exchange was introduced in India under the Defense of India Rules,1939 which was replaced by the Foreign Exchange Regulation Act,1947 and later by the Foreign Exchange Regulation Act,1973 which is currently in force. Restrictions on dealings in foreign exchange U/s 8 of this Act,the previous general or special permission of the RBI is necessary for any person other an authorized dealer in India to purchase or otherwise acquire, borrow, sell,lend exchange with any person not being an authorized dealer . Foreign exchange defined under section 2(h) RBI Act. Foreign exchange means foreign currency and includes all deposits ,credits and balances payable in any foreign currency and any drafts,travelers checks ,letters of credit and bills of exchange ,expressed or drawn in foreign currency too . Authorized Dealers &Money Changers Under section 6 of the Act,Reserve Bank is empowered to authorize any person to deal in foreign exchange .Persons so authorized are called “Authorized dealers” as defined in Section 2(b). Such authorization may be granted subject to conditions and may be for,[i] dealings in foreign currencies or restricted to specified foreign currencies;[ii] transactions of all descriptions in foreign currencies or restricted to specified transactions;[iii]a specified period or within specified periods.Authorized dealers are generally scheduled banks .However RBI has given restricted license IDBI and EXIM and to undertake certain specified functions. Money Changers defined Section 7 of the Act. Act empowers the RBI to authorize any person to deal in foreign currency.Persons so authorized are called ‘money changers’. The authorization given to money changers may be , [i] for all foreign currencies [ii]for all transactions in foreign currencies or for specified transactions and also may be[iii]for operating a specified place and for a specified amounts money changers license have been given to certain established firms ,hotels and other organizations. Blocked Accounts Section 10 of the Act deals with blocked accounts.[Regarding NRI Accounts:NRE, NRO,FCNR,NRNR, etc].A blocked account is an account opened as a blocked account at any office or branch of bank in India authorized by RBI IMPORT & EXPORT OF CURRENCY Import or Export of Foreign exchange or Indian currency to or from India is also subject to restrictions imposed under Section 13. General or special permission of RBI is necessary to take or send out of India any Indian currency or foreign exchange obtained from an authorized dealer or a money changer. Acquisition of Foreign Exchange Section 14 authorizes the Central Govt. to order by by a notification in the official gazette ,every person in or resident in India to sell foreign exchange to the RBI or to persons authorized by the RBI for this purpose. Export and Transfer of Securities General or special permission of the RBI is necessary under Section 19 for the following transactions: [i] Taking or sending any security to any place outside India; [ii]Transfer of any security or creation or transfer of any interest in a security to or in favor of any non-resident; ………….[cont’d] [iii] Issuing in India or outside India, any security which is registered or to be registered in India to a non resident; [iv] Acquiring,holding or disposing of any foreign security. Bearer Securities Section 22 of the Act restricts the issue of bearer securities without permission of RBI. Gift and Settlements Settlement or gift of any property to a non resident without the general or special permission of RBI under Section 24. Holding of Immovable Property outside India Persons resident in India are prohibited under Section 25 from acquiring ,holding or disposing of [by sale, mortgage,lease,gift,settlement or otherwise]any immovable property situated outside India except with the general or special permission of RBI. Establishment of place of Business Non residents and other persons under Section 28 require the general or special permission of the RBI FOR VARIOUS TRANSACTIONS AS UNDER; [1] To establish or carry on in India a place of business for carrying bon trading ,commercial or industrial activity [ii] Acquiring the whole or any part of any undertaking in India of any person or a company carrying on trade,commerce or industry ,or purchasing the shares of such company in India. Duty of Persons Entitled to Receive Foreign Exchange Under Section 16(1) of the Act,general or special permission of the Reserve Bank is necessary for any person having a right to receive foreign exchange or a rupee payment from a non-resident,to do or refrain from doing anything which has the effect of delaying such payment or ceasing such payment in whole or in part. Payment for Exported Goods [Section :81]Empowers Central Government to stipulate that before exporting any goods from India ,the Exporter furnishes to the prescribed authority a declaration in the prescribed form like GR,PP AND VP/COD forms. Export and Transfer of Securities General or special permission of the Reserve Bank is necessary under Section 19 for the following transactions: 1. Taking or sending any security to any place outside India; 2.Transfer of any security or creation or transfer of any interest in security to or in favor of any non resident; …….[Con’t ] 3.Issuing in India or outside ,any security which is registered or to be registered in India; 4.Acquiring ,holding or disposing of any foreign security. Holding of Immovable Property outside India Persons resident in India are prohibited under Section 25 from acquiring,holding or disposing of Organization & Management RBI was initially designed on the pattern of Bank of England,theoretically subordinate to treasury. The Governor,4 Deputy Governors,all Directors of the Central Boards are either appointed or nominated by the Central Government. The Governor & the Deputy Governors are whole time officials and hold office for such term not exceeding 5 years as may be fixed by the Central Government and are eligible for reappointment[Section 8(4)]. They however may be removed from their office by the Central Government at any time.This legal Preamble of RBI Act 1934 “Where as it is expedient to constitute a Reserve Bank of India to regulate the issue of bank notes and the keeping of reserves with a view to securing monetary stability[in India] and generally to operate the currency and credit system of the country to it’s advantage”. 1. Main Functions of RBI To maintain monetary stability so that the business and economic life can deliver welfare gains of a properly functioning mixed economy. To maintain financial stability and ensure sound financial institutions so that monetary stability can be safely pursued and economic units can conduct their business with confidence. To maintain stable payments system so that financial transactions can be safely and efficiently executed. 1. Main Functions of RBI To promote the development of financial infrastructure ,and to enable it to operate efficiently ie.,to play a leading role in developing a sound financial system so that it can discharge it’s regulatory function efficiently. 1. Main Functions of RBI To ensure that credit allocation by the financial system broadly reflects the national economic priorities and societal concerns. 1. Main Functions of RBI To regulate the overall volume of money and credit in the economy with a view to ensure a reasonable degree of price stability. ROLES OF RBI [a] Note Issuing Authority * Sole right,authority or monopoly of issuing currency notes[other than one rupee notes or coins]. * The responsibility is not only to put currency in to or with draw it from circulation but also to exchange currencies and notes. * All affairs of Bank are related to note issue are conducted by Issue Department. [b]Government Banker The RBI is the banker to the Central and State . Governments * It provides to the governments all banking services such as acceptance of deposits,withdrawal of funds by cheques, making payments as well as receipts and collection of payments on behalf of the government ,transfer of funds,and management of public debt. [c] Banker’s Bank The RBI like all other central banks,can be called a banker’s bank because it has a very special relationship with commercial and co-operative banks and major part of it’s business with these banks. In times of need ,the banks borrow funds from the RBI.It is therefore called the “bank of last resort” or “the lender of last resort”. On the whole,the RBI is the ultimate source of money and credit in India. [d]Supervising Authority The RBI has vast powers to supervise and control commercial and co-operative banks with a view to developing an adequate and sound banking system in the country. The RBI has the following powers as the Supervising Authority. 1.To issue licenses for the establishment of new banks; 2.To issue bank licenses for setting up of bank branches; 3.To prescribe minimum requirements regarding paid up capital and reserves,transfer to reserve fund,and maintenance of cash reserves and other liquid assets; Cont’d 4.To inspect the working of banks in India as well as abroad in respect of their organizational set up,branch expansion,mobilization of deposits,investments,and credit portfolio management,credit appraisal,region wise performance,profit planning ,manpower planning and training,and so on. Cont’d 5.To conduct ad hoc Investigations ,from time to time,in to complaints, irregularities,and frauds in respect of banks. 6.To control methods of operation of banks 7.To control appointment,reappointment,and termination of appointment of Chairman and CEOs of private sector banks. [e]Exchange Control Authority One of the essential functions the RBI is to maintain the stability of the external value of the rupee. * To administer the ‘foreign exchange control’ * To choose the exchange rate system and fix or manage the exchange rate between rupee and other currencies * To manage exchange reserves * To interact or negotiate with the monetary authorities with IMF,World Bank & ADB. The objective of Exchange Control Is primarily to regulate the demand for foreign exchange within the limits set by the available supply. This is sought to be achieved by conserving foreign exchange,by using it in accordance with the plan priorities,and by controlling flows of foreign capital. [f]Promoter of the financial system The RBI has been rendering ‘developmental’ or ‘promotional’ services which have strengthened the country’s banking and financial sector.The following sectors have attracted the benefits from RBI. Money Market In the money market ,RBI has continuously worked for the integration of it’s organized and unorganized sectors by trying to bring indigenous bankers in to the main stream of the banking business. Agricultural sector The RBI has rendered service in directing and increasing the flow of credit to the agricultural sector. Industrial Finance The role of the Bank in diversifying the institutional structure for providing industrial finance has been equally important. All the special developmental institutions[SDIs] at the central and state levels and many other financial institutions were either created by by the Bank on it’s own or it advised and rendered help in setting up these institutions. Credit Delivery The Bank has evolved and put in to practice the consortium ,co-operative ,and participatory approach to lending among banks and other financial institutions. Regulator of Money and Credit Monetary policy refers to the use of techniques of monetary control at the disposal of the Central Bank for achieving certain objectives.