Plenary speech

advertisement

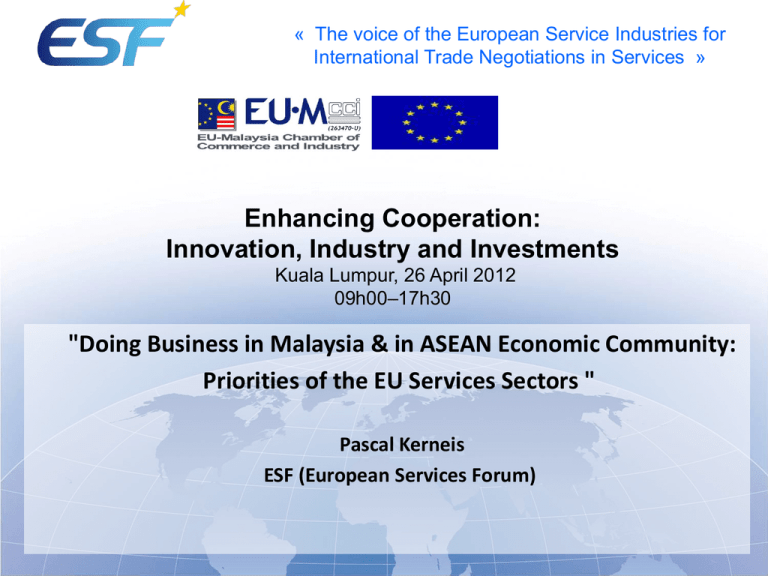

« The voice of the European Service Industries for International Trade Negotiations in Services » Enhancing Cooperation: Innovation, Industry and Investments Kuala Lumpur, 26 April 2012 09h00–17h30 "Doing Business in Malaysia & in ASEAN Economic Community: Priorities of the EU Services Sectors " Pascal Kerneis ESF (European Services Forum) « The voice of the European Service Industries for International Trade Negotiations in Services » ESF Membership covers a large range of services sectors and Horizontal federations: • Insurance • Banking • Business services: IT & Computer; consulting, advertising, after-sales services, News Agencies • Professional services: Legal services, Accountants, Architects, Engineers, etc. • Construction services • Distribution services • Postal & Express Delivery • Audio-visual services • Energy related services For more information, see www.esf.be • • • • • Environmental services Telecommunication services Tourism Air Transport Maritime Transport & • • • • • BUSINESSEUROPE Confederation of Danish Industries (DI) Confederation of Finnish Industries (EK) Confederation of Swedish Enterprises (SN) Irish Business and Employers Confederation (IBEC • Confederation of French Enterprises (MEDEF) « The voice of the European Service Industries for International Trade Negotiations in Services » ESF MEMBERS INCLUDE: For more information, see www.esf.be « The voice of the European Service Industries for International Trade Negotiations in Services » World Economy: Percentage of GDP by Sector - 2011 « The voice of the European Service Industries for International Trade Negotiations in Services » THE IMPORTANCE OF THE EU IN GLOBAL SERVICES TRADE If we take intra and extra EU together, EU export of services represent 42% of global export of services EU is by very far the biggest exporter of services: 24% of world export of services Services Exports in Millions $US - Source: World Bank & WTO « The voice of the European Service Industries for International Trade Negotiations in Services » INTEGRATION BOOSTS SERVICES TRADE • Text • Text 58% 42% – Text In Yellow is the EU Internal Market on Trade in Services (58% of total) 6Source: Eurostat 26 April 2012 « The voice of the European Service Industries for International Trade Negotiations in Services » Outflows of FDI to the world - $ Billion – Source: OECD Share of EU in World FDI Outflows Share of services in EU FDI “Other” is also: electricity, gas, water, construction, real estate… = Partly services 70% 70% 70% 53% 54% Extra EU outward FDI stock of the EU - € Billion – Source: Eurostat « The voice of the European Service Industries for International Trade Negotiations in Services » Integration facilitates investment EU Member States Services FDI stocks destination Outside EU 35% Origination of FDI stocks held inside EU From outside EU 33% Inside EU 65% Source: Eurostat Would From inside EU 67% Source: Eurostat that scenario also apply to AEC after 2015? «« The of of thethe European Service Industries for for Thevoice voice European Service Industries International Trade Negotiations in Services » International Trade Negotiations in Services » Current EU Trade Policy Only 30 Countries, not 153 WTO Members! •China •Taiwan •Saudi-Arabia •Vietnam •Ukraine •Cambodia •CariForum (15) •Korea •Columbia •Peru . Ukraine . Morocco . Egypt . Georgia . Jordan . Moldova . Tunisia (EU “Acquis”) •Canada •India •Singapore •Central America (6) •Mercosur (4)(?) •Malaysia •Russia •Kazakhstan (?) •Japan (?) •Indonesia(?) •Thailand(?) •Vietnam •Philippines(?) •Taiwan (?) •Mexico •Chile DDA+ Market access level WTO UR (1995 1997) DDA Offers (July 2008) WTO Accession since 2001 Multilateral Old EU FTA US FTA + •US Parity •Market Acc + •Public Proc + •Mode 4 + New EU FTAs Bilateral •Market Acc + •Public Proc.+ •IPR + •BIT + •SOE + •Reg. Coop. + « The voice of the European Service Industries for International Trade Negotiations in Services » EU Bilateral Trade Agreements Canada Ukraine Georgia, Moldova USA Japan Korea GCC suspended Cariforum (15) Mexico India Vietnam Philippines Thailand Central America (6) Colombia Singapore & Malaysia Mercosur (4) Peru EPAs +/-50: •WAEMU •CEMAC •COMESA •EAC •SADC Indonesia EPA Pacific (14) Chile The EU FTA Negotiations are covering a very large number of countries, including key emerging countries (Russia PCA, BIT with China?) EU: (27) EPAs with ACP: Implemented FTA: (18) Concluded FTA: (64) FTA under negotiations : (18) “Scoping Exercise”: (9) (5) « The voice of the European Service Industries for International Trade Negotiations in Services » EU Services Exports and Imports per sectors (2010 - € 1 000 million) 40% « The voice of the European Service Industries for International Trade Negotiations in Services » ASEAN Countries are already big exporters of services Countries Value (US$ Bio) World share (%) World rank EU 685 24,4 1 Singapore 112 4 6 Thailand 34 1,2 15 Malaysia 33 1,2 17 Indonesia 16 0,6 23 Philippines 13 0,5 27 Vietnam 7 0,3 37 ASEAN 6 215 7,6 3 USA 518 18,5 2 China 170 6,1 3 Source: WTO – ITS 2011 ASEAN Specific Commitments in the U. R. (or upon accession) Sectors Max Poss. Brunei 1 2 46 26 7 6 5 5 5 4 16 14 17 5 4 5 3 4 24 11 5 Cambodia (LDC) 24 Indonesia « The voice of the European Service Industries for 3 International 4 5 6 Trade7 Negotiations 8 9 in Services 10 11 » Total Laos (LDC) Malaysia 23 5 4 15 1 3 15 2 Not yet a WTO Member 23 1 2 5 35 162 1 19 1 11 2 88 54 2 65 3 47 60 66 23 16 2 2 2 3 1 2 1 15 2 11 2 2 16 107 Myanmar (LDC) Philippines 4 Singapore 7 20 15 5 ? Thailand 21 6 3 1 3 4 13 Vietnam 26 22 5 4 4 3 21 2 1: Business Services; 2: Communication Services; 3: Construction & Related Engineering Services; 4: Distribution Services; 5: Education Services; 6: Environmental Services; 7: Financial Services; 8: Health Services, etc.; 9: Tourism, etc.; 10: Recreational Services, etc.; 11: Transport Services; 12: Other Services « The voice of the European Service Industries for International Trade Negotiations in Services » IMPORTANCE OF SERVICES IN A SUSTAINABLE DEVELOPMENT Attract FDI in Infrastructure Attract transfers of expertise services: and of know-how of foreign • Telecoms, IT related service suppliers, which in services, turn initiate: • Logistics (Transports, Express Courier, Distribution, etc.), •Local jobs creations • Energy distribution network, •Staff vocational training, etc. • Water and Waste •Better quality of the services, management, • Financial services System, •Cheaper services, etc. •More choice for the • Tourism (Hotel, travel, consumers leisure, etc.) •Reduction of the cost of doing Experience shows that foreign service suppliers business for local SMEs. that invest in a country do it for a long period. « The voice of the European Service Industries for International Trade Negotiations in Services » Main barriers to FDI/Establishment (Mode3) in Services Sectors: • Obligation to enter the market through joint venture • Limitations on capital ownership • Limitations on licences allotted to foreign companies • Restrictions on branching, • Lack of National Treatment in many services sectors • Local employment requirements • Long and burdensome administrative procedures • Restrictions on real estate access • Lack of transparency in domestic regulation (economic needs tests, etc.) « The voice of the European Service Industries for International Trade Negotiations in Services » • • • • • • • • List of criteria that a CEO looks at when taking a decision to invest in a developing countries: Potential market (size, income per capita, follow the demand, i.e. corporate customers) Existing competition, special treatment for local players Benefits prospects at short, medium and long terms Good governance (level of corruption, transparency of the legislation, etc.) State of the regulation (existing barriers at all levels, independent regulatory authority, implementation of the regulations, i.e. Regulatory Certainty) FDI incentives (special zones, tax incentives, corporate tax, etc.) Business Environment (incl. availability of human capital, level of education) Country Risk Assessment: political stability, GATS/Trade agreement sector specific binding commitments, BITs, etc. i.e. the GATS/BITs/FTAs Commitments are only additional criterion for companies to tick. But they can often make the difference. For the Developing countries, it is an additional opportunity to seize as to attract FDI. 1. • • • • 2 3 • • 4 5 • 6 • • • • SERVICES SUB-SECTORS FOR LIBERALISATION announced by PRIME MINISTER (April 2009) Business Services « The voice of the European Service Industries for Regional Distribution Centre (CPC 87909). International Trade in Services Total = 6 Negotiations services sectors, not 27;» International Procurement Centre (CPC 87909). Technical Testing and Analysis Services (CPC 8676). Autonomous liberalisation for Management Consulting Services (CPC 8650). Commitment at 5 digit level, i.e. Computer and Related Services extremely restrictive ! (CPC 841; 842; 843; 844; 845; 849). Health and Social Services All veterinary services (CPC 9320). Welfare services to old person and the handicapped (CPC 93311); to children (CPC 93312); Child day-care services (CPC 93321); Vocational rehabilitation services for handicapped (CPC 93324). Tourism Services Theme Park (CPC 96194); Convention and Exhibition Centre (CPC 87909); Travel Agencies and Tour Operators Services (For inbound travel only) (CPC 7471); Hotel and Restaurant services (for 4 and 5 star hotels only) (CPC 64110 and CPC 64199); Food Serving Services (for services provided in 4 and 5 star hotels only) (CPC 642 643). Sporting and other recreational services Sporting Services (CPC 9641) (Sports event promotion and organisation services) Transport Services Class C Freight Transportation (Private Carrier License – to transport own goods) (CPC 7123). Rental/Leasing Services without Operators Rental/Leasing services of ships that excludes cabotage and offshore trades (CPC 83103); Rental of cargo vessels without crew (Bareboat Charter) for international shipping (CPC 83103). Supporting and Auxiliary Transport Services Maritime Agency services (CPC 7454). Vessel salvage and refloating services (CPC 7454). Sector-by-Sector Analysis of Malaysia GATS DDA Revised Offer « The voice of the European Service Industries for International Trade Negotiations in Services » 1) Professional and Business Services • • Legal Services - No new offer since the UR – very limited commitments Accounting, Auditing and Bookkeeping Services – No new offer since the UR – very limited commitments • Taxation Services – No new offer since the UR • Architectural and Engineering services – New offer - Weak offer • Computer and Related Services – acceptable offer • Other Business Services - No offer – not enough 2) Communications Services • Postal and courier services – Nothing new - no commitment in the Uruguay Round – weak offer • Telecommunications – Nothing new - Weak offer • Audiovisual – Nothing new 3) Construction Services – Weak offer 4) Education services – limited offer 5) Distribution Services - Nothing new - no commitment in the Uruguay Round, Bad Offer 6) Environmental Services – Nothing new – No commitment in the UR - Disappointing offer 7) Financial Services and Insurance – Weak offer 8) Health Services – Weak offer 9) Tourism Services – Nothing new – Disappointing offer 10) Transport services – No offer – weak offer Liberalisation package for the financial sector announced in April 2009: The voice the European Service for • Issuance of new licences to«strong andof world-class players in Industries categories:International Trade Negotiations in Services o In 2009, up to 2 new Islamic banking licences to foreign players to » establish new Islamic banks with paid-up capital of at least USD1 billion; o In 2009, up to 2 new commercial banking licences to foreign players that will bring in specialized expertise; o In 2011, up to 3 new commercial banking licences to world class banks that can offer significant value propositions to Malaysia; and o In 2009, up to 2 new family takaful licences. • Flexibility will be accorded for an increase in the foreign equity limits from 49% to 70% of investment banks, Islamic banks, insurance companies and takaful operators. The foreign equity limit for domestic commercial banks will remain at the current 30%; • Locally incorporated foreign commercial banks will be allowed to establish 4 new full-fledged branches with effect in 2010 and 10 microfinance branches with effect from this year; • Labuan offshore players be given flexibility to establish an operational and management office in Kuala Lumpur; • Greater flexibility will also be accorded for employment of expatriates in specialist areas that can contribute to the development of the financial sector. Autonomous Reform = complex and very limited Concrete examples of restrictions in Financial Services in Malaysia: • Malaysia: Banking: 30% foreign equity cap; • Malaysia: Banking & Insurance: Restriction to acquire shares in any other commercial or merchant bank (5%) « The voice of the European Service Industries for International Trade Negotiations in Services » The European Services Companies would like therefore that Malaysia and ASEAN countries: • substantially improve offers in the current DDA round; • accept to bind existing practice, i.e. consolidation under the WTO rules all autonomous domestic reforms that have been undertaken since the end of the UR FS in 1997; • create new business opportunities by allowing at least foreign equity majority ownership (51%); • consider doing in regional EU-ASEAN RTA or in bilateral negotiations with the EU what is believed not doable in the WTO. « The voice of the European Service Industries for International Trade Negotiations in Services » THANK YOU FOR YOUR ATTENTION ! Pascal KERNEIS Managing Director European Services Forum – ESF 168, Avenue de Cortenbergh B – 1000 – BRUSSELS Tel: + 32 2 230 75 14 Fax: + 32 2 320 61 68 Email: esf@esf.be : Website www.esf.be