1 - Campus360@IIFT

advertisement

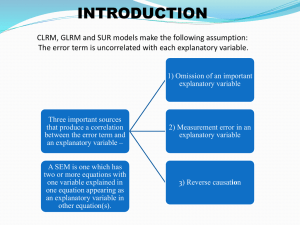

Global Business Environment: Going Global to Stay Local? Lecture 1 The Course • Why the need for firms to go global? • Global Business Environment, trends in key indicators • The Current Scenario in Trade and Investment – theories and experience • Evolution of International Institutions and their role in ensuring Global Business Environment • Lessons from the Growth Experience across countries / sectors – what defies or defines success? Which countries to do business in? 1. The Political Economy – what’s a perfect recipe for success? 2. Soft factors – role of Culture etc. 3. Operational issues: Trade Finance, Global Sourcing 4. Control factor in international business The References • ‘International Business’ by Daniels, Radebaugh, Sullivan and Salwan, Pearson • ‘International Business’ by Hill and Jain, Tata Mcgraw-Hill • ‘International Business’ by Czinkota, Ronkainen and Moffett, Wiley • World bank, IMF, UNCTAD and WTO Webresources • Recent happenings on international business issues Evaluation Pattern and Schedule Component Weight Class Participation 10 Quiz (Best Two out of three) 20 Group Project Report Presentation 30 End Term Examination 40 Session No Quizzes and Project Report 4 Quiz No 1 7 Quiz No. 2 10 Quiz No. 3 End Term Examination Submission of Group Project Report What is International Business? • All commercial transactions between two or more countries (merchandise sales, service contracts, investments, business, transportation) – Private (for profits) – Public (for political / strategic reasons) • International business adds significant influences to typical domestic operations – Physical – Societal – Competitive • International business and globalization • Globalization: The broadening set of interdependent relationships among people from different parts of a world that happens to be divided into nations IPL, ATP Tours and Football Leagues: Sports or Business? Difference between Domestic and International Business • In additional to domestic business management skills, international business management requires – – – – Social science understanding Political science appreciation Legal awareness (taxation, forex transaction) And an innate ability in: • • • • • • Anthropology (aspirations and demands) Sociology Psychology (motivations) Economics (GDP, inflation, unemployment) Political Economy (sanctions and terrorism) Geography (supply and demand factors) • • How is International business affected by: GDP Growth? Oil Price Movement? • • • • • • • • • What defines Globalization? Growing Income? Growing Trade in Goods and Services? Deepened Production Networks? Lowering Trade Barriers and Procedural Hassles? Growing Global Governance? Increasing Cross-Regional Association? Deepened Investment Inter-linkage? More Acquisitions and Mergers? Increasing International Cooperation in Infrastructure Projects? • Movement of Technicians / Managers from another country? • Movement of workers from another country? • No to the policy of ‘Self-Reliance’? Motivation for consumers: More variety, better quality, lower prices The ‘International’ Burger Sesame seeds from Mexico Pickles and Sauce from Germany Onions from US Lettuce from Ukraine Cheese from Poland Bun from Russia Beef Patties from Hungary Source: Czinkota et al The fragmentation of production: The example of the Boeing 787 Dreamliner Source: WTO (2011) Complementary parts supply system of an automobile assembler in ASEAN Source: Hiratsuka (2010) The Other Side of the Coin? • Increasing instability owing to International Events? (e.g. US decision to reduce outsourcing of services from India; Chinese decision to stop export of rare earth materials to Japan) • Growth of a region linked more with the Growth scenario in other countries? (e.g. the 2009 recession in US and the impact on Chinese exports) • Less Control of the Government to influence Domestic Policy Challenges? (e.g. the Greece crisis and failure to tackle the problem through Monetary and Fiscal Policies) • Increasing Privatization? • Worsening of Income Inequality and Employment Scenario? (e.g. experience of Sub-Saharan African countries) • Greater influence by MNCs and external players on local population and production? e.g. environmental concerns – Brazil and Amazonian forests; mining sector in Indonesia Serious challenge to local players?? Global Canvas: GDP Growth 20 China European Union India Japan United States 15 10 5 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 0 -5 World Bank Data -10 • China has established itself as a growing location: More FDI inflow • What are the prospects of India? • Does GDP growth influence ability to engage in international business? Growth in Global Export (Merchandise) 50 India 40 World 30 20 10 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 0 -10 -20 -30 How has India’s merchandise export suffered, due to imbalances in Global Market? Growth in Global Export (Service) 70 India 60 World 50 40 30 20 10 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1991 1992 -10 1990 0 -20 How has India’s service export suffered, due to imbalances in Global Market? Who are the prominent exporters? Global Merchandise Export Market Share (%) 45.00 40.00 US EU (27) 35.00 China India 30.00 Japan 25.00 20.00 15.00 10.00 5.00 Is business / trade mainly created by Price difference?? 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 0.00 Who are the prominent exporters? Global Service Export Market Share (%) 60 China EU Japan India US 50 40 30 20 10 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 0 Is GDP growth affected by external factors, e.g., oil supply? Recession and Global FDI (US $ Bn.) WIR (2012) Global Recession and Commodity Prices Biggest decreases: 1. Metals 2. Agriculture raw materials (cotton and rubber) 3. Edible oils 4. Coconut and palmkernel oil 5. Cocoa • Major Commodity Price boom in 2008 for several , products. • Move to Biofuel, Export bans, Prohibitive taxes etc., supply and demand mismatch • Price crash in 2009 • How Economic Boom and Recession affects international business? • Domestic Policy Tightening • Energy and Metal price recovery from March 2009, but longer time taken for agriculture. • Commodity prices peaked in early 2011 and then declined on concerns about the global macroeconomic and financial outlook and slowing demand in emerging markets, notably China. Going Local? Going Extinct .. • Local Soft Drinks in many countries are either driven out by aggressive pricing by MNC giants, Coke and Pepsi, or, bought / marginalized by them, e.g. Campa Cola in India • Synthetic Fibre – increasing Export from China over the years, increasing import, hurting the interest of the local producers • Television market - Indian example – experience of Philips during 1990s, present battle between Videocon (India), Sony (Japan), Samsung (South Korea) LG (South Korea) etc. • Any other example? The Lesson So Far .. • No business is now purely ‘internal’ barring few exceptions, and hence internationalization is an important strategy for firms given foreign competition • Globalization is here to Stay • Countries with limited set of options earn limited benefits • Fiscal and Financial health of an economy plays a crucial role in determining its competitiveness, attractiveness and hence future growth path • Country Strength and Business Negotiations with Partners • Role of Economic Diversification and moving up the value chain is important The Most Competitive Economies.. • India was ranked 51st as per 2010-11 Ranking • That worsened to 56th position during 2011-12 • Does competitiveness gets affected by the ease of doing business? • DBR 2012 Stronger legal institutions and property rights protections are associated with more efficient regulatory processes (Average ranking on sets of Doing Business indicators) DBR (2012) • • • • • Reasons for Growth in International Business Rapid expansion of technology - New technology encouraged newer products and flexible specialization – designed to produce differentiated products in large patches – Fixed cost is much less important as compared to 1980s (e.g. – electronic components industry) Capturing Economies of Scale – Targeting the Global Market Bulk production in low-skilled products – China produced 45% shoes of the World Transportation is quicker while costs are lower - Reduction in physical cost of transport – containerization, packaging, Miniaturization – bulkiness reduced – creation of newer markets (e.g. perishables through air cargo) Communication enables control from afar - Reduction in communication cost – internet and mobile phones – Tirupur in India Liberal government policies on trade and resources – movement of capital and labour – reform of sea and airports and customs framework Reasons for Growth in International Business .. • • • • • • • • Emergence of services supporting international business – banking services, postal and courier services Development of institutions that support international trade, WTO-induced reform – reduction in tariff level Consumer pressures (demand for quality features, e-commerce, lookout for cheaper deals) Increased global competition - Need to Stay Competitive even in the Local Market – cost innovations, Merger and Acquisitions Growing Intra-Industry Trade – The Need to Source the Input at the Best Competitive Price and Quality Where and How to Source? Exploitation of key inter-linkages Product Cycle Hypothesis – Quick Learning for the New Entrants Reduction in Storage cost – Just-In-Time mode – so no need to book the warehouse for 3-4 weeks (precondition: credibility in providing) e.g. Integrated Production Network in Southeast Asia for automobile Technological progress has reduced the quantity of commodities used per unit of GDP Reduction in transportation cost and accessibility of modern communication technology has a positive impact on trade and growth. 20th Century Revolution Source: Hummels Operations and Influences Why Engage in International Business? • Expand sales – Volkswagen (Germany); Ericsson (Sweden); IBM (US) • Acquire resources – Better components, services, products (Tata Steel – willing to set up iron ore or steel mill projects in western Australia given the natural reserve in that territory; BPO industries in India and Philippines) – Foreign capital – Cheap labour (Rawlings producing baseball in Costa Rica) – Technologies (Tata Steel – purchase of Corus) – Information (Zodiac Shirt – purchase of European and American Brands) • Minimize risk – Take advantage of the business cycle for products / services – Diversify among international markets The More people view the Harry Potter Movie, the higher the sales and profitability. A Globalized Venture: Harry Potter Category Person - Country of Origin Author J. K. Rowling (British) Producer David Jonathan Heyman (British) Distributor Warner Brothers (US) Director Christopher Joseph Columbus (US); Alfonso Cuarón Orozco (Mexico) Screenplay Stephen Keith Kloves (US); Michael Goldenberg (US) Editing Richard Francis-Bruce (Australia) Music Patrick Doyle (Scotland) Visual Effects Rising Sun Pictures (Australia); Double Negative (UK); Cinesite (UK); Industrial Light & Magic (US) Actors From more than 20 countries Location UK, Scotland Question 1 Why simultaneous multiple release of the Movie? Question 2 Why the recent movies were released in 3D? And how the countries Gain? • Lord of the Rings Filming locations in New Zealand are now great tourist attractions • • • • • • • Modes of International Business Importing (Reliance Industries Limited importing crude oil) and exporting (Tata Motors exports Nano to Sri Lanka) Tourism and transportation Licensing (e.g. Breyers Yogart, TGI Friday's frozen appetizers produced by unrelated firms under licensing arrangements, Arvind Brnads and Wrangler in India) and franchising (e.g. Subway, McDonalds, Seven-Eleven etc.) Royalties, operating standard and use of brand names Turnkey operations - seller agrees to put up the plant or business, with his own financing without initial backing from the buyer, guaranteed to be paid by the buyer only upon delivery of the fully operational installation, occurs in franchising – Bechtel in Afghanistan. Management contracts – persons undertaking certain specialized management functions in another entity (Disney theme parks in Paris) Direct (Honda investing in Indian subsidiary Honda-SIEL Cars India) and portfolio investment (Foreign Institutional Investors in the Stock Market) International Strategy Lifecycle Selling Products or Services Outside a Firm’s Domestic Market 2 1 Product Demand Develops and Firm Exports Products Firm Introduces Innovation in Domestic Market 5 3 Foreign Competition Begins Production Production Becomes Standardized and is Relocated to Low Cost Countries 4 Firm Begins Production Abroad The Location choice of MNCs? • How can a firm develop to become a global player? • First step: Sourcing Capital – availability in Developed countries – the role of the Global Banks – Headquarter • How can developing countries be able to grow? • Second step: Sourcing Labour - Developing countries – securing skilled and unskilled labour, considerations on infrastructure, human capital etc. • Can cheap labour come to domestic country and ensure production? • Example – Bangladesh Garments Industry - local labour – Korean FDI Is FDI all about manufacturing and services? Role of FDI: Flying Geese Model • • • • • • • • • • Production - export – FDI - import. First wave of FDI from Japan to South Korea, Taiwan, Hong Kong and Singapore (NIEs). NIEs turned into efficient producers of manufactured products. Consequent increase in cost of production. Second wave of FDI from South Korea and Taiwan to Thailand, Malaysia and Indonesia. Japanese investment also followed. Sectoral perspective – move towards more techno-intensive sectors. China benefited in the process during 1980s. Flow to Philippines in next period. Process suffered during East Asian Crisis. Recent FDI flow to Cambodia, Lao PDR, Viet Nam. Importance of being at the right place at the right time Sequential flying geese paradigm Sequential flying geese paradigm .. India’s advantage? How Did Japanese FDI Travel? 1. Phase 1: 1970s - 2. Phase 2: 1980s - 3. Phase 3: 1990s 4. Phase 2: 2000s - FDI - Production • • • • • • • • Agri FDI: Recent Trends Nestlé (Switzerland) had contracts with more than 600,000 farms in over 80 developing and transition economies as direct suppliers of various agricultural commodities. Olam (Singapore) has a globally spread contract farming network with approximately 200,000 suppliers in 60 countries (most of them developing countries). In Brazil, 75% of poultry production and 35% of soya bean production are sourced through contract farming, including by TNCs. Sime Darby (Malaysia): $800 million investment in plantations in Liberia in 2009 (palm oil, rubber). China: investments and contract farming in commodities like maize, sugar and rubber in the Mekong region, especially in Cambodia and Lao PDR. Zambeef (Zambia): investment in Ghana and Nigeria. Grupo Bimbo (Mexico): investment across Latin America and the Caribbean (potato, cereals). Food security led investment: South Korea and GCC Countries. Role of SWFs: Agricapital (a State-owned fund based in Bahrain) is investing in food crops overseas to support its government’s food security policies. Policy Issue for a country: Export Promotion or Import Substitution? X or M? www.abanet.org Empirical Evidence: Reasons behind Trade and Development Policy Reforms • Demographic Pressure (increasing population, import demand) • Military Compulsions (technological innovations, increasing government expenditure) • Export Growth (broadening product base, increasing productivity, competitiveness of the economy / select product groups) • Demonstration Effect (consumerism, increased consumption) • Late entry and industrial structure • Infant Industry and Optimum Tariff Argument ‘Other’ factors for Growth? • A visionary leader? (e.g. Lee Kuan Yew, Singapore; Deng Xiaoping, Peoples Republic of China; Suharto, Indonesia) • Valuable exportable commodity? (e.g. oil in Iran; manufacturing in China) • Unpredictable aggressive enemy? (e.g. China for Taiwan; Russia for China) • Superpower patron? (e.g. US as patron for Singapore and Taiwan during 1970s and 1980s) • ‘Fair’ Trade Regime? (e.g. Chewing gum export in Singapore) • Business-Friendly Macroeconomic Regime? (difference between Democratic India, Chile under Augusto José Ramón Pinochet and China under Communist Party) • How to Learn from Past Mistakes so as to prevent their repetition???? ‘No matter if it is a white cat or a black cat; as long as it can catch mice, it is a good cat’ – A Sichuan Proverb used by Deng became famous • • • • Levels / Terms of International Companies - Strategies Joint Venture (JV): two or three players from more than one country coming together to form a business – e.g. Sony-Ericsson is a JV by the Japanese consumer electronics company Sony Corporation and the Swedish telecommunications company Ericsson to make mobile phones; Walmart and Bharti Enterprises formed a JV, Bharti Walmart Private Limited. Multinational Enterprise (MNE): global approach to markets and production, direct investment in more than one country – Multinational Corporation (MNC) – e.g. Pepsi – Transnational Company (TNC) - integrate various country operations while dispersing the location of control (Transnational strategy), e.g. Nokia, Nestle Globally integrated company: integrated operations located in different countries - integrate various country operations into an international headquarters control (Global Strategy) Multidomestic company: multinational companies that allow local responsiveness – country offices have power to operate autonomously (Multidomestic strategy) – e.g. McDonald and Maharaja Mac in India International Corporate Strategy When is each strategy appropriate? High Need for Global Integration MultiDomestic Low Low High Need for Local Market Responsiveness International Corporate Strategy When is each strategy appropriate? High Global Strategy Need for Global Integration MultiDomestic Low Low High Need for Local Market Responsiveness International Corporate Strategy When is each strategy appropriate? High Global Strategy Transnational Need for Global Integration MultiDomestic Low Low High Need for Local Market Responsiveness Standardized vs Responsive Practices • Global standardization advantages – Reduced costs in development and manufacturing (e.g. Canon Digital Camera; Sony Flat Screen TV) – Economies of scale since fixed costs are spread over more units of production • Responding to national preferences – Adjusting operating, marketing, and design to meet specific national preferences (e.g. Coca Cola marketing Stoney Tangawizi beer in Tanzania, Kenya where Tangawiki means ginger in Swahili; in US the product is sold as Stoney Gold Ginger beer). Pattern of Internationalization Greater reach abroad is also characterized by greater demand for quality service, if needed, by global players Global Business: Bharti Airtel • Bharti Airtel has outsourced all of its business operations except marketing, sales and finance. • It’s network — base stations, microwave links, etc.—is maintained by Ericsson, Nokia Siemens Network and Huawei • Business support is provided by IBM • Transmission towers are maintained by Bharti Infratel Ltd. (in India) In March 2010, Bharti struck a US $ 9 Bn. deal to buy the Kuwait firm Zain's mobile operations in 15 African countries Maximizing Global Profits • Profits are greatly influenced by: – International rivalry (e.g. Airbus backed by EU and Boeing backed by US) – Cross-national treaties and agreements (UN, WTO, Trade, Transit, environment, health etc.) – Ethics National Cooperation / Problems • Treaties and agreements address a variety of commercial advantages (transportation, trade, etc) – To gain reciprocal advantages – To attack problems that one country alone cannot solve – To deal with concerns that lie outside the territory of all countries – Trade barrier reduction (WTO) – Convention on Transit Trade of Land-locked States (UN) – International arbitration on investment disputes (World Bank) – Knowledge networks (G8, G20, IBSA, BRICS) – Often firms actively lobby with the governments for reciprocal market access • Countries reluctantly cede some sovereignty / facility because of: – Coercion (e.g. Suez Canal, Panama Canal) – International conflicts (e.g. following independence of Eritrea in 1991, Ethiopia lost access to Red Sea and became a land-locked country) The US Primary Dealers Act (1988) provides for National Treatment of foreignowned dealers of U.S. government securities, as long as U.S. firms operating in the government debt markets of the foreign country are accorded "the same competitive opportunities" as domestic companies operating in those markets. Suez Canal Crisis • • • • • • • • • • 1869: Suez Canal, an artificial sea-level waterway opened, work financed by the French and Egyptian governments - operated by the Universal Company of the Suez Maritime Canal, an Egyptian-chartered company; the area surrounding the canal remained sovereign Egyptian territory Growth in trade between Asia and Europe 1875: facing debt and financial crisis, the Egypt sold its shares in the canal operating company to British government 1882: Britain controlled Egypt, built army bases 1936: British lease of Suez canal extended for 20 years 1950s: Suez became a gateway for oil trade to Europe and America 1953: Establishment of Egyptian Republic 1956: Nationalization of the Suez Canal by Egypt, to be managed by Suez Canal Authority (SCA) War with Israel, defeat, introduction of UN Peacekeeping Mission 1967-75: Arab-Israel war, difference sorted after that 1. 2. 3. Results: Gradual weakening of UK and France as major powers Lead to Pan-Arabism, crucial step in OPEC decision to increase oil price during 1970s Political Scenario in Egypt and Arab Spring