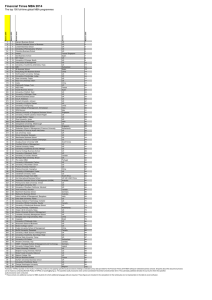

KPMG Screen 3:4 (2007 v4.0)

Insider trading and front running laws in India and role of compliance officers

17 August, 2012

Agenda

Background and context

Key regulations around insider trading

SEBI guidelines

Case Studies

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

1

Background and context

Overall environment

India joins the elite club of 12 countries with a trillion dollar economy due to the appreciation of the rupee against the US dollar

SOURCE: News article from The Hindu

Fraud

But with economic and political scenario of the country coupled with the recent scams, frauds and corruption issues has highlighted certain challenges in doing business in India

Corruption

Source: Google search trends in the past 12 months

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

3

The concerns are not unfounded

There is a rise in the incidence of fraud – ineffective control systems and diminishing ethical values are key contributors

Financial statement fraud a major issue in India

Fraud risk management in companies need to improve

Bribery and corruption remains a challenge in conducting business

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

Employees poses highest risk of committing fraud

4

Perception of fraud in India

75%

Fraud incidences in India have increased

54%

Fraud is on the rise within their industry

2010

India

Fraud Survey Report

2006 2008

The fraud risk threat is perceived to be the highest in the Financial Sector

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

5

Global environment around fraud – Financial services

Financial services sector has lost the most to fraud

Prone areas

Money laundering

Financial mismanagement

Regulatory and

Compliance breach

Information theft, loss or attack

Source: Global Fraud report by Kroll, 2009-2010

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

6

Perceptions of fraud in India (Contd.)

Key contributing factors of fraud

Diminishing ethical values and lack of action against the deviation from established policies

63%

Inadequate internal controls/ compliance program

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

7

Insider trading cases

Rajat Gupta

Rajat Gupta, who sat on boards at some of the most influential companies in the U.S., was charged in October with helping his friend Raj Rajaratnam carry out his ill-fated insider trading scheme. The Federal Bureau of

Investigation contends that Gupta illegally leaked inside information about firms where he'd been a director - including Goldman Sachs and Procter &

Gamble - to Rajaratnam's Galleon Group hedge fund. The conspiracy count of which Gupta was convicted carries a maximum sentence of five years in prison and at least $250,000 in fines. Gupta faces 20 years and a

$5 million fine for each securities fraud count. He has been found guilty for one conspiracy and three of the five counts of securities fraud

Raj Rajaratnam

The Galleon Group founder was convicted in May of spearheading the largest insider trading scheme to ever involve a hedge fund. The regulator slapped Raj Rajaratnam with a record

$92.8 million penalty and 11 years behind the bar for his crimes.

The case also marked the first time the SEC deployed courtordered wiretaps to track down criminality on Wall Street.

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

8

Insider trading cases

James Fleishman

On December 21, former Silicon Valley sales manager James

Fleishman, a former employee at Primary Global Research, was slapped with 25 years of imprisonment after being convicted in September of conspiracy to commit both securities and wire fraud. Alleged that that Fleishman illegally leaked confidential information about publically-traded technology firms like Dell Inc. and Advanced Micro Devices Inc. to hedge funds

Doug DeCinces

Former Major League Baseball player Doug DeCines was charged in August 2011 with insider trading after the SEC discovered he and his associates loaded up on shares of

Advanced Medical Optics Inc. after being illegally tipped off about its impending sale to Abbott Laboratories Inc. The former

Angels third baseman allegedly made $1.7 million on the scheme, but had to pay $2.5 million penalty to settle the allegations.

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

9

Recent cases..

SEBI observed that three individuals were trading ahead of the trades of Citigroup Global based on trading based on information leaked by a Hong Kong-based Citigroup trader. Total penalty of

INR 1.19 crore was imposed on them

SEBI identified front running involving an employee at a leading mutual fund company and passed an interim order in June 2010, which involved a total penalty amount of INR 55 lakh

SEBI has imposed a INR 5 lakh fine on the erstwhile Satyam Computer's compliance officer G

Jayaraman for failing in his duty to close the trading window in time which would have avoided the insider trading in the company's shares in December 2008 - before the major corporate scam broke out

Nomura Holdings Inc CEO Kenichi Watanabe resigned over a widening insider trading scandal

Six men have been jailed in UK for a total of 16 years for participating in an insider trading ring that profited them of £732,000 . Confidential information stolen from the print rooms of UBS and

JPMorgan Cazenove and were accused of passing price sensitive takeover information to Pardip

Saini, who then disseminated the data using an email “drop box” that could be accessed by the other defendants.

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

10

Key regulations around insider trading

Insider Trading – A concept

• Insider trading is the trading of a corporation's stock or other securities by individuals with potential access to non-public information about the company.

• Insider trading can be illegal or legal depending on when the insider makes the trade

• It is illegal to trade when the material information is non-public as it is unfair to other investors who are not privy to such information. Illegal insider trading therefore includes tipping others when you have any sort of nonpublic information.

• Insider trading is legal once the material information has been made public, at which time the insider has no direct advantage over other investors

• The important criteria here is that the access to the insider information and the time of the investment constitute an important criteria for the rationale of the investment.

• The trade could be conducted through any of the following methods:

• through their own account

• their relative’s account

• organisation / firm’s account or

• a client’s account.

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

12

Front Running – A concept

A practice whereby a person takes a position in an equity in advance of an action which he/she knows his/her entity / clients will take, that will move the equity’s price in a predictable fashion

400

350

300

250

200

150

100

50

0 Time

Intra day stock price movement

Stock price

Front runner

Stock price

Accomplice Institution Broker

400

350

300

250

200

150

100

50

0

Time

BUY

(Institution)

SELL

(Institution)

A front running exercise typically involves intra-day trades and hence timing of execution is critical.

Typically the counterparty in the second leg of the transaction for the front runner is the institution itself.

The objective is to make small gains on large volumes.

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

13

Key regulations around insider trading/front running in India

SECURITIES AND EXCHANGE BOARD OF INDIA

([PROHIBITION OF ] INSIDER TRADING)

REGULATIONS, 1992

Prohibition on dealing, communicating or counselling on matters relating to insider trading

Sec (3) No insider shall —

(i) either on his own behalf or on behalf of any other person, deal in securities of a company listed on any stock exchange [when in possession of] any unpublished price sensitive information; or

(ii) Communicate [or] counsel or procure directly or indirectly any unpublished price sensitive information to any person who while in possession of such unpublished price sensitive information shall not deal in securities

Sec (3A): No company shall deal in the securities of another company or associate of that other company while in possession of any unpublished price sensitive information

Any insider who deals in securities in contravention of the above provisions shall be guilty of insider trading.

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

14

Some important terminologies as per the act

Some important terminologies as per the act:

Insider : Insider means any person who: i.

Is or was connected with the company or is deemed to have been connected with the company and is reasonably expected to have access to unpublished price sensitive information in respect of securities of [a] company, or ii.

Has received or has had access to such unpublished price sensitive information

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

15

Important terminologies as per the act

‘Person is deemed to be a connected person’, if such person:

i.

Is a company under the same management or group, or any subsidiary company ii.

Is an intermediary i.e. Investment company, Trustee Company, Asset Management Company or an employee or director or an official of a stock exchange or of clearing house or corporation iii.

Is a merchant banker, share transfer agent, registrar to an issue, debenture trustee, broker, portfolio manager, Investment Advisor, sub-broker, Investment Company or an employee there of, or is member of the Board of Trustees of a mutual fund or a member of the Board of Directors of the Asset Management

Company of a mutual fund or a member of the Board of Directors of the Asset Management Company of a mutual fund or is an employee thereof who have a fiduciary relationship within the company iv.

Is a Member of the Board of Directors or an employee of a public financial institution v.

Is an employee of a Self Regulatory Organisation recognized or authorized by the Board of a regulatory body; or vi.

is a relative of any of the aforementioned persons; vii.

is a banker of the company viii.

relatives of the connected person; or ix.

is a concern, firm, trust, Hindu undivided family, company or association of persons wherein any of the connected persons have more than 10 per cent of the holding or interest

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

16

Important terminologies as per the act

“

Price sensitive information” means any information which relates directly or indirectly to a company and which if published is likely to materially affect the price of securities of company .

Explanation.

—The following shall be deemed to be price sensitive information :— i.

periodical financial results of the company; ii.

intended declaration of dividends (both interim and final); iii.

issue of securities or buy-back of securities; iv.

any major expansion plans or execution of new projects.

v.

amalgamation, mergers or takeovers; vi.

disposal of the whole or substantial part of the undertaking; vii. and significant changes in policies, plans or operations of the company

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

17

Defense mechanism

Sec 3(B): In a proceeding against a company in respect of regulation 3A, it shall be a defence to prove that it entered into a transaction in the securities of a listed company when the unpublished price sensitive information was in the possession of an officer or employee of the company, if : a) the decision to enter into the transaction or agreement was taken on its behalf by a person or persons other than that officer or employee ; and b) such company has put in place such systems and procedures which demarcate the activities of the company in such a way that the person who enters into transaction in securities on behalf of the company cannot have access to information which is in possession of other officer or employee of the company; and c) it had in operation at that time, arrangements that could reasonably be expected to ensure that the information was not communicated to the person or persons who made the decision and that no advice with respect to the transactions or agreement was given to that person or any of those persons by that officer or employee; and d) the information was not so communicated and no such advice was so given.

Note: It would be a defense to prove for a company that the acquisition of shares of a listed company was as per the Securities and Exchange Board of India (Substantial Acquisition of

Shares and Takeovers) Regulations, 1997

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

18

SEBI guidelines

POLICY ON DISCLOSURES AND INTERNAL PROCEDURE FOR

PREVENTION OF INSIDER TRADING

All listed companies and organisations associated with securities markets shall:

Frame a code of internal procedures and conduct as near thereto the Model Code specified in Regulations

shall abide by the code of Corporate Disclosure Practices

shall adopt appropriate mechanisms and procedures

enforce the codes specified

Ensure that the action taken by the entities against any person for violation of the code shall not preclude the Board from initiating proceedings for violation of these Regulations

Contents for the Model Code of Conduct:

• Appointment of a Compliance Officer including the duties and responsibilities of the compliance officer

• Preservation of a price sensitive information

• Prevention of misuse of Price Sensitive information

• Restricted List/ Grey List

• Other restrictions

• Reporting requirements for transaction in securities

• Penalty for contravention of code of conduct

• Information to SEBI incase of violation

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

20

Indicative guidelines

Appointment of

Compliance

Officer

Preservation of Price

Sensitive information

• Setting forth policies and procedures

• Monitoring adherence to the rules for the preservation of “Price Sensitive Information”

• Pre-clearing of all designated employees and their dependents trades (directly or through respective department heads as decided by the organisation/firm)

• Monitoring of trades and the implementation of the code of conduct under the overall supervision of the partners/proprietors.

• Maintain a record of designated employees and any changes made in the list of designated employees

• In case of a violation, the Compliance Officer should report the matter to SEBI

• In addition, Compliance Officer can assist staff in addressing any clarifications regarding SEBI and the firm’s code of conduct

• Employees/directors/partners must ensure to maintain the confidentiality of all Price Sensitive

Information and not pass on such information directly or indirectly by way of making a recommendation

• Strictly provide information on need to know basis

•

Ensure that confidential information is kept secure

• Create a Chinese wall which segregate the ‘inside areas’ from the ‘public areas’

• Set up a mechanism for pre-clearance of trades

Prevention of misuse of price sensitive information

•

Obtain an undertaking from the employee confirming the receipt/ non receipt of price sensitive information

•

Include declarations which refrain the employee from trading in the securities while in possession of the information

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

21

Indicative guidelines

Restricted

List/ Grey

List

• To monitor Chinese wall procedures and trading in client securities based on inside information, the organisation/firm shall restrict trading in certain securities and designate such list as restricted/grey list

• The security must be added to the Grey list at the time of receiving price sensitive information /before handling the assignment / at the time the security is being purchased or sold or is being considered for purchase or sale by the organisation on behalf of its clients/schemes of mutual funds, etc. as the case may be

• List must be maintained by the Compliance Officer and is highly confidential in nature

• Trading of entities in the Restricted list must be disallowed at the time of Designated employees must be disallowed at the time of pre-clearance if the trading entity exists in the designated list

Other

Restrictions

Reporting requirements

• All directors/designated employees/partners shall execute their order within one week after the approval of pre-clearance is given. Fresh approval must be sought if the transaction is not conducted with the approved time frame

• Investment must held for a period of 30 days to be considered as held for investment

• Holding period may be waived by the Compliance Officer incase of personal emergencies such as wedding/ medical treatment etc.

• Analysts at the time of preparation of a report must disclose their shareholding/ interest to the Compliance

Officer and shall not trade for a period of 30 days from the preparation of such report

• Details of investment- Interests must be provided by the employees at the time of joining to the

Compliance Officers

• Periodic declarations can be obtained based on the time frame fixed by the employee

• Annual statement of holding of securities can be obtained by the Compliance Officer to check for any violations

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

22

Indicative guidelines

Penalty for the contraventi ons

• Any employee/partner/director who trades in securities or communicates any information or counsels any person trading in securities, in contravention of the code of conduct may be penalized and appropriate action may be taken by the organisation/firm.

• Employees/partners/directors of the organisation/firm who violate the code of conduct may also be subject to disciplinary action by the company, which may include wage freeze, suspension, etc.

• The action by the organisation/firm shall not preclude SEBI from taking any action in case of violation of

SEBI (Prohibition of Insider Trading) Regulations, 1992.

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

23

Comparison with UK Trading Laws

• In the UK, the relevant laws are the Criminal Justice Act 1993 Part V Schedule 1 and the Financial Services and Markets Act 2000, which defines an offence of Market Abuse. The principle is that it is illegal to trade on the basis of market-sensitive information that is not generally known.

• Relationship: No relationship to the issuer of the security is required; all that is required is that the guilty party traded (or caused trading) whilst having inside information

• Individuals – As per this act, only individuals can ne held liable unlike in India where individuals or corporations can be held guilty of the offence

• Classification of information: UK regulations state that information can be said to have been made public if –

• it is published in accordance with the rules of a regulated market for the purpose of informing investors and their professional advisors;

• it is contained in records which by virtue of any enactment are open to inspection by the public;

• it can be readily acquired by those likely to deal in securities (a) to which information relates (b) or an issuer to which the information relates; or

• it is derived from information which has been made public .

Indian regulations are silent on when and how the information is considered to be public

• Intent of the Offender: Insider Trading is considered as a criminal offence since 1980. However, India is still yet to consider this as a criminal activity mainly because Indian laws do not seem to take the ‘intent’ of the offender into account

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

24

Comparison with US Trading Laws

The US passed the Securities Exchange Act in 1934 and the Securities & Exchange commission

(SEC) was formed. Whilst in India, the Insider trading regulations came in as late as 1992.

• Scope of ‘Insiders’: ’: In US, the term ‘insiders’ not includes individuals not connected to a company, but also to includes traders who have traded based on non-public financial information

• Wiretapping: US regulations allow wiretapping. The evidence in a majority of insider trading cases in US have been obtained by way of wiretapping. Circumstantial evidence in the

Galleon case was obtained through this process In India, no such powers have yet been granted to the regulator.

• Penalty : In US, Securities fraud carries a maximum prison sentence of 20 years. Conspiracy carries a five-year maximum prison sentence. In India, a violator shall be punishable with imprisonment for a term which may extend to 10 years or with fine which may extend to

Rs.25 Crores or with both.

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

25

Case studies

Perceptions of fraud in India (Contd.)

Key contributing factors of fraud

Diminishing ethical values and lack of action against the deviation from established policies

63%

Inadequate internal controls/ compliance program

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

27

Perpetrator of Fraud

‘Enemy within’ poses the highest risk

2006

36 percent

2008

42 percent

2010

Over 75 percent

2010: Over 75 percent of all fraudulent activities were perpetrated by employees

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

28

Profile of a fraudster

Age

• Typical fraudster is between the ages of 36 and 45.

Gender

• Male

• Entrusted with sensitive information

• Ability to override controls

• Senior Management implicated in Fraud than

Junior Staff

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

29

Case Study – I

Background

●

One of the leading financial institutions in India

●

There was an allegation regarding front running of stocks against one of its key employees.

Modus Operandi

●

The employee was the mastermind and was running the entire operation. The external associates used to just implement the suggestions given by the insider.

●

Aim was to look for small gains on large volumes

●

Large cap stocks were targeted

●

On a particular day, not more than two stocks will be targeted for manipulation

●

Company landlines were primarily used for communication. There were instances when the mobile phone was also used.

●

Though there seem to be multiple parties involved, there was a single point of contact for all the external associates. The employee used to only coordinate and work with this person.

●

There did not seem to be any evidence of other employees being involved and the employee seems to have acted alone

© 2010 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

Case Study – I

Recommendations made

●

Existing control framework to be strengthened – Access controls, communication policy

●

System controls to be built in – order placing

●

Dealer rotation – to be introduced for a longer time period

●

A monthly monitoring mechanism to be introduced

●

Incidence response mechanism to be implemented

© 2010 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

Case Study - II

Background

●

Leading financial institution

●

There was a suspicion regarding front running of stocks against some of its employees.

Key challenges related to the investigation

●

Specific employee or specific transactions not identified

●

Appropriate monitoring systems not in place

●

Suspicion related to transactions over a two year horizon

Methodology adopted

●

Data analytics – Identification of trends and patterns

●

Sampling methodology followed

●

Use of market intelligence

●

Bringing together different sources to prepare the case

© 2010 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

Case Study

Recommendations made

●

Steering group set up involving Risk, Operations and Investment teams

●

Modernization of existing systems recommended

●

Restricted access to key areas of the dealing room

●

Incidence response mechanism to be implemented

© 2010 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

Q&A

Thank You

Rohit Mahajan

Partner & Co- Head Forensic Services

KPMG

+91(22) 3090 2626 rohitmahajan@kpmg.com

Samir Paranjpe

Associate Director

KPMG

+ +91 (22) 3090 2398 samirp@kpmg.com

© 2012 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved

The KPMG name, logo and “cutting through complexity” are registered trademarks or trademarks of

KPMG International Cooperative

(“KPMG International”).