ALI-CLE-2013-Tax-Court-Procedures_-Trial

advertisement

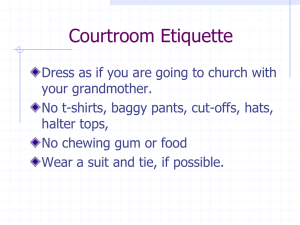

Dentons US LLP Tax Court Procedures: Trial ALI CLE Handling a Tax Controversy: Audits, Appeals, Litigation, and Collections Washington, DC October 18, 2013 Locations October 18, 2013 Dentons US LLP 2 Offices by list Key Canada United States Europe Central and Eastern Europe l Offices l Calgary Atlanta l Barcelona l Bratislava Associate offices l Edmonton Boston l Berlin l Bucharest Facilities l Montréal l Chicago l Brussels l Budapest u Associate firms l Ottawa l Dallas l Frankfurt l Istanbul l Toronto l Kansas City l Madrid l Prague l Vancouver l Los Angeles l Paris l Warsaw Miami u Zurich New Orleans l New York l Phoenix + Special alliance firms l San Francisco l Short Hills l Silicon Valley l St. Louis l Accra l u Algiers Amman u Bissau u u Bujumbura l Cairo u Cape Town Kuwait City u Casablanca l Manama u Dar Es Salaam l Muscat u u Johannesburg u Kampala u Kigali u Luanda u Lusaka u Maputo u Nairobi u Nouakchott Kyiv u Port Louis l Moscow u Praia l St. Petersburg u u Washington, DC l l Dentons US LLP Middle East Abu Dhabi Asia Pacific l Beijing l Hong Kong Beirut l Shanghai l Doha l Singapore l Dubai Riyadh + Lagos United Kingdom October 18, 2013 Africa London Milton Keynes Russia and CIS l Central Asia l Almaty u Ashgabat São Tomé l Baku Tripoli l Tashkent 3 Tax Court Procedures: Trial PANELISTS • Chief Special Trial Judge Peter J. Panuthos, U.S. Tax Court • Peter K. Reilly, Office of Chief Counsel, Internal Revenue Service • M. Todd Welty, Head of Tax Controversy and Litigation, Dentons US LLP MODERATOR • Miriam L. Fisher, Co-Chair of Global Tax Controversy, Latham & Watkins LLP* *These materials were prepared by Ms. Fisher with the helpful assistance of October 18, 2013 Dentons US LLP Denise Mudigere of Dentons US LLP 4 Tax Court Procedures: Trial • Trial or No Trial? • Planning Trial Logistics • Burden of Proof • Developing and Presenting the Trial Narrative • Making the Trial Record • Settlement: Still an Option • A Note About Courtroom Conduct October 18, 2013 Dentons US LLP 5 Trial or No Trial? When is a decision without a trial possible? • Summary Judgment – TC Rule 121 Either party may move, with or without supporting affidavits or declarations, for a summary adjudication in the moving party’s favor upon all or any part of the legal issues in controversy. Such motion may be made at any time commencing 30 days after the pleadings are closed but within such time as not to delay the trial, and in any event no later than 60 days before the first day of the Court’s session at which the case is calendared for trial, unless otherwise permitted by the Court. • Submission Without Trial – TC Rule 122 Any case not requiring a trial for the submission of evidence (as, for example, where sufficient facts have been admitted, stipulated, established by deposition, or included in the record in some other way) may be submitted at any time after joinder of issue by motion of the parties filed with the Court. The parties need not wait for the case to be calendared for trial and need not appear in Court. October 18, 2013 Dentons US LLP 6 Trial or No Trial? Also… • Alternative Dispute Resolution – TC Rule 124 Voluntary binding arbitration, non-binding mediation or other ADR • Judgment on the Pleadings – TC Rule 120 By motion; treated as summary judgment if matters outside the pleadings are presented • Default and Dismissal – TC Rule 123 Default: failure to plead or prosecute Dismissal: failure to prosecute, comply with Rules or Orders or other cause the Court deems sufficient Query: When might decision without trial be a good strategic option? October 18, 2013 Dentons US LLP 7 Planning Trial Logistics • Place of Trial – TC Rule 140 Petitioner’s “home field advantage” -- Consider: • Cost concerns • Location of witnesses • (In)Convenience of trial counsel • Convenience of the Judge • Courtroom Dynamics • Learn the Judge’s preferences in advance • Discuss with Court in advance anticipated schedule, opening/closing/direct exam of expert practices, courthouse/courtroom access, anticipated evidentiary or scheduling issues, presentation of remote testimony, etc. • Exclusion of witnesses upon party request – TC Rule 145 • Parties and experts generally not excluded • Organization: witness and document “readiness” • Use of courtroom technology October 18, 2013 Dentons US LLP 8 Burden of Proof • General Rule -- TC Rule 142(a) • The burden of proof -- to establish the party’s claim by a preponderance of the evidence (or other applicable standard) -- generally shall be upon the petitioner, except as otherwise provided by statute or determined by the Court • Shifting the Burden to the Commissioner – IRC sec. 7491 • Assuming no Code provision provides for a specific burden of proof, where petitioner introduces credible evidence with respect to any factual issue, the burden of proof shifts to the Commissioner, if • the petitioner has complied with applicable substantiation requirements, • the petitioner has maintained all required records, • the petitioner has cooperated with the IRS’s reasonable requests for witnesses, information, documents, meetings and interviews, and • the petitioner, if not an individual, satisfies the net worth requirements of IRC sec. 7430(c)(4)(A) (ii) (see 28 USC sec. 2412(d)(2)(B)) October 18, 2013 Dentons US LLP 9 Burden of Proof • Specific Exceptions to General Rule – TC Rule 142 (b)–(e): The burden of proof shall be upon the Commissioner with respect to: • Any new matter asserted by the Commissioner, increases in deficiency, or affirmative defenses included in the Answer (see TC Rule 39) • Fraud with the intent to evade tax (by clear and convincing evidence) – IRC sec. 7454(a) • Transferee liability and other limited exceptions – IRC sec. 7454(b)-(c); IRC sec. 6201(d) Query: For practical purposes, what role does the burden of proof play? • At trial • As a tool for settlement October 18, 2013 Dentons US LLP 10 Developing and Presenting the Trial Narrative • Pleadings and Motions • Is there an early opportunity to begin to establish your themes? • Pretrial Memorandum • Excellent format for setting out your “trial story” • Opening Statement • Usually allowed, concise summary of the issues and evidence • Opportunity to establish a relationship with trier of fact, set tone • Address the other side’s story • Order of Proof • Important strategic opportunities • Closing Argument (if allowed – always ask) • Post-Trial Briefs October 18, 2013 Dentons US LLP 11 Making the Trial Record Practical Strategic Considerations in Tax Court Trial Practice • Thorough Stipulations of Fact, including as to exhibits, require advance planning of proof, save trial time, telegraph your trial story and help educate the Court • Expert Reports, submitted in advance, are direct testimony -- TC Rule 143(g) • Pre-trial Depositions can only be used at trial if received as evidence -- TC Rules 81(i), 143(d) • Consider the Transcript! • Communicate clearly and elicit clear testimony; refer to exhibits by correct number, signal topics and transitions; clarify any confusion in the record • Consider impact of long delay before Judge and clerk will review the record • Double check before the record is closed as to admission of exhibits and ruling on objections • Post-Trial: any need for leave to supplement the record? • Briefs: advance planning to address all elements of the case -- how will the record translate into proposed findings of fact? October 18, 2013 Dentons US LLP 12 Making the Trial Record Evidence • Rules of Evidence – TC Rule 143(a); IRC sec. 7453 Trials before the Court will be conducted in accordance with the rules of evidence applicable in trials without a jury in the United States District Court for the District of Columbia. To the extent applicable to such trials, those rules include the rules of evidence in the Federal Rules of Civil Procedure and any rules of evidence generally applicable in the Federal courts. • The “for what it’s worth” Rule of Evidence While the formal rules of evidence are certainly applied in the Tax Court, there is considerable flexibility, particularly as to issues of relevance and materiality, where the Judge is the sole trier of fact • Evidence does not include ex parte affidavits, statements in briefs or unadmitted allegations in pleadings – TC Rule 143(c) October 18, 2013 Dentons US LLP 13 Making the Trial Record Documentary Evidence • Stipulations include all documents – TC Rule 91(a) • Be as comprehensive as possible • Get to the Judge as early as possible • Preserve objections and get them addressed at trial • Exhibits • Preparation: sufficient copies and readiness for use • Scope: have you omitted, or failed to explain on the record, something you will need when briefing? • Demonstratives (to make the Judge’s job easier) • Summarize and help tell the trial story • e.g., transaction diagrams, timelines, list of code names, abbreviations and acronyms • Share in advance; deal with any objections; seek admission as trial exhibits • Provide ready reference and refresher for Judge and clerk months after trial October 18, 2013 Dentons US LLP 14 Making the Trial Record Testimonial Evidence • Trial Subpoenas to compel witness attendance and for production of documents – TC Rules 147, 148; IRC sec. 7456(a) • Witness Preparation • Credible, with knowledge of subject matter, familiarity with exhibits • Demeanor, comfort level in courtroom • Anticipation of cross-examination, objections, potential treatment as hostile witness, potential for impeachment, possible questions from the Judge • Presentation of Testimony • Strategic order of witnesses • Flow, signaling topics and transitions, clarity of record • Rapport, communicating with the fact-finder • Contemporaneous remote transmission possible upon a showing of good cause and with appropriate safeguards -- TC Rule 143(b) October 18, 2013 Dentons US LLP 15 Making the Trial Record Expert Witnesses • Expert Reports – TC Rule 143(g) • Submitted after trial is calendared or Judge assigned and typically no later than 30 days before trial; intended to facilitate settlement • Expert must be qualified to give opinion • New Rule 143(g)(1) adds to required content of expert report, to include – • • • • • • all opinions and basis or reasons supporting facts and data considered any exhibits to summarize or support opinions qualifications, including all publications in last 10 years cases in which expert has testified in last 4 years compensation for the study or testimony • Rebuttal reports may be required • Discovery of drafts and communications to prepare report (except as to compensation arrangements, facts and assumptions relied on) generally not permitted – TC Rule 70(c)(3) and (4) October 18, 2013 Dentons US LLP 16 Making the Trial Record Expert Witnesses • Court may allow limited instances of expert testimony without a report upon timely request – TC Rule 143(g) (3) and (4) • e.g., as to industry practice, mere rebuttal or under exceptional circumstances by deposition transcript (see TC Rule 74(d)) • Expert Testimony at Trial • Report constitutes expert’s direct testimony (TC Rule 143(g)(2)), although limited direct may be permitted at trial at the Court’s discretion • Be prepared to present and defend any rebuttal testimony • If permitted, consider use of summary demonstratives at trial in support of expert testimony • Court will determine weight to be afforded expert opinion and may disregard all or part of an expert’s testimony • Attention to objectivity/potential bias or conflicts, argumentative tone, reliability of methodology, compliance with any special statutory or regulatory requirements or applicable industry standards, exceeding scope of expertise, disclosure of all sources and data relied upon, reliance on other’s opinions • Court-appointed experts; concurrent testimony option October 18, 2013 Dentons US LLP 17 Settlement: Still an Option Settlement • Keep in mind that settlement discussions are encouraged and can take place at any stage of a Tax Court proceeding, including from “the courthouse steps” to post-trial to post-decision • Consider scheduling a settlement conference in the 45 days before trial, even if settlement seems unlikely; do not expect the Judge to postpone a trial at the last minute • The Judge may urge the parties to discuss settlement before, during or after trial • Mid-trial settlements are possible and post-trial settlements are not uncommon; consider whether hazards on appeal or the potential for resolution of other audit cycles may influence the parties to find an agreed resolution October 18, 2013 Dentons US LLP 18 A Note about Courtroom Conduct Courtroom Decorum • It goes without saying that it is a privilege to practice in the Tax Court and that all parties in attendance should conduct themselves at all times in a respectful fashion vis à vis the Court and its staff, opposing counsel and parties, and all others present. • Practitioners before the Court must conduct themselves in accordance with the letter and spirit of the ABA Model Rules of Professional Conduct – TC Rule 201. The Court has disciplinary authority over the conduct of members of the Court’s Bar – TC Rule 202, IRC sec. 7456(c). • In addition to the usual ethical restrictions, the Judges may have their own protocols for courtroom decorum, including, generally, orderly conduct, use of the podium, rising when instructed, addressing the Court rather than opposing counsel, not interrupting, etc. See, e.g., Rules Governing Conduct During Proceedings of the U.S. Tax Court (April 15, 1986) (including prohibiting photographs, recording or broadcasting and possession of weapons). October 18, 2013 Dentons US LLP 19 Thank you Dentons US LLP 2000 McKinney Avenue Suite 1900 Dallas, TX 75201 USA Dentons counsel drafted this paper for a specific event which occurred in the past. As such, it reflects the state of the law at the time it was drafted, and is not necessarily a reflection of current developments. For an update on this topic, please contact the editors of USTaxDisputes.com. IRS Circular 230: We inform you that any US federal tax analysis contained an any blog post, email, attachment, or other writing (including any attachments), unless specifically stated otherwise, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending any transaction or matter addressed herein to another party. © 2013 Dentons Dentons is an international legal practice providing client services worldwide through its member firms and affiliates. This publication is not designed to provide legal or other advice and you should not take, or refrain from taking, action based on its content. Please see dentons.com for Legal Notices.