Consulting Services

advertisement

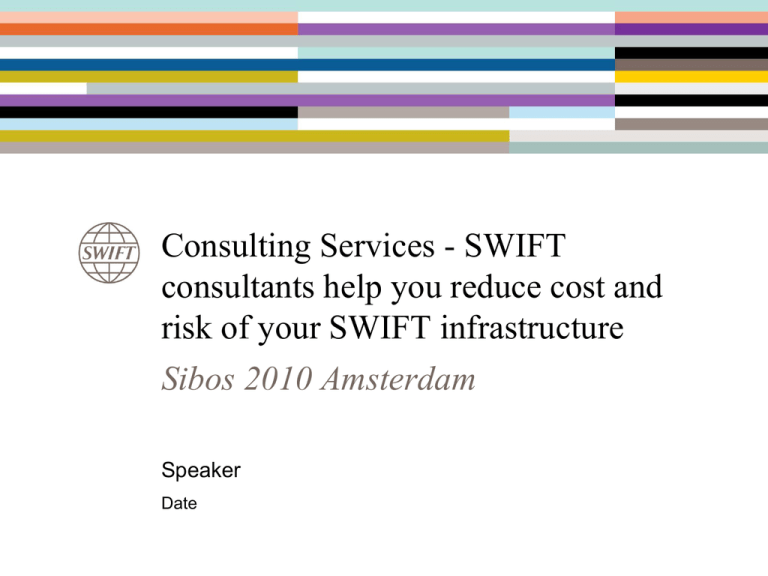

Consulting Services - SWIFT consultants help you reduce cost and risk of your SWIFT infrastructure Sibos 2010 Amsterdam Speaker Date Consulting Services • Instrumental for the 2015 strategy and execution, enabling: – Interoperability – TCO reduction Agenda & Speakers • Introducing Consulting Services Kurt Ryelandt, Head of Consulting Services EMEA, SWIFT • Testimonial from Groupe BPCE Fabrice Denèle, Head of Payments Retail Banking Coordination Department • Testimonial from J.P. Morgan Nigel Hayward, Managing Director Treasury Services Technology Agenda & Speakers • Introducing Consulting Services Kurt Ryelandt, Head of Consulting Services EMEA, SWIFT • Testimonial from Groupe BPCE Fabrice Denèle, Head of Payments Retail Banking Coordination Department • Testimonial from J.P. Morgan Nigel Hayward, Managing Director Treasury Services Technology SWIFT Services New Initiatives Business Opportunities Reputation Risks Total Cost of Ownership Operational Efficiency STP Operational Risks Internal Inefficiencies Project Lifecycle SWIFT Services can assist you at every step Assess Analyse Design Implement Go live Business & Technical Consulting Project Management Implementation Training Support Maintain Project Lifecycle SWIFT Services can assist you at every step Assess Analyse Design Implement Go live Business & Technical Consulting Project Management Consulting Services Implementation Training Support Maintain Business Consulting Improve your business processes Assess Analyse Securities Design Payments Optimising your Reviewing your Business &Consulting Technical Consulting Funds Distribution Payments STP Operations Best Practice Implement Maintain Treasury Go live & Benchmarking Reviewing your Treasury Operations Traffic & Data Benchmarking Reviewing Correspondent Banking Operations Reviewing your Corporate Actions Optimising Accord for Treasury Messaging Landscape Analysis E&I Value Review Assessing the impact of Target-2-Securities Accord Health Check Leveraging SWIFT Governance … … … … Technical Consulting Reduce your total cost of ownership • Auditing your SWIFT infrastructure Assess Analyse Design Implement Go live Maintain • Prepare for Alliance Access 7.0 • Alliance Access Options Value Review Interface & Connectivity • Analysing your messaging/infrastructure capacity • Reviewing your messaging architecture Business & Technical Consulting • … BCP & Security Architecture & Cost • Reviewing your business continuity and disaster recovery processes • Implementing Security Best Practices • Analysing and benchmarking your total cost of ownership • Consolidating your SWIFT infrastructure Packaged Consulting Services “Grey-hair projects” • Frequently performed studies – Built on internal intellectual capital – Predictable planning • For each step of a project phase • In each area of interest – Business and/or Technical – Implementation, Project Management • Proven value • Appreciated by customers • Opportunity to benchmark within each package Flexibility of package is discussed during scoping meeting Tailor-made Consulting Services Fixed price projects or Time & Material Strategic Workshop • • • • Targets, plans & strategy Issues & challenges Opportunities / market trends Influencing factors • Topic selection • Scope definition • Key stakeholders Service Proposal • • • • Focus / priorities Charges & resources Planning & governance Deliverables vs expectations • Project timing • Project content • Costs Initial scoping meeting is critical Agenda & Speakers • Introducing Consulting Services Kurt Ryelandt, Head of Consulting Services EMEA, SWIFT • Testimonial from Groupe BPCE Fabrice Denèle, Head of Payments Retail Banking Coordination Department • Testimonial from J.P. Morgan Nigel Hayward, Managing Director Treasury Services Technology Case Study – Groupe BPCE Presentation title – dd month yyyy – Confidentiality: xxx 13 Creation of the BPCE Group in 2009 A clear case for rationalisation with 10 SWIFT infrastructures in France SWIFT infrastructures BPCE Group Banque Chaix Banques Populaires et Natixis Banque Dupuy Caisses d’Epargne Banque BCP Banque de Savoie BRED Planet Link Service Bureau Credit Coopératif Banque Palatine SWIFT Consulting Services Reducing BPCE’s Total Cost of Ownership • Neutral assessment of BPCE Group SWIFT infrastructures • Recommendations for consolidation and further fine-tuning of withheld infrastructure(s) • Benchmarking against best practices • Migration roadmap • Input for Business Case SWIFT Infrastructure Rationalization Results for BPCE • Reduced total cost of SWIFT infrastructures of EUR 3.85 Mio (more than 50%) • Tangible recommendations to further optimise the BPCE setup • Independent and neutral analysis • Clear migration roadmap minimising operational impact SWIFT Consulting Team Value Added Results for BPCE • Clear identification of BPCE Group strength • Valued recommendations to increase the BPCE Group strength • Consideration of tools around SWIFT infrastructure • Efficiency and low footprint toward the bank operational teams Agenda & Speakers • Introducing Consulting Services Kurt Ryelandt, Head of Consulting Services EMEA, SWIFT • Testimonial from Groupe BPCE Fabrice Denèle, Head of Payments Retail Banking Coordination Department • Testimonial from J.P. Morgan Nigel Hayward, Managing Director Treasury Services Technology Case Study – J.P. Morgan Presentation title – dd month yyyy – Confidentiality: xxx 19 JPMorgan Chase & C° Lines of Business JPMorgan Chase & Co. J.P. Morgan JPMC STRATEGIC MESSAGING PROGRAM Investment Bank Chase Treasury & Securities Services Asset Management Retail Financial Services Card Services Commercial Banking Businesses: Businesses: Businesses: Businesses: Businesses: Businesses: • Investment banking • Worldwide Securities Services • Investment management • Home lending • Credit card • Middle market banking • Business banking • Merchant acquiring – Advisory – Debt & equity underwriting • Treasury Services – Institutional – Retail • Market-making and trading – Fixed income • Mid-corporate banking • Auto finance • Private banking • Education finance • Private wealth management • Consumer banking • Commercial real estate banking • Chase capital – Equities • Chase equipment leasing • Bear stearns private client services • Corporate lending • Prime brokerage • International banking • Broker dealer services • Community development banking Worldwide Securities Services Treasury Services • Reporting & information • Deposit products, escrow services services • Procurement solutions • Global payments & • Trade services collections • Liquidity & investments • Document management solutions • Document management • E-commerce & outsourcing solutions solutions • Global custody • Derivative services • Fund services • Hedge fund administration • Securities lending • Performance measurement • Compliance reporting • Private equity funds administration • Transfer agency • Transition management • Depositary receipts • Clearance • Outsourcing solutions • Collateral mgmt • Commission recapture • Futures & options clearance • Foreign exchange Our Business Overview About Treasury & Securities Services (TSS) Treasury Services (TS) in Brief • TSS generates more than $8 billion in revenue annually • The TS Business provides payment, collection, liquidity management, trade finance, commercial card and information solutions and is a global leader in custody, securities lending, fund accounting and administration, as well as in treasury services • Our clients span corporations, financial services institutions, middle market companies, small businesses, governments and municipalities worldwide JPMC STRATEGIC MESSAGING PROGRAM • TSS supports the needs of institutional clients worldwide and is one of the top three providers in both of its businesses: • TS has more than 14,300 employees, operating in over 60 countries, servicing 100,000+ clients – Treasury Services (TS) and; – Worldwide Securities Services (WSS) Global Financial Messaging (GFM) Legacy JPMC Global SWIFT FIN Infrastructure • Within TS, GFM was established to manage the Firm-wide SWIFT messaging service US • Continued effort to rationalise the Firm’s messaging systems has led to the current 2 region deployment, simplifying Technology and Operational functions LoB Apps • FIN processing peaked at 55million messages in May 2010, with continuing steady growth from 20million in 2005 at 15% year-on-year LoB Apps • All GFM messaging systems support over 200 delivery feeds from over 70 applications LoB Apps US US Messaging SWIFT CBT Hub SWIFT Gateways SWIFT Asia EMEA 4 EMEA EMEA SWIFT Messaging SWIFT CBT Gateways Hub Challenges in Financial Messaging in Today's Environment Reduce Technology Risk JPMC STRATEGIC MESSAGING PROGRAM • • • Ensure sufficient capacity to meet planned business growth Increase Business Resiliency • Drive the technology platform towards support of a continuous service model – Remove impact of unit failure through Remove “end of life” technology components an active-active configuration – Introduce load balancing capability Improve service agility to respond to client needs across the global environment – Reducing maintenance windows • Improve cross-region failover/recovery capability across messaging application stack – Better management of redundancy in globally deployed resources Solution: Offer a truly Firm-wide shared service capability managing global message volumes and local market needs How has SWIFT helped us? Product Offering • • Market leading product for SWIFT integration – SAA Feature enhancements through collaborative teaming – SAA health monitor web services. Exemplary product service with on-time delivery to project team JPMC STRATEGIC MESSAGING PROGRAM – SAA Standalone customisation for coupling with JPMC strategic middleware Professional Services • • • Shaping end-state solution proposal & program structure Solution architecture direction and SWIFT design ratification Provision of IT expertise for product configuration reviews and performance tuning Support Services • • • • Pre-implementation health checks Involvement in operational readiness reviews FIN capacity planning – integral to JPMC knowledge base development Seamless integration of new products into the existing service model JPMC PoV Where SWIFT Consulting really added value Inception & Scoping Planning & Requirements Design & Build Testing Implementation JPMC STRATEGIC MESSAGING PROGRAM Inception & Scoping • • • Significant role in leading the solution proposal Close partnership moving into project execution - advising JPMC on delivery risks Early Proof-of-Concept model to underwrite their solution Planning & Requirements • • Invaluable solution architecture expertise for designing a SWIFT FIN middleware solution SWIFT product gap analysis against JPMC requirements Design & Build • • Continued participation bridging divide between technical requirements & product possibilities Good oversight of early performance benchmarking So why SWIFT Consulting & Alliance Access? Solution Integrity • SWIFT recognise the market demand for multi-threaded processing of traffic JPMC STRATEGIC MESSAGING PROGRAM • SAA product roadmap aligns with JPMC interests to create a global capability of ‘alwayson’ processing centres Trusted Partnership & Capability Certainty in Delivery Sound Business Case SWIFT have a proven Enabler for JPMC to track record supporting meet its objectives for JPMC with the right increased resiliency people when and and capacity and where they are required internal financial working together as a single team requirements Conclusion Why Partnering with SWIFT Consulting - Benefits Leverage the knowledge and experience of SWIFT from those who live it on a daily basis TAP into SWIFT’s business, technical & product expertise to execute your strategy • Hands-on knowledge of designing, implementing and running vs a theoretical approach • Increase operational efficiency and STP • Improve scalability and resilience • Cost-benefit analysis – rapid ROI • Reduce your total cost of ownership (TCO) • Alignment with best practices • Identify opportunities for growth • Improve client service • Reduce risk Questions Visit us at the SWIFT stand Christian Sarafidis Kurt Ryelandt Global Head of Consulting Services Head of Consulting Services EMEA SWIFT SWIFT Av Adèle 1 B-1310 La Hulpe Belgium T F M E W +32 2 655 3908 +32 2 655 3752 +32 475 287 609 christian.sarafidis@swift.com www.swift.com T F M E W Yves Smeyers Marco Attilio T F M E W Av Adèle 1 B-1310 La Hulpe Belgium +32 2 655 3123 +32 2 655 3752 +32 476 292 319 kurt.ryelandt@swift.com www.swift.com Lead Consultant Consulting Services, EMEA Lead Consultant Consulting Services, EMEA SWIFT SWIFT Av Adèle 1 B-1310 La Hulpe Belgium +32 2 655 3617 +32 2 655 3752 +32 496 50 59 20 marco.attilio@swift.com www.swift.com Av Adèle 1 B-1310 La Hulpe Belgium +32 2 655 4241 +32 2 655 3752 +32 476 896 084 yves.smeyers@swift.com www.swift.com T F M E W Questions Visit us at the SWIFT stand T F M E W Edward Adams Pat Antonacci Director Sales Services Americas SWIFT Americas Senior Business Consultant Consulting Services, Americas SWIFT Americas 7 Times Square, 45th floor New York, NY 10036 United States 7 Times Square, 45th floor New York, NY 10036 United States +1-212-455-1847 +1-212-455-1817 +1-917-607-1649 edward.adams@swift.com www.swift.com T F M E W Pierre Blum Barry Silberstein Lead Consultant Americas SWIFT Americas Senior Consultant Consulting Services, Americas SWIFT Americas 7 Times Square, 45th floor New York, NY 10036 United States T F M E W +1-212-455-1971 +1-212-455-1817 +1-646-509-0969 barry.silberstein@swift.com www.swift.com +1-212-455-1947 +1-212-455-1817 +1-347-277-4957 pat.antonacci@swift.com www.swift.com T F M E W 7 Times Square, 45th floor New York, NY 10036 United States +1-212-455-1972 +1-212-455-1817 +1-646-593-1269 pierre.blum@swift.com www.swift.com Questions Visit us at the SWIFT stand Patrick Yeh Head of Consulting and Training Asia Pacific SWIFT Hong Kong 31/F, One IFC, 1 Harbour View Street Central, Hong Kong People’s Republic of China T F M E W +852-2107-8707 +852-2107-8733 +852-9195-3649 patrick.yeh@swift.com www.swift.com Questions & answers ? Thank you