Ben Wallace - Wellington Regional Strategy

advertisement

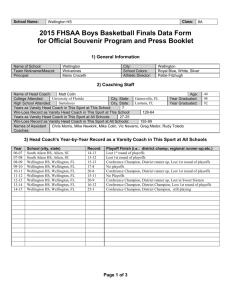

WELLINGTON labour market snapshot Employment Employment Growth - 2007 to 2012 % 8 Wellington 6 Auckland 4 Canterbury 2 -4 -6 GFC Recession (M08 - J09) -8 Source: Statistics NZ Annual Average Percentage Change Feb 11 Quake Dec-12 Sep-12 Jun-12 Mar-12 Dec-11 Sep-11 Jun-11 Mar-11 Dec-10 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 Sep-08 Jun-08 -2 Mar-08 0 Dec-07 • 269,000 people employed end Dec 2012 (rate 65.6%) • Wellington tanked post recession. Slow since March 2010. • Canterbury and Auckland tanked earlier, but recovered more rapidly, until February 2011. • Now Auckland has weakened but still growing, and Canterbury is stepping up. Incomes • Wellington has high average annual household incomes • But employment growth in filled jobs has been below average (and below other urban regions) Vacancies Skilled Vacancies Index (trend series) 200 180 160 140 120 100 80 60 Feb-13 Nov-11 Aug-11 May-11 Feb-11 Nov-10 Aug-10 May-10 Feb-10 Nov-09 Aug-09 May-09 Feb-09 Nov-08 Aug-08 May-08 Feb-08 Nov-07 Aug-07 Source: Department of Labour, Jobs Online Monthly Report Nov-12 Feb11 Quake 0 Aug-12 20 May-12 Recession Mar08 Jun09 (6Q) Canterbury New Zealand Auckland Wellington Feb-12 40 May-07 • Canterbury vacancies have been higher, esp. since the Feb 11 quake • Auckland and Wellington vacancy levels are similar (flat) % 80 Participation Participation Rate - Wellington & All Regions 75 70 65 • High participation – 70.3% vs 68.2% nationally (only Southland higher) • Larger proportion of population in the working ages (15-64) 60 Wellington Region All Regions 55 50 Source: Statistics New Zealand, Household Labour Force Survey Participation Rate - Wellington & All Regions % 80 75 70 65 60 Wellington Region All Regions 55 50 87 89 91 93 95 97 99 01 03 05 07 Source: Statistics New Zealand, Household Labour Force Survey 09 11 Unemployment Rate - Wellington & All Regions % 12 Unemployment 10 8 • Wellington now matches the national rate (6.9%) • Has generally been more resilient during recessions 6 4 Wellington Region All Regions 2 0 Source: Statistics New Zealand, Household Labour Force Survey % 12 Unemployment Rate - Wellington & All Regions 10 8 6 4 Wellington Region 2 All Regions 0 87 89 91 93 95 97 99 01 03 05 07 Source: Statistics New Zealand, Household Labour Force Survey 09 11 Industry • Strongest in professional, scientific and technical services, and in public administration and safety • Weaker in manufacturing, and agriculture, forestry and fishing. 2012 Skills • Wellington and Auckland both highly skilled, with less emphasis on skilled and elementary occupations, but also with a higher than average share of semi-skilled • • • • Highly skilled: managers and professional occupations Skilled: technicians and trades workers Semi-skilled: clerks, services and sales workers, agriculture and forestry workers Elementary: machinery operators and assemblers, general labourers Forecasts Annual average percentage change 2013* 2014 2015 GDP Growth (Treasury) 3.0 3.4 3.1 Labour Productivity 1.2 1.3 1.5 Employment growth 1.8 2.1 1.6 Source: MBIE Short-term Employment Prospects: December 2012 (March years) • Forecasts vary continuously, but can be usefully examined to see the basic trends and how the various components relate • 2013 employment growth to March is now forecast to be -0.7%, GDP 2.3%* • Labour productivity has been growing, as GDP does quite well, while employment growth has been slow Employment growth by industry forecast Industry 2013 2014 2015 Primary sector 1,800 1.1 3,600 2.2 2,700 1.6 Primary processing 1,700 1.8 1,500 1.5 2,100 2.1 Other manufacturing 2,900 1.8 1,700 1.0 2,300 1.4 Construction & utilities 15,800 8.6 18,600 9.3 4,200 1.9 Private services* 14,200 1.5 13,700 1.4 14,900 1.5 -700 -0.7 -200 -0.2 400 0.4 4,200 1.0 6,000 1.4 7,200 1.7 700 0.5 1,100 0.8 2,200 1.4 40,700 1.8 46,100 2.1 36,000 1.6 Core government Health & education Other public Total Source: MBIE Short-term Employment Prospects: December 2012 (March years) * incl. Communication Services; Finance and Insurance; Property and Business Services; Professional , Scientific and Technical Services; Employment growth by skills forecast Skill level 2013 2014 2015 Highly skilled 15,300 2.1 17,100 2.3 16,500 2.2 Skilled 12,100 2.5 13,300 2.7 7,200 1.4 Semi-skilled 6,100 0.9 7,800 1.1 7,400 1.1 Elementary 7,200 2.2 7,900 2.4 4,900 1.4 40,700 1.8 46,100 2.1 36,000 1.6 Total Source: MBIE Short-term Employment Prospects: December 2012 (March years) • Strongest growth in skilled, highly skilled, and elementary level occupations, reflecting the Canterbury rebuild and the strong growth in construction • Both skilled and elementary play a smaller than national average role in Wellington’s labour market Employment growth by region forecast Region 2012-14 2012-15 Northland 1,100 0.9% 3,200 1.6% Auckland 23,600 1.8% 35,300 1.7% Waikato 4,300 1.3% 8,200 1.7% Taranaki 2,300 1.1% 6,100 2.0% Bay of Plenty 5,200 1.7% 8,700 1.9% East Coast 3,200 1.6% 5,600 1.8% Central 3,400 1.5% 6,600 1.9% Wellington 1,600 0.3% 8,900 1.2% Nelson 3,700 2.0% 5,700 2.0% Canterbury 26,500 4.2% 22,100 2.4% Southern 11,800 2.7% 12,000 1.8% Total 86,800 2.0% 122,800 1.8% Employment growth by industry forecast - WN Industry 2013 2014 2015 Primary sector 25 3.0 35 4.0 3 0.0 Primary processing 65 -2.0 69 2.0 172 6.0 Other manufacturing 92 -1.0 49 0.0 416 4.0 Construction & utilities 886 5.0 654 3.0 1,542 8.0 Private services* 549 0.0 1,637 1.0 1,796 2.0 -1,469 -5.0 -1,235 -5.0 1,935 7.0 Health & education 93 0.0 336 1.0 1,024 2.0 Other public 19 0.0 167 1.0 448 2.0 Total 93 0.0 1,713 1.0 7,331 3.0 Core government Source: MBIE Short-term Employment Prospects: December 2012 (March years) * incl. Communication Services; Finance and Insurance; Property and Business Services; Professional , Scientific and Technical Services; Challenges/Opportunities • Diversifying Wellington’s industry mix • Internationalising Wellington’s professional business service firms (which are currently focussed on government) • Continuing to improve tourism takings and better leveraging visitor attractions to attract talent and investment • Commercialising science and research development