DG TREN - The Climate Group

advertisement

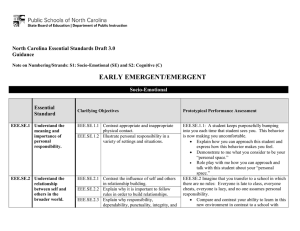

Stefano Panighetti, Policy Officer, DG Energy, EC Financial Instruments for Energy Efficiency EEE F Facility overview EPPR amended regulation 2010 .. . .. . . Fund (EEE F) Launched 1st July 2011 265 M€ (EC, EIB, CDP, DB) Objective: addressing financial needs of commercially viable EE and RES projects in a local and public context Scope: Energy efficiency, renewable energy and clean transport Tailor made financing: Senior/junior loans, convertible debt, equity participation,forfeiting schemes… Commercially managed fund, operating under market conditions Technical Assistance (TA) € 20m (EU), grants for project development financed by the Fund Awareness raising activities through EPEC (European PPP Expertise Centre) EUROPEAN ENERGY EFFICIENCY FUND | 2 Eligibility and investment portfolio Investment portofolio • 70%EE, 20% RES, 10% Clean Urban Transport Beneficiaries • Final Beneficiaries: local/regional public authorities • Direct and indirect investments (through Financial intermediaries) EUROPEAN ENERGY EFFICIENCY FUND | 3 EEE F Eligibility criteria • At least 20 % primary energy savings for EE • • • • • • projects, (higher for buildings) Min. 20 % reduction of CO2 equiv. for RE and transport Comply with EU legislation (RE directive, CHP…) concrete objectives to mitigate climate change +multi-annual strategies proven technologies Strong support for ESCOs providing guaranteed energy savings Projects eligible as from 01.01. 2011 EUROPEAN ENERGY EFFICIENCY FUND | 4 EEE F Technical Assistance (TA) Objective: support project development services for technical and financial preparation of projects .. .. . TA of total of 20M€ (provided by the EC), grant (up to 90% of eligible costs) Min. leverage factor of 20 Only for projects applying for funding to the EEE- F Based on ELENA model EUROPEAN ENERGY EFFICIENCY FUND | 5 .. . . . . Application process Initial screening (DB) Possible TA request (DB) Due diligence process (DB): financial, technical,legal review Investment Committee advisory opinion (EEE F) Management Board final decision based on IC opinion (EEE F) Once project financed: monitoring, reporting on financial and environmental performance EUROPEAN ENERGY EFFICIENCY FUND | 6 Financial Structure – Layered fund Size at first closing € 265m Target Up to € 700m Notes EIB, CDP Senior – A Shares € 117m EIB, CDP, Deutsche Bank EU Mezzanine - B Shares € 23m Institutional investors Public banks & institutional investors Public financial institutions EU Junior/FLP - C Shares € € 125m EUROPEAN ENERGY EFFICIENCY FUND | 7 . Role of the Fund in mobilising private finance EEE F objective: enhance viable EE and RES investments at local/regional level within multiannual strategies to mitigate CC » Adress market failures .. . » (information/awareness,TA,…) Adress Lack of access to capital (specific financial products…) Confidence building around EE investment, Develop and spread ESCO/EPC models, Offer innovative financing EUROPEAN ENERGY EFFICIENCY FUND | 8 Links & Contacts . .. On ENER website: http://ec.europa.eu/energy/eepr/eeef/eeef_en.htm EEE F website: www.eeef.eu Contact point at Deutsche Bank: Lada Strelnikova +49(69)910-46444 lada.strelnikova@db.com Zarpana Massud-Baqa +49(69)910-49858 zarpana.massud-baqa@db.com EUROPEAN ENERGY EFFICIENCY FUND | 9