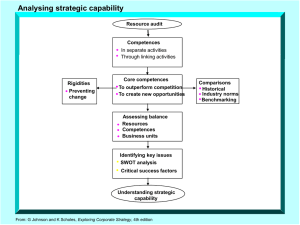

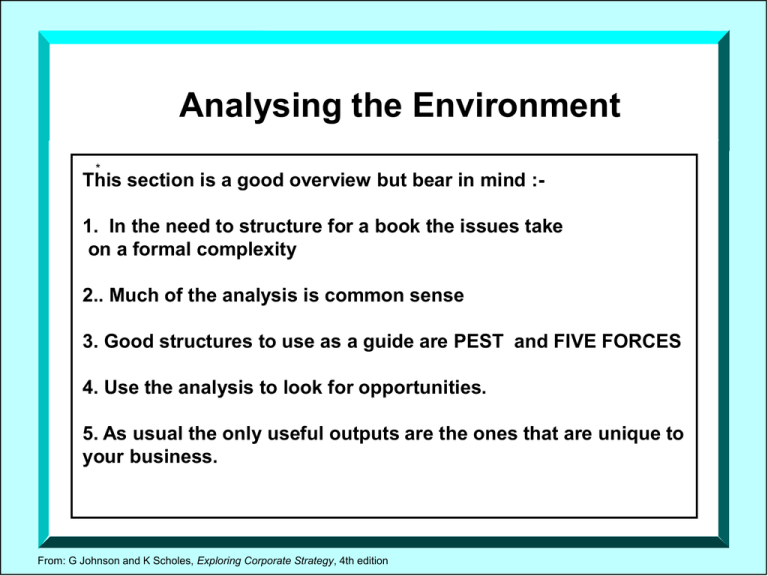

Analysing the Environment

*

This section is a good overview but bear in mind :1. In the need to structure for a book the issues take

on a formal complexity

2.. Much of the analysis is common sense

3. Good structures to use as a guide are PEST and FIVE FORCES

4. Use the analysis to look for opportunities.

5. As usual the only useful outputs are the ones that are unique to

your business.

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Steps in environmental analysis

Assess the nature of the

environment

Audit environmental

influences

Identify key

competitive forces

Identify

competitive position

Identify key

opportunities

and threats

Strategic

position

From: G Johnson and K Scholes, Exploring Corporate

Corporate Strategy,

Strategy, 4th

4th edition

edition

Figure 3.2 Approaches to making sense of the environment

Simple

ENVIRONMENTAL

CONDITIONS

Complex

Static

•Historical analysis

•Forecasting

ENVIRONMENTAL

CONDITIONS

Decentralisation

of organisations

Experience

and learning

Scenario

planning

Dynamic

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

A PEST analysis of environmental influences

1. What environmental factors are affecting the opposition?

2. Which of these are the most important at the present time?

In the next few years?

Political/legal

Monopolies legislation

Environmental protection laws

Taxation policy

Foreign trade regulations

Employment law

Government stability

Economic factors

Business cycles

GNP trends

Interest rates

Money supply

Inflation

Unemployment

Disposable income

Energy availability and cost

Sociocultural factors

Population demographics

Income distribution

Social mobility

Lifestyle changes

Attitudes to work and leisure

Consumerism

Levels of education

Technological

Government spending on

research

Government and industry focus

of technical effort

New discoveries/ development

Speed of technology transfer

Rates of obsolescence

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Industry Globalisation Drivers

Illustration 3.2

Industry Globalisation Drivers

LOW

Market Convergence

X

Cost Advantages

X

Government

Influence

X

Global Competition

X

OTC Pharmaceuticals

Ethical Pharmaceuticals

Automobiles

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

HIGH

X

X

X

X

X

X

X

X

Figure 3.4 Drivers of globalisation

Global market

convergence

Similar customer

needs

Global customers

Transferable

marketing

Scale economies

•Trade policies

Government

influence

•Technical standards

Global

strategies

•Host government

policies

Sourcing efficiencies

Country-specific costs

High product

development costs

Interdependence

Competitors global

High exports/

imports

Global competition

Source: Based on G. Yip, Total Global Strategy, Prentice Hall, 1995, chapter 2.

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Cost

advantages

The determinants of national advantage (Porter’s diamond)

Firm strategy,

structure and

rivalry

Demand

conditions

Factor

conditions

Related and

supporting

industries

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Five forces analysis

Potential

entrants

Threat of

entrants

Suppliers

COMPETITIVE

RIVALRY

Buyers

Bargaining

power

Bargaining

power

Threat of

substitutes

Substitutes

Source: Adapted from M. E. Porter, Competitive Strategy, Free Press, 1980, p. 4. Copyright by The

Free Press, a division of Macmillan Publishing Co., Inc. Reproduced with permission.

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Figure 3.7 The life cycle model

Development

Users/

buyers

Growth

Maturity

Few:

Growing adopters: Growing selectivity Saturation of

trial of

of purchase

trial of

users

early

product/service

Repeat purchase

adopters

reliance

Entry of

competitors

Competitive

conditions

Shakeout

Few

competitors

May be many

Attempt to

achieve trial

Fight to maintain

share

Decline

Drop-off

in usage

Exit of some

competitors

Likely price cutting

Difficulties in

Selective

for volume

gaining/taking

distribution

share

Fight for share

Shake-out of

Undifferentiated

Emphasis on

weakest

products/services competitors

efficiency/low cost

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Figure 3.8 Some characteristics for identifying strategic groups

It is useful to consider the extent to which organisations differ in terms of

characteristics such as:

Extent of product (or service) diversity

Extent of geographic coverage

Number of market segments served

Distribution channels used

Extent (number) of branding

Marketing effort (e.g. advertising spread, size of salesforce)

Extent of vertical integration

Product or service quality

Technological leadership (a leader or follower)

R&D capability (extent of innovation in product or process)

Cost position (e.g. extent of investment in cost reduction)

Utilisation of capacity

Pricing policy

Level of gearing

Ownership structure (separate company or relationship with parent)

Relationship to influence groups (e.g. government, the City)

Size of organisation

Source: Adapted from M.E. Porter, Competitive Strategy, Free Press, 1980; and J.McGee and H.Thomas,

‘Strategic groups: theory, research and taxonomy’, Strategic Management Journal, vol. 7, no. 2 (1986), pp.141-60.

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Figure 3.9 Some criteria for market segmentation

Type of factor

Consumer markets

Industrial/organisational

markets

Characteristics of

Age, sex, race

people/organisations Income

Family size

Life cycle stage

Location

Lifestyle

Industry

Location

Size

Technology

Profitability

Management

Purchase/use

situation

Size of purchase

Brand loyalty

Purpose of use

Purchasing

behaviour

Importance of

purchase

Choice criteria

Application

Importance of purchase

Volume

Frequency of purchase

Purchasing procedure

Choice criteria

Distribution channel

Users’ needs and

preferences for

product

characteristics

Product similarity

Price preference

Brand preferences

Desired features

Quality

Performance requirements

Assistance from suppliers

Brand preferences

Desired features

Quality

Service requirements

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Figure 3.10 Perceived value by customers: the luxury car market

Rating

Competitor B's car

Competitor A's car

Car X

5

4.5

4

3.5

3

2.5

2

1.5

1

0.5

0

Styling

Performance

Marque

strengths

Most important

Source: D. Faulkner and C. Bowman, The Essence of Competitive Strategy, Prentice Hall, 1995.

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Engineering

innovations

Build quality

Least important

Indicators of SBU strength and market attractiveness

Indicators of SBU strength

compared with competition

Indicators of market

attractiveness

Market share

Salesforce

Marketing

R&D

Manufacturing

Distribution

Financial resources

Managerial resources

Competitive position in terms

of, e.g. image, breadth of

product line, quality/reliability,

customer service

Market size

Market growth rate

Cyclicality

Competitive structure

Barriers to entry

Industry profitability

Technology

Inflation

Regulation

Workforce availability

Social issues

Environmental issues

Political issues

Legal issues

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition bbbbyh

Scenario Planning is Useful:

To take a long view of influences on strategic

choice;

Where the factors influencing the success of

strategies are:

Limited in number

Have a high impact

Uncertain

Help build plausible different futures

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Five Forces Analysis (1)

The threat of entry ...

Dependent on barriers to entry such as:

Economies of scale

Capital requirements of entry

Access to distribution channels

Cost advantages independent of size (eg the

“experience curve”)

Expected retaliation

Legislation or government action

Differentiation

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Five Forces Analysis (2)

Buyer power is likely to be high when:

There is a concentration of buyers

There are many small operators in the supplying

industry

There are alternative sources of supply

Components or materials are a high percentage

of cost to the buyer leading to “shopping around”

Switching costs are low

There is a threat of backward integration

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Five Forces Analysis (3)

Supplier power is high when:

There is a concentration of suppliers

Switching costs are high

The supplier brand is powerful

Integration forward by the supplier is possible

Customers are fragmented and bargaining power

low

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Five Forces Analysis (4)

Threat of substitutes

Substitutes take different forms:

Product substitution

Substitution of need

Generic substitution

Doing without

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Five Forces Analysis (5)

Competitive Rivalry is high when:

Entry is likely

Substitutes threaten

Buyers or suppliers exercise control

Competitors are in balance

There is slow market growth

Global customers increase competition

There are high fixed costs in an industry

Markets are undifferentiated

There are high exit barriers

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Five Forces Analysis: Key Questions and

Implications

What are the key forces at work in the

competitive environment?

Are there underlying forces driving competitive

forces?

Will competitive forces change?

What are the strengths and weaknesses of

competitors in relation to the competitive forces?

Can competitive strategy influence competitive

forces (eg by building barriers to entry or

reducing competitive rivalry)?

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition

Strategic Group Analysis

Strategic Group Analysis is useful to:

Identify firms with similar strategic characteristics

Therefore identify the most direct competitors

Identify mobility barriers

Identify strategic opportunities (“strategic

spaces”)

Strategic threats and problems

From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition