Chapter 16

advertisement

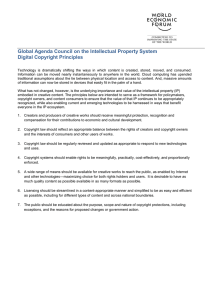

CHAPTER Protecting Your Business Section 16.1Legal Issues Section 16.2 Insurance SECTION Legal Issues OBJECTIVES Explain the value to entrepreneurs of intellectual property law Distinguish the types of work covered by each form of intellectual property protection Describe the conditions needed for valid business contracts Explain legal remedies for contract and intellectual property law violations Section 16.1: Legal Issues 2 Benefits of Intellectual Property Law Entrepreneurs need protection for their creations. The founding fathers understood that creators are more highly motivated if they are guaranteed control over their work and can profit from it and thus they embedded this principle in the U.S. Constitution. Under Constitutional Law, creators were given an exclusive right to their work, but for limited times. The doctrine of fair use—allowing other people restricted use of protected works—balanced the rights of both the individual and the public. Section 16.1: Legal Issues 3 Protecting Your Works Intellectual property law covers almost any kind of creation. Depending on the nature of the idea, you might take out a copyright, patent, trademark, service mark, or even protect a trade secret. A copyright is the exclusive right to perform, display, copy, or distribute an artistic work. Patents cover industrial devices and processes that are implemented by applying ideas. A trademark is a word, phrase, or symbol that a manufacturer uses to identify the company’s products. A service mark is a word, phrase, or symbol a service provider uses to identify its services. A trade secret is any information that a business keeps confidential to gain advantage over competitors. Section 16.1: Legal Issues 4 Business Contracts Contracts play a significant role in business ownership. Understanding how contracts work is essential to succeeding as an entrepreneur. For a contract to be valid, or legally enforceable, there must be: Agreement between the Parties. The parties must agree on the conditions, or the events or circumstances that must occur for the contract to be binding. Competence. In the legal sense, competent means being capable of understanding the terms of a contract and the consequences of signing it. Mutual Exchange. This is termed the consideration, the benefit that each party provides for the other. Section 16.1: Legal Issues 5 Seeking Remedy Entering into a business contract gives you the right to take action against parties who violate the agreement. Violating a copyright or patent is called infringement. Failure to carry out the conditions of a contract is referred to as breach of contract. The law allows different types of remedies: In cases of infringement, the common remedy is injunctive relief, an order for the violator to stop the illegal activity. In a breach of contract, the violator must agree to carry out the agreed-upon terms. In either situation, the guilty party may be forced to pay damages, a payment to reimburse the injured party for loss. Section 16.1: Legal Issues 6 SECTION Insurance OBJECTIVES Relate insurance to risk management Describe different business insurance needs and options Distinguish the qualities of a good insurance agent and good policies Create a plan for reducing business risk Section 16.2: Insurance 7 Understanding Insurance Don’t think you can’t afford insurance. You can’t afford not to have insurance. Managing risk, or the possibility of loss, is an aspect of starting a business. Speculative risk is risk that holds the possibility of either gain or loss. Pure risk is the chance of loss with no chance of gain. Another option for managing pure risk, risk transfer, is a means shifting risk to another party. For business owners, that means purchasing business insurance. A policy is a written contract between the insurer and the policyholder. Section 16.2: Insurance 8 Types of Business Insurance Property insurance protects a business’s possessions in the event of fire, theft, or damage from the weather. Insuring property for its actual worth is called cash value. The cost of replacing property at current prices is called its replacement cost. Liability insurance provides protection when a business’s action, or lack of action, injures another party. General Liability covers expenses related to injuries sustained on the business premises. A product liability policy protects a business from losses caused by a product it produced or developed. Professional Liability covers harm done by a business’s actions, or failure to act. Workers’ compensation insurance covers losses to employees due to job-related injury or illness. Section 16.2: Insurance 9 Buying Insurance Selecting an insurance package is an integral part of a business’s start-up plan. Choosing an insurance agent is like hiring an important employee. You want someone who is familiar with your type of business. Ask advice from other businesspeople in your field. Exclusive agents work for a single insurance company. An independent agent represents several insurers and can offer a wider range of policies. The best insurance package is the one that most closely fits your needs. A rider is an amendment to a policy that changes the benefits or conditions of coverage. Section 16.2: Insurance 10 Reducing Business Risk Risk reduction involves limiting the chances that a policy-covered event will occur. Securing physical property involves keeping buildings, supplies, and merchandise safe. Businesses must safeguard sensitive information from falling into the wrong hands. Providing a safe workplace is an employer’s legal and ethical responsibility. Business owners can reduce risk by promoting employee wellness. An ergonomics assessment reveals whether the current work environment helps maintain physical and emotional health. Section 16.2: Insurance 11