IntroductiontoCreditUnionSocialResponsibility

advertisement

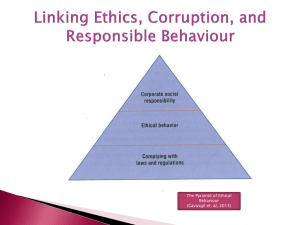

Venue & Date Introduction to Credit Union Social Responsibility Presenter 1 Introduction 1. What is CSR? 2. Why have a CSR strategy in place? 3. How to implement a CSR strategy? 4. Who is currently practicing CSR? 5. Where to go for more information? 2 1. What is Corporate Social Responsibility? 3 History & Terminology • • • Rooted in the evolution of commerce Credit Union Social Responsibility notes the unique approach of credit unions Many terms in use, for example: o Corporate social responsibility/Corporate responsibility o Corporate citizenship o Sustainability o People, planet, profits o Sustainable development o Environmental, Social, Governance (ESG) (investor terminology) o Triple bottom line 4 Definition CSR is: The balanced integration of social, environmental and economic factors in business decision making, including governance, strategy, and operations while taking stakeholder interests into account. In essence, Credit Union Social Responsibility is about managing a credit union’s social and environmental performance to reduce its negative and enhance its positive impacts. 5 Sustainable Finance • For financial institutions, CSR incorporates social and environmental considerations into financial products and services (banking, insurance and asset management), and is often referred to as “sustainable finance.” 6 CSR Practice Areas 1. Governance, ethics and management systems 2. Environment 3. Community involvement 4. Employee relations 5. Member (customer) relations 6. Products and services 7. Supplier and business partner relations 7 CSR Practices Continue 8. Human rights 9. Aboriginal relations (where relevant) 10.Communications 8 Stages of CSR Stage 1: Pre-CSR • No consideration of environmental or social impacts or role Stage 2: Basic • Takes an ad hoc approach to CSR; primarily focuses on philanthropy plus some basic environmental steps such as recycling. Stage 3: Proactive • Invests in a few CSR initiatives where it can reduce costs, foster employee engagement and build brand. 9 Stages of CSR Continue Stage 4: Integrated • CSR is embedded across the organization through policies, procedures and practices; CSR goals are incorporated into business strategies. Stage 5: Mission-Driven • The business purpose is to improve social and environmental conditions. 10 CSR Leadership 1. House in Order 2. Products and Services 3. Investments and Procurement 4. Stakeholder Engagement 5. Advocacy 11 CUCC Position Statement Canadian Central’s Board of Directors adopted four principles to guide its work to help member Centrals and Canada’s credit unions to “build stronger, more sustainable communities”: 1) 2) 3) 4) Demonstrating co-operative and sustainable governance Promoting social inclusion and diversity Fostering economic development Encouraging environmental sustainability CC Position Statement 12 International Co-operative Principles International Co-operative Principle 7: Concern for Community “Co-operatives work for the sustainable development of their communities through policies approved by their members.” 13 International Standards for CSR International Organization For Standardization (ISO) adopted CSR guidelines in 2010 • Referred to as ISO 26000: “Guidance on Social Responsibility” Seven ISO principles of social responsibility: 1. 2. 3. 4. 5. 6. 7. Accountability Transparency Ethical behaviour Respect for stakeholder interests Respect for the rule of law Respect for international norms of behaviour Respect for human rights 14 Summary • No single term or standard definition for CSR • Credit Union Social Responsibility is about managing your social and environmental performance to reduce your negative and enhance your positive impacts • Aligned with CUCC and international cooperative principles 15 Summary Continue • A natural fit for Canadian credit unions • It is important to understand the scope of CSR to make an informed business decision regarding focus and strategic priorities 16 2. Why have a CSR Strategy? 17 Drivers of CSR Trends • • • • • • • • • • • • • Campaigning NGOs (non-governmental organizations) Rise in government and regulatory standards Investors seeking improved ESG performance Globalization of corporations Instant worldwide communications Supply chains and increasing CSR demands of purchasers Niche innovating sectors Rising customer and employee expectations Growing resource scarcity Rising poverty levels Corporate scandals Trade associations Growing awareness of the business case 18 CSR Trends Companies are: • Adopting CSR commitments and policies • Taking a catalytic role within their spheres of influence • Implementing 3 – 5 year CSR strategies • Disclosing their CSR performance in CSR reports • Creating board CSR committees • Assigning accountability to a senior staff person reporting to a CEO • Supporting internal CSR or green teams and training staff on CSR • Incorporating CSR into their performance management systems • Offering CSR oriented products and services • Perceiving CSR as a risk management and business strategy issue • Key priorities are often climate change and poverty/social inclusion • Redesigning community programs to be more “strategic” • Consulting stakeholders in developing CSR strategies 19 International FI Network • Nearly 200 financial institutions (banks, insurers and fund managers) from around the world are signatories to the United Nations Statement by Financial Institutions on the Environment & Sustainable Development. • Committing to make the economy and lifestyles sustainable and integrate environmental considerations in their operations. • Network is a resource to financial institutions to help them improve their CSR performance. • Includes the five major Canadian banks, Desjardins and The Co-operators. 20 CSR Product Array Social Products • • • • Financing for affordable housing Products tailored to Aboriginal and other underserved groups Micro-credit financing for community economic development Term deposits that finance community development Green Products • • • • • Green mortgages and home improvement loans Green car loans Green credit cards Term deposits that finance environmental initiatives Green car and home insurance 21 CSR Product Array Continue Green Products Continue • Financing for environmental businesses and eco-advice services • Business loans for eco-efficiency retrofits, fuel efficient fleets, etc. • Socially responsible investments 22 CSR Business Case Top-line benefits: Generating Growth Opportunities • • • • Attract and retain customers Improve employee morale and productivity Enhance and maintain competitive advantage Foster innovation and opportunity creation, including new business lines and new products and services • Build and sustain positive brand and reputation • Build and sustain social license to operate • Improve access to capital 23 CSR Business Case Continue Bottom-line benefits: enhancing operational efficiency • • • • • • Avoid and reduce operating costs Improve recruitment and retention of talented employees Manage risk Forestall further government regulation Improve management quality Enhance supply chain management 24 Competitor Scan CSR management systems: • Banks are designating lead staff and departments to be responsible for CSR strategy and implementation • They are implementing comprehensive CSR strategies • They are reporting on their CSR performance • They are becoming more strategic in their community investments and developing environmental action plans to reduce their environmental footprints 25 Competitor Scan Continue Community and social priorities include: • Financial literacy projects • Multicultural and Aboriginal banking • Accessibility of banking services to people with disabilities Environmental priorities include: • Implementing environmental policies and strategies; designating key staff with environmental responsibilities • Building or renovating green buildings / branches • Reducing energy use and GHG emissions and sourcing renewable energy • Reducing paper 26 Competitor Scan Continue “Blended” priorities include: • Providing environmental grants to community groups • Implementing sustainable purchasing • Offering Socially Responsible Investment (SRI) products 27 Summary • CSR is becoming mainstream amongst most sectors, including financial institutions. • CSR oriented companies are implementing CSR strategies and integrating CSR into operations. • Canadian banks are implementing well thought CSR strategies. 28 Summary Continue • A CSR strategy can generate business benefits, though this is not the only rationale for adopting CSR: some do it because it is a core credit union value. • Reasons for managing CSR performance include: o Core credit union value o Maintain competitive advantage o Generate business benefits 29 3. How To Implement a CSR strategy? 30 CSR Strategy Development Phase One: Commitment and Gap Analysis 1.Define CSR and agree on the business case and rationale. 2.Adopt and communicate CSR vision and policy. 3.Assess baseline (e.g. existing programs) and current practices. 4.Research best practices and understand stakeholder priorities and key sustainability impacts and risks. 5.Conduct gap and opportunity analysis. 31 CSR Strategy Development Continue Phase Two: Develop Strategy 1. Develop long-term CSR vision (10 years). 2.Develop medium-term CSR goals and targets (3 – 5 years) and one year business plan. 3. Develop key performance indicators to measure progress. 32 CSR Strategy Development Continue Phase Three: Implement, Measure and Report 1.Assign responsibilities and resources. 2.Establish steering committee to monitor implementation. 3.Integrate into performance systems and training. 4.Regularly review performance. 5.Communicate progress on performance. 33 Common Practice Areas 1. Community (Aboriginal business, accessibility, financial literacy, community economic development) 2. Employees (Diversity management, work life balance, healthy lifestyles) 3. Environment (Energy, GHG emissions, green buildings, waste, water and paper) 4. Suppliers (Sustainable purchasing) 5. Products (see earlier slide) 6. CSR management and reporting systems 34 Role of The Board of Directors • • • • • • • • • • Approve CSR mission, vision, values Adopt CSR strategy and provide oversight over implementation Monitor CSR policy compliance and integration Integrate CSR into CEO performance plan and recruitment Consider CSR trends that impact the credit union and integrate into enterprise risk management Monitor stakeholder relations Foster board diversity (gender, age, ethnicity, etc.) Provide CSR orientation and education for directors Provide Input into CSR reporting Assess board CSR competency 35 Summary • To develop a CSR strategy the credit union must answer four questions: 1) 2) 3) 4) Where are we now? Where do we want to be in the future? How do we get there? How do we measure progress? • The Board of Directors has an important governance role to play to foster CSR success 36 4. Who is currently implementing a CSR strategy? 37 Not Just Big Credit Unions iNova Credit Union (Halifax, NS) Asset Size -$25 million (2009) Sydney Credit Union (Sydney, NS) Asset Size -$100 million (2009) Bergengren Credit Union (Antigonish, NS) Asset Size - $177 million (2009) 38 Alterna Savings and Credit Union • CSR definition: “An organization’s commitment to operate in an economically, socially, and environmentally sustainable manner, while recognizing the interests of its stakeholders, including members, employees, business partners, local communities, the environment and society at large”. • Board of Directors and Member Relations Committee has overall responsibility for the CSR strategy and policy, oversees the CSR report (accountability report), and monitors stakeholder relations • Board sets CEO’s CSR goals and ensures board is educated on CSR. • CSR is responsibility of SVP of Marketing, Communications and CSR. 39 Alterna Savings and Credit Union Continue • Implementing a 5-year CSR strategy adopted in 2007, which set goals and targets for community economic development, financial literacy, environmental sustainability, accountability and philanthropy. • Environmental sustainability committee of employees assesses environmental impacts, and develops and monitors implementation of environmental initiatives. • A key CSR performance indicator is member satisfaction with the credit union’s CSR efforts. • Provides an “ethical” screen to its investments, partners and suppliers, based on Ethical Funds’ screening program. 40 Assiniboine Credit Union • Credit Union Mission: “Our purpose as a socially responsible and profitable financial co-operative is to provide accessible financial services for the wellbeing of our members, employees and community; offer fair and meaningful employment in a safe and respectful workplace; and build partnerships that foster self-reliant, sustainable communities.” • 5-year corporate strategic plan includes visioning goal of Making a Difference in Our Community: “When we reach our vision we are positive agents of change and CSR is integrated into everything we do.” Key Performance Indicators measure progress towards achieving vision • CSR strategies to achieve visioning goal and long-term targets: expand services to the underserved; invest strategically in the community, model and facilitate a commitment to environmental sustainability, and integrate CSR and the Co-operative Principles throughout ACU 41 Assiniboine Credit Union Continue • Annual Balanced Scorecard approved by Board includes a CSR component to measure progress in moving forward on CSR strategy. • Balances Scorecard results account for 50% weighting on individual performance plans for executive management team. • Board governs CSR through mission, values, corporate strategic plan, annual Balanced Scorecard, and governing policies. • Community & Member Relations Committee oversees stakeholder relations with members and community; including governing policies e.g. Community Investment Policy, Member Engagement Policy 42 Assiniboine Credit Union Continue • HR Policy & Compensation Committee oversees stakeholder relations with employees, including governing policies e.g. Employment Principles, Compensation Philosophy. • CSR is responsibility of VP Corporate Social Responsibility who reports to CEO. A small team of CSR subject matter experts supports the roll-out, coordination and integration of CSR efforts. • New Eco-Excellence Team will develop integrated action plans to continuously improve environmental performance. 43 Northern Savings Credit Union • Sustainability vision: ”Strong, resilient, Northwest BC communities and credit union, excellent financial services and enhanced quality of life for members, and recognized by our employees to be a great place to work.” • One of five values is: Positively impacting the communities we serve. • Six principles guide the credit union to build strong, resilient and sustainable communities. • Seven long-term business goals include three focused on sustainability and community reinvestment: o Strong, resilient communities o Enhanced community reputation and increased profile as a community leader and champion 44 Northern Savings Credit Union Continue o Stakeholder awareness and understanding of and support for Community Reinvestment Strategy • Board of Directors has a Donations and Community Reinvestment Committee which provides oversight over implementation of sustainability strategy (referred to as the Community Reinvestment Initiative). • Manager of Community Reinvestment reports to the HR VP • Sustainability is incorporated into job descriptions. • Team of ‘Sustainability Champions’ provides support to implementation and manages sustainability projects. 45 Vancity Credit Union • Credit Union Vision: “Redefining Wealth in a way that both grows our business and supports our members and communities in a reciprocal fashion. This new definition of wealth goes beyond profit alone to one that includes social justice, environmental sustainability, and community wellbeing. It’s a definition that goes beyond the trade-offs assumed in a triplebottom-line approach to one that creates true blended value.” • Three year strategic business goals include one focused on: Build Our Social Finance Offer – provide access to credit, investment and financial advice for members and agencies engaged in businesses that create social or environmental benefit as well as economic benefit. • “Community Investment” Division is focused on increasing their Social Finance business, an entrepreneurial and risk-based discipline of investment in enterprises – business, not-for-profit, and co-operative. 46 Vancity Credit Union Continue • The Community Investment Division includes Vancity’s Sustainability Group (focused on reducing the credit union’s environmental footprint) as well as its business banking and commercial real estate groups to capitalize on synergies with existing business and new community investment / social finance initiatives • Community Investment Committee of the Board provides strategic oversight over Social Finance strategy • CSR is decentralized and embedded into other departments, including finance, facilities, marketing and branch operations • Currently working on the development of a community impact metric to measure success 47 5. Where to go for more information on Credit Union Social Responsibility? 48 Canadian Central and CCA 1. Credit Union Central of Canada’s “Credit Union Social Responsibility InfoHub” at www.cusr.cucentral.ca 2. Canadian Co-operative Association’s Environmental Toolkit 49