coop planning & property insurance

advertisement

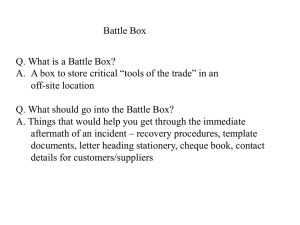

CONTINUITY OF OPERATIONS PLANNING AND PROPERTY INSURANCE Continuity of Operations Planning Overview Continuity of Operations “Is an effort within individual executive departments and agencies to ensure that Primary Mission Essential Functions continue to be performed during a wide range of emergencies, including localized acts of nature, accidents, and technological or attack-related emergencies.” -FEMA Essential Functions “Those functions an organization must continue in a continuity situation”. -FEMA Goal “The ultimate goal of continuity in the executive branch is the continuation of National Essential Functions. In order to achieve that goal, the objective for organizations is to identify their Essential Functions, and ensure that those functions can be continued throughout, or resumed rapidly after, a disruption of normal activities. The Federal Government has an important partnership with other non-federal government entities and with private sector owners and operators who play integral roles in ensuring our homeland security”. -FEMA Continuity of Operations Planning Overview Question: What emergencies may result in the interruption of your agency’s business operations? Continuity of Operations Planning Overview Property Insurance • “All direct risks of physical loss or damage… not otherwise excluded” Types of Covered Causes of Loss • Fire • Frozen Pipes & Water Damage • Hail • Flood • Windstorm (tornado, hurricane) • Terrorist Events • Arson • Accidental Breakdown of Equipment Phase I: Readiness and Preparedness • Development of the plan • Test, Train, and Exercise • Risk Management Phase I: Readiness and Preparedness Risk Assessment Helps to determine an organization’s vulnerability to hazards, including human-caused incidents that pose a threat to the facility or personnel. Factors to consider when comparing hazards: • Frequency of occurrence. • Potential magnitude and intensity. • Probable spatial extent and duration. • Speed of onset. Phase I: Readiness and Preparedness Statewide Property Insurance Program Resources: • Swiss Re “CatNet” – natural hazards assessment based upon geographic location • Catastrophe Modeling – computer simulation of realistic disaster scenarios based upon your agency’s exposures • Hartford Steam Boiler Property Surveys – on-site analysis of fire and related hazards • Infrared Thermography – onsite analysis of electrical hazards • American Appraisals – replacement cost valuation of your facilities Phase I: Readiness and Preparedness Other Resources: • Local/State Fire Marshal (AHJ) • Local/State/Federal Law Enforcement Current threat levels Physical security analysis • Maps – 5 mile building radius Potential targets HazMat sites Phase I: Readiness and Preparedness Budgeting and Acquisition (CGC 1): • Through the budgeting process, an organization’s leaders and staff will ensure critical continuity resources are available to continue performing the organization’s Essential Functions before, during, and after a continuity event. – Identify and provide continuity funding and specific budgetary requirements to establish and maintain the requirements for all elements of a viable and resilient continuity capability. – Identify provisions for the acquisition and procurement of necessary equipment, supplies, resources, and personnel that are not already in place at the continuity facilities on an emergency basis and needed to sustain operations for up to 30 days or until normal operations resume. Phase II: Activation Activation of continuity plans and all associated procedures necessary to support the continued performance of Essential Functions. If your property is damaged as a result of a covered cause of loss, contact SORM to initiate claims process. Phase III: Continuity Operations Activities to continue essential functions, including communicating with supporting and supported organizations, customers, and stakeholders. Emergency Relocation Group Team that continues agency essential functions. Phase III: Continuity Operations How Property Insurance Supports Continuity of Operations • Coverage is tailored to offset the financial costs resulting from an event – Potential advance payments for large scale disasters • Pre-loss – Preservation of Property – funds expended to prevent impending disaster – Emergency Vacating Expense – cost to evacuate students, patients, occupants Phase III: Continuity Operations How Property Insurance Supports Continuity of Operations • Post-loss – Extra Expense – additional costs expended to maintain operations – Business Interruption – loss of revenue due to loss – Civil Authority – prevention of access to facilities Phase IV: Reconstitution Definition: “The Process by which surviving and/or replacement organization personnel resume normal organization operations from the original or replacement primary operating facility”. -FEMA Implemented when the emergency, or threat of emergency, is over, and organizations initiate operations for resuming normal business operations. Organizations can plan for reconstitution prior to activation of their continuity plan and concurrently with continuity operations. Phase IV: Reconstitution Phase IV: Reconstitution • Insurance will repair or replace facility with like kind & quality – If building codes have changed, upgrading to new code requirements – Extra expenses required for returning equipment to original location • Support of SORM Coordinating Claims Adjuster – York Risk Services helps facilitate claim payments on behalf of SORM agencies Phase IV: Reconstitution • Speed of payment – Insurance • Partial advance payments possible in 1-2 weeks • Continual payments until final closeout of damages – FEMA Public Assistance Grants • Only applies for Federally Declared Disasters • Lengthy claims process, continual audits of distributed funds • Recent reports show average FEMA closeout period to be 10 years – State Legislature • Must get approval • Timing of payment? Continuity of Operations Planning and Property Insurance QUESTIONS? Andres Campo, ARM Chris R. Connelly, ARM-P Director of Risk Management Area Senior Vice President Email: andres.campo@sorm.state.tx.us State Office of Risk Management Phone: (512) 936-1561 Fax: (512) 370-9029 Email: Chris_Connelly@ajg.com Arthur J. Gallagher Risk Management Services, Inc. 200 S. Orange Avenue, Suite 1350 Orlando, FL 32801 Direct: (407) 563-3513 Mobile: (410) 905-7180 Toll-Free: (800) 524-0191 Ext. 3513 Fax: (407) 370-3057