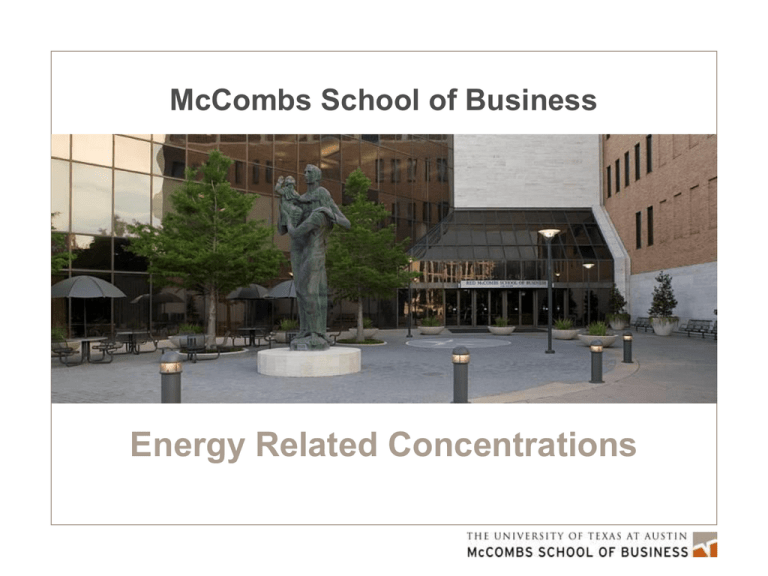

Energy Finance Practicum

advertisement

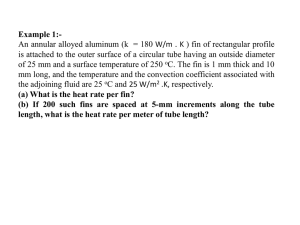

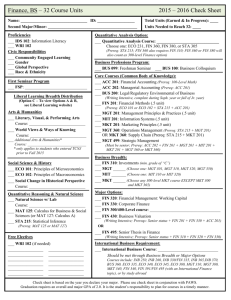

McCombs School of Business Energy Related Concentrations Energy Enormous, Global Problem Almost 2B people don’t have electricity 800M people India don’t have refrigerators 70% of US population lives in cities China = 180 Chicagos Peak oil Global Warming Environmental Standards Carbon Tax Smoking section? 2 Investment in New Supplies Needed Cumulative Investment in Energy-Supply Infrastructure, 2008-2030 = $25.6 trillion (in $2008) Exploration & development 79% Refining Other 17% 4% Electricity 53% Oil 23% $5.9 trillion 52% Power generation 48% Transmission & distribution 86% Mining 14% Shipping & ports $13.7 trillion Biofuels 1% $5.1 trillion Exploration & development LNG chain Transmission and distribution 58% Gas 20% Coal 3% 9% 33% $1.2 trillion investment needed per year 3 Source: International Energy Agency, 2009 World Energy Outlook University of Texas Contribution to the University of Texas Energy Institute through engagement in multi-disciplinary research with: • Cockrell School of Engineering •Jackson School of Geosciences •LBJ School of Public Policy •Architecture School Law School Industry University of Texas Corporate members of EMIC with representation from: • Energy majors • Clean technology • Investment banking, private equity and hedge funds • Consulting • Major industrial users of energy McCombs •Center for Energy Finance • Supply Chain Management Center • Center for Customer Insight & Marketing Solutions • Real Estate Finance Center • Herb Kelleher Center for Entrepreneurship • Hicks, Muse, Tate & Furst Center for Private Equity Finance Energy Management and Innovation Center 4 McCombs Energy Paths Energy Finance CleanTech Finance Marketing Related Concentrations Corporate Social Responsibility Operations Accounting Double Down? MBA & Energy Management MBA & Law MBA & Energy and Earth Resources MBA & Policy 5 Curriculum Requirements FIN 286 - Valuation (flexible-core) MAN 385 - Energy Technology & Policy (Spring only, recommended to be taken during 1st year) FIN 394.1 - Advanced Topics in Corporate Finance FIN 397.1 - Investment Theory & Practice FIN 394.2 - Financial Strategies – Energy Focus (Fall only, prereq: FIN 394.1 & FIN 397.1) Project Management & Experience Any one (1) course chosen from the list below: OM 386.5 - Managing Projects (Fall only) MAN 385 - Management Sustainability Practicum (Energy & Water focus – Spring Only) BA 391 - Special Studies in Bus. Admin. (Must be related to clean technology and approved by Program Office) Public Policy & Law Any one (1) course chosen from the list below: LEB 380.31 - Energy Law LAW 379M - Wind Energy PA 188G - Climate Change Law & Policy CRP 383 - Environmental Law & Policy LEB 380.3 - Law of Comm Real Estate Fin & Develop LEB 380.26 - Law for Entrepreneurs Total credit hours: 20 Other Recommended Electives: FIN 394.4 - Financial Management of Small Business RE 386.2 - Real Estate Investment Decisions MAN 385.64 - Enterprise of Technology: Mind to Market EMR 396 - Energy and Earth Resource Economics 6 Curriculum Requirements FIN 286 - Valuation (flexible-core) FIN 394.1 - Advanced Topics in Corporate Finance FIN 397.1 - Investment Theory & Practice Finance Block The following two finance courses should be taken during the 2nd year fall semester: FIN 394.2 - Financial Strategies - Energy Finance FIN 397.4 - Financial Risk Management - Energy Finance Accounting Block Choose one of the following accounting courses: ACC 380K.8 - Topics in Accounting/Tax for Mineral Industries ACC 380D - Advanced Topics in Financial Reporting ACC 380K.7 - Financial Statement Analysis Other Recommended Electives LEB 380.32 - Energy Law FIN 394.15 - Energy Finance Practicum 7 Special Courses Energy Practicum Sustainability Practicum Financial Strategies – Energy Focus Financial Risk Management – Energy Focus Decision Modeling Marketing and the Environment Oil and Gas Law / Policy Oil and Gas Accounting Global Energy Transactions Green Energy Law Energy Technology and Policy 8 Opportunities Companies Deloitte, Walmart, ConocoPhillips, Mariner, Buckeye Partners Exxon, JP Morgan, BoA / Merrill, Morgan Stanley, XTO, PWC, El Paso, Chevron Organizations Pecan Street Project, EDF, Austin Energy, LCRA IC2 and ATI Plus Projects Fayetteville 9 Opportunities Smart Grid Primer Mitchell Foundation : Best Practices for Shale Gas Haynesville screening ANGA Economics of Green Development Smart Grid Conference Energy Forum Spring EMIC Conference Competitions Energy Finance Challenge Renewable Energy Challenge 10 The Next Wave Shale Gas C02 reduction Energy independence Fracking? Electricity Storage Load shaping Electric Cars Carbon Capture and Sequestration Artificial Photosynthesis 11 Web Pages http://www.mccombs.utexas.edu/students/ctg/ http://www.mccombs.utexas.edu/students/EFG/ http://www.mccombs.utexas.edu/students/netim pact-grad/ http://blogs.mccombs.utexas.edu/energy/ http://www.youtube.com/watch?v=GszEWuz53dk 12 EMIC Our mission is to empower leaders to more effectively manage energy demand and resources while enabling innovative technologies grounded in sound business principles. 13 Honest Debate The Center is committed to rigorous objectivity, while fully considering the technical, economic, cultural and geopolitical implications of the various energy pathways. 14 · Brief overview of the area of concentration · Your teaching methods (case, lecture, practicum, etc.) · Opportunities for students to connect to industry leaders (in or out of your classroom) · Current business developments/research in this field · Impact on career changers 15