APPROACHES TO STUDY MARKETING

advertisement

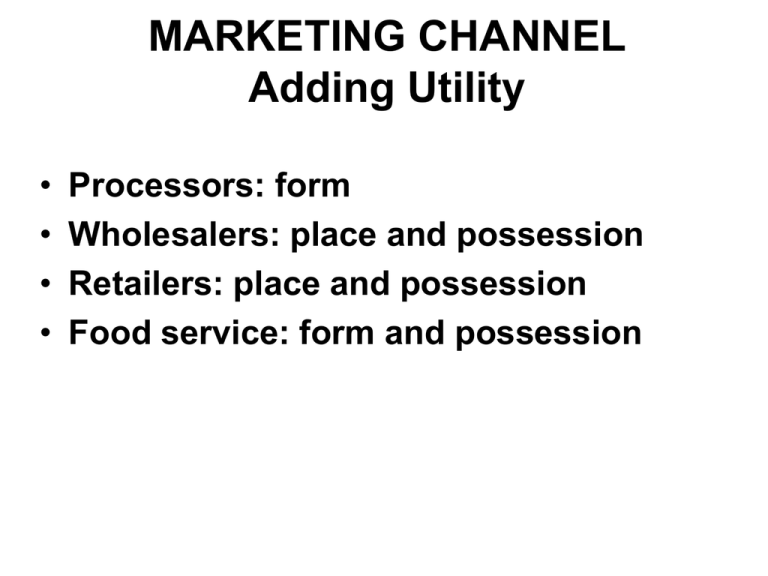

MARKETING CHANNEL Adding Utility • • • • Processors: form Wholesalers: place and possession Retailers: place and possession Food service: form and possession Top 5 Food Companies by Stage of Marketing, 2005 Second 5 Food Companies by Stage of Marketing, 2005 FOOD PROCESSING • Food and beverage manufacturing plants transform raw agricultural materials into intermediate foodstuffs or edible products • Use labor, machinery, energy, and scientific knowledge. • In 2005, these plants accounted for 13% of the value of shipments from all U.S. manufacturing plants. FOOD PROCESSING • Size and location of processing plants: – Geographic concentration of raw products – Economies of scale – Cost of transportation of raw materials vs. final products – Cost of labor FOOD PROCESSING • Challenges: – “Right” plant size • Operational efficiencies vs. transportation costs FOOD PROCESSING Vertical integration to address how to operate at full capacity with highly fluctuating supplies FOOD PROCESSING • Most processors are highly diversified: – Multiplant – Multiproduct – Multimarket – Multinational FOOD PROCESSING FOOD WHOLESALING • Food wholesaling consists of that part of food marketing in which goods are assembled, stored, and transported to customers, including retailers, foodservice operators, other wholesalers, government, and other types of businesses: • Sales in 2002, the latest year available. – Retailers (food-at-home sector) - $282 billion – Foodservice (food-away-from-home) sector - $118 billion – Sales to other wholesalers—small specialty wholesalers who purchase goods from larger wholesalers—were a significant share (26 percent) of total sales. Three Types of Wholesalers by Function • Manufacturers' sales branches and offices (MSBO) – Wholesale operations maintained by grocery manufacturers to market their own products. • Merchant wholesalers – Also referred to as third-party wholesalers – Buy from manufacturers and resell to retailers, institutions, and other businesses. – Account for 61% of grocery wholesale sales. • Brokers and agents – Buy or sell for a commission as representatives of others – Typically do not own or physically handle the products. Merchant grocery wholesalers by the types of products distributed: • General-line distributors – Also referred to as broadline or full-line distributors – Handle a broad line of groceries, health and beauty aids, and household products – Examples: C&S Grocers, Supervalu, Nash Finch, and Sysco. • Specialty distributors – Primarily handle items such as frozen foods, dairy products, meat and meat products, or fresh fruits and vegetables. – Specialty wholesalers account for nearly half of grocery wholesale sales. • Miscellaneous distributors – Primarily distribution of a narrow range of dry groceries such as canned foods, coffee, bread, or soft drinks. Three types of foodservice distributors • Broadline foodservice distributors – Purchase and stock a wide range of food products from manufacturers – Offer value-added services designed to meet the needs of singlestore restaurants and small chains. – For instance, foodservice operators without the staff to research new products and plan menus may rely on a distributor's sales representative for assistance (for example, Sysco and U.S. Foodservice). • Specialty distributors – Operate in niche markets where it is necessary to have specialized knowledge about the type of product being handled or type of operator being served. – For example, specialty cut meats, produce, ice cream, and coffee. • System distributors – Serve mostly of chain restaurants with centralized purchasing and menu development. Types of Food Retailers for Food at Home Supermarkets still the largest Non-traditional continuing to grow Food Retailing Strategies • Differentiation of store or company – Natural, organic – Upscale products and service – Life styles: Health, layout, experience • Cost lowering – Data synchronization with trading partners • 29% of retailers and wholesalers using it in 2004 • 29% planning to participate in 2005 • 33% were considering it Food Service • Large and growing – Nearly equal to food at home on a dollar basis – Buying more than nutrition in the price Percent of US Food Expenditures on Food at Home and Away 60 55 50 45 At Home Away 2005 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 40 Food Service Types • Full-service establishments, 40% – Have waitstaff, and other amenities such as ceramic dishware, nondisposable utensils, and alcohol service. • Fast food restaurants, 38% – Use convenience as a selling point; they have no waitstaff, limited menus and relatively sparse dining amenities. • Noncommercial foodservice operators, 15% – Institutional and educational settings, such as schools, nursing homes, child care centers, and hospitals. • Other 7% – Vending, sporting arenas, bars Trends in Food Marketing • Trends: – Mergers and acquisitions – Concentration Peaked in late 1990s and has slowed in 2000s Trends in Food Marketing • Trends: – Mergers and acquisitions – Concentration – New product introduction Over 90% considered “non-innovative” Over 90% failure rate Upscale = premium, gourmet, CAB, etc Credence attributes????? Trends in Food Marketing • Trends: – Mergers and acquisitions – Concentration – New product introduction – Globalization Globalization of Food Business About the same dollar amount of US in other countries and foreign firm located in the US US firms mainly manufacturing Foreign own manufacturing and retail FOOD PROCESSING Globalization Global Food Retailing • Largest 5 worldwide food retailers in 2004 (Source: Supermarket News): 1. Wal-Mart (U.S.) • 2. Carrefour (France) • 3. Austria, Belgium, Bulgaria, China, Croatia, Czech Republic, Denmark, France, Germany, Greece, Hungary, India, Italy, Japan, Luxembourg, Moldova, Morocco, Netherlands, Poland, Portugal, Romania, Russia, Serbia and Montenegro, Slovakia, Spain, Switzerland, Turkey, Ukraine, U.K., Vietnam Ahold (Netherlands) • 5. Argentina, Bahrain, Belgium, Brazil, China, Colombia, Czech Republic, Dominican Republic, Egypt, France, French Polynesia, Greece, Guadeloupe, Indonesia, Italy, Japan, Malaysia, Martinique, Mexico, New Caledonia, Oman, Poland, Portugal, Qatar, Reunion, Romania, Saudi Arabia, Singapore, Slovakia, Spain, South Korea, Switzerland, Taiwan, Thailand, Tunisia, Turkey, United Arab Emirates Metro Group (Germany) • 4. Argentina, Brazil, Canada, China, Germany, Hong Kong, Japan, Mexico, Puerto Rico, Singapore, South Korea, U.K., U.S. Costa Rica, Czech Republic, El Salvador, Estonia, Guatemala, Honduras, Latvia, Lithuania, Netherlands, Nicaragua, Norway, Poland, Slovakia, Sweden, U.S. Tesco (United Kingdom) • China, Czech Republic, France, Hungary, Ireland, Japan, South Korea, Malaysia, Poland, Slovakia, Taiwan, Thailand, Turkey, U.K. Trends in Food Marketing • Trends: – Mergers and acquisitions – Concentration – New product introduction – Globalization – Wholesale club-stores – Store size FOOD RETAILING • Trends: – Increased market share of supercenters and wholesale clubs vs. traditional foodstores Food sales by foodstores and wholesale clubs 1995 ($ billion) 2000 ($ billion) Growth rate (%) FOODSTORES 402.5 483.7 20.2 WHOLESALE CLUBS 39.9 63.2 58.3 Costco 17.9 31.9 78.5 Sam’s Club 19.8 26.4 33.3 FOOD RETAILING Number and sales of retail foodstores Year Number of Foodstores (1,000) Annual Average Sales per Foodstore ($1,000) Number of Food Items Carried 1920 375 30.7 700 1940 446 20.2 1,800 1960 260 198.8 5,900 1980 167 1,321.4 13,000 1992 180 2,043.2 16,000 1997 177 2,429.9 18,000 Trends in Food Marketing • Trends: – Mergers and acquisitions – Concentration – New product introduction – Globalization – Wholesale club-stores – Store size – Information technology Information technology • Trading partners work closely together to eliminate excess costs from the supply chain and efficiently serve consumers • Example – On-time replenishment of products based on consumer demand that allows manufacturers to more directly respond to consumer purchase behavior » Efficient Consumer Response (ECR) » Efficient Foodservice Response (EFR) Trends in Food Marketing • Trends: – Mergers and acquisitions – Concentration – New product introduction – Globalization – Wholesale club-stores – Store size – Information technology – Corporate social responsibility The Five Stages of Corporate Responsibility 1. Defensive stage. When faced with unexpected criticism from media and social activists, typical deny the allegations or a relationship between the company’s practices and negative outcomes. 2. Compliance stage. Corporate policy is formed and observed, and is usually made visible to critics. Compliance is viewed as a cost of protecting the company’s reputation and avoiding litigation. 3. Managerial stage. Companies realize that the problem cannot be deterred by simple compliance or public relations strategies. Source: Harvard Business Review excerpt, Zadek (2005) The Five Stages of Corporate Responsibility 4. Strategic stage. Companies learn how establishing strategies to address responsible business practices can give them a competitive advantage. One example is food companies that seek greater awareness of how their products affect consumer health. 5. Civil stage. Leading companies promote industry guidelines and actions to address societal concerns. For example, companies may engage in educational initiatives to promote healthy lifestyle choices, or refrain from sales promotion strategies that could adversely affect social welfare. In a 2005 press release, Kraft Foods announced an initiative to advertise more nutritionally healthy products in media primarily viewed by children ages 6-11. Source: Harvard Business Review excerpt, Zadek (2005) Trends in Food Marketing • Trends: – – – – – – – – – Mergers and acquisitions Concentration Integration New product introduction Globalization Wholesale club-stores Store size Information technology Corporate social responsibility