Mr. R Prabha - Sa-Dhan

advertisement

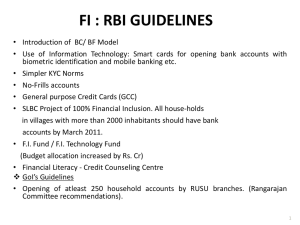

FINANCIAL INCLUSION: A STUDY ON THE EFFICACY OF BANKING CORRESPONDENT MODEL By Sa-Dhan A Presentation By R . Prabha BACKGROUND •Banking Correspondent (BC) model- launched by RBI in 2006 as a part of Govt. strategy for Financial Inclusion. •Aimed at providing Banking services at affordable costs to nearly 40% of the excluded population. • In the first phase, 73000 unbanked villages were to be covered by BCs or by tiny branches by March 2012. •As at March 2012, 1,20,355 Customer Service Points (CSPs) were established by BCs – 103 M No frill A/csA huge Achievement. • Was it delivering the intended results? • The study was thought of in this background. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 2 Why by Sa-Dhan ? • Through the Bank led BC model-financial infrastructure is being built to serve the unbanked/under banked population . • There is convergence of Sa-dhan’s objective and the programme of the Govt. of India. • The Community Dev.Fin. Institutions and MFIs have a role. • Has the BC model opened up a new opportunity for MFIs to do business with the poor? • The study would provide better understanding of the challenges and possibilities and help in policy advocacy. • Sa-dhan took up the study in this context. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 3 OBJECTIVES OF THE STUDY • To understand the different Models of BCs operating on the ground. • To identify the challenges faced by the BC model. • To pinpoint Challenges overcoming them. and to suggest means of • Different products and services offered by BCs and the potential products- And the factors preventing to offer these products and services. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 4 SCOPE AND COVERAGE • Different geographical regions: • North-east • East • Western Region • Northern Region • South • Different legal forms: • ‘Not for profit’ Section 25 Companies • Trusts (including SHG Federations) • Societies August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 5 SCOPE AND COVERAGE Contd… •Other Important stake holders: Clients and non clients Govt. of India Reserve Bank of India NABARD Banks Technology providers Training Institutions August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 6 METHODOLOGY • Information collected using a structured format from the stake holders. • Personal discussions • Conclusions/opinions on the basis of data collecting and information gathered. • Limitations-The study has not followed the research methodology of random sampling and smaller sample size August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 7 BACKGROUND INFORMATION • Entities permitted by RBI to act as a BC and the extant guidelines • The different BC models and their operating procedures • International experience on BC model • Studies on BC Model conducted so far August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 8 KEY FINDINGS • Commercial viability is the greatest challengecompensation too meagre to sustain the model. • CSP-the weakest link in the BC chain-least staying power, poor morale and high expectations • Banks Consider it as a mandated one -business too small to attract business interest/ investment.Dep Rs9500- cr Rs34 cr overdrawing thru 103 million NFAs • Infirmities in Selection process of BCs. • Over emphasis on quantity-especially on opening of No Frill Accounts and number of Customer Service points. • Inadequate financial literacy support-Clients do not feel the need to utilise the financial infrastructure. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion 9 contd… Conference -2012 KEY FINDINGS Contd… • Too risky by banks-hesitation to offer credit related products. • All Government to Persons payments not getting routed through NFAs. • Lack of customer grievance mechanism & business continuity plan. • Poor connectivity and technical infrastructure August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 10 RECOMMENDATIONS Strategies for improving viability • Viability gap funding and assured minimum fixed income to the CSP-Banks to provide viability gap funding for BCs for initial 3 years. • RBI/IBA to prescribe uniform minimum rates to BCs to ensure fair return on investments to BCs. • Change in selection process-capacity to deliver should be the main criteria. • Minimum assured compensation to CSPs. • BCs to keep the initial investment low. Kiosk model Rs.1,26,000/- GPRS Mobile based biometric model 40,000/- SMS based mobile model 25-35,000/contd… August 7 - 8, 2012 Sa-Dhan- Financial Inclusion 11 Conference -2012 RECOMMENDATIONS Strategies for improving viability Contd… • SHG Federations, CBOs and MFIs including NBFC-MFIs as BCs-NBFC-MFIs to offer saving products as BC. • Routing all Govt. to Persons (G2P) payments through BCs. All payments to beneficiaries under state sponsored programmes to be routed through BCs thru the No Frill Accounts. Pay 2% administration costs to Banks • Convergence of BC Model with National e-governance plan- Kiosk model of BCs to act as Common Service Centre (CSC). • BC as an alternative channel like ATM, internet banking etc. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 12 RECOMMENDATIONS Strategies for improving viability Contd… • Creating trust and confidence in BCs. Banks to be made responsible for: Developing and implementing Proper systems and procedures at BC level. Capacity building of CSPs-continuous training improve capacity and morale of CSPs. to Diversification of product offering by banks-The banks to offer products other than NFAs through BCs especially credit products. Present -2.15 M KCCs August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 13 RECOMMENDATIONS Strategies for enhancing commercial interest of Banks •Amortise all costs-Banks to be permitted amortisation of all direct & indirect cost for 10 years. •Incentivise banks for deposits mobilised by BCs-give weightage in calculation of % of priority sector advances. •Create a separate vertical in the Banks to create more ownership and accountability. •Weed out non serious players-replace with SHG Federations from MFI. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 14 RECOMMENDATIONS Client Centric Strategies • Financial literacy programme to be given equal emphasis to derive benefits from building, financial infrastructure in rural areas- literacy program should run hand- in- hand • Create a National Literacy Task Force under the finance ministry. • Make F.I fund functional-utilisation of funds in last three years. 5% fund should support all financial literacy programmes. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 15 RECOMMENDATIONS Client Centric Strategies Contd… • Activate No Frill Accounts- National campaign every year. • Dedicated Customer Grievance Mechanism for clients of BCs. • Emphasis on Customer service • A Business continuity plan for BC clients. • Catch them young-Financial Literacy to be made part of school curriculum. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 16 FINDINGS FROM FINANCIAL MODELLING • Financial modeling attempted as a part of this study. • Modeling based on assumption of usage and different technology models. • Kiosk based model takes 3 ½ years to break even under the best of circumstances. • A biometric GPRS mobile base model takes about 2 years and an SMS based remittance model less than 2 years. • A GPRS based mobile based model is considered suitable to service a cluster of villages. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 17 CURRENT SCENARIO • There will be one common BC for all public sector banks in a state or a region. Country divided in to 20 regions • The convener of SLBC shall undertake the selection process on behalf of all Public sec. banks. • Only entities with an annual turn over of Rs.5 crores and above are eligible to be considered. • Fixed the remuneration for the BC for opening of A/C s. Bidding for cash transactions rates. • CSPs salary for the first 6 months would be paid by the banks. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 18 CONSEQUENCES OF THE NEW PROCESS- • Govt. signals that only well established entities with financial muscle would be considered as BC. • The process can create a monopolistic situation with less or nil competition. • Smaller institutions/entities CBOs with local flavour are kept out or they will have to work as sub- BC sharing revenues with a larger player. • The entities would be highly profit driven. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 19 THE ROAD AHEAD •The financial inclusion – in the wider context of economic inclusion is essential for our growth. • A Bank-led, technology driven Agency Model is still the best bet to reach the unreached. •Initial investment- until the FI programme reaches a tipping point- has to come from the Banks/government. •Banks, in the larger business interest, has to show the motivation and initiative to tap the huge growth potential. • New Business Models and innovative products have to emerge- with emphasis on quality of implementation . • RBI and the government should create an enabling environment for the Model to flourish. August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 20 THANK YOU R. Prabha Contact : prabhatvm@yahoo.com August 7 - 8, 2012 Sa-Dhan- Financial Inclusion Conference -2012 21