GUIDE TO UNDERSTANDING INSURANCE CLAIMS

advertisement

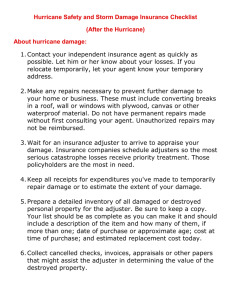

HURRICANE KATRINA GUIDE TO UNDERSTANDING INSURANCE COVERAGE, THE CLAIMS PROCESS, and OTHER INFORMATION DISCLAIMER: The information provided in this material and in any accompanying presentations is provided for informational purposes only and is not represented to be error free nor intended to provide advice, legal or otherwise. Exxon Mobil Corporation and its related and affiliated companies specifically disclaims any liability for damages sustained by any person relying upon this information. ExxonMobil Risk Management Contacts: John Dill Office Phone: (703) 846-2484 Cell Phone: (703) 307-7631 Fax: (703) 846-2363 E-Mail: john.e.dill@exxonmobil.com Todd Johnstone Office Phone: (713) 680-7084 Cell Phone: (713) 805-1955 Fax: (713) 680-7303 E-Mail: todd.a.johnstone@exxonmobil.com Understanding Your Insurance Policy • • • • • • Coverage For Your Home Coverage For Your Personal Items Coverage For Other Structures Coverage For Living Expenses Coverage For Tree Removal & Clean-Up Coverage For Temporary Repairs Coverage For Your Home • • • • Coverage Amount Listed On Policy All Risk Coverage-with Exceptions (Flood) Replacement Cost Coverage Valued Policy Statute – May Pay Policy Limit If Home Is Total Loss • Hurricane Deductible – Higher Deductible Than Standard Deductible • Temporary Repairs Covered • Depreciation Holdback Until Property Replaced Coverage For Your Personal Items • Coverage Amount Listed On Policy – Usually 50% of House Coverage Amount • Coverage Only For Named Causes • Replacement Cost Coverage Endorsement • Food Spoilage - Limited Coverage Things To Do - Prepare List Of Damaged Items - If Possible, Save Items For Inspection - Take Photos Of Items Before Disposal Coverage For Other Structures • Coverage Amount Listed On Policy – Usually 10% Of House Coverage Amount • All Risk Coverage • Replacement Cost Coverage • Insurance To Value Requirements • Fence Damage Paid On Depreciated Basis Coverage For Living Expenses • Coverage Amount Listed On Policy – Usually 20% Of House Coverage Amount • Pays Extra Living Costs • May Pay For Generator-if Needed • Pays For Variety Of Accommodations SAVE ALL RECEIPTS! Coverage For Tree Removal & Clean-Up • Pays For Removal From Covered Property Such As: – Home – Driveways – Swimming Pool – Fences • Once Trees Are Removed From Covered Property, There Is $500 Of Coverage Available To Remove All Trees From Premises. Coverage For Temporary Repairs • Insurance Covers Expenses Incurred To Make Temporary Repairs Needed To: – Protect Property From Further Damage – Make House Habitable • Document The Need For Temporary Repairs • Save Receipts For Expenses Incurred Flood Insurance • Specified Coverage Amount For Building & Personal Items • Separate Deductible For Building & Personal Items • Policy Usually Pays Replacement Cost On Insured Home If It Is The Primary Residence And The Amount Of Coverage Is 80% Or More Of The Replacement Cost Of The Building • Personal Property Paid On Depreciated Basis • Must submit Proof Of Loss Form Within 60 Days Or Secure Extension Of Time To File Proof Of Loss Renters Insurance • Provides Coverage For Personal Items • Coverage Only For Named Causes • Pays Depreciated Value Unless Replacement Cost Endorsement Purchased • Pays Extra Expense & Extra Living Costs – Coverage Amount Usually 20% Of Personal Property Coverage Amount Or For Specified Time Period Such As For 6-Months Auto Insurance • Comprehensive Coverage Provides Coverage For All Damages Except Collision With A Fixed Object • Comprehensive Coverage Deductible May Be Lower Than Collision Deductible • Comprehensive Coverage Provides Coverage For: – Flood – Damage From Falling Objects & Windblown Debris – Most Other Damage Occurring To A Vehicle Question & Answer Question: How do I report my Claim? Answer: Call your insurance agent or insurance company and report your claim. Question: How do I know what coverage I have? Answer: The front of your insurance policy has a page called the Declarations Page. Look at this page and it will indicate the amount of your coverage. Question: How long will it take for an adjuster to call me? Answer: It depends on each situation. Call your insurance company to secure an idea of when you should expect to hear from an adjuster. Question & Answer (cont.) Question: Will the adjuster attempt to reduce my claim? Answer: The adjuster wants to pay and close your claim as fast as possible and still be fair to you and your insurance company. The adjuster may pay more than you expected or less than you expected, depending on your coverage and damages. Adjusters are encouraged to pay fair amounts. Question: Should I request an advance payment from my insurance company? Answer: If you sustained significant damage and you need money now, you should request an advance payment from your insurance company. Question: Should I throw damaged items away? Answer: Without creating a hazard, and if possible, you should save evidence of valuable items so that you can document you owned these items. Question: Should I hire a public adjuster to represent me? Answer: The decision to hire a public adjuster is a personal choice that you must make depending on your circumstances. Question & Answer (cont.) Question: Can I use my own repair contractor or should I use the contractor suggested by the insurance company? Answer: You can use your own contractor. The contractor suggested by the insurance company may be able to expedite your claim handling since the contractor knows the insurance company procedures and requirements and may be able to resolve issues more easily with your insurance company. Question: Will the insurance company pay to take care of my animals while I am out of my home? Answer: The cost of boarding or kenneling your animals will be covered as additional living expense costs. Question: If I rent a travel trailer or motor home to live in, will the insurance company pay for the cost? Answer: Within reason, the insurance company should pay for the cost as an additional living expense. Question & Answer (cont.) Question If I buy a generator, will the insurance company pay for it? Answer: If you are going to be without power for a significant period of time, the insurance company should pay for a generator as an additional living expense. Question: If I stay with relatives and pay them, will I be reimbursed? Answer: If you have increased living costs because you are staying with relatives, the insurance company should pay for the increased costs as additional living expenses. Question: Should I get the trees off my house and buildings and make temporary repairs? Answer: If possible, you should take action to make temporary repairs to prevent further damage and to make your house habitable. Question & Answer (cont.) Question: What is depreciation and how does it affect my claim? Answer: Depreciation is the reduction in value of property because of age or use. If you have replacement cost coverage, the insurance company may only pay the depreciated value of the item until you replace the item. Once you replace the item, the insurance company will usually pay only what you spent to replace the item. Question: Will the insurance company pay for food spoilage? Answer: It depends. Usually the insurance company will pay if damage to your premises interrupted your electrical service, but they will not pay if the spoilage was caused by a general power outage. State, Federal, & Charitable Agency Contact Information • FEMA Disaster Assistance 1-800-621-3362 / 1-800-462-7585 (TTY) • • National Flood Insurance Program: (888) 379-9531 Louisiana Department of Insurance: 1-800-259-5300 or 1-800-259-5301 and (225) 342-5900 or (225) 342-0895 Mississippi Department of Insurance: 1-800-562-2957 or 601-359-3569 Alabama Department of Insurance: 334-269-3550 Charitable organizations recommended by the Federal Emergency Management Agency (FEMA) – American Red Cross Disaster Relief Fund-(800) 435-7669 – Catholic Charities, USA-(800) 919-9338 – Salvation Army-(800) 725-2769 – United Methodist Committee On Relief-(800) 554-8583 • • • Contacting Your Insurance Company • Most Insurance Companies Have Toll Free Telephone Numbers And You Can Secure Contact Information Through The Following Sources: – – – – Radio Newspaper Television Internet