Revenue PowerPoint template 1 - AARP TaxAide MN-1

advertisement

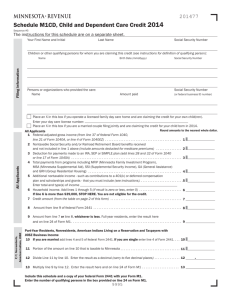

MN-1 District Coordinator Meeting September 26, 2014 Volunteer Coordinator Kerrin Lee 651-556-3052 or 1-800-818-6871 kerrin.lee@state.mn.us 2 Department Updates • Direct Deposit Promotion • Governor Dayton’s “Unsession” • What have we been doing? • Power of Attorney • Payment Voucher Project • What laws were eliminated? 3 “Opportunities to give us feedback” Department Updates • Federal Conformity (1st Tax Bill) • • • • March 21, 2014 tax bill Aligns Minnesota’s tax code more closely to federal code 1.1 million returns filed with the new law changes Reviewed 280,000 returns that were already filed • Letters to Homeowners • Potential eligibility for Homestead Credit Refund • All letters were mailed by August 22, 2014 4 Tax Law Updates • Omnibus (2nd) Tax Bill • Signed May 20, 2014 • Retroactive Changes for 2013 • Property Tax Refunds • Changes for 2014 and forward 5 Tax Law Updates Temporary Reading Credit The Basics • • • • • Tax year 2014 only 75% of qualifying expenses Maximum credit of $2,000 Credit calculated on Schedule M1READ Fact sheet will be released soon • Visit our website and search Reading Credit 6 Tax Law Updates Temporary Reading Credit Qualifying Child • A child who: • meets the definition of a qualifying child for K-12 Education Credit, • has been evaluated by a school district for a specific learning disability, • was found, through the evaluation, to have a deficiency in reading skills, reading fluency or reading comprehension that impairs his or her ability to meet expected age or grade-level standards, and • does NOT qualify for an Individualized Education Program (IEP) 7 Tax Law Updates Temporary Reading Credit Qualifying Expenses • • • • Tutoring, instruction, or treatment Not compensated by insurance, or pre-tax accounts Actual expenses that can be documented Not used to claim the K-12 Credit or Subtraction 8 Tax Law Updates Temporary Reading Credit Qualifying Tutoring and Instruction Expenses • Instruction by a qualified instructor that helps the child meet state academic standards in various subjects Qualifying Instructor • Cannot be a lineal ancestor or sibling of the child • Must meet one of the following tests: • Have a valid teaching license for the grade level and subject taught (or is supervised by someone who is) • Have successfully completed a teacher competency evaluation, • Provide instruction at an accredited school, or • Have a bachelor’s degree 9 Tax Law Updates Temporary Reading Credit Qualifying Treatment To qualify for the credit, the treatment must: • be intended to improve the child’s basic reading skills, reading comprehension and reading fluency, • use recognized diagnostic assessments to determine what intervention would be most appropriate for the child, and • use a research based method to teach language decoding skills in a systematic manner. If you are unsure whether or not a child’s treatment qualifies, contact the treatment provider. 10 Tax Law Updates Child and Dependent Care Credit • Minnesota Child and Dependent Care Credit aligns more closely to the federal credit • Maximum qualifying expenses increased: • 1 Qualifying Child - $3,000 maximum • 2 or more Qualifying Children - $6,000 maximum • Percent of qualifying expenses allowed in calculating the credit increased 11 Tax Law Updates Additions and Subtractions Minnesota Income Tax Additions • Married couples claiming the standard deduction are no longer required to add back a portion of their deduction Minnesota Income Tax Subtractions • Employer-provided mass transit benefits that are included in federal taxable income can be subtracted. The per month subtraction amount is limited to the lessor of: • $120, or • the benefits received in excess of $130 • Military pay earned under Title 32 AGR Status in the Minnesota National Guard or Reserves can now be subtracted 12 Tax Law Updates 2013 Property Tax Refund What changed? • Renter’s Property Tax Refunds increased by 6% • Homestead Credit Refunds increased by 3% What if my clients already filed? • We will make changes to returns filed before 6/4/2014 and those that used outdated refund tables What if my clients haven’t filed yet? • Use our updated refund tables on our website if filing by paper • Ensure that you have the most up-to-date version of TaxWise installed if filing electronically13 Tax Law Updates Supplemental Agricultural Credit What is it? • Agricultural homesteaded properties • Property taxes payable 2014 • Lesser of $205, or net taxes excluding house, garage, and surrounding acre Additional Information • Credit will be administered by counties as a reduction in property taxes payable going forward • Relative Agricultural Homestead classification qualifies • Must not owe delinquent property taxes What do you need to do? • Nothing- we will mail checks by 10/15/14 • If you have questions, review our website or contact the county auditor 14 Tax Law Updates 15 Tax Professional Enforcement • What is it? • Tax professionals must follow standards of ethics and conduct • If you don’t, you may be subject to penalties, criminal prosecution, or suspension from representation • Who may this affect? • Attorneys, accountants, enrolled agents, and any person preparing returns for compensation • Anyone who represents taxpayers in dealings with us • Why are we sharing this with you? • We want you to be informed and share this information 16 Tax Professional Enforcement What can we do? If a tax professional Then we can • Knowingly files false or fraudulent tax returns Advises a taxpayer to evade taxes Does not file a required tax return Attempts to threaten or bribe a department employee Does not demonstrate adequate familiarity with state tax laws and rules • Is convicted of a crime related to tax return preparation Is assessed a civil penalty of more than $1,000 for certain actions related to tax return preparation • • • • • • • • 17 Suspend them from “representing” taxpayers before the Department for up to 5 years or bar them indefinitely Place their name on our Tax Professionals Sanction List Place their name on our Tax Professionals Sanction List Administrative Updates • DOR Letter Procedures • Quality Review of M1 and M1PR • Point of emphasis • Modernized e-file • Unlinking to send M1PR only • Do not e-file federal returns with $1 of interest or income • Site Visits • See how the site operates • Looking for best practices • Available for questions or concerns 18 State Training • January Training Sessions • Contact Kerrin to set up a date and to discuss material you wish to be covered • MN Review Questions • Incorporate into your state training • Volunteers will need to answer the questions • MN Intake Sheet • Questions on the sheet should flag potential issues • Feel free to make copies and distribute as needed 19 Volunteer Training Packets • Packets will be mailed to volunteers using the volunteer addresses provided by the IRS • After mid-November, send any new volunteer names and addresses directly to Kerrin to get MN training materials • MN training materials will be mailed mid-December to all volunteers • Extra copies of training packets are available • Call or email Kerrin to have additional copies sent out 20 Form M281V: Blank 2014 MN Forms • Changes to order form for filing season 2014 • No payment vouchers • Please correctly fill out the form and order only what you need • Forms are also available on our website or at libraries • Contact Kerrin if you have a shortage of forms later in the year • Order the appropriate form and booklet if you are doing prior year returns by paper 21 Site List on DOR Website • Please update your tax site information in the AARP Portal system • If specific information applies to your site, make sure to note it in the additional information section • Military-certified volunteers: Please note this in the additional information section or email Kerrin • Update opening and closing dates for each site • Will send out reminder to all DC’s before tax season starts 22 Helpful Resources 23 Minnesota Volunteer Hotline VITA/AARP Tax Aide Hotline • 651-556-3050 • 1-800-657-3829 • Hours: Monday – Friday, 8:00 am – 4:30 pm Email questions to: individual.incometax@state.mn.us Please encourage volunteers to use the hotline. 24 Outreach and Education Staff Hillary Jasicki (Outreach & Education Leadworker) 651-556-6471, hillary.jasicki@state.mn.us Celeste Marin (Latino Outreach Coordinator) 651-556-6616, celeste.marin@state.mn.us Chueyee Moua (Asian Outreach Coordinator) 651-556-6613, chueyee.moua@state.mn.us Jake Feneis (Paid Preparer Outreach Coordinator) 651-556-6606, jake.feneis@state.mn.us Karen Kittel (Withholding Tax Outreach Coordinator) 651-556-3668, karen.kittel@state.mn.us 25 Thank You For All Of Your HARD WORK!