Title – Maximum Two Lines

advertisement

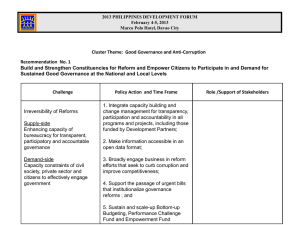

A country strategy on how to improve upon corporate governance: from form to substance Sebastian Molineus Practice Manager, Capital Markets Practice The World Bank Presented on May 14, 2012, in Chisinau, Moldova Objective and outline Objective Outline To provide inputs on how to improve upon corporate governance practices in Moldova 1. Defining what good corporate governance is and why it matters 2. What are the lessons from over 10 years of World Bank experience 3. A potential roadmap for Moldova 2 Introduction: what is and why does corporate governance matter? Lessons learned: Corporate governance challenges across the world A potential roadmap for reforms 3 To begin with, it is important that we are all on the same page as to what good corporate governance means Simplified definition The OECD defines corporate governance as: A system by which companies are directed and controlled … which involves a set of relationships between: • a company’s management • board of directors • its shareholders and • other stakeholders … and which provides the structure through which company objectives are set, attained and monitored. Source: OECD Principles of Corporate Governance 4 What is “bank governance”? How is it different? The manner in which banks are governed by their boards and senior mgmt, which affects how they: 1. Set corporate objectives 2. Operate the bank on a day-to-day basis 3. Meet their accountability to shareholders and interests of stakeholders 4. Operate the bank in a safe and sound manner, and in compliance with laws and regulations 5. Protect the interests of depositors Source: Basel Committee on Banking Supervision - Enhancing corporate governance for banking organisations 5 The following illustration offers a ‘look & feel’ of the key themes corporate governance touches upon Illustration Robust legal & regulatory environment 6 Protection of (minority) shareholder rights Strong disclosure & transparency regime Robust control structures Good board practices Strong enforcement regime But what does it mean to in practice? A change in behavior! … in the end, corporate governance is about what people in privileged or v don’t do) with other people’s (e.g. responsible positions actually do (or shareholders’ and depositors’) money! 7 The good news: research and practice demonstrates that good corporate governance adds to the corporate “bottom line” Optimizes Operational and Financial Efficiency • Streamlines business processes, leading to better operating performance & lower capital expenditures Gompers, Ishii and Metrick, Corporate Governance and Equity Prices, August 2001 • Improves the company’s ROCE, with firms in the top cg quartile avg. 33% & in bottom quartile 15% Credit Lyonnais SA, 2001 • Better share price performance, higher profitability, larger dividend payouts & lower risk levels than peers Lawrence Brown, Georgia State University, Sept. 2003 Improves Access to Outside Capital •Global Institutional Investors managing more than 1 trillion of assets state that they will pay a premium for well governed companies. Premiums avg. 30% in Eastern Europe & Africa and 22% in Asia and Latin America McKinsey Global Investor Opinion Survey on Corporate Governance, 2002 Improves Valuation and Lowers the Cost of Capital •Over 10 years, well-governed companies across a wide range of sectors have seen superior valuation multiples of more than 8% over their badly governed peers. Metrick, Ishi and Gompers, Corporate Governance and Equity Prices, August 2001 •One standard-deviation improvement in governance brings an improvement in valuation multiples that ranges from 18% for companies in major OECD markets to 33% in emerging markets. Clapper and Love, World Bank, 2002 Builds/Improves the Company’s Reputation • CG can make/break reputations by creating confidence &goodwill and building/restoring investor trust 8 And also brings benefits to the public For regulators and supervisors • A first line of prudential defense • Increased financial stability & reduction to crisis For markets • Higher market capitalization and liquidity • Increase in investor confidence and trust • Ability to attract, allocate & monitor investment For economies More “champion” companies that can compete and grow internationally Higher economic growth 9 Introduction: what is and why does corporate governance matter? Lessons learned: Corporate governance challenges across the world A potential roadmap for reforms 10 The World Bank has carried out 90 governance assessments or reviews in 70+ countries, including the ECA region, with the following set of lessons learned The World Bank’s Corporate Governance Group carries-out country-level corporate governance ROSC assessments, and reviews for SOEs and financial institutions 11 1. Most boards are not fulfilling their role: that of providing managerial oversight and strategic guidance on behalf of all shareholders Role Structure Composition Remuneration Training & evaluation • Boards involved in day-to-day management; no succession plans • Duties (of loyalty and care) defined, but not understood • In practice, most companies have not formed board committees • Position of CEO and chairman legally separated, yet insiders continue to dominate board • MCGC calls on 1/3 of boards to be independent, but definition fails to cover directors who are shareholders • In practice, few directors thought to be truly independent • Except for the largest companies, NEDs receive low pay • Executive pay not based on formal evaluation or LT incentives • Cultural stigma against training • Board self evaluations virtually non-existent 12 Financial and non-financial disclosure in particular remains weak, despite the adoption of IFRS and ISA Financial disclosure IFRS typically mandatory, but often incomplete, or based on outdated versions In practice, critical gaps in financial reporting in terms of quality and timeliness Non-financial disclosure Few companies prepare and disclose annual reports; most do not have CG sections Little information on CG, ownership, board information, remuneration, risk structures, etc External audit Conflicts of interest due to the provision of non-audit work Quality of peer review process questioned 13 Financial institutions have often established the requisite control functions, although most remain nascent and under-resourced Key control functions Key issues Most boards do not set risk appetite, approve credits 1 Risk management 2 Internal controls 3 Internal audit 4 Compliance “Shareholder Risks are identified, assessed, monitored in boards” are units–but not across the bank through a CRO focused on Risk function has sufficient authority/stature, but growth, lacks independence, resources and board dividends, and access market share, IC in some banks is underdeveloped due to lack but not on the underlying IT infrastructure bank’s Inadequate follow-up to management letter risk/return IA formally reports to CEO and AC, but in practice, dimension strong liaison to CEO in most banks (sets salary, promotion, hiring/firing) Few IA plans truly risk based IA function has sufficient authority/stature, but lacks independence, resources and board access Controls are under Formal report to board but CEO typically presents resourced and for the head of compliance; position lacks under-staffed authority and resources Often consists of only one individual (0.2 vs. 1%) 14 Introduction: what is and why does corporate governance matter? Lessons learned: Corporate governance challenges across the world A potential roadmap for reforms 15 Much has already been achieved these past ten years! However, the CG ROSC shows that a number of important challenges remain Today’s Achievements Tomorrow’s Challenges • CG Codes/Regs launched for Legal & regulatory reforms • To close remaining gaps in the legal listed companies, banks, SOEs and regulatory framework • Key laws in place & recently • Modernize and build ‘smart’ CG amended; new reforms launched frameworks • A&A, CG ROSCs commissioned • SECs typically in place; Enforcement capacity • Build enforcement capacity/ regulatory “bite”, with real fines resourced • MoUs between the CB, SEC, • Independence of regulators should be MoF to ensure for financial market stability strengthened • Launch of CG reform Actual practices • Boards need to fulfill their primary role of oversight/guidance • Launch of CG Centers and • Disclosure must be improved training programs to build capacity among directors • Nascent internal control frameworks are built 16 Policy Recommendations. The Government of Moldova might consider the following strategy: Short term (<1 year) 1. Targeted changes to the regulatory framework Amend corporate governance code; specific regulations 2. Launch CG course for shareholders, board members and sr. managers Targeted training courses for board members and sr. managers, as well as for technical control bodies (Internal Audit, Risk Management, etc.) Medium term (years 2-3) 3. Incorporate CG into supervisory process CG incorporated into supervisory process and supervisors to receive targeted training; issue implementation guide 4. Require financial institutions and other public interest entities to carry-out corporate governance (self) assessments Financial institutions to develop action and implementation plans Develop a strategy to improve upon the corporate governance of SOEs. Long term (>4 years) 5. Carry-out comprehensive review of the legal and regulatory framework, incl. Company and Banking Law 17 But in the end … … it is up to the private sector to demonstrate its commitment to real reforms! 18 More specifically, in building a corporate governance framework, Moldovan financial institutions will need to… 19 Direct = to organize, energize, and supervise; to lead 1. Create a professional, vigilant, and independent board In practice, this means that board need to: Set policies and the overall direction, and not manage (“nose in, hands out”) Guide and supervise management; set performance objectives Act in the interest of the company and all shareholders, not a particular shareholder Build robust corporate, board, and risk governance frameworks 20 To disclose = revealing, uncovering, making known to others 2. Improve disclosure practice! In practice, disclosure means: Disclosing accurate, relevant and timely financial information Disclosing non-financial information! Being transparent to shareholders, debt-holders, depositors, regulators, and other stakeholders Demonstrate how “other people’s money” is being used, what risks are being taken, and what returns shareholders may expect To control = to check, test, or verify 4. To create a robust control environment. In practice, building a robust control framework means : Understanding the company’s risks Implementing internal controls Establishing an independent internal audit function Working with (not against) the external auditor Establishing an audit committee to coordinate the control environment To protect = to shield from injury or damage, save from financial loss 4. Protect shareholder rights In practice, protecting shareholder rights is to: Inform minority shareholders of their rights Allow all shareholders to participate in the profits of the company Protect shareholders from abusive actions, e.g. related party transactions 23 out of