Esther Eghobamien, Head, Gender Section

advertisement

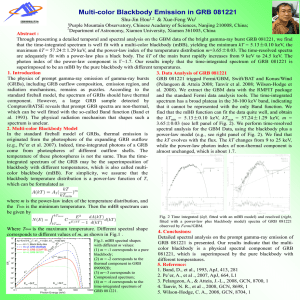

Gender Responsive Budgeting (GRB) as a Policy Tool for Women’s Advancement Esther Eghobamien Head of Gender Section & Interim Director Social Transformation Programmes Division Commonwealth Secretariat Overview Who we are (Commonwealth, STPD Gender Section) Background to GRB work and lessons learned Evolving to Gender Responsive Investments (GRI) work Key Lessons and Findings Conclusion Social Transformation Programmes Division Contributes to the Secretariat’s agenda on Human Development by working with governments and key stakeholders to address issues and challenges in Education, Health and Gender. Global Policy Framework global commitments in MDGs, BPfA, PoA, UNSCR 1325, CEDAW Approach: Advocacy: Knowledge creation and Policy dialogue Brokering: Technical Assistance, Capacity Building 3 Work Programme: Four Critical CW PoA Action Areas & Mandates The Commonwealth Plan of Action for Gender Equality 2005–2015 (PoA) provides an overarching mandate for gender equality. The Secretariat’s Gender Section coordinates the four PoA critical areas of concern Gender, Democracy Peace and Conflict Gender, human rights and law Gender, poverty eradication and economic empowerment Gender and HIV/AIDS Commonwealth Mandates CHOGM Ministerial . Gender Responsive Budgeting (GRB) Definition GRB is a budgeting process/tool that incorporates a gender equality perspective into the budgeting process and policies that underpin the budgetary processes towards promoting equality between women and men. 5 Background to GRB work GRB pioneered in the late 1990s through strategic engagements with Commonwealth Finance Ministers. By 2005 biannual reporting to Finance Ministers on progress in implementing GRB among members was instituted. GRB reviewed in 2009 revealed that a third of Commonwealth member countries had adapted GRB, including South Africa, Namibia, Mozambique and the United Kingdom, to mention a few. Modality Knowledge Creation Tools and resources Capacity strengthening 6 Key Lessons over 10-year GRB Implementation The tendency for most GRB work to be women focused and not utilise a systemwide approach for integrating gender with budget analysis; Efforts often overlooked areas where men’s needs define the norm; A clear absence of accountability to women at all levels hinders GRB; Statutory accountability mechanisms (parliaments, government machineries, women’s NGOs) fail to make the necessary linkages between women’s empowerment and poverty eradication; 7 Key Lessons Cont. Promoting women’s leadership is pivotal to achieving development goals and targets; The need to rethink ethics, values and priorities that shape and drive financial systems and markets; The participation of women with capacity in budget matters has been pivotal, particularly in South Africa, Uganda and Australia; A key role is played in GRB implementation by women parliamentarians in Uganda and South Africa; Two thirds of countries that have initiated GRBs are still at the initial stage, i.e. environment building; 8 Key Lessons cont. The regions in which the greatest progress has been made are South Asia and Southern/Eastern Africa where the process of mainstreaming gender budgets within concerned ministries has been initiated. GRB require systematic support and follow up for this to become institutionalised. The processes in these regions have been quite different; however, to a large extent the initiatives in South Asia have been led from within the government, whereas those in Africa, for example Tanzania, were initially led by CSOs and then taken over by government; 9 Key Lessons cont. Countries have chosen between looking at the budget as a whole and focusing on specific sectors. When the latter has been the case, the sectors that have figured prominently have been education, health and social security; Focus: primarily on the expenditure side of the budget, with work on the revenue side focusing on taxes (both direct and indirect) and tariffs in a comparatively preliminary phase; Some countries have initiated activity at sub-national level. There have been regional initiatives in Australia, South Africa, India and Sri Lanka; and Within the Commonwealth there are about 20 countries for which we have not received any evidence of GRB 10 Gender Responsive Investments “Women account for between 25-40% of SMEs Worldwide with earning power estimated to reach $18 trillion by 2014... yet they are unbanked and receive low proportion of credit.” Evolved out of pioneering GRB work Study on GRB findings showed weak institutional structures and mechanisms Public budget reforms alone inadequate to archive gender parity 9WAMM Mandated Secretariat to: • • Research and source investors committed to paying for the required change Configure the implications of financing gender focussed change and innovation Enlarged focus to private-sector investment GRI Key Issues & Research Questions Issues Large percentage of women owned and operated SMEs receive a small fraction of total capital available Financing gap is exacerbated by relative lack of skills, scarce business linkages and weak technical capabilities How to: Deal with heightened barriers Better address asset distribution Innovate and change conventional lending practices Address the barriers of small and medium business in formation and achieving success Facilitate access to capital and mobilization of start up resources GRI Research Recommendations 1. Allocate resources towards the development of a “Commonwealthwide” data gathering initiative focusing on Women SMEs 2. Address the adverse risk perception of local banks and provide technical assistance designed to reduce failure rates and increase profitability. 3. Innovation in GRI is needed and conventional lending practices must be revisited and revised ( GRI Handbook). 4. Members and the Secretariat’s external partners have a key role to play to increase resource pool and ensure effective use of risk capital for SMEs for women entrepreneurs. 5. Need to forge greater linkages between financial services and business development services (BDS) that target women Recommendations 6. Raise awareness on the need to grow micro businesses into SME’s (Savings and Credit Organisations (SACOS) Global Knowledge Sharing Event - India); 7. Improve Data & Statistics on Women’s Enterprise 8. Members to develop a national strategy for women’s enterprise development (Commonwealth Business Council partnership) The Way Forward A Roadmap for Fostering GRI Objective: An “Enabled” GRI SME Environment Gender Awareness Training Banks & Funders Incentivised Private Sector Support Holistic Technical Assistance Gender Responsive SME Investment Conducive Macro Environment Coherent National Policies Priority Action areas Develop tools and resources to enable gender responsive financial policies and services. Include comprehensive technical assistance as an integral part of any financing model. Deepen research on GRI Develop and Disseminate a “Code of Good Practices” With Respect to GRI The Proposed Commonwealth GRI Good Practice Award Tool for inspiring financial institutions to improve service delivery Award financial institutions and Ministries or government agencies Conclusion An established need for GRI to address Gender gaps in area of finance. Publication and tools to advance GRI underway. GRI Handbook Feedback and comments requested from partners. Stakeholders key to publicising the Commonwealth GRI practice award. Open to partnership and collaboration Parting Question What role can we play to advance GRI and enable Women be better Agents of Change? Thank you