Chapter 3

External Analysis:

Industry Structure, Competitive Forces, and Strategic Groups

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Exhibit 3.1 The Firm Embedded in

Its External Environment

3-2

Political/Legal Factors

Political environment

• Processes/actions of government that can influence the

decisions and behavior of firms

Legal environment

• Laws, mandates, regulations, and court decisions – all of

which can have a direct bearing on a firm’s profit potential

3-3

Economic Factors

Economy-wide phenomena, consisting of the following

five macroeconomic factors affecting firm strategy:

•

•

•

•

•

Growth rates

Interest rates

Levels of employment

Price stability (inflation and deflation)

Currency exchange rates

3-4

Strategy Highlight 3.1

How the Eurozone Crisis Is Hurting Companies

The EU (European Union) began its formation in the

early 1950s.

Today – The euro is the common currency used by 17

of the 27 EU member states.

2009 – Several European countries took on too much

debt and were unable to repay their credit obligations.

Strict austerity programs were enacted.

Banks tightened credit hampering firms worldwide.

3-5

ChapterCase 3

Courtesy of Tesla Motors

Tesla Motors and the U.S. Automotive Industry

With high entry barriers, the BIG THREE – GM, Ford,

and Chrysler – dominated the U.S. car market until the

1980s.

There have been no new recent entrants due to the

HIGH industry entry barriers.

Tesla Motors’ Model S received outstanding market

reception, and was awarded the 2013 MotorTrend Car

of the Year.

3-6

Sociocultural Factors

Sociocultural factors

• Capture cultures, norms, and values for society; are

dynamic and differ across groups.

• Implications for firm strategy must be considered.

Demographic trends

• Capture population characteristics related to age, gender,

family size, ethnicity, sexual orientation, religion, and

socioeconomic class.

3-7

Technological Factors

Technological factors

• Capture the application of knowledge to create new

processes and products.

Innovations in process technology

• Lean manufacturing, Six Sigma quality, and biotechnology.

Nanotechnology revolution

• (Initial stages) Major upheaval for several industries –

medical devices to new-age materials for earthquakeresistant buildings.

3-8

Ecological Factors

Broad environmental issues, e.g., the natural

environment, global warming, and sustainable

economic growth

Business and natural worlds are interdependent and

inextricably linked.

Managing these relationships in a sustainable manner

directly influences the continued existence of human

societies and the organizations we create.

3-9

Exhibit 3.2 Porter’s Five Forces Model

3-10

FIVE FORCES MODEL –

MICHAEL PORTER

A framework for identifying the five forces that

determine industry profit potential and help shape

firm competitive strategy

This model intersects:

• Theory: industrial organization economics with

• Practice: hundreds of case studies

Managers can predict industry profit potential and

position their firms for sustainable competitive

advantage.

3-11

3.2 Industry Structure and Firm

Strategy: The Five Forces Model

Industry

• A group of (incumbent) firms that face the same set of

suppliers and buyers

Industry Analysis

• Identifies the industry's profit potential

• Derive implications for a firm’s strategic position within an

industry

Strategic Position

• A firm’s ability to create value (V) for customers while

containing costs (C)

Competitive Advantage = a large value gap (V - C)

3-12

INDUSTRY FORCES IMPACT FIRM PROFITABILITY

ATTRACTIVE INDUSTRY

Sustainable Competitive Advantage Easier

• High profit potential

• The weaker the five forces

UNATTRACTIVE INDUSTRY

Sustainable Competitive Advantage Harder

• Low profit potential

• The stronger the five forces

3-13

3-14

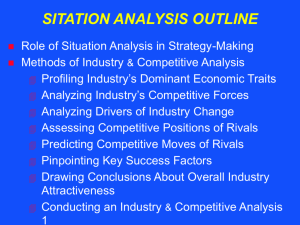

Chapter Outline

3.1 The PESTEL Framework

3.2 Industry Structure and Firm Strategy: The Five Forces

Model

3.3 Changes over Time: Industry Dynamics

3.4 Explaining Performance Differences within the Same

Industry: Strategic Groups

3.5 Implications for the Strategist

3-15

EXTERNAL ANALYSIS

MACRO

• PESTEL Framework

INDUSTRY ANALYSIS

• Five Forces Model

MICRO

COMPETITOR ANALYSIS

• Strategic Group Mapping

3-16

EXTERNAL ANALYSIS

MACRO

• PESTEL Framework

INDUSTRY ANALYSIS

• Five Forces Model

MICRO

COMPETITOR ANALYSIS

• Strategic Group Mapping

3-17

Strategy Highlight 3.2

The Five Forces in the Airline Industry

Low Entry Barriers

Powerful Suppliers

Powerful Buyers

Strong Substitute Threat

Intense Rivalry

RESULTS – Low overall industry profit potential, thus

an “unattractive” industry for investment.

3-18

Exhibit 3.3

Industry Competitive Structures along

the Continuum from Fragmented to Consolidated

3-19

Adding a Sixth Force:

The Strategic Role of Complements

COMPLEMENT

• A product, service, or competency that adds value when

used in tandem with the original product offering

Complementor – A firm that provides a good/service

that leads customers to value your firm’s offering

more when the two are combined

Co-opetition – Cooperation by competitors to

achieve a strategic objective

3-20

3.3 Changes over Time:

Industry Dynamics

The static five forces model cannot determine the

speed of change for an industry.

As consolidated industries tend to be more profitable

than fragmented ones, firms tend to change their

industry structures toward being more consolidated

through (horizontal) mergers and acquisitions.

Industry Profitability

Consolidation

3-21

INDUSTRY CONVERGENCE

• A process whereby formerly unrelated industries begin to

satisfy the same customer need

Driver: Technological advances

Example: Convergence of media industries due to

technological progress in IT, telecommunications, and

digital media

3-22

EXTERNAL ANALYSIS

MACRO

• PESTEL Framework

INDUSTRY ANALYSIS

• Five Forces Model

MICRO

COMPETITOR ANALYSIS

• Strategic Group Mapping

3-23

STRATEGIC

GROUP

Set of firms

pursuing a similar

strategy within a

specific industry

STRATEGIC

GROUP MODEL

Framework that

explains performance

differences within the

FIRM

same industry by

PERFORMANCE

clustering different

firms into groups

Determined not only

based on key strategic

by the industry to

dimensions

which the firm

belongs, but also by its

strategic group

membership

3-24

3.4 Explaining Performance Differences

Within the Same Industry: Strategic Groups

Firms in the same strategic group follow a similar

strategy.

Strategic group differences identify business-level

strategies.

Direct competitors – same strategic group firms

Intra-group rivalry exceeds inter-group rivalry:

• Rivalry among firms within a strategic group is more intense

than the rivalry between strategic groups.

3-25

MAPPING STRATEGIC GROUPS

1. Identify important strategic dimensions.

2. For the horizontal and vertical axes – select two key

dimensions which expose pivotal differences among

the competitors.

•

These dimensions should not be highly correlated.

3. Graph the firms in their strategic groups, indicating each

firm’s market share by the size of the bubble with which

it is represented.

3-26

The Threat of Entry

Entry barriers

• The risk that potential competitors will enter an industry

With new entrants, profit potential is depressed for

incumbent firms:

• Lower prices

• Spend more to satisfy existing customers

3-27

The Threat of Entry

Incumbent firms can benefit from several important

sources of entry barriers:

•

•

•

•

•

•

•

Economies of scale

Network effects

Customer switching costs

Capital requirements

Advantages independent of size

Government policy

Credible threat of retaliation

3-28

The Power of Suppliers

POWERFUL SUPPLIERS

Can demand higher prices for their inputs.

Capture part (sometimes a large part) of the economic

value created.

-

Signs of Strong Suppliers

Suppliers industry is concentrated.

They don’t depend heavily on the incumbent’s industry.

Incumbent firms face high switching costs.

Suppliers’ products are differentiated.

Limited substitutes.

Suppliers have credible forward integration threats.

3-29

The Power of Buyers

The bargaining power of buyers impacts industry profit potential.

POWERFUL BUYERS

Can demand a lower price or higher product quality

Reduce industry profit potential:

• Through price discounts (limited revenue)

• Through increased quality / better service (higher costs)

• As they capture part of the economic value created

3-30

THE POWER OF BUYERS EXAMPLES

Google

• Faces strong buyer power from Samsung who has 40% of

Android-operated smartphones

Walmart

• As the world’s largest retailer, it leverages huge buyer

power from its suppliers.

CEMEX

• Strong buyer power in the U.S. leaves it very small profits

• Weaker buyer power in Mexico yields much higher profits.

3-31

The Threat of Substitutes

This threat derives from products/services fulfilling the

needs of current customers from outside the industry.

POWERFUL SUBSTITUTES: THE POWER OF

SUBSTITUTES is HIGH when:

• Price-performance: Has an attractive trade-off.

• The buyer’s switching cost is low.

Substitutes limit the price that industry competitors can

charge for their products/services.

3-32

Rivalry among Existing Competitors

The intensity of rivalry among existing competitors is

determined largely by the following factors:

COMPETITIVE INDUSTRY STRUCTURE

INDUSTRY GROWTH

STRATEGIC COMMITMENTS

EXIT BARRIERS

3-33

COMPETITIVE INDUSTRY STRUCTURE

The structure of an industry is captured by:

• Number and size of industry competitors

• Pricing power possessed by firms

• Products/services offered by firms

(Commodity vs. differentiated product)

• Height of entry barriers

3-34

Mobility Barriers

Mobility barriers

• Restricts movement between groups; industry-specific

factors that separate one strategic group from another

Exhibit 3.5 – Airline industry strategic groups:

• Hub-and-spoke group with international routes

• Point-to-point airline groups do not

3-35

Exhibit 3.5

Strategic Groups and the Mobility

Barrier in the U.S. Domestic Airline Industry

3-36

ChapterCase 3

Courtesy of Tesla Motors

Consider This…

• Recent dynamics in the automotive industry have lowered the

profit potential, reducing its attractiveness.

• Tesla Motors has demonstrated how new technology can be

used to circumvent entry barriers.

• However, incumbent firms are also introducing hybrid or allelectric cars, further increasing rivalry in the industry.

3-37

3-38