HealthCareReformIssues

advertisement

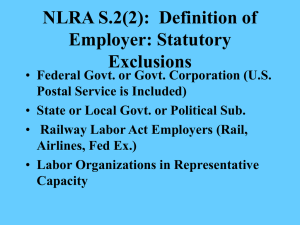

Health Care Reform Issues for the Unionized Employer Patient Protection and Affordable Care Act: Issues for Employers Who Are Parties to Collective Bargaining Agreements Presented by Jerold E. Glassman, Esq. © 2011 Fox Rothschild The Union Contract (CBA) Two Basic Types of Obligations to Provide Health Care Coverage for Employees in the Bargaining Unit 1. Employer Obligated to Participate in a Taft Hartley Plan 2. Employer Obligated to Cover Bargaining Unit With Employer Plan © 2011 Fox Rothschild Taft Hartley Plans Called “Multi Employer Plans” Equal Amount of Trustees Administrator Self Insured, Insured or Combo Funded by Employer Contributions Agreed Employee Contributions © 2011 Fox Rothschild Employer Health Coverage for Bargaining Unit Employees Named Insurance Carrier/Policy Described Minimum Coverage Same or Similar Plan to Non Bargaining Unit Employees Premiums are paid by the Employer; in some cases with Employee Contributions © 2011 Fox Rothschild Health Care Reform $$$ $$$ The Costs $$$ © 2011 Fox Rothschild Health Care Reform Excise tax on high-cost employer-sponsored health coverage. For tax years beginning after Dec. 31, 2017, a 40% nondeductible excise tax will be levied on insurance companies and plan administrators for any health coverage plan to the extent that the annual premium exceeds $10,200 for single coverage and $27,500 for family coverage. An additional threshold amount of $1,650 for single coverage and $3,450 for family coverage will apply to retired individuals age 55 and older and for plans that cover employees in high risk professions. © 2011 Fox Rothschild SPECIAL RULES FOR COLLECTIVELY BARGAINED PLANS Fully insured collectively bargained multi-employer plans and single employer plans in effect on 3/23/10 are “grand fathered” not subject to the Act’s rules until THE DATE ON WHICH THE LAST OF THE CBAs RELATING TO THE COVERAGE TERMINATES Act specifically provides that a collectively bargained plan is permitted to be amended early for some or all of the Act’s rules. This voluntary amendment will not be treated as a termination of the CBA which could otherwise cause the plan to be subject to an earlier compliance deadline © 2011 Fox Rothschild SPECIAL RULES FOR COLLECTIVELY BARGAINED PLANS However, some key provisions of Act still applicable to collectively bargained plans effective plan year commencing on or after 9/23/10 Include: children up to age 26, even if married, eligible for coverage (not required to cover if eligible to participate in another employer’s plan) Prohibition on life time benefits of essential benefits © 2011 Fox Rothschild SPECIAL RULES FOR COLLECTIVELY BARGAINED PLANS Prohibition on exclusions of pre-existing conditions for children No recission of coverage except for fraud All will increase your costs; costs you hadn’t planned for when you negotiated your CBAs © 2011 Fox Rothschild NATIONAL LABOR RELATIONS ACTS AND OTHER CONSIDERATIONS PERTAINING TO UNION EMPLOYERS Section 8(a)(5) of NLRA prohibits unilateral changes to terms and conditions of employment Exception if changes required by law, so foregoing changes not a violation of NLRA Any attempt to shift costs to employees mid CBA will usually be met with a grievance or unfair labor practice charge unless union consents. © 2011 Fox Rothschild NATIONAL LABOR RELATIONS ACTS AND OTHER CONSIDERATIONS PERTAINING TO UNION EMPLOYERS Review your CBA-it might be your friend! Some CBAs allow for cost-sharing and the Employer to pass the increased cost of health insurance to employees usually with caps on premium contribution by the employee On the other hand, some do not and unions may or may not resist changes Is there a re-opener? Risks? © 2011 Fox Rothschild NATIONAL LABOR RELATIONS ACTS AND OTHER CONSIDERATIONS PERTAINING TO UNION EMPLOYERS Mandatory vs. permissive subjects to bargaining Mandatory includes wages hours and other terms/conditions of employment; if one party refuses to bargain, its an unfair labor practice to refuse to bargain Permissive includes subjects like advertising and have minimal effect on the employment relationship; unfair labor practice to demand bargaining over permissive subjects If CBA silent and no zipper clause, Employer could argue increased cost not contemplated by CBA and seek changes as mandatory subject of bargaining © 2011 Fox Rothschild POSSIBLE IMPACT OF 2014 CHANGES Excise tax could cost less for Employers than premium contributions Typical strategy of seeking larger premium contributions may throw you into penalty situation-lots of moving parts Employers who contemplate terminating health insurance coverage need to be careful Decision to terminate is mandatory subject of bargaining Considerations before deciding whether to terminate include: union opposition (institutional and for benefit of employees), litigation and employee morale © 2011 Fox Rothschild STRATEGIES AND RECOMMENDATIONS Start your planning now for 2014 changes particularly if your CBA is set to expire in 2014 If CBA expires before 2014 and are bargaining successor CBA, may want to turn to re-opener clause to see where its all headed Should consider broad language in CBA allowing you to unilaterally amend or terminate health insurance coverage © 2011 Fox Rothschild Contact Information Jerold E. Glassman 973 994 7550/561 804 4422 jglassman@foxrothschild.com © 2011 Fox Rothschild