Partial Acquisitions

advertisement

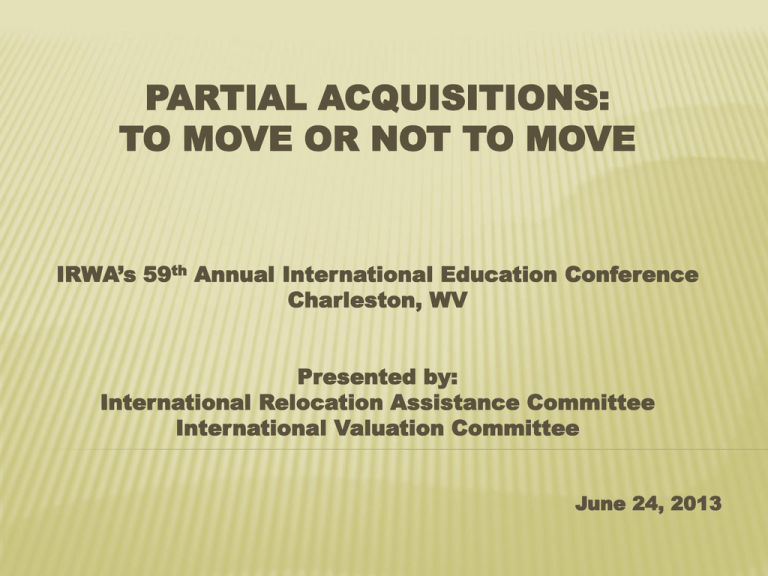

PARTIAL ACQUISITIONS: TO MOVE OR NOT TO MOVE IRWA’s 59th Annual International Education Conference Charleston, WV Presented by: International Relocation Assistance Committee International Valuation Committee June 24, 2013 APPRAISAL BASICS Rick Pino Partner Petersen LaChance Regan Pino, LLC FUNDAMENTAL ELEMENTS Know purpose and the jurisdiction under which you are performing the valuation assignment Establish the basis for valuation development and reporting requirements Uniform Standards of Professional Appraisal Practice (USPAP) Uniform Appraisal Standards for Federal Land Acquisitions (UASFLA) Other entities with eminent domain power Non-federal governmental (state, county, municipal) Public and quasi-public agency or authorities Private entities Determine critical definitions Market Value Real Estate/Real Property Personal Property LARGER PARCEL Unity of title Unity of use Contiguity or proximity HIGHEST AND BEST USE Tests Legally Permissible Physically Possible Financially Feasible Maximally Productive As if Vacant As Improved VALUATION METHODOLOGY Before and After Method Value of Property Before the Acquisition (Larger Parcel) Less the Value of Property After Acquisition (Remainder) Value Difference Value of Part Acquired (Plus) + (Less) Value of the Acquisition Severance Damages Special Benefits Value Difference CASE STUDY 1 Type of Property: Newly constructed 21,320 SF retail building 14,820 SF – Walgreens (drive-through) 6,500 SF – Typical retail space Pad site for 3,260 SF Wendy’s 137,538 SF (3.16 Acres) Site Highest & Best Use: As Vacant – Retail development As Improved – As developed Rents: 40.00 – Pharmacy $28.00 – Typical Retail Capitalization Rates: 6% - Pharmacy 7% - Typical Retail AFFECTED PROPERTY SITE PLAN - BEFORE ACQUISITION PLAN: FEE, PERMANENT AND TEMPORARY EASEMENTS REMAINDER PROPERTY Type of Property: Newly constructed 21,320 SF retail building 14,820 SF – Typical retail space 6,500 SF – Typical retail space 99,137 SF (2.28 Acres) Site Highest & Best Use: As Vacant – Retail development As Improved – As developed Rent: $28.00 – Typical Retail Capitalization Rate: 7% - Typical Retail CASE STUDY 1 SUMMARY Change in Highest & Best Use Value Before: Value After: Difference $ 14,700,000 $ 8,000,000 $ 6,700,000 No Change in Highest & Best Use Value Before: Value After: Difference $ 14,700,000 $ 12,200,000 $ 2,500,000 CASE STUDY 2 Acquisition: Washington Street, Lynn, Massachusetts Use: A parking lot Site: 18,046 square feet, irregular shape with 99 feet of frontage Improvements: 52 open parking spaces History: Leased with adjacent property Zoning: Central business zoning district Assessment: $36,000 R. E. Taxes: $1,206.98 ACQUISITION & AFFECTED PROPERTY AFFECTED PROPERTY Acquisition: Washington Street, Lynn, Massachusetts Design: Single story commercial building, plus adjacent parking lot Use: Juvenile court facility Site: 18,042 square feet, irregular shape with 50 feet of frontage on Washington St. and 50 feet on Central St., plus adjacent parking lot Improvements: 18,042 square feet of building area History: Recently renovated for $1,971,174 or $109.25/SF of leasable area and recently leased for $28.20/SF of leasable area. Gross rent including tenant imp. costs over term Zoning: Central Business Zoning District Assessment: $1,321,400 R. E. Taxes: $43,936.55 JUVENILE COURT BUILDING BUILDING PLAN HIGHEST AND BEST USE BEFORE As Vacant Assemblage parcel for parking and/or future development $9.00/SF of land area based on commercial development and/or parking sales range of $6.05 to $11.47, with average of $8.47/SF of land area As Improved Existing use of the property for juvenile court facility Build-to-suit rents courthouse facility rents range from $24.23 to $32.50, with average of $29.77/SF of leased building area HIGHEST AND BEST USE AFTER As Vacant Assemblage parcel for parking and/or future development As Improved Use of the property for commercial/industrial use Comparable sales range from $31.74 to $50.97, with average of $40.61/SF of building area Rents range from $3.39 to $6.75/SF, with 10% vacancy, 7.5% expense ratio and cap rates 9% to 12% Requires $180,420 or $10.00/SF for demolition and removal of existing tenant improvement to return the space to market standard VALUE OF DAMAGES Before and After Method $2,900,000 (Large Parcel) (Less) - $541,000 (Remainder) $2,359,000 (Value Difference) Value of Portion Acquired = $162,000 MOVE OR NOT TO MOVE ? TAKE AWAY Importance of an in-depth BEFORE and AFTER Highest and Best Use Analysis Outcome of the analysis may affect the Agency’s project plan Proper planning may include advising agency of changes in use - proactive and may allow time for exploring other design alternatives CONCEPT CORRELATION Janet Cruppi, SR/WA, R/W-RAC Michelle Colby, SR/WA, R/W-RAC, R/W- NAC Moderators CORRELATION This same concept is used in relocation planning A thorough Non-residential Occupancy Interview is critical to establish the BEFORE The AFTER - What is the effect of the partial acquisition on the business’s: Access Deliveries Parking Circulation Ability to operate in a similar manner REAL LIFE SCENARIOS Partial acquisition from a cattle ranch, Thermopolis, Wyoming Partial acquisition from a restaurant in Homer, Alaska Partial acquisition from a custom truck building facility in Anchorage, Alaska FAA PERSPECTIVE Rick Etter Airports Acquisition Specialist Federal Aviation Administration AIRPORT TENANTS & BUSINESSES Relocate on Airport? Not a displacement for Airfield Users, e.g. Airlines, other support services. Relocate Off Airport? On airport business leased property needed for project, nowhere to move on airport. Typically displaced. Off airport service business. Project need several years in future. Option not to be displaced. May leaseback acquired property long term. Closed Airport. Tenant aviation business. Not displaced, no obligation in lease to continue operations. RELOCATE ON AIRPORT - AIRFIELD USERS Airfield (AOA) Tenant Leases Not Displaced by Airport Development (Works/Support for On-airport Operations) Example: Airline Hangar to be Removed for Airfield Construction Airfield Lease is Re-negotiated with Airport New Hangar Location Developed by Airport As applicable credit unamortized value of Improvements/Moving Expense Other Issues with Airfield Leases: Subtenants? Subject to Airfield Lease ON AIRPORT TENANT – WORKS ON & OFF AIRPORT Example: On-airport Rental Car Airport Lease must be broken to use land for project (poor planning) No on-airport location available, so displaced for project Eligible for Relocation Assistance and Payments OFF AIRPORT SERVICE BUSINESS – AIRPORT CUSTOMERS & BUSINESS Example: Off Airport Parking, displaced business owner desires to stay on property as long as possible. Continued Occupancy offers: Full relocation assistance and payment eligibility must be offered and available now when property purchased. Or; Leaseback property pending project development in 5 years. Subject to an 18 month lease, with three 12 month renewal options (extends a maximum of 60 months) If tenant terminates lease within initial 18 month period, eligible for offered relocation eligibility. FHWA PERSPECTIVE Marshall Wainright Lead Realty Specialist FHWA Resource Center Federal Highway Administration CREATIVE SOLUTIONS Janet Cruppi, SR/WA, R/W-RAC Michelle Colby, SR/WA, R/W-RAC, R/W- NAC Moderators ACQUIRED 1 AC FROM 3.8 AC SITE SITE CONCEPT PLAN AFTER CONFIGURATION QUESTIONS THANK YOU FOR ATTENDING