Financing Solutions

for the

Petroleum Industry

Cat® Financial

November 2009

Cat Financial Services

Wholly-owned subsidiary of Caterpillar Inc.,

world’s largest manufacturer of construction

and mining equipment, diesel and gas

engines, industrial gas turbines

28 years in business

$30B portfolio

Offering financial products to customers

who purchase equipment manufactured by Caterpillar

– Equipment leases and loans

– Corporate finance debt products including syndicated bank loans

– Project and construction finance

Industries: Mining, Construction, Electric Power, Marine, and Petroleum

Cat Financial Services

Dedicated Team: Petroleum Industry

– In 2007, Cat® Financial dedicated a team of professionals to focus on

petroleum industry

– $900 million already committed to the sector

– The desire is to grow to $3 billion by 2012

To Provide Financial Products for Select Industries:

– Drilling and Well Servicing

– Natural Gas Compression: contract services, gathering, processing,

storage and transmission

Cat Financial Services

Equipment Loans: Well Servicing and Drilling

– Equipment type(s): onshore drill rigs, workover rigs, FRAC trailers, coiled tubing

units, wireline trucks powered by Cat engines

– Term: 3 to 5 years

– Down payment: 20% or more

– Minimum transaction size: $1 million

– Minimum EBITDA: $10 million (may be lower if an affiliate of larger entity)

Recent Transactions:

– $25 million financing for two new 1500 hp Cat powered rigs. Owner is a public

international oilfield service company. Rigs are under contract in the Haynesville

Shale.

– $9.6 million financing to rebuild and repower a 1000 hp drill rig for use by proprietary

drilling company of private E&P company operating in West Texas. Rig equipped

with new 2 x C15s.

– $2.3 million financing for three new workover rigs equipped with a Cat C15 diesel

engine and TH-35 transmission. Private operator in East Texas.

* Final customer pricing and down payment is based on risk assessment and is subject to internal credit approval by Cat Financial

Cat Financial Services

Equipment Leases and Loans: Natural Gas Compression

–

–

–

–

–

Equipment type: natural gas compressors powered by Cat engines

Term: 5 to 10 years

Security deposit or down payment: 0-25%

Minimum transaction size: $1 million

Minimum EBITDA: $5 million (may be lower if an affiliate of larger entity)

Recent Transactions:

– $75 million operating lease for purchase of new Cat powered gas compression

equipment. A portion of the financing is available for sale and leaseback of recently

acquired fleet. Lessee is a public contract compression company.

– $45 million operating lease for purchase of new Cat powered gas compression

equipment. Lessee is a private contract compression company.

* Final customer pricing and down payment is based on risk assessment and is subject to internal credit approval by Cat Financial

Cat Financial Services

Syndicated Bank Loans: Non-Investment Grade and Highly Leveraged

Companies

Industries:

– Natural Gas Transmission

– Natural Gas Storage

– Natural Gas Compression

– Drilling and Well Servicing

Loan Purpose:

– Project and construction

– General corporate

– Capital expenditure

– Merger and acquisition

Parameters:

– Longstanding Caterpillar petroleum customer

– Or, first time customer purchasing new fleet

powered by Cat engines

– Public and private ownership

– Credit ratings: BBB- or lower, or non-rated

companies

– Term: 3 to 7 years

– Minimum transaction size: $10 million

– Minimum EBITDA: $5 million

– Indicative pricing: 3 month Libor + 350 bps or

higher (reflects market conditions as of

November 2009)

* Final customer pricing and down payment is based on risk assessment and is subject to internal credit approval by Cat Financial

Cat Financial Services

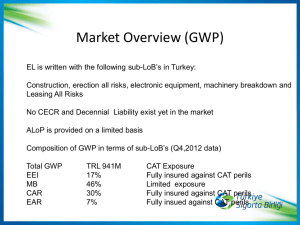

Syndicated Bank Loans: Select Borrowers by Industry

Well Service and Drilling:

– MidCon Compression, L.L.C.

(Chesapeake Energy)

– Parker Drilling Company

– Cal Dive International, Inc.

– Trinidad Drilling Ltd.

– Key Energy Services, Inc.

– Pioneer Drilling Company

– Saxon Energy Services Inc.

Contract Compression Services:

– CDM Resource Management LLC

– USA Compression Partners LP

– J-W Operating Company

– Mustang Gas Compression

– Natural Gas Compression Systems, Inc.

Natural Gas Storage Projects:

– Arcadia Gas Storage, LLC

– Bobcat Gas Storage

– Monroe Gas Storage Company LLC

– Pine Prairie Energy Center LLC

– SGR Holdings, L.L.C.

Natural Gas Gathering, Processing,

and Transmission:

– Atlas Pipeline Partners, LP

– Continental Energy Systems LLC

– Enterprise GP Holdings L.P.

– Myria Acquisition Inc. (Natural Gas

Pipeline Company of America)

– Martin Midstream Partners L.P.

– Regency Energy Partners LP

Cat Financial Services

What makes us different?

Cat Financial is solely devoted to promoting Caterpillar

products and supporting our customers’ growth

We originate transactions for our own balance sheet.

Committing our own money. We do not act as a placement

agent or broker.

While many lenders are divesting their portfolios in the

petroleum sector, Cat Financial seeks to grow its portfolio.

Rarely do we have customer or portfolio concentration issues.

Your company will have direct communication and coordination

through a dedicated and knowledgeable account manager.

Caterpillar Financial

2009-2010

Buy Now Incentives

Natural Gas Compression Re-Value Program

Cat Access Account:

Petroleum Engine Overhaul Program

2009 Bonus Depreciation Tax Incentive

Natural Gas Compression Re-Value Program

Do you currently own a fleet of Cat powered

natural gas compressors?

Do you want to upgrade your fleet and buy new

in 2010?

Monetize the value of your existing fleet and use a portion of the

proceeds

as a down payment to buy new Cat powered equipment.

Cat Financial will:

Provide you with the money to upgrade and refinance your existing fleet,

Finance the new Cat powered fleet with a modest down payment, and

Provide additional cash for operating needs.

Natural Gas Compression Re-Value Program:

Example

1. Customer seeks new equipment

– New Cat powered equipment to

expand and upgrade fleet

– Purchase price = $37.5 million

2. Cat Financial lends:

– $30 million to purchase the new fleet

– $20 million to refinance the existing

fleet

– Advance rate of 80% of equipment

value

3. Customer monetizes the value

of existing equipment

– Existing fleet of Cat powered

equipment with an orderly liquidation

value (OLV) = $25 million

4. End result

– Customer nets $12.5M in cash for

operations after a down payment of

$12.5 million

* Final customer pricing and down payment is based on risk assessment and is subject to internal credit approval by Cat Financial

Natural Gas Compression Re-Value Program

Program minimum size $25 million. Value of new equipment

purchased must be >60% of loan amount. Qualifying

equipment must contain Cat engines.

Cat Financial will require the loan to be secured by the

compression equipment.

Our team of professionals is well versed in understanding the

restrictions often imposed by bank credit documents, including

limitations on additional debt, liens, asset sales, and

sale/leaseback.

Most often we can find financial solutions that work within the

framework of these documents.

Cat AccessAccount

Use one account nationwide at any U.S. Cat

dealer to pay for parts, service, sales, and rentals.

Standard Rate: Prime +7%, 10% min. monthly payment

Special Program: Petroleum Engine Overhaul Program

6 Months No Payments 0% Interest

12 Equal Monthly Payments 0% Interest

Program Term: Through June 30, 2010

Qualifications:

– Caterpillar major engine overhauls (parts and labor) purchased from and conducted

by a Cat dealer. Engine must be used in petroleum application.

– Eligible engines include: Cat gas and diesel 6.25" bore, C-Series engines 15L and

up, 3400, 3500, and 3600 series products

– Cannot be combined with any other offer

2009 Bonus Depreciation Tax Incentive:

Some of the Requirements to Extend

Bonus Depreciation to 2010

Asset is placed in service by 12/31/10 and costs more than $1 million

Asset takes more than (or about) 1 year to be manufactured and placed in service (may

include time for design and development)

Where the asset requires components like engines, these components are ordered

during the production period, delivered, and placed in service by 12/31/10

The amount that would qualify for Bonus Depreciation is the cost incurred by 12/31/09,

including amount incurred for components purchased for manufacturing of the asset

Qualified cost incurred is the amount taxpayer reports on its GAAP financial statement

(in case of an accrual basis taxpayer) or pays (in case of a cash basis taxpayer), and the

amount is more than 10% of the total cost of the property (excluding cost of any land and

preliminary activities such as planning or designing, securing financing, exploring, or

researching)

Recovery period of the asset needs to be between 10 and 20 years, and the asset

qualifies for MACRS depreciation

Contact Information: Cat Financial

Person

Industry

Phone

Email

Martin Donner

Petroleum Sales

Manager

615-341-5078

Martin.Donner@cat.com

Alex Karwowski

Midstream and

Gas Transmission,

Compression

615-341-1082

Alex.Karwowski@cat.com

George Simon

Drilling, Well Service,

Compression

214-383-2967

George.Simon@cat.com

615-341-1044

Alexander.Tumanov@cat.com

Alex Tumanov

E&P, Gas Storage

Jeff Condo

Cat AccessAccount

469-362-6219

Jeff.Condo@cat.com

Hap Henley

Cat AccessAccount

615-341-5-66

Hap.Henley@cat.com

Information contained in this publication may be considered confidential.

Discretion is recommended when distributing.

Materials and specifications are subject to change without notice.

CAT, CATERPILLAR, their respective logos, “Caterpillar Yellow” and the “Power Edge” trade dress, as well as corporate

and product identity used herein, are trademarks of Caterpillar and may not be used without permission.

LESW0017-00 (11/09)

2009 Caterpillar

All rights reserved.