Capital Markets Day

advertisement

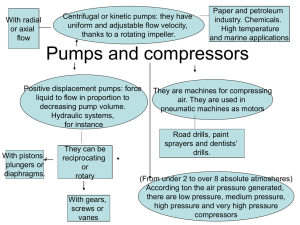

Concentric AB Ian Dugan/David Bessant 20 May 2011 Introductions 2 Ian Dugan – Chief Executive David Bessant – Chief Financial Officer David Woolley – Senior Vice President, Europe and India Len Mason – Senior Vice President, Americas David Williams – Group Technical Director (Engine Products) Bill Pizzo – Vice President, Global Hydraulics Engineering 20 May 2011 Concentric AB - Agenda A global leader in the design and manufacture of pumps for diesel engines and hydraulic systems 3 Concentric – built on a solid foundation A streamlined business A focused strategy towards growth 20 May 2011 Concentric AB 4 Built on a solid foundation A streamlined business A focused strategy towards growth 20 May 2011 Concentric AB – Overview Concentric AB is organized regionally Two regions – Americas and Europe and ROW Manufacturing occurs in the UK, India, China, Sweden, Germany and the US close to customers The company employs 1,156 people Focus on four end markets – Truck, Agricultural machinery, Construction equipment and Industrial applications We make pumps for diesel engines, used for pumping lubricating oil, coolants and diesel fuel Concentric AB is the global market leader in engine pumps in the 0.8 - 2 litre per cylinder niche Largest customers are engine manufacturers and large truck manufacturers which produce diesel engines for their own trucks and construction machinery We make gear pumps for a broad range of hydraulic pump applications Concentric AB is a market leader in niches such as fan drives and supplementary power steering Largest customers are OEMs of a wide range of industrial vehicles, agricultural machinery and construction equipment 5 20 May 2011 History 1921 Concentric founded in Birmingham, England 1929 JS Barnes Company founded in Rockford, USA 1948 Concentric makes first engine pump 1977 JS Barnes focuses on hydraulic pumps Mid 1980s Hesselman, Haldex and Garphyttan consolidates under the name Haldex AB 1987 Haldex acquires JS Barnes 1991 Haldex acquires Reichert, a Vickers company 2002 Group of companies comprising Barnes, Vickers and Hesselman is renamed Haldex Hydraulic Systems Division April 2008 Haldex Hydraulic Systems Division acquires Concentric Spring 2011 Haldex Hydraulic Systems Division is renamed Concentric AB to prepare for demerger and listing on OMX NASDAQ 6 20 May 2011 End Markets Source: 2010 Group sales Diverse spread of platforms across four end markets Multiple growth opportunities 7 20 May 2011 Blue Chip – Customer Base Top 10 Customers Source: 2010 Group sales Top 10 customers account for 64% - reflects engine products customer concentration Other customers account for 36% - reflects diverse base in hydraulics products (700+) 8 20 May 2011 Extensive Product Portfolio We offer best in class technologies, focused on fuel economy, emissions reduction and noise management, with the major products including: Oil pumps, fixed and variable displacement, mechanical or electronic control Water pumps, fixed and variable control with future stretch for electrification Fuel transfer pumps, mechanical with electrification options Hydraulic pumps and motors featuring low noise, low speed and high power density Key new products include: Alfdex oil mist separators Hydraulic Hybrid drive systems offering 40-50% fuel savings and engine downsizing options Varivent EGR pumps to provide greater mass of re-circulated exhaust gas, reducing emissions Alfdex: Oil mist separator 9 20 May 2011 Variable Flow Coolant Pump Variable Flow Oil Pump Hydraulic Hybrid Drive System Global Infrastructure Birmingham, UK Itasca, Illinois Landskrona, Sweden Manufacturing Headquarters Manufacturing & Distribution Skånes Fagerhult, Sweden Manufacturing & Distribution Manufacturing Suzhou, China Manufacturing Rockford, Illinois USA Manufacturing Hof, Germany Manufacturing Pune, India Manufacturing 10 20 May 2011 Global Manufacturing Hof, Germany Birmingham, UK Itasca, USA Skånes Fagerhult, Sweden Pune, India Suzhou, China Production Sites 11 20 May 2011 Rockford, USA Landskrona, Sweden A Solid Financial Position (Key Metrics) Q1 2011 2010 SEK 554m SEK 1,977m Sales Sales growth 1) 11% 53% Material % of sales 52% 49% EBITDA margin 15.1% 12.7% Operating income SEK 66m SEK 151m Operating margin 2) 11.9% 7.6% Operating free cash flow SEK 44m SEK 272m Working capital as % of sales 0.4% 0.3% ROCE 2) 16.5% 12.1% Debt/equity ratio 39.0% 41.5% 1) Like-for-like sales growth, constant currency 2) Before items affecting comparability (demerger costs, restructuring expenses and capital losses) 3) Pro forma financial information 12 20 May 2011 2) 3) 3) Q1 2011 Comments Sales development Constant currency 11.5% above Q4 2010 Profit development 11.9% EBIT vs 10.2% in Q4 Cash flow development SEK 44m Free cash flow 13 20 May 2011 - Material price pressure - Double corporate costs (SEK 3m) - Listing advisor costs (SEK 5m) - Drag-through benefit of restructuring - Supply constraints - Currency - Growth pressure on accounts receivable - CAPEX to fund growth Concentric AB Built on a solid foundation A streamlined business A focused strategy towards growth 14 20 May 2011 Strongly impacted by the downturn... In Q1 2009 sales fell by 31% versus Q1 2008 Reaching a low point in Q3, 2009 where sales fell 46% year-on-year Throughout this difficult period, robust management action ensured that the business remained consistently cash generative In 2009, the business generated SEK 64m of operating free cash flow despite the fall in sales 15 20 May 2011 ... but decisive actions have been taken Blue Collar staff and variable overheads were flexed in line with sales Reduced headcount from 2,662 employees in April 2008 to 1,156 employees by the end of 2010 Protected key staff and know-how, to secure growth post the Recession Material escalator pass through agreements, were driven through the customer base Won opportunistic new contracts from competitor distress Removed surplus and non value adding capacity Sold majority interest in operation in Qingzhou, China and closed a manufacturing plant in Statesville, USA 16 20 May 2011 Lean Operational Structure Decentralized organization - all sites profit and cash accountable Supported by best practice, in design and manufacturing Ian Dugan Finance, IR & IT David Bessant HR Melissa Dunn Engineering David Williams/Bill Pizzo Strategy Brian Nelson Americas Len Mason Europe David Woolley China Kevin Johanson Alfdex JV Mats Ekeroth Suzhou Landskrona Rockford Itasca USA USA 17 20 May 2011 Birmingham UK Hof Germany Skanes Sweden Pune India China Sweden Concentric AB Built on a solid foundation A streamlined business A focused strategy towards growth 18 20 May 2011 Vision - Leading the Way Mission Concentric AB is a global company specialising in fluid dynamics and fluid power technologies that provide better fuel economy, emissions reduction, vehicle control and productivity in trucks, buses and agricultural and other off-road vehicles We are a global leader specialising in engines and hydraulics, delivering custom solutions in application niches where we add value to the customer’s products Vision To remain the industry global leader providing innovative energy saving technology via a global manufacturing footprint adjacent to our customer Technology + Innovation = Sustainability Strong sense of ethics Values Respect for the individual Elimination of waste 19 20 May 2011 Market Drivers Positive Underlying Growth Environment and Regulation Emission limit, Regulation Concentric pursues a strategy of continuous product development to enable our customers to meet and exceed increasingly stringent environmental requirements. The company is a world leader in this area and offers a portfolio of competitive products that contribute to more efficient emission control, superior fuel economy and noise reduction Global infrastructure growth Continued infrastructure growth, particularly in developing economies will continue to stimulate long-term growth for the Company’s products used in transportation, mining, construction, agriculture and power generation sectors, above GDP growth Forecasted Real GDP growth (% change, year on year) Country/ region 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Brazil 3.2 4 6.1 5.2 -0.6 7.5 4.5 4.1 4.1 4.2 4.2 China 11.3 12.7 14.2 9.6 9.2 10.3 9.6 9.5 9.5 9.5 9.5 Euro area 1.7 3.1 2.9 0.4 -4.1 1.7 1.6 1.8 1.8 1.9 1.8 India 9.2 9.7 9.9 6.2 6.8 10.4 8.2 7.8 8.2 8.1 8.1 Japan 1.9 2 2.4 -1.2 -6.3 3.9 1.4 2.1 1.7 1.5 1.3 Unites States 3.1 2.7 1.9 0 -2.6 2.8 2.8 2.9 2.7 2.7 2.7 Source: International Monetary Fund, World Economic Outlook Database, April 2011 20 20 May 2011 A Focused Strategy Market leading positions in both diesel engine and hydraulic pumps, enables Concentric to take full advantage of strong underlying market growth and to leverage its technology to meet increasingly stringent environmental demands Maintain a diverse spread of end-markets and geographic activity to reduce economic and legislative cyclicality of revenues a competitive cost structure and maximize operational leverage to drive profit and cash conversion a leading position in the premium hydraulic pumps segment in both North America and Europe Use the existing infrastructure to expand the scope for specialist hydraulic gear pumps in India, China and Brazil Actively explore complimentary bolt on acquisitions 21 20 May 2011 Financial Targets Targets (over a business cycle) Comments 7% CAGR Calculated on a constant currency basis and driven by new emissions legislation and global infrastructure growth Operating income (EBIT) 11% EBIT margins Calculated on a constant currency basis and driven by a lean manufacturing operation supported by global sourcing and cost effective design Capital structure Debt/equity ratio < 1.0 Organic Growth Dividend 22 20 May 2011 1/3 of net income 2011 Outlook Comment Applied to Concentric’s business mix, underlying market statistics currently indicate around 11 percent growth in constant currencies for the full year 2011 versus the full year 2010 23 20 May 2011 Summary – Well Positioned for Growth Built on a solid foundation A clear history of delivering profit and cash through the business cycle Streamlined during the financial crisis Experienced management, decisive and quick to act Maintaining lean structures to maximise drop-through as volumes recover A focused strategy towards growth 24 20 May 2011 - Products, people, resources, markets and customers, all developed and moving forward - Clear and transparent drivers of growth, strong history of successful execution Appendix 25 20 May2011 Appendix Financial Performance Key figures 2011 2010 2010 2009 SEK m Q1 Q4 Full year Full year Net sales 554 520 1,977 1,406 EBITDA 84 73 252 28 66 53 151 -79 Operating free cash flow 44 125 272 64 Working capital 8 6 6 50 1,077 1,132 1,132 1,363 282 312 312 510 1) Operating income 2) Capital employed Net debt 1) 2) 2) 1) Before items affecting comparability (demerger costs, restructuring expenses and capital losses) 2) Pro forma financial information 26 20 May 2011 Appendix Financial Performance Key metrics Sales Growth 2) Operating margin ROCE 2010 2010 2009 Q1 Q4 Full year Full year 11.5% 1) EBITDA margin 2011 2) 2) Working capital as % of sales Debt/equity ratio 3) 3) 53.0% 15.1% 14.0% 12.7% 2.0% 11.9% 10.2% 7.6% (5.6)% 16.5% 12.1% 12.1% (4.4)% 0.4% 0.3% 0.3% 0.6% 39.0% 41.5% 41.5% 67.5% 1) Like-for-like sales growth, constant currency 2) Before items affecting comparability (demerger costs, restructuring expenses and capital losses) 3) Pro forma financial information 27 20 May 2011 Any Questions 28 20 May2011