DHR 3rd Party ACP Training EN

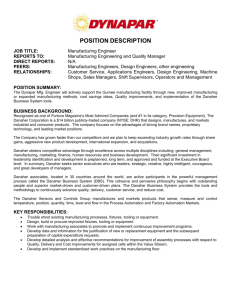

advertisement

Anti-Corruption Training for Third Parties (Sales Reps, Distributors, Suppliers, etc.) 1 Purpose of this Training > Danaher companies believe that integrity and compliance with laws are important drivers of business success. > We encourage and require third parties we do business with (“DHR Contractors”) to work with us to build a global foundation of integrity and compliance as the basis of our mutual success. > This training will explain what this means for your day-to-day business with Danaher companies. Your Integrity/Our Success 2 Part I Anti-Bribery Laws Danaher’s Standards of Conduct Danaher’s Supplier Code of Conduct Your Contract 3 Many Laws, One Purpose > Anti-bribery laws and treaties are now common in every part of the world. > Many of these laws focus on bribes to government officials, like the US Foreign Corrupt Practices Act (the “FCPA”), but you must avoid all corrupt payments, even to nongovernment, commercial parties. > This training will focus on the FCPA, because it is actively enforced and has severe penalties, but you are expected to comply with all laws that apply in the places where you do business. > You are also required to comply with Danaher’s Standards of Conduct, Danaher’s Supplier Code of Conduct and any integrity and compliance provisions of your contract. Anti-Bribery Laws Are Global 4 DHR Standards Also Apply > Danaher’s Standards of Conduct and Supplier Code of Conduct identify the standards of conduct and honest business practices which must be followed by all DHR Contractors, including standards relating to how you pursue business opportunities that may benefit Danaher companies. > DHR Contractors are required to represent Danaher companies consistent with Danaher’s commitment to integrity and anti-corruption described in the DHR Standards of Conduct. > Even in situations where you may believe that no anticorruption law applies, the DHR Standards of Conduct apply and must be carefully followed. Corrupt Payments Are Never Acceptable 5 FCPA Specifics > The FCPA prohibits anyone with a connection to a US business from: – corruptly – offering, paying, giving, promising to pay or authorizing the payment of, – directly or indirectly through another – anything of value – to any non-US government official or any non-US political party, official or candidate – in order to obtain, retain or direct business. > The DHR Standards extend this prohibition to cover payments to non-government persons and parties. No Payments to Government or Private Parties for Business 6 FCPA Specifics, cont. > A “promise to pay” can be found even where no actual payment was made or where the person promising is unable to make the payment. > “Anything of value” does not mean only money. It might mean an interest in another venture, a future job offer, a political contribution, a gift (no matter how small), or a benefit to a friend or relative. > “To any foreign official” includes any government official, political party or candidate, any conduit to a government official, political party or candidate, and any employee of a government owned company. > Under the DHR Standards, these prohibitions apply to nongovernment parties as well as government parties. Anything of Value to Influence Any Business Outcome 7 FCPA Violations Are High Risk > Violating the FCPA can cause the following serious consequences: – Immediate termination of your relationship with DHR; – Significant fines: 2009 – Kellogg Brown & Root, Inc. fined $402 million for bribery in Nigeria; 2008 - Siemens AG fined $450 million for bribery in Argentina, China, Russia, Venezuela, Vietnam, others; 2008 – Willbros Group, Inc. fined $22 million for bribery in Bolivia, Ecuador and Nigeria; – Imprisonment for up to five years; and – Loss of US gov’t. contracts and US export privileges. Severe Consequences Leave No Room for Violations 8 Legitimate ExpensesAll Parties-Product Promotion/Contracts > The DHR Standards do allow you to provide or reimburse travel and living expenses directly related to promotion of products or the execution of a contract, if: – Local law, your own company policies and the recipient’s company/government policies allow you to provide or reimburse these items; – All reimbursed expenses were actually incurred and supported by detailed and accurate receipts prior to reimbursement; – The travel and living provided or reimbursed is reasonable (nonluxury); and – Each item provided or reimbursed is directly related to the promotion of products or services to the recipient’s company/government, or the execution of a contract by the recipient’s company/government. Actual and Reasonable Expenses – No Unrelated Expenses 9 Legitimate ExpensesNon Government Only-Gifts/Entertainment > The DHR Standards do allow you to provide potential customers unrelated to the government with non-cash gifts, including meals and entertainment, if: – The gift/entertainment is of nominal value; – The gift/entertainment is customary in your trade or industry; – The gift/entertainment is legal under local laws; and – The gift/entertainment is given and accepted without any express or implied understanding that the recipient is in any way obligated. Nominal Value – Not Cash – No Obligation 10 Accurate Records >All information provided to a Danaher company in support of any request for payment (commission, expense reimbursement, etc.) must be factually accurate. >All contractual requirements regarding receipts and recordkeeping must be strictly followed. No Fake Receipts/False Purposes 11 Summary > Be aware of and adhere to the Danaher Standards of Conduct discussed in this training, the specific requirements of your contract, and all anticorruption laws in the areas where you operate, including the FCPA. > Keep in mind the severity of the personal and corporate consequences associated with violating the FCPA and similar laws and devote sufficient attention to compliance. > When you are faced with a close call, we invite you to speak with your Danaher contacts. Where necessary, they will direct your questions to the legal team at Danaher. Your Integrity/Our Success 12 Additional Resources The Danaher Integrity and Compliance Helpline: www.danaherintegrity.com Your Integrity/Our Success 13 Part II Review Questions 14 Review Questions Question 1: What if the recipient of the bribe is not a government official, but a commercial customer? Q1 15 Review Questions, cont. Answer 1: The DHR Standards prohibit payment of bribes to any party, whether or not the customer is an arm of the government. A1 16 Review Questions, cont Question 2: What if I do not really know if a gift reached a decision maker and influenced his decision? Q2 17 Review Questions, cont Answer 2: > Not being sure what happened to something of value you provided is not a defense under the FCPA or the DHR Standards. > If the circumstances, conduct or results suggest a prohibited payment, your business relationship with Danaher will be terminated and you may face other legal consequences. A2 18 Review Questions, cont Question 3: What will happen if a Danaher company determines that a DHR Contractor has violated the FCPA and/or the DHR Standards? Q3 19 Review Questions, cont Answer 3: > The business relationship with that DHR Contractor will be terminated. > Danaher will exercise all rights to withhold compensation and will seek return of earlier payments that may have been used in violation of the FCPA or the DHR Standards. > US and/or non-US regulatory authorities may seek to impose monetary penalties on that DHR Contractor and/or seek imprisonment of individuals involved in the violation. A3 20 Part III Sample Cases 21 Sample Cases Case A: > A non-US government official requests a visit to the US to meet with the technical experts on a new product being launched by a Danaher company. The official asks a DHR Contractor to arrange the trip, including a side-visit to Disneyland in Los Angeles for his family while he is in Chicago. He suggests he will provide receipts for reimbursement, but that he would also like walking-around money for his children. > Can the DHR Contractor agree to this request? Case A 22 Sample Cases, cont Case A Response: NO > The FCPA and the DHR Standards allow reimbursement of reasonable and bona fide expenditures incurred by a customer and directly related to the promotion of products. > Expenses for spouses/children are not considered directly related to product promotion and are prohibited. > Recreational side trips are not permitted either, even for the person to whom products are being promoted. > Cash advances like “walking around money” are not supported by receipts which creates the appearance of impropriety and does not meet the record keeping requirements of the FCPA or the DHR Standards. Case A 23 Sample Cases, cont Case B: >You would like to give a relatively inexpensive watch to the wife of a foreign official who is involved in evaluation of a Danaher product. Since this is a token gift, customary in your country, is this allowed? Case B 24 Sample Cases, cont Case B Response: NO >Because the gift is being given to a family member of a government official, it is prohibited by both the FCPA and the DHR Standards. >Remember, customary gifts of nominal value may be given to non-government-related persons if the recipient will not feel obligated. >This is not a product promotion case because the gift is not a travel or living expense provided to the official evaluating the product. Case B 25 Sample Cases, cont Case C: > You want to suggest to a government official that he should select the Danaher product you can provide. Because you know that local law prohibits the payment of bribes, your intent is simply to write a letter explaining the wisdom of this choice. In your letter, you state that you will make it worth his while if he selects the Danaher product. > Is it ok to send this letter? Case C 26 Sample Cases, cont Case C Response: NO >Sending this letter would violate the FCPA and the DHR Standards because it suggests to the government official that ‘you will make it worth his while’ to select your product. >This letter is a ‘promise to pay’ to this ‘government official’ ‘something of value’ even if you do not have any particular payment in mind at the time you send the letter. >This case is a good example of why you need to take care in all communications with government officials regarding business opportunities – a poorly chosen phrase can lead to serious consequences. Case C 27 28