Majid Khandwala Presentations of Post Budget Seminar 2012

advertisement

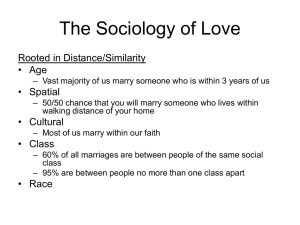

Post Budget Seminar Organized by: Karachi Tax Bar Association Budget 2012 – 2013 Majid Khandwala Partner - Tax 04 June 2012 Fiscal Budget 2012 – Sales Tax Table of contents Updates in the sales tax laws S. No. Sales tax updates Section of the Act effected 1 Assessment of tax and recovery of tax not levied or shortlevied or erroneously refunded 11 and 36 2 Supplies against International Tender Fifth & Sixth Schedules 3 Higher sales tax rates abolished SRO 644(I)/2007 4 Amendments in Sales Tax Rules, 2006 Rules 5, 7 & 12 5 Amendments made in Sales Tax Special Procedures Rules, 2007 Rules 58E, 58F to 58MB 6 Input tax claim of wholesalers restricted 8B, SRO 647(I)/2007 7 Sales tax SROs amended - effective 02 June 2012 Various 8 Rescinding Notifications Various 9 Recent introductions Various Page 3 Fiscal Budget 2013 – Sales Tax & FED Updates Assessment & recovery of tax Section 11 ► Under the Act separate sections are provided for ► ► ► “Assessment of Tax” – Section 11 and “Recovery of tax not levied or short-levied or erroneously refunded” – Section 36 It is now proposed to consolidate both under revised Section 11 titled ► Page 4 “Assessment of Tax and recovery of tax not levied or short-levied or erroneously refunded”. Presentation title Assessment & recovery of tax Section 11 ► Major changes in the revised Section 11 Time limit for assessment & recovery of tax for inadvertence, error or misconstruction, enhanced to 5 years from 3 years The Commissioner will now have powers to grant extension for passing an order for a period of up to 90 days instead of 60 days SRO 555(I)/1996 dated 01 July 1996 has been rescinded enabling any officer to carry out assessment and recovery proceedings under sections 11 and 36 as per the threshold amount assigned to each rank. Page 5 Presentation title Supplies against International Tenders Fifth & Sixth Schedules ► “Supplies against international tenders” is proposed to be deleted from the Fifth Schedule and included in Table II of the Sixth Schedule. ► Therefore, supplies against international tender will now be exempt instead of being zero rated. Page 6 Presentation title Supplies against International Tenders Fifth & Sixth Schedules ► Major changes Input tax on such supplies will no longer be available. Exemption provided by SRO 551(I)/2008 dated 11 June 2008 has been removed. Materials imported for manufacture of goods to be supplied against international tender will be taxable w.e.f. 2 June 2012. Rules 50A, 50B and 50C of Chapter VIIA to Sales Tax Rules, 2006 regarding zero rated supplies made against international tenders have been revised to incorporate the change. Page 7 Fiscal Budget 2013 – Sales Tax & FED Updates Higher sales tax rates abolished SRO 644(I)/2007 dated 27 June 2007 ► ► ► With effect from 2 June 2012, SRO 644(I)/2007 dated 27 June 2007 has been rescinded, abolishing higher sales tax rates of 22% on certain types of chemicals, paper and paperboard, glass, plastics, etc. 19.5% on flat rolled products of iron or non-alloy steel, stainless steel and other alloy steel, etc. The standard rate of 16% will now be applicable on these items Page 8 Fiscal Budget 2013 – Sales Tax & FED Updates Higher sales tax rates abolished Impact of Section 8B ► Section 8B of the Act restricts the claim of input tax to 90% of the output tax except for the following sectors excluded vide SRO 647(I)/2007: ► ► electricity, gas, oil, zero rated supplies, commercial importers, wholesale cum retail outlets, wholesalers and distributors, manufacturers consuming raw materials taxed at higher rates, etc. As higher sales tax rates have now been abolished, the 90% limit of input tax claim will now be applicable upon such manufacturers. Page 9 Fiscal Budget 2013 – Sales Tax & FED Updates Amendments in Sales Tax Rules, 2006 SRO 589(I)/2012 dated 01 June 2012 ► Amendment in registration rules for sales tax – Rules 5 & 7 Rule Description Amendment Rule 5 Application for registration As per clause (c) of Rule 5, corporate persons had the option to apply for transfer of registration to the Collectorate having jurisdiction where the place of business is located. The Board is also empowered to transfer the registration to a jurisdiction based on – Page 10 • Registered office • Place of business • Place of manufacture Fiscal Budget 2013 – Sales Tax & FED Updates Amendments in Sales Tax Rules, 2006 SRO 589(I)/2012 dated 01 June 2012 ► Procedure for transfer of business is prescribed as follows – Rule 7 Transfer of business From Authorized office Verification by To Individual Spouse or Children Local Registration Office (LRO) Regional Tax Office (RTO) Individual AOP LRO RTO AOP Corporate entity (same ownership) LRO RTO/Large Taxpayers Unit ► ► ► The same etration number would continue in aforesaid cases. In case of transfer on any other account, a new Sales Tax Registration Number shall be issued to the entity. The cases of transfer of business from an Individual to a corporate entity are not covered. Page 11 Fiscal Budget 2013 – Sales Tax & FED Updates Amendments in Sales Tax Rules, 2006 SRO 589(I)/2012 dated 01 June 2012 ► Blacklisting of taxpayers Rule Description Amendment Rule 12 Blacklisting and suspension of registration highlighted the procedure of blacklisting and suspension of registration on the grounds where the tax authority had reasons to believe that a registered person had committed tax fraud Through the amendment, the entire above procedure as laid down in rule 12 has now been substituted. Page 12 Fiscal Budget 2013 – Sales Tax & FED Updates Amendments in Sales Tax Special Procedures Rules, 2007 SRO 592(I)/2012 ► The following amendments take effect from 02 June 2012: Rule Description Proposed amendment Rule 58E Special procedures for payment of sales tax by importers – Filing of return and audit Commercial importers not claiming refund of excess input tax were excluded from audit except with the permission of the Board. This exclusion has now been withdrawn and commercial importers whether or not claiming any refund of excess input tax can now be subject to audit. Rule 58F to Rule 58MB Special procedure for steel melters, rerollers and ship breakers Chapter XI of the Sales Tax Special Procedure Rules, 2007 outlined specific procedures for payment of sales tax by steel melters, re-rollers and ship breakers. An upward revision of rates of sales tax along with certain conditions has been prescribed. Page 13 Fiscal Budget 2013 – Sales Tax & FED Updates Sales tax SROs amended – effective 02 June 2012 New SRO Category SRO Amended 591 Zero-rated 811(I)/2009 dated to exempt 19 September 2009 595 Exemption granted/Ze ro-rated to exempt 551(I)/2008 dated 11 June 2008 granting sales tax exemptions Impact import and supply of polyethylene and polypropylene for manufacturing of mono filament yarn and net cloth is now exempt instead of being zero-rated resulting in nonadjustment of input tax. Waste paper, exempted , it was taxable at 22% Remeltable scrap, sprinkler and drip equipment, spray pumps and nozzles granted exemption instead of zero rating. 593 Zero-rating 1125(I)/2011 dated Scope of zero-rating granted to monofilament of granted 31 December up to 67 decitex. 2011 602 Zero-rating 549(I)/2008 dated granted 11 June 2008 granting sales tax zero rating Page 14 Zero-rating granted on cotton seed oil if supplied to registered manufacturers of vegetable ghee and cooking oil. Fiscal Budget 2013 – Sales Tax & FED Updates Sales tax SROs amended - effective 02 June 2012 New SRO 590 Category Impact No utilization 1020(I)/2006 Minimum value addition sales tax of 10% on supply of dated 02 computer hardware and parts no longer applicable on October commercial importers. 2006 No utilization 849(I)/1997 Exemption from sales tax to imported industrial raw material and other goods, if imported directly by the manufacturers who are liable to pay turnover tax or are engaged in manufacture of the goods other than taxable goods. 308(I)/2008 Rates for repayment of sales tax on steel products dated 24 exported from Pakistan have been increased. March 2008 596 Rate increase 597 Rate increase Page 15 SRO Amended 345(I)/2010 Rates fixed for minimum value of locally produced billets dated 24 and ingots supplied by registered persons opting to pay May 2010 sales tax on ad valorem basis have been increased. Fiscal Budget 2013 – Sales Tax & FED Updates Sales tax SROs amended - effective 02 June 2012 New SRO Category SRO Amended 604 Rate reduced 313(I)/2006 Rate of sales tax reduced from 7% to 6% on the value of dated 31 import of soyabean seed by solvent extraction March 2006 industries. 605 Rate reduced 69(I)/2006 dated 28 January 2006 608 Rate reduced Page 16 Impact Rate of sales tax reduced from 15% to 14% on the value of import of rapeseed, sunflower seed and canola seed by solvent extraction industries. Sales tax charged on import and supply of black tea reduced to 5%. Fiscal Budget 2013 – Sales Tax & FED Updates Rescinding Notifications SRO 594(I)/2012 Rescinded SROs Description 103(I)/2005 Fixation of value of Potassic Fertilizers at import and local supply stage for sales tax at Rs.4,610/- per metric ton. Effectively taxed at 16% standard rate of sales tax. 15(I)/2006 Fixation of value of locally produced nitrogenous fertilizer, Calcium Ammonium Nitrate (CAN) for sales tax at Rs.3,765/- per metric ton. Effectively taxed at 16% standard rate of sales tax. Page 17 Fiscal Budget 2013 – Sales Tax & FED Updates Amnesty Scheme SRO 548 (I)/2012 dated 22 May 2012 ► Vide this SRO amnesty from surcharge and penalty was granted on non-payment of sales tax or FED outstanding on account of: ► ► ► ► ► Audit observation Show cause notice Adjudication order Failure to pay sales tax/FED Inadmissible input tax claim ► Provided the payment is made by 31 May 2012 ► This date has not been extended so far. Page 18 Fiscal Budget 2013 – Sales Tax & FED Updates Amnesty Scheme SRO 606(I)/2012 dated 1 June 2012 An amnesty scheme for persons who have claimed input tax illegally has been introduced granting – ► Exemption from payment of penalty and default surcharge on outstanding sales tax payments Abatement of any criminal proceedings lodged by the department ► The last date for payment is 25 June 2012 ► This is subject to the condition that proceedings filed by registered persons at appellate forum are withdrawn ► This scheme replaces the earlier one issued through SRO 563(I)/2012 dated 25 May 2012 ► Page 19 Fiscal Budget 2013 – Sales Tax & FED Updates Significant Pre-Budget Sales Tax Amendments . Taxability of fixed assets SRO 727(I)/2011 dated 1 August 2011 ► Import of plant & machinery ► ► ► Not manufactured locally, and Having no compatible local substitute Imported by or for supplying to industrial user Is exempt at import stage. Page 21 Conditions at import stage • Registered manufacturers or Industrial importers are required to give post dated cheques covering the sales tax amount which would be returned after filing of a first sales tax return after import of plant and machinery. • Commercial importers are required to make an advance payment or issue a bank guarantee / pay order of the sales tax amount which would be returned or refunded upon provision of next supply to a registered manufacturer or industrial user. Fiscal Budget 2013 – Sales Tax & FED Updates Taxability of fixed assets – Local Disposal SRO 727(I)/2011 dated 1 August 2011 ► Fixed assets – not taxable ► ► ► ► Immovable properties Vehicles falling under Chapter 87 of PCT (not being stock in trade) ► ► All other assets - taxable ► Page 22 Plant and Machinery - not taxable if it is an imported plant & machinery that is not manufactured locally and has no compatible local substitutes if sold to registered industrial regimes Such plant and machinery is taxable if sold to commercial regimes or unregistered industrial regime - taxable. Fiscal Budget 2013 – Sales Tax & FED Updates Input tax claim for wholesalers & distributors SRO 564(I)/2012 ► Section 8B of the Act restricts the claim of input tax to 90% of the output tax except for the following sectors excluded vide SRO 647(I)/2007: ► ► ► ► electricity, gas, oil, zero rated supplies, commercial importers, wholesale cum retail outlets, wholesalers and distributors, etc. Wholesalers have now been excluded through SRO 564(I)/2012 dated 26 May 2012 This means the 90% limit of input tax claim will be applicable to wholesalers. Distributors are however not affected. Page 23 Fiscal Budget 2013 – Sales Tax & FED Updates Requirement of NTN or CNIC on Sales Tax Invoice Status of SRO 191(I)/2012 dated 23 February 2012. Page 24 Fiscal Budget 2013 – Sales Tax & FED Updates Fiscal Budget 2013 – Federal Excise Table of contents Updates in Federal Excise laws S. No. Federal Excise updates Effected sections 1 Increase in rates of duty First Schedule 2 Excise duty on travel by air First Schedule 3 Exemptions granted from excise duty Third Schedule 4 Asset management companies Third Schedule 5 Withdrawal of excise duty First Schedule 6 Other updates Various Page 26 Fiscal Budget 2013 – Sales Tax & FED Updates Rates of duty changed First Schedule ► Duty on cigarettes enhanced ► Duty on Portland cement, aluminous cement, slag cement, super sulphate cement and similar hydraulic cements, whether or not coloured or in the form of clinkers reduced From Rs. 500 per metric ton to Rs. 400 per metric ton. Page 27 Fiscal Budget 2013 – Sales Tax & FED Updates Withdrawal of excise duty First Schedule ► The Bill seeks to withdraw duty on a number of goods, which are in nature lubricants and cosmetics with effect from 02 June 2012 Lubricating oil Base lube oil Perfumes Beauty or make-up preparations Page 28 Fiscal Budget 2013 – Sales Tax & FED Updates Exemptions from FED Third Schedule ► The Bill seeks to include the following services in the Third Schedule: Live stock insurance Services provided by Asset Management Companies w.e.f. 01 July 2007. Page 29 Fiscal Budget 2013 – Sales Tax & FED Updates Asset Management Companies ► Currently under serial No.8 of Table II of the First Schedule to the FE Act, services provided by banking companies or non-banking financial companies are subject to FED at the rate of 16%. ► The tax authorities created huge demands against asset management companies from 2007 onwards for payment of FED on the management fee charged by them on the grounds that asset management companies are covered under non-banking financial companies as defined in the Act. ► This has been challenged and cases are pending at the appellate forum. Page 30 Fiscal Budget 2013 – Sales Tax & FED Updates Asset Management Companies ► It appears that in order to resolve this dispute, the Board has proposed insertion of an exemption in Table II of the Third Schedule to the Act from the charge of FED in respect of services provided by asset management companies with retrospective effect from 01 July 2007. ► However this comfort will not be available to asset management companies located in Sindh in view of the provisions of the Sindh Sales Tax on Services Act, 2011 unless a similar exemption is granted. Page 31 Fiscal Budget 2013 – Sales Tax & FED Updates Excise duty on air travel First Schedule, Table II ► ► With effect from 1 July 2007, FED is leviable on tickets issued for International travel to and from Pakistan irrespective whether the ticket has been issued from Pakistan or elsewhere The issue from 1 July 2007 to 30 June 2012 remains open Page 32 Presentation title Substituting Clause (b) of serial No.3 of Table II of the First Schedule to the FE Act as under: Services provided or rendered in respect of travel by air of the passengers embarking on international journey from Pakistan. Economy and economy plus. Three thousand eight hundred and forty rupees. Club, business and first class Six thousand eight hundred and forty rupees. Other updates Excise Duty on Services Pursuant to the 18th Amendment, it is anticipated that the Punjab provincial government is due to establish its own authority for administering and collecting sales tax on services in the province of Punjab Page 33 Fiscal Budget 2013 – Sales Tax & FED Updates Fair & equitable practice of the law ► Unreasonable interpretation of law ► Achievement of the budgeted targets should not be the basis of creating tax demands ► A new interpretation which deviates from existing practice should not be enforced retrospectively ► Even handed treatment should be meted out – e.g. gains and losses ► Input tax should not be disallowed because an active taxpayer has failed to deposit the output tax ► Joint and several liability of registered persons is a draconian provision of law ► Delay in tax refunds Page 34 Fiscal Budget 2013 – Sales Tax & FED Updates Thank you