Workshop Session 4 - Understanding Stock Admin Related to Payroll

advertisement

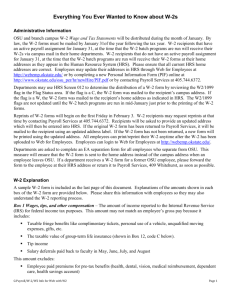

California Payroll Conference Understanding Stock Administration Related to PAYROLL Suzie Bentley, CPP, NVIDIA Corp. Christine Zwerling, CEP, Stock & Options Solutions September 11 and 12, 2014 Agenda Overview – Common equity awards and their life cycles Employee Stock Purchase Plans (ESPP) Stock Options Stock Appreciation Rights Restricted Stock Tips on streamlining processes Working together! Appendix of other interesting info… A day in the life of payroll… External Service Provider Stock Admin IRS, State and Local Agencies Human Resources Global / Sub / Other Payrolls Tax Dept Payroll Employees A day in the life of stock admin… External Service Provider Payroll – U.S. & Global Finance – A/P and Reporting Human Resources IRS, State and Local Agencies Legal / Compliance Securities Exchange Commission Tax Dept Stock Admin Employees ESPP – What is it? Purchase of Company Stock at a discount Each pay period, participants contribute a percentage of their pay (calculated before tax, deducted after tax) At the end of the purchase period, contributions are used to purchase company stock at a discount Definitions: Grant Date / Offering Period Start Date / Purchase Period Start / Enrollment Date Exercise Price, Strike Price, Grant Price, Purchase Price, FMV Exercise / Purchase Dispositions Qualified / Disqualified Section 423 ESPP / Non-423 Example: First Day (enrollment date) January 1; FMV $10/share Last Day (purchase date) June 30; FMV $12/share Purchase Price $8.50 ESPP – Enrollment / Contributions Plan documents govern the program and define: What pay is eligible Which participants are eligible to participate How calculated Gross pay Deducted from net pay Contribution limits Excess contribution distribution - refunded or rolled forward Deadlines for enrollment, changes, withdrawals, refunds ESPP – Changes Employment changes Termination – refund Ineligibility – refund Withdrawal – refund Contribution rate changes Process for managing changes All ESPP changes to be made through stock administrator Track # of changes (i.e., one decrease during period, etc.) Effective date for changes Contribution limits Flat dollar contribution limit? $25k limit ESPP - Purchase Contribution file to Stock Admin (Timing is critical!) Per pay period or Once at end of purchase period Process for updating contributions before purchase - Adjustments Multiple payroll groups sending contributions – global program Currency conversion No reporting or tax in U.S. at purchase! Yeah! Carry forwards Refunded Remain in the plan until the next purchase Who tracks this? What if a participant terminates participation in the plan? Example $1,000 contributions and $8.50 purchase price 117 shares purchased and $5.50 remaining contributions (carry forward) ESPP –Dispositions (Sales/Gifts) Reporting for 423 plans (qualified and disqualified) How often - monthly, quarterly, annually? Compensation income recognized on sale of shares in U.S. Statutory holding period not met recognize income equal to the spread in the stock when the shares were purchased Statutory holding period met - recognize lesser of 1) the discount offered under the plan as computed on the participant's offering date, or 2) the actual gain on the sale (Sale Price minus Purchase Price) Terminated employee sales ESPP sale income exempt from FICA/FUTA under the American Jobs Creation Act of 2004 ESPP – W-2 Reporting Form W-2 reporting: Box 1 (Wages, tips, and other compensation) Box 16 (State wages, tips, etc.), if applicable Box 18 (Local wages, tips, etc.), if applicable Just for fun! Regulation §1.6041-2(a)(1) requires Form W-2 even if those payments are not subject to withholding: Disqualified Disbursements (also receive Corporate Tax Credit) Qualified Disbursements IRS Publication 15-B: Employer’s Tax Guide to Fringe Benefits 2014 W-2 Options/SARs – What are they? Stock Option Contractual right to purchase shares of the company's stock A specified number A specified price (the exercise price) and A specified period of time(generally between five and 10 years) Value only if stock appreciates Non Qualified (NQ) or Qualified (ISO – Incentive Stock Option) Stock Appreciation Right (SAR) Only pays out the appreciation in the stock price Options/SARs – What are they? Definitions Grant / Award Grant Date, Date Of Grant, Award Date Exercise Price, Strike Price, Option Price, Grant Price, Purchase Price, FMV Vest Exercise / Purchase Cash Cashless / Same-Day Sale Disposition / Sale Qualified or Disqualified Section 421 ISO Options/SARs – Vesting Payroll usually doesn’t have to do anything! UNLESS… Exercise of unvested Granted at a discount Look out for 409A! Options/SARs – Exercise NQ (non qualified) or SAR Recognize compensation when purchase shares Market Value minus Exercise price Form W-2 reporting: Box 1 (Wages, tips, and other compensation) Box 3 (Social Security wages), if applicable Box 5 (Medicare wages and tips). Box 12, with code V Box 16 (State wages, tips, etc.) Box 18 (Local wages, tips, etc.) NOTE: Taxes withheld should be aggregated with employees’ other withholdings for the year and reported in Boxes 2, 4, 6, 17, and 19, as appropriate 2014 W-2 tax reporting Stock Options – Exercise (ISOs) Nothing! UNLESS… Pennsylvania Then income and state income taxes due upon exercise Stock Options – Disposition (ISOs) Subject to tax for regular tax purposes at sale (disposition) Meet holding periods (qualified) No reporting or withholding obligations at sale Do not meet the required statutory holding periods (disqualified) The compensation income recognized is equal to the lesser of: 1) the spread at exercise (difference between the market value of the stock at that time and the exercise price, or 2) the actual gain realized on the sale (the difference between the sale price and the exercise price) Timely Tax Deposits IRS requires tax receivables in excess of $100,000 per day to be deposited within one business day. All receipts combined from all sources Stock admin primary sources are stock option exercises and restricted stock vestings Deposit date of T+1 for non broker stock option exercises Deposit date of T+4 for stock option transactions via broker Deposit date of V+1 for RSUs and RSAs Calendar “known” transactions Stock administration knows when RSU vest Immediate notification for stock option exercises Failsafe process to confirm/deny daily or periodic activity Restricted Stock – What is it? Restricted Stock (RSA) / Restricted stock units (RSUs) Outright grant of company stock to employees or other service providers Known as “Free Shares” No cost to grantee “Restricted" Subject to a vesting schedule Time Based or Performance goals May be governed by other limits on transfers or sales imposed by the company Restricted Stock - Grant Payroll usually doesn’t have to do anything! UNLESS… IRC Section 83(b) election filed, then taxed immediately. Only available for RSA Restricted Stock Unit- Vesting Compensation income reported at vest market value FIT / FICA / FUTA taxable at vest unless the RSU is subject to deferral Not reported in Box 12 May voluntarily report income in Box 14 (Other) Restricted Stock - Timely Tax Deposits IRS requires tax receivables in excess of $100,000 per day to be deposited within one business day. All receipts combined from all sources Stock admin primary sources are stock option exercises and restricted stock vestings Deposit date of T+1 for non broker stock option exercises Deposit date of T+4 for stock option transactions via broker Deposit date of V+1 for RSUs and RSAs Calendar “known” transactions Stock administration knows when RSU vest Immediate notification for stock option exercises Failsafe process to confirm/deny daily or periodic activity Yeah, we’re done! Here you go… But what happens if… Streamlining Processes Same-day or close proximity transactions Example 1 This transaction will bring Social Security to annual maximum ($6,510 previously withheld + $539.40 = $7,049.40) Settlement to occur T+3 (2/25/13) Payroll Deposit to occur T+4 (2/26/13) Streamlining Processes Same-day or close proximity transactions Example 2 Social Security maxed out in Transaction 1 Settlement to occur T+3 (2/25/13) Payroll Deposit to occur T+4 (2/26/13) Streamlining Processes Same-day or close proximity transactions Example 3 + YTD income surpasses $200,000 (Medicare threshold) and $1,000,000 (Supplemental Income threshold); part of transaction to be taxed at 2.35% Medicare rate and 39.6% Federal rate. Medicare: ($66,699.50 taxed at 1.45% and $883,300.50 taxed at 2.35%) Federal: ($866,699.50 taxed at 25% and $83,300.50 taxed at 39.6%) Streamlining Processes Payroll data entry needs to match stock system and employee confirmations Example Data Entry Sequence #1 Entered First #2 Entered Next #3 Entered Last Working Together • Both need to understand: • Who to tax • employees vs. non-employees, jurisdictional requirements • What tax rates to apply • Income reporting and tax withholding triggers • Timing of reporting transactions • Solutions: • Create a matrix of taxability of various transactions • Multiple states/jurisdictions • Employees (and former) only Appendix Sample Taxability Matrix: U.S. RSU and NQSO Sample Matrix: U.S. ESPP Taxable Values Prepare matrices to explain taxability and timing to Payroll RSU Global Tax* Shares Withheld Taxable Compensation Taxable Compensation Company will withhold shares from vested portion of grant to cover tax liability Company will report taxable compensation but will not withhold any taxes Company will report taxable compensation and may withhold taxes through payroll * Handling of Global tax is subject to change based on local regulations and requirements. Any tax rates applied to RSU vested shares are provided by Regional Finance groups based upon estimated values of compensation. Please direct your tax rate related questions to your Regional Finance group who processes your Payroll. ** French RSU Sub-plan (“Q”) requires two year vesting period and no tax withholding. FY13 grants not under the sub-plan (“NQ”) will be taxable at vest. [Non-Qualified grants issued in FY14 will be reviewed for taxation in FY15. Terminated Employees Transactions by former employees are generally subject to the same withholding and reporting requirements that apply to current employees. Under Regulation §31.3401(a)-1(a)(5) any payment for services constitutes wages regardless of whether or not the employment relationship exists at the time the payment is made: “Remuneration for services, unless such remuneration is specifically excepted by the statute, constitutes wages even though at the time paid the relationship of employer and employee no longer exists between the person in whose employ the services were performed and the individual who performed them. Thus, excluding the exceptions described below, compensation income recognized by a former employee should be reported on a Form W-2 and should be subject to withholding. W-2s need to be prepared for terminated employees and may need to be reactivated in payroll system Address changes See if changes can be forced through company (e.g. broker doesn’t unilaterally change in their own system) Explore messaging ability on vendor sites to remind former employees to change their address Ideally advance communication about transactions for terminated employees Develop batch process for communicating post termination activity to Payroll Don’t wait until the very end of the year = during crunch time Thank you for your attention Suzie Bentley, CPP Christine Zwerling, CEP Director, Stock Admin & 401(k) Senior Equity Compensation Consultant NVIDIA Corp. sbentley@nvidia.com Stock & Option Solutions, Inc. czwerling@sos-team.com 408.566.6591 Tel 510.735.4487 Tel The information presented herein is of a general nature and has been simplified for presentation to a large audience. It is not a complete discussion of all aspects of the laws, rules, regulations, standards, and principles that govern equity compensation plans. The contents are neither designed nor intended to be relied upon, and should not be considered, as legal, tax, or accounting advice.Your specific situation may involve circumstances that cause the laws, rules, regulations, standards and principles described herein to apply differently. Consult your own advisors before deciding what, if any, course of action to take in your own particular situation.