Disability_Buyout

advertisement

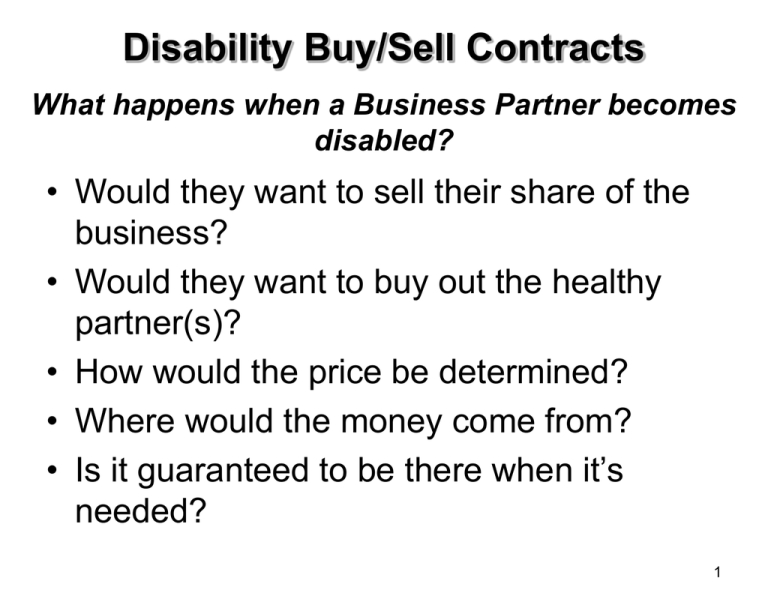

Disability Buy/Sell Contracts What happens when a Business Partner becomes disabled? • Would they want to sell their share of the business? • Would they want to buy out the healthy partner(s)? • How would the price be determined? • Where would the money come from? • Is it guaranteed to be there when it’s needed? 1 In the Event of a Disability,There Are Many Issues to be Resolved The disabled partner may: • Become a drain on income while not contributing to the business • Have different priorities for the business income and profits and may not want to reinvest profits • Decide to let their spouse or relative take over his/her role in the business In the Event of a Disability, there are Many Issues to be Resolved The healthy partner: • May not be able to pay the disabled partner an income and maintain the business • May not have funds to buy the disabled partner out • May not want to share business decisions with the disabled partner’s family Advantages of a Buy-Sell Agreement • Assures active business owner can buy out the disabled owner at a predetermined price and pre-arranged time after disability strikes. • Maintains business continuity and credibility - which are concerns of customers, creditors and employees. 4 Advantages to the Disabled Business Owner • Creates an automatic market by guaranteeing a definite and fair price and a buyer for the business interest • Assures that his/her financial future is no longer contingent upon the strength of the business • Provides money which may be needed to pay medical bills and living costs • Avoids involving the disabled owner and his/her family in the management of the business 5 Advantages to the Active Business Owners • Avoids negotiation of price • Assures complete and orderly transfer of ownership • Retains control of the business • Competitors cannot purchase the disabled owner’s business interest in the firm and force out the active owners 6 Once Again, Consider The Likelihood... Chances of a Disability Lasting 12 Months or Longer (before age 65) Age 2 Owners 3 Owners 4 Owners 27 26.3% 36.7% 45.7% 37 24.5% 34.5% 43.1% 47 20.7% 29.4% 37.1% 57 12.1% 17.6% 22.8% Commissioner’s Individual Disability Table B - Equally Weighted 90 Day Elimination Period. Buy-Sell Considerations • Date to Establish a Plan • The date the owner first becomes disabled; or • The trigger date of the buy-sell agreement • Method of payment • When is the first payment due? • How should it be paid? • Lump sum payment • Monthly installments • Combination of both 8 Buy-Sell Agreement Considerations Structure of the agreement: • Cross-purchase agreement • Works best with two owners • Insurance company reimburses the non-disabled owner(s) • Receive step up in basis • Entity purchase agreement • Insurance company reimburses the corporate entity • Best to use with multiple owners 9 The most practical solution is... • A written agreement that specifies when and for how much the buy-out will take place, and... • is funded with the right amount of Disability BuySell insurance. Why Disability Buy-Out Insurance? • Objective • The objective of Disability Buy-Sell insurance is to reimburse money paid for the purchase of a disabled owner’s interest in the business in the event of a long-term disability • Benefits • Benefits are income tax-free - the disabled owner is taxed only on the gain from the sale of the business* • Provides a funding solution for the business 11 How Does it Work? • The non-disabled owner(s) are reimbursed for buyout expenses paid during the buy-sell process • Premiums are non-deductible (IRC 265; Rev. Rul. 66-262, 1966-2 C.B. 105) • Benefits are received income tax-free (IRC 104(a)(3); Rev. Rul. 66-262, 1966-2 C.B. 105) • The disabled owner is taxed only on the gain from the sale of the business. The gain may be considered an installment sale if at least one payment is to be received after the close of the tax year in which the sale was made. Clients should contact their tax advisor for details. 12 Cross Purchase Agreement • Each owner owns a policy on each of the other owners • After disability, the non-disabled owner(s) purchase the disabled owner’s share in accordance to the Buy-Sell Agreement and receives policy benefits (up to the maximum policy limit) as a reimbursement • The non-disabled owner(s) then own the business, and the disabled owner has been paid the price agreed upon 13 How a Cross Purchase Agreement Works Business Owner A Buy-Sell Agreement Premium Policy and Disability Benefits on Owner B Business Owner B Premium Insurance Company Policy and Disability Benefits on Owner A 14 Advantages/Disadvantages of a Cross Purchase Agreement Advantages • Policies are not available to business creditors • Non-disabled owners receive an increase in their basis Disadvantages • If there are more than two owners, the number of policies needed may not be practical 15 Entity Purchase Agreement • The business purchases and owns a disability buy-out policy on each owner • After disability, the business purchases the interest of the disabled owner in accordance to the buy-sell agreement and receives policy benefits (up to the maximum policy limit) as a reimbursement • The non-disabled owners then own the business, and the disabled owner has been paid the price agreed upon 16 How an Entity Purchase Agreement Works Business Owner A Buy-Sell Agreement Business Owner B Business Premium Buy-Sell Agreement Policy and Disability Benefits on Owners A and B Insurance Company 17 Advantages/Disadvantages of an Entity Purchase Agreement Advantages • Only one policy per business owner is necessary Disadvantages • Policies are open to claims by creditors • The buy-out will not increase the healthy owner’s basis 18 Ideal Candidates • White to Gray Collar, small to mediumsized businesses with less than 10 owners • 10% ownership to be considered • Need to have a plan for succession • Owners that depend on each other to keep the business running smoothly 19 Common Methods to Calculate Business Value • For Personal Service Businesses: - 2 times income plus the profit of the business • For General Businesses: - Book value plus capitalization of excess earnings 20 Elimination Periods and Pay Out Methods • • • • 365, 540, or 730 Day Elimination Lump Sum Monthly Installments over 2, 3, or 5 Years Combination of Lump Sum and Monthly Installments 21 Issue and Participation Limits • • • • Total Pay Out: Up to $2,000,000 Limits per Occ Class Limits per Pay Out Method Limits per Elimination Period 22 Disability Buy/Sell Underwriting • Financial: Most Recent Business Tax Returns, all schedules. (Three Full Years Preferred) • Medical: Telephone Interview (all amounts and ages), Blood/Urine, Para Med, EKG (by amount, age, and state) 23 Disability Buy/Sell Carriers • • • • • Berkshire/Guardian MassMutual MetLife Principal Standard 24

![You can the presentation here [Powerpoint, 1.01MB]](http://s2.studylib.net/store/data/005417570_1-0810139cfc2485ebcaf952e0ae8bb49a-300x300.png)