Supply-Side Policy:

Short-Run Options

Chapter 16

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.

Supply-Side Policy

• Any policies that alter the willingness or

ability to supply goods at various price levels

will shift the aggregate supply curve

– How does the aggregate supply curve affect macro

outcomes?

– How can the aggregate supply curve be shifted?

16-2

Aggregate Supply

• The macro economy experienced stagflation in

the 1970s

• Stagflation: The simultaneous occurrence of

substantial unemployment and inflation

• No shift of the aggregate demand curve can

solve inflation and unemployment at the same

time

16-3

Aggregate Supply

• The shape and shifts in aggregate supply hold

the clues on how stagflation may occur

• Aggregate supply: The total quantity of

output that producers are willing and able to

supply at alternative price levels in a given

time period, ceteris paribus

16-4

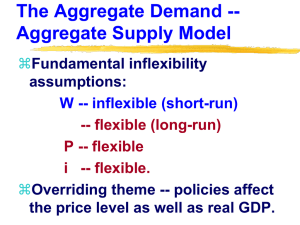

Shape of the AS Curve

• The response of producers to an AD shift is

expressed in the slope and position of the AS

curve

• There are three views concerning the shape

– Keynesian AS

– Monetarist AS

– Hybrid AS

16-5

Keynesian AS

• Little risk of inflation during

a recession

• Producers increase output,

not prices, when aggregate

demand picks up

• Inflation becomes a problem

only if demand increases

beyond capacity

16-6

Monetarist AS

• Changes in money supply

affect prices but not output

• Rising prices don’t entice

producers to increase output

because costs rise just as

fast

• AS is vertical and located at

full employment

16-7

Hybrid AS

• At low rates of output AS is

horizontal

• At high rates of output AS is

nearly vertical

• In between, AS is gently

upward sloping

• The closer the economy is to

capacity, the greater the risk

that fiscal or monetary

stimulus will cause inflation

16-8

The Inflation-Unemployment Tradeoff

• Fiscal and monetary policies cannot reduce

unemployment and inflation at the same time

• Because AS curve is upward-sloping

– Rightward shifts of AD increase both prices and

output

– Leftward shifts of AD decrease prices and output

16-9

The Phillips Curve

• Phillips curve: A historical (inverse)

relationship between the rate of unemployment

and the rate of inflation; commonly expresses

a trade-off between the two

• The trade-off originates in the upward-sloping

AS curve

16-10

Inflation Rate (percent)

The Phillips Curve

11

10

9

8

7

6

5

4

B

3

2

A

1

0

C

1

2

3

4

5

6

7

Unemployment Rate (percent)

16-11

The Phillips Curve Trade-Off

A trade-off between

unemployment and inflation

Aggregate

supply

C

B

A

AD3

AD2

AD1

REAL OUTPUT

INFLATION RATE

PRICE LEVEL

Increases in aggregate

demand cause . . .

Phillips curve

c

b

a

UNEMPLOYMENT RATE

16-12

The Inflationary Flashpoint

• Phillips curve indicates there is bound to be a

trade-off between unemployment and inflation

at some point in economic expansions and

contractions

• Inflationary flashpoint: The rate of output at

which inflationary pressures intensify; point of

inflection on AS curve

16-13

Shifts of the AS Curve

• Many economists argue that the economy can

attain lower levels of unemployment without

higher inflation

• Only a rightward shift of the AS curve can

reduce unemployment and inflation at the

same time

16-14

Shifts of Aggregate Supply

Price Level

Rightward AS shifts reduce AS1

unemployment and inflation

E1

AS2

E2

AD

0

Output

16-15

Phillips Curve Shift

• The Phillips curve shifts left when the AS

curve shifts right, and vice versa

• The unemployment-inflation trade-off eases

when the Phillips curve shifts to the left

16-16

Phillips Curve Shift

Inflation Rate (percent)

PC1

Rightward AS shifts cause

leftward Phillips curve shifts

PC2

a

4

b

2

1

2

3

4

5

6

Unemployment Rate (percent)

7

8

16-17

Leftward AS Shifts: All Bad News

• Leftward AS shifts create stagflation

• Supply-side shocks can shift the AS curve to

the left

• Leftward shifts of aggregate supply cause

rightward shifts in the Philips curve

16-18

Policy Tools

• Policy options to shift AS rightward include:

–

–

–

–

–

Tax incentives for saving, investment, and work

Human capital investment

Deregulation

Trade liberalization

Infrastructure development

16-19

Two Theories for Getting the

Economy Moving

Supply-Side Theory

Keynesian Theory

1

Cut tax rates to boost incentives to

work and invest.

1

Cut tax rates to put more disposable

income in people’s hands.

2

Firms invest more and try new

ventures; jobs are created; people

work harder aggregate supply

increases.

2

People use increased income to buy

more goods and services:

aggregate demand increases.

3

New investment and labor

bring increased output.

3

To meet new demand, companies

expand output.

4

Employment rises, new plants go up, the

whole economy expands.

16-20

Tax Incentives

• In Keynesian economics, tax cuts are used to

increase aggregate demand

• Direct effects of taxes on the supply of goods

are the concern of supply-side economists

• Taxes not only alter disposable income but

also affect incentives to work and produce

16-21

Marginal Tax Rates

• Supply-side theory places special emphasis on

marginal tax rates

– Marginal Tax Rate: The tax rate imposed on the

last (marginal) dollar of income

• If the marginal tax rate is high, there is less

incentive to work

16-22

Marginal Tax Rates

• Progressive marginal tax rates discourage

entrepreneurship

• Growth rate, investment, and employment of

small businesses are affected by marginal tax

rates

• Corporate investment decisions are also

affected by corporate tax rates

16-23

Changes in Marginal Tax Rates

Since 1915

16-24

Tax-Induced Supply Shifts

• A reduction in marginal tax rates shifts the

aggregate supply curve to the right

• Work effort, entrepreneurship, and investment

increase

• Tax rebates do not shift AS, because they are a

one-time windfall and do not effect marginal

tax rates

• Tax rebate: A lump-sum refund of taxes paid

16-25

The Tax Elasticity of Supply

• If the tax elasticity of supply were large

enough, a tax cut might actually increase tax

revenues

Tax elasticity % change in quantity supplied

of supply

% change in tax rate

16-26

Savings and Investment Incentives

• Supply-side economists favor tax incentives

that encourage saving

• Tax incentives for investment are an

alternative lever for shifting aggregate supply

– Examples include investment tax credits and

cutting capital gains tax rates

16-27

Human Capital Investment

• Tax incentives to businesses that offer worker

training are a viable policy tool for future

shifts in aggregate supply

• Expansion and improvement of the education

system through increases in education

spending will develop human capital gradually

16-28

Human Capital Investment

• Addressing discriminatory barriers through

affirmative action programs can reduce

artificial barriers between job seekers and job

openings

• Restructuring of transfer payments can reduce

impact on labor supply

16-29

Deregulation

• Government regulations limit the flexibility of

producers and tend to raise production costs,

shifting AS to the left

• Government intervention in factor markets

increases the cost of supplying goods and

services in many ways

16-30

Minimum Wage and Mandatory Benefits

• Minimum-wage laws increase the cost to

employers of hiring additional workers,

shifting the aggregate supply curve leftward

• By requiring employers to provide specific

fringe benefits, the government increases the

cost of doing business

16-31

Occupational Health and Safety

• OSHA, the Occupational Health and Safety

Administration, forces employers to conform

to certain minimum safety conditions at

workplaces

• The additional costs shift the aggregate supply

curve to the left

16-32

Product Markets

• Government regulations also raise costs in

product markets

• Regulation of transportation costs constrains

producer’s ability to respond demand increases

• Food and drug standards, enforced by the

Food and Drug Administration (FDA), cause

companies to incur additional costs as well

16-33

Reducing Costs

• The basic contention of supply-side

economists is that the regulatory costs are now

too high

• They favor deregulating the production

process in order to shift aggregate supply to

the right

16-34

Easing Trade Barriers

• In the factor markets, reducing tariffs or quotas

on imports of production inputs decrease

production costs and increase aggregate supply

• In the product markets, foreign suppliers

increase the quantity of output available at any

given price level, helping flatten the AS curve

16-35

Easing Trade Barriers

• Free trade pacts like the North American Free

Trade Agreement (NAFTA) tend to shift

aggregate supply rightward

• Allowing immigration of foreign-born workers

can increase the pool of skilled labor and help

shift the aggregate supply curve to the right

16-36

Infrastructure Development

• Improving the nation’s infrastructure reduces

costs of supplying goods and services

• Infrastructure: The transportation,

communications, education, judicial, and other

institutional systems that facilitate market

exchanges

16-37

Expectations

• Because investment is always a bet on future

economic conditions, expectations directly

affect the shape of the AS curve

16-38

Rebuilding America

• The output of the American economy depends

on public as well as private investment

• Declining infrastructure investment reduces

actual and potential output

• Infrastructure improvements will increase

aggregate supply, boosting both short-run and

long-run economic outcomes

16-39

Supply-Side Policy:

Short-Run Options

End of Chapter 16

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.