Client Centricity - Believe in Yourself

advertisement

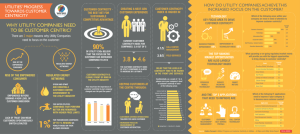

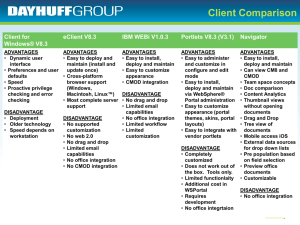

Client Centricity Momentum Sales Lee-Ann du Toit Agenda 1) Introduction 2) What is client-centric? 3) Developing a deep understanding of your clients 4) Why become client-centric? 5) The role of technology 6) The shift in our landscape 7) Moving to action Without our clients we don’t have a business • “The purpose of a business is to make and keep a client.” 1909 - 2005 Our future gameboard Deliver Value: Innovation Passive clients Disruption Commoditisation Engaged (active) clients Agenda 1) Introduction 2) What is client-centric? 3) Developing a deep understanding of your clients 4) Why become client-centric? 5) The role of technology 6) The shift in our landscape 7) Moving to action What is client centricity? • A real, sincere and deep understanding of your target clients’ true needs • • Identifying which needs can be profitably met • Eg Mobilizing your business to supply solutions to these identified needs, and then dynamically adjusting our solutions as our clients and the market dictates What is client centricity? A client-centric business knows these five 5 key principles: 1. The client is the primary source of income 2. Different clients should be treated differently 3. Not all clients are profitable and some are more profitable than others 4. With focused attention, you can increase your practice’s profitability by increasing the profitability of your clients 5. Your business is essentially a portfolio of clients more than a portfolio of products What is client centricity? 1. The client is the primary source of income • The client is the primary source of income for your business • This realisation shifts the focus to the real source of income • This impacts your entire strategy and approach • Client centricity is first and foremost a strategic issue • Knowing that the client is the real source of income, then one’s focus on the client becomes more intense: • How can one more effectively generate income through the client? What is client centricity? 1. The client is the primary source of income /cont. • Client centricity is a business strategy • The client takes centre stage in all business decisions • It is a profit-growth strategy; not a “make-the- client• • happy-at-any-cost” strategy Client centricity involves the whole business: • leadership, processes, the decision-making, the culture, the systems, the structure, the way people are rewarded and promoted Client centricity is not the same as client focus What is client centricity? 2. Different clients should be treated differently • It is not unfair to treat different people differently • The opposite is more likely to be true • Clients have different needs which not only require • different products but different solutions and different modes of interaction Different clients have differing levels of profitability potential or influence • Know your clients well enough to treat them appropriately i.e. both differently and profitably What is client centricity? 3. Not all clients are profitable. Some are more profitable than others • • • • Successful business is based on mutual value exchange • The client receives value and pays according to that value so the business receives value in exchange Clients know whether they are receiving fair value Do you know the profitability level of each of your clients / client segments? Use that information to make profitable business decisions What is client centricity? 4. With focused attention, you can increase your profitability by increasing the profitability of your clients • • • Investing in systems, processes, people and research to know the client better Enabling decisions and execution of deliverables for clients with express intention to increase the value for both the client and your practice Structuring around client segments, so that one person is in charge of the profitability level of a particular client or client segment What is client centricity? 5. Your business is essentially a portfolio of clients rather than a portfolio of products • • • • The focus of measurement is now around the client Previously, profitability comparisons were done on product level (eg product A makes more money that B or C) Rather compare the profitability of client segment A vs B vs C Enables appropriate decisions towards specific actions to increase the profitability of client segment A or B or C What is client centricity? 5. Your business is essentially a portfolio of clients rather than a portfolio of products •Invests resources to find more products or solutions for your clients • Given your rich understanding of your clients’ needs •You have a portfolio of clients to look after for life •A business that only sees itself as a portfolio of products invests resources into finding more clients for their products •It is more cost effective to sell to an existing client than to find a new one How is client centricity different? Client centricity is different to client focus Many businesses focus on their clients: • Conducting client satisfaction and/or loyalty research • Emphasising excellent service • Offering flexible, customisable products • Tailoring their client communications • Designing positive client experiences How is client centricity different? Client centricity is different to client focus A client centric business will do these, and more: • Research will not be limited to satisfaction or loyalty, but will include research into client needs, problems and unsolicited feedback • It will know the value of each of their clients and segments their clients according to their needs so that they can better meet those needs • Excellent service will be given and great client experiences will be created, but certain offerings will only be available to clients within a particular segment or value level How is client centricity different? Client centricity is different to client focus A client centric business will do these, and more: • Value-add services are offered with the specific intent to increase the value of particular client segments • Products remain extremely important, but are now designed in response to identified needs of specific client segments • Client feedback (including complaints) is treated like gold, captured on systems, tracked per client, and acted upon Agenda 1) Introduction 2) What is client-centric? 3) Developing a deep understanding of your clients 4) Why become client-centric? 5) The role of technology 6) The shift in our landscape 7) Moving to action Our past approach to pricing and benefit design • Products were designed within focused product development units in insurance companies • Once the product was developed, and priced appropriately given risk profile etc, it was rolled out to consumers • “Insurance is sold not bought” Grudge purchase Traditionally used a financial advisor Products pushed to clients Consumer expectations • Consumers are becoming more demanding • Understanding the role of trigger events is essential for success • Sources of financial advice are changing (social media) • Simplicity, safety and quality (transparancy is key) • The financial advisor is still king • For clients, the new normal will be about “buy what you understand and understand what you buy” So what are consumers looking for? Consistent theme in both upper and lower LSMs Momentum Brand Health Study 2011 Client centric product design is essential for bottom line Customer centric product design Revenue growth Cost control Increased customer engagement and satisfaction Reduce product design costs through lower failure rates Source: Datamonitor 2010 “Businesses that successfully combine value-creating customization with cost effective delivery outperformed industry peers two to one in revenue growth and generated profit margins 5% to 10% above their competitors” Booz Allen Hamilton Consumer insight must drive product development Value proposition & benefits of products Consumer insight Identify the need A customer centric organisation must utilise an array of market intelligence to firmly grasp what issues are driving consumers’ and clients’ choices and attitudes. Source: Datamonitor 2010 Practical ideation Develop the product A customer centric organisation must let its product innovation be driven by revealed consumer needs Example of successful customer centric product design: Savings • Smartypig rewards consumers for reaching their savings goals • Clients can set themselves specific goals and then track their progress • Contributions are made automatically with the consumer choosing the frequency; however, additional contributions can be made at any time • Rewards are critical to the SmartyPig offering SmartyPig rewards savers with more than just interest High • SmartyPig offers consumers a means to organise their savings ambitions Customer centricity • The rewards it offers are relevant and significant • Tangible rewards like cashback are particularly appealing to consumers Low High Underlying demand • Extra rewards for saving are even more appealing while interest rates remain depressed • Soon many more aspects of financial services will be linked to accompanying incentive and rewards schemes Low Agenda 1) Introduction 2) What is client-centric? 3) Developing a deep understanding of your clients 4) Why become client-centric? 5) The role of technology 6) The shift in our landscape 7) Moving to action Why become client centric? A true story – meet John* Why become client centric? A true story /cont Why become client centric? A true story /cont Why become client centric? Now, imagine if the private banker… Why become client centric? • Make sure the bank innovated to keep clients like John happy Why become client centric? There is a bank like this – the Royal Bank of Canada • Don’t you wish there was a bank like this in South Africa? • How would your clients and your business benefit from this approach? Why become client centric? Client centricity pays • RBC converted their large Personal and Commercial division into a client centric division • It reduced expenses by $1-billion • They are ahead of schedule towards increasing revenues by $1-billion • If the P&C division was measured on its own, its stock performance would far exceed the market Why become client centric? Bottom line: • Become client centric because… • … for those in a commoditised B2C environment, it is a more profitable business strategy Agenda 1) Introduction 2) What is client-centric? 3) Developing a deep understanding of your clients 4) Why become client-centric? 5) The role of technology 6) The shift in our landscape 7) Moving to action “We are in the midst of one of the most disruptive and informative transformations in business history” Financial Services Keynote opening, Salesforce conference, San Francisco USA September 2011 Access to financial services 100% 4.3% % of consumers with life insurance 90% 11.5% 80% 7.2% 16.2% 70% 60% 50% 40% 71.6% 53.0% 30% 20% 4.6% 10% 11.1% 14.6% 0% South Africa Global average Online directly from the company Through my bank Online through a price comparison site Other Through an tied agent / IFA Don't know A shift in distribution towards consumer friendly channels • Consumers want to access financial products via simple and convenient channels • Consumers prefer channels that offer comfort and safety • Traditional channels vs. technology advanced channels Sales – the future financial advisor • Convergence on the mass affluent- everybody is going after the same customer • Everybody thinks they are a financial expert • Shifts from "households" to "living arrangements" • Clients more comfortable with technology - advisors also needs to be • Evolution of how we: • Gather prospects and customer data • Engage & collaborate with customers Sales – the future financial advisor • How have all the consumer shifts affected our industry? • “The customer experience is something you create with the customer, not do to the customer” • Advisors that find a way to integrate customer experience and social platform will be sustainable into the future • Invite clients to be part of the process to create the right solutions: Put client in co-pilot seat, make him part of the process of decision making around their financial needs The Social Revolution “How to delight your customers in a whole new way” Delighting customers is knowing who they are, what they need and ) The Social Revolution – Financial Services • Customers trust their networks and communities more than advertising (imagine a “tripadvisor" for financial advisors...) Opportunities for social media in insurance 64 % who pick an insurer based on friends’ advice are satisfied with their choice 59 % using social media do so in order to get the opinions of others who have already gone through the purchase process Source: Boston Consulting Group study of “new Media” relating to insurance Industry Opportunities for social media in insurance 14 % 25 % are connected to their financial advisors via Facebook, Twitter, or LinkedIn are connected to their financial advisors on two or more social networks Source: Boston Consulting Group study of “new Media” relating to insurance Industry Agenda 1) Introduction 2) What is client-centric? 3) Developing a deep understanding of your clients 4) Why become client-centric? 5) The role of technology 6) The shift in our landscape 7) Moving to action The future role of advice Changes in consumer needs and legislation will result in: • Consumers demand greater choice of advice channel and may even use multiple advisors / channels • More focus on longer term relationship with client, and holistic needs provision • Partnerships and collaboration between different advisors • Less number of independent advisors • Quality of those remaining likely to improve Client incorporates the landscape changes Product focus Client need / solution Business unit Silos Collaborated, crossfunctional units Standardised solutions Customised, individualised Single advice channel Multiple advice channels (partnerships) Single need view Multiple need of client (single view) Agenda 1) Introduction 2) What is client-centric? 3) Developing a deep understanding of your clients 4) Why become client-centric? 5) The role of technology 6) The shift in our landscape 7) Moving to action How do we become client centric? With determination. It is not easy. Nelson Mandela: “After climbing a great hill, one only finds that there are many more hills to climb.” How do we become client centric? Step 1 • Understand that client centricity is a business strategy • It is a business strategy rooted in a business philosophy that says: “If you look after the client’s interests, your business interests will be advanced” • Clients are our only source of revenue How do we become client centric? Step 2 • The mindset at the core of this strategy is one that recognises that the client, not your financial practice, is the centre and the starting point How do we become client centric? Step 3 – Study your clients • Focus on your client data – clean it, analyse it, and see where the gaps are • Group clients based on their needs and values and relevant drivers of those needs and values (segmentation) • Conduct research to understand their lifestyles relative to your offering and competencies • Identify what matters most to your clients • Immerse yourself in your clients’ worlds How do we become client centric? Step 4 – Calculate your client’s profitability • Allocate revenue to each client • Define various costs associated to transactions and ongoing relationships • Calculate current profitability of each client • Calculate potential profitability of each client • Set out profit targets per segment and overall • Technology can assist greatly here How do we become client centric? Step 5 – Organise your business around your client • Inspire and educate your people on client centricity and across product knowledge • Enhance systems and create single view of the client • Redesign incentive measures and profit reports • Assign managers to be responsible for client segments • Hold managers accountable for segment profit increases • Design, communicate and execute tailored client value propositions What does this mean going forward? Momentum Sales is also on this journey • We are partners in this journey and will work with you • If we are both client-centric, we will be able to achieve the outcomes the clients really need • Give us feedback - tell us how we can assist • Tell us where we are falling short • There are going to be changes and kinks in the road, but together, we can be successful What next? • Transform current client-mindset to profitable client-centric financial practice over time • You will unlock more value and profits over time • Open and honest feedback to Momentum Sales • Identify long-term value of clients • Where are the big concerns? • Where are the opportunities? • Discussion forum: m-panel • Share similar challenges Where to start – implementing in practice • Decide on an action plan • Set specific measures and targets in place – monitor • Competition? • • • • • Most goals achieved on action plan Most profitable client base Highest practice revenue increase Best practice of the year Other? Closing thought • To be client-centric, you will focus on a lifetime financial partnership & relationship with your client • … instead of short-term non-sustainable product push approach in the past • Holistic view Thank you Lee-Ann du Toit