New Developments in Commissioning and Procurement (13 Nov 14)

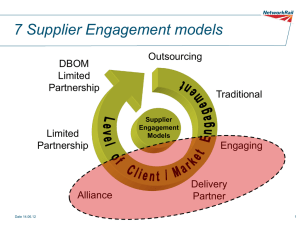

advertisement

New Developments within Commissioning and Procurement Neil Coulson Associates What will be covered? • New EU Procurement Directives • Alliance Contracting New EU Procurement Directives • Council of the European Union - new directives came into force on 17 April 2014 • Nation states have up to 2 years to transpose them into national law • New Public Contracts Regulations 2015 • Opening up public contracts for SMEs (including VCSE organisations) Definition of SME’s Company category Employees Turnover or Balance sheet total Mediumsized < 250 ≤ € 50 m ≤ € 43 m Small < 50 ≤ € 10 m ≤ € 10 m Micro < 10 ≤€2m ≤€2m Dividing large contracts into smaller lots • New turnover cap - contracting authorities will not be able to set company turnover requirements at more than two times contract value except where there is a specific justification • If contracting authorities decide not to break contract into smaller lots, they have to state their reasoning in writing, but it could include issues of expense or complexity ‘Innovation Partnerships’ • Commissioners able to publish a notice outlining a need to be met by an innovative product or service not currently available on the market, stating minimum qualitative requirements • One or more respondents then selected to become the commissioner's innovation partner(s) ‘Innovation Partnerships’...cont • IP engages with commissioner to develop service that best meets the commissioner's requirements (encompassing cost negotiations) • Peterborough Plus VCSE Consortium? New ‘light touch’ approach to smaller contracts • The current Part A/Part B services distinction has been removed • Replaced by new light touch regime for health, social and educational contracts below a new €750,000 threshold (equivalent to around £635,000). Ring-fencing of certain contracts • Certain health, social and cultural services may be reserved to employee-owned mutuals or social enterprises for a period of up to three years Alliance Contracting: Context • Fragmentation of health and social care services • Competition between providers is often detrimental to the end user • Need for new, more integrated approach • Both main political parties are showing growing interest in it Form of Outcomes Based Commissioning (OBC) Inputs/ resources Deliverables/ activities Outputs Outcomes Focus of OBC What is it? • Encourages the buyer and suppliers to work as an integrated team • Ties the commercial objectives (e.g. profit/performance payments) of all the parties to the actual outcome of the project – ‘best for project’ and ‘not best for individual’ • The alliance either wins or loses as a group Potted History • Originated within heavy engineering in the 1990’s • British Petroleum introduced it in the North Sea oil platforms in response to a range of problems in working with suppliers: escalating costs, delays in project completion, dispute and litigation • Australia and New Zealand have subsequently used it extensively within the public sector • Now coming into the UK How does contracting work? Traditional Contracting Commissioner Provider Provider Provider Provider Lead Contractor or SPV model Commissioner Lead Contractor/SPV Provider Provider Provider Provider Alliance Contracting: single contract with a group of suppliers Commissioner Provider Provider Provider Alliance Provider Shared risk and reward • ‘gainshare painshare’ compensation model • Each party’s commercial interest is expressly tied to the actual whole system outcomes • The commissioner, as the ‘owner’ of the contract, drives this shared risk and reward approach Process involved in setting up ‘gainshare painshare’ system • Set initial target cost, generated by the whole project team (commissioner working alongside providers) • The target cost is then compared to the final cost and the resultant cost under or over-runs are then shared by all participants – team wins or loses as a group depending on project performance • The comparison of target to actual cost is done through ‘open book accounting’ (each supplier has to show actual records of expenditure against the project to the other participants in the contract – commissioner and other suppliers). • NB needs to be competition law compliant • The split of gains and losses between the commissioner and providers is agreed by the parties to the alliance at the outset of the project Alliance Contracting Target Cost Model Contribution to corporate overheads plus operating surplus Direct Costs Subject to Project Performance/ gainshare painshare system Automatically Reimbursable Key differences between alliance contracting and traditional contracting Traditional Contracting Alliance Contracting Commissioner is separate Commissioner is part of from delivery process integrated delivery team Based on risk Based on risk sharing transference Exculpatory approach ‘No blame’ culture within risk management framework Responsibility for Everyone works towards outcome delivery is whole system outcomes apportioned across separate providers Encourages decision Encourages decision making making founded on ‘best founded on ‘best for project’ for self’ Closed book accounting Open book accounting Key ingredients of effective alliancing • Small number of participants (alliance contracting is based on relationship development and management so the larger the team, the more difficult and problematic this becomes); evidence suggests a maximum of 8 partners • There is a need for equality between the team members – the presence of a large, dominant provider could skew the consensual decision-making processes that alliance contracting is based on • Therefore, alliance team members need to be carefully selected • The alliance has to be based on clearly documented principles to which all members of the alliance are completely agreed • People need to behave like grown-ups!! Why is the interest in Alliance Contracting growing? • Focus on outcomes • Within Health & Social Care - a way of facilitating integration across the care cycle • Monitor – formally recognises “contracting an alliance of providers” as a possible approach for CCGs Case study: Stockport Metropolitan Borough Council • Mental health reablement and recovery service – 2 VCSE providers plus commissioner in alliance team • Seen as opportunity to link collaborative approach embedded in alliance contracting with the principle and practice of co-production • ‘...a maturity of approach and manner and a willingness to take some risks is required; collaboration is very different in my eyes to partnership, captured I think with the idea of aligning your organisation’s future success or failure with that of former competitors’ (Nick Dixon, Commissioning Manager, Stockport Metropolitan Borough Council). Challenges • Legislation – Competition Law • Demand side - appetite for risk, skills and knowledge of commissioners • Supply side – limited knowledge of alliance contracting within VCSE, issues with sharing risk