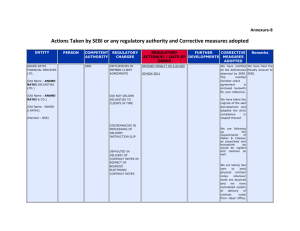

Shri J.J.Bhatt

advertisement

Practice & Procedure Before Securities Appellate Tribunal BY ADV. J. J. BHATT Phone: 022 22658615 Mobile: 09820297384 e-mail : jjbhattadv@hotmail.com 09.05.2013 1 Disclaimer The views expressed are personal. To seek appropriate legal advice upfront from the stage of first communication, summons, recording of statement, Enquiry, SCN of SEBI- This is because: ..You may not know the ultimate consequences. .. You may not know the purpose of proceedings of SEBI .. SEBI’s actions may be sudden / unpredictable / multiple. .. SEBI passes ex- parte ad- interim orders against entities for diverse reasons. .. Issues may be complex, multi-dimensional having far reaching consequences (e.g. disclosures to be made in future in any document such as Prospectus) and directions may be issued to key service providers such as CAs, Legal Advisors on the Board of Companies, Independent directors etc. 2 Address of SAT Securities Appellate Tribunal Earnest House, 14th Floor Nariman Point, Mumbai 400 021 **************************************************** SAT’s daily Board of Hearing of Cases / Orders displayed on SEBI’s website www.sebi.gov.in 3 SAT Tribunal of 3 Members Presiding Officer Retired Chief Justice of High Court; or Retired Judge / Sitting Judge of Supreme Court 2 Other Members 4 Regulatory Framework Independent Regulator – SEBI Act, 1992- Latest and in addition to existing commercial laws Ch. VIB deals with SAT’s powers Securities Market Laws - - SEBI Act / Regulations :SEBI Act is pre-eminently a social welfare legislation to protect the interests of investors - SC ( R) Act,1956 / Rules - Depositories Act, 1996 - Certain Provisions of the Companies Act,1956 - Rules, Bye-laws & Regulations of Stock Exchanges. - SAT Rules, 2000 5 SEBI Board The Board is an expert body. As a legislature, it makes the regulations, as an executive, it implements the legislation and in case of breach it takes upon a quasi-judicial function. While functioning in its judicial capacity, it has wide discretion. It can initiate criminal proceedings in terms of Section 24 of the Act, issue directions in terms of Section 11B and Regulation 44 as also take recourse to penal provisions as contained in Section 24 and Chapter VI-A of the Act. Its decision is final subject ot the decision of the Tribunal. AIR 2004 SC 4219Civil Appeal No. 2361 of 2003 D/-25-8-2004 Swedish Match AB and Another 6 Accountability Orders of SEBI reviewed by an Independent Tribunal Judicial Review of statutory provisions – HC Writ Petition - Price Waterhouse & co. V/s. SEBI [2010] 6 taxmann.com 129 (Bom) Provisions of Section 11(2) of SEBI Act would take within its sweep a C.A. if his activities are detrimental to the interests of investors or securities market. (SAT’s order dated 01.06.2011 in Price Waterhouse)- Split verdictCross Examination allowed7. - MCX- SS- Refusal to permit trading in cash / Derivative marketMatter considered by High Court 7 Appeal to SAT Any person aggrieved- 15 T of SEBI Act An order of the Board [12(3), 11(4), 11B, 11D] An order of Adjudicating Officer [15 I ] 23L SC( R) – order or decision of SE, 22A SC( R) – against refusal of listing 23A Depositories. Act- order of Board / AO Order – quasi judicial or adjudicatory order. HSBC MUTUAL FUND Order- Unit holder aggrieved party in the event terms of MF Plan amended unilaterally. 8 Appeal to SAT What is an Order ? [SAT’s Order in NSDL case. Deepak Mehra V/s SEBI Informal guidance / interpretative letter does not constitute an ‘order’] Who can appear and argue before SAT ? 1. Appellant in person 2. Lawyer 3. CA / CS / Cost Accountant 9 Persons Aggrieved If order is materially adverse to them They have been denied or deprived of something to which they are legally entitled or they have to show that a legal burden is imposed on them If adverse findings are recorded, through no monetary penalty involved Order prejudicially affect their interest / legal rights. Supreme Court order in Jasbhai Motibhai Desai Vs Rohan Kumar 10 Procedure Not bound by procedure in CPC Guided by PNJ - Institute of CA- AIR 1987SC 71 Power to regulate own procedure Same powers as vested in Civil court Judicial Proceedings Appeal to be filed within 45 days from the date of receipt of the Order Application for condonation of delay containing reasons of delay to be filed. Delay can be condoned with / without costs. 11 Powers of SAT Power to impose costs? Yes Interim Orders or injunction or stay in the interest of justice. Summoning and enforcing the attendance of any persons and examining him on oath. Requiring the discovery and production of documents. If appeal is say against order of BSE, SAT can make SEBI a party and seek its views. 12 Powers of SAT (Contd.) Receiving evidence on affidavits. Issuing commissions for examination of witness or documents. Reviewing its decisions - 30 days from the date of order. Where there is a glaring omission or patent mistake, or when a grave error has crept in the judgement. A review petition has a limited purpose and can not be allowed to be an appeal in disguise. Limitation Act applies- Section 15w of SEBI Act. Dismissing an application for default or deciding it ex-parte. 13 Powers of SAT (Contd.) Setting aside any order of dismissal of any application for defaults or any order passed by it ex-parte. Intervener’s Application may be considered Any other matter which may be prescribed SAT (Procedure) Rules, 2000 Appeal can be disposed off at admission stage itself Appeal tied to other similar appeals or to be taken up separately. 14 Powers of SAT (Contd.) Pass such orders thereon as SAT thinks fit Confirming (Upholding on other grounds) Modifying Remand back * Set Aside / Quash Rule 21 – may make such orders or such directions as may be necessary or expedient to give effect to its orders or to prevent abuse of its process or to seek ends of justice. Passing orders in terms of consent terms mutually agreed upon. * e.g. If the impugned order did not consider certain material aspects, findings not recorded on vital issues etc. 15 Powers of SAT (Contd.) Can reduce monetary penalty / debarment period. SAT considers among other factors Legal principles. Facts and circumstances of each case. Delay in passing orders. Errors on facts and law on the part of SEBI. SEBI’s powers. Nature of transaction considered as objectionable. Substance of dispute- Nature of wrong doing. Multiple proceedings in sequence against the same entity SAT will assess, appraise and evaluate the evidence / material relied upon by SEBI. Can SAT reduce penalty even though findings upheld- Yes Company in Financial Doldrums – Can Reduce penalty. 16 Whether Appeal lies against Non- redressal of Complaints by SEBI Right of cross-examination where sole material was statement of some person Observations on offer documents ? Procedural order not affecting rights ? Letters issued by SEBI under IGS ? Though no penalty imposed, but adverse findings recorded against any entity. 17 Discretionary Powers of SAT The Tribunal has been constituted u/s 15K of the Act and is thus a creation of the said Statute and as such the Tribunal is to exercise the jurisdiction, powers and authority conferred on it by or under the Act or any other law for the time being in force. No power is conferred on the Tribunal to travel beyond the areas covered by Section 12 and Rule 3. When something is to be done statutorily in a particular way, it can only be done that way. There is no scope for taking shelter under discretionary power. 18 Appeal to Supreme Court Under Section 15Z of the SEBI Act On Question of Law Within 60 + 60 days to Supreme Court Whether if a finding of fact is perverse and is based on no evidence, it can be set aside in appeal even though appeal is permissible only on question of law.(2004) 54 SCL 601 (SC) Dale & V/s. P.K. Prathapan. Does SEBI challenge orders of SAT to Supreme Court ? Allowed Appeals Where adverse findings are recorded by SAT on SEBI’s Powers. Remanded Matters Where costs are imposed 19 THANK YOU 20