CBSA Infrastructure Update

advertisement

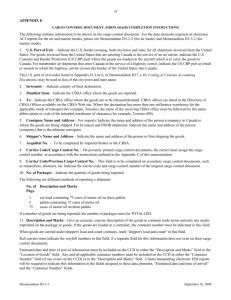

Canada Border Services Agency Transportation Border Working Group Border Infrastructure Updates Quebec City October, 2010 1 CONTENT Background Current Environment Port of Entry Projects Challenges Future Direction 2 BACKGROUND The CBSA has responsibility for the entire asset life cycle of 109 land ports of entry (6 are jointly owned by CBSA and the US) 63 residential units at remote/isolated ports of entry and 16 wharves; Over the past decade the CBSA has focused investment on modernizing and upgrading the port infrastructure examination facilities at the larger 7/24 ports of entry with a focus on the designated commercial offices; Federal government investments made through the Border Investment Fund (BIF) and its successor, the Gateways and Border Crossing Fund (GCBF) have improved significantly the transportation infrastructure in all modes of transportation; 3 BACKGROUND….cont’d Major investments in port of entry infrastructure have also been funded through the BIF, the GBCF, and the CBSA’s capital budget; The majority of the investment has been earmarked for expansion of the transportation infrastructure. Over this period the CBSA has modernized and expanded its commercial and travelers examination facilities at major ports of entry at Osoyoos, Coutts, Emmerson, Stanstead, Armstrong, Douglas, and St. Stephen ; 4 CURRENT ENVIRONMENT The majority of the CBSA’s large and medium sized ports have been, or are in the process of being redeveloped within the last ten years, are functional and provide adequate serviceability; Under the Government of Canada’s Economic Action Plan (EAP), the CBSA will further invest in the modernization and expansion port of entry facilities, with an emphasis on improving commercial operation: Kingsgate, B.C.; Prescott, Ont.; Pacific Highway, B.C.; and Abbotsford-Huntingdon, B.C. 5 CURRENT ENVIRONMENT….cont’d With the completion of the EAP projects, the CBSA will shift focus to addressing the rust-out and serviceability issues related to the smaller ports of entry; A portion of the CBSA funding under the EAP was for the construction of required residential accommodation at 3 northern remote locations. 50% of the CBSA inventory of smaller ports is over 35 years of age and cannot adequately support new program initiatives such as the Doubling-Up; 6 PORT OF ENTRY PROJECTS Modernization and replacement of the port infrastructure at Prescott, Ont. and Kingsgate, B.C.; Expansion and modernization of the commercial examination facilities at Pacific Highway and Abbotsford-Huntingdon, B.C.; Replacement of the port of entry facilities at Aldergrove, B.C. underway; Completion of the new residential accommodation at Pleasant Camp, B.C. and Little Gold and Beaver Creek, Yukon; 7 PORT OF ENTRY PROJECTS….cont’d Replacement of 5 small ports in the Prairies Goodlands, MB Coulter, MB Lyleton, SK Coronach, SK West Poplar, SK . Replacement of Stewart Port of Entry and expansion of commercial examination facilities at North Portal, Sk.; Expansion of the commercial examination facilities at Lacolle (GBCF funded project). Project will include realignment of the bus processing facility and increase in the Primary Line capacity. 8 CHALLENGES Although the CBSA and Transport Canada have made considerable investment in expanding and modernizing the transportation and port infrastructure there are operational deficiencies and border wait times at several land ports of entry that need to be addressed on a priority basis. CBSA’s (and Transport Canada’s) joint challenge over the coming years will be to address: Capacity, redundancy, and operational deficiencies in the Windsor-Detroit corridor; Ensure that the top 20 commercial ports of entry at the land border are effective particularly the Montreal-New York corridors; Increasing trade in the marine mode on both coasts. 9 CHALLENGES….cont’d At the CBSA’s custodial portfolio rust-out remains a major concern: Facilities have not kept pace with the demands (increased volume of international trade in all modes of transportation coupled with the increased border security environment post911); Need to replace 90 smaller ports while ensuring that those recently redeveloped remain functional and reliable: Backlog is in the order of $180M at the land border; The replacement facilities are considerably larger than the original to accommodate today’s program needs creating a significant future O&M funding liability in addition to inflation 10 FUTURE DIRECTION Need to develop joint Transport Canada-CBSA priority areas for investments in the national transportation system in three broad areas: Major transportation and port of entry infrastructure needs in the Windsor-Detroit and Montreal-New York trade corridors and at the top 20 land ports of entry; Targeted investments to improve the efficiency of existing infrastructure (e.g. dedicated FAST and NEXUS lanes) where there is a high benefit to cost ratios; and Investments in IT that will help to optimize the use of the existing infrastructure by providing timely information to the users of the system sustain the level of recapitalization required to ensure the maintenance of adequate border inspection facilities while continuing to support future investments; Implementation of the Port Closure announcements. 11