Northern Cape – Industrial Development Corporation

advertisement

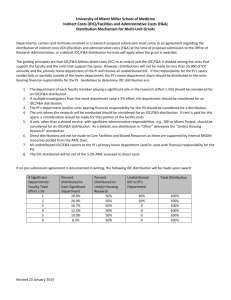

Jowell Tobias Regional Office: Northern Cape February 2014 IDC - Corporate profile • Established: October 1940 • Corporate type: Development finance institution, mandated by Act • Objectives: Increased industrial capacity • Activities: Provide risk capital to viable businesses in various sectors • Regional mandate: South Africa & the rest of Africa (since 1998) • Shareholding: Government of South Africa = 100% shareholder • Reporting: SA Ministry of Economic Development • Funding: 100% self-financing • Governance: Follows normal company policy and procedures Partnerships, Professionalism & Passion IDC Head Office, Sandton, SA Role of IDC’s Regional Office • Strategy for regional development • Proactively identify and support investment opportunities • Improve IDC’s efficiency & accessibility Convenience (district visits) Personal attention Package applications to conform to IDC norms Involve other stakeholders e.g. Landbank, NEF, IDC Regional Office, Kimberley DBSA, DoA, Water Affairs • Business Support • Represent all IDC sectors Sectoral focus Logistics Green and energy saving industries Bio fuels Clothing, textiles, footwear, leather Mining related technologies Biotechnology Cultural industries: Craft and film Business process services Automotives, components, medium and heavy commercial vehicles Advanced manufacturing Pharmaceuticals Healthcare ICT Agroprocessing Metals fabrication, capital and transport equipment Industrial infrastructure Forestry, paper & pulp, furniture Plastics and chemicals Tourism Legend: Mining Downstream mineral beneficiation IPAP New Growth Path 4 Strategic Business Units • • Agro Industries Forestry and Wood Products • • • • Metal, Transport and Machinery Mining and Minerals Beneficiation Textiles and Clothing Chemicals and Allied Industries • Tourism • Media and Motion Pictures • Information and Communications Technology • Venture Capital • Healthcare • Green Industries • Strategic High Impact Projects and Logistics Special IDC Schemes Gro-E Scheme • R10 billion available for 5 years • Loans @ Prime - 3% for the first 5 years • Equity @ 5% RATIRR • Capital and interest payment holidays as per financial needs of the business • Minimum = R3 million & Maximum of R1 billion per project • Business must have prospects of acceptable profitability to service its obligations • Cost per job created should not exceed R500 000 UIF Job Creation Fund Transformation and Entrepreneurial Scheme (TES) • R2 billion unsecured 5-year listed private placement bond • Women Entrepreneurial Fund (R400 million) • Cost per job of up to 450,000 will be eligible • People with Disabilities Fund (R50 million) • Pricing @ approximately 6.0% - 10.0% fixed; • Extent of discount is based on the risk and developmental impact • Development Fund (R250 million) • Equity Contribution Fund (R150 million) • Community Fund (R150 million) • Maximum = R100m • Only senior debt instruments • Client is expected to drawdown within 7 months after approval • B-BBEE certification from an accredited verification agency is required Distressed Funding • R6,1bn made available for companies negatively affected by the recent international financial crisis Gro-E Youth scheme • Earmarked R1 billion of the Gro-E scheme to businesses owned by young people (age less than 35); • Loans at prime less 3% to businesses; • Industries falling within IDC’s mandate; • Are creating new jobs; • Available to South African citizens; • Minimum amount for finance is R1 million; • Experienced entrepreneurs to join with the youth in establishing businesses to ensure that these new entrepreneurs are coached and mentored. Gro-E Youth scheme (cont.) Criteria and terms of the scheme: • Start-up businesses; • Existing businesses for expansionary purposes; • Businesses that demonstrate economic merit; • For the duration of the funding period; • Maximum cost per job does not exceed R500 000; • Broad-based Black Economic Empowerment certification, where applicable; • Businesses operating or expanding in South Africa; • Funding period will be structured to meet the cash flow needs of the business; • Appropriate capital and interest payment holidays will be applied; • There is no prescribed minimum for owner contribution; • Shareholding by youth of more than 50%. Business Support • Technical assistance (TA) for IDC clients; • Outsourced Consultants, Mentors, Coaches legal experts provide TA; • Training courses delivered through IDC Learning & Development (External) Dept.; • Training offered to investee members of the Board of Directors / Trustees, Management Team, middle management, supervisors & staff destined for promotion • Funding principle: Cost sharing between IDC and Client The norm is: 50% Grant funding and 50% Client own contribution; Client own contribution: business cash flow OR a low interest or zero rated loan. Appraisal & approval process Enquiry& Application Approval Legal Agreements Initial Screening Basic Assessment Due Diligence Term Sheet Disbursements Post Investment Management/ Business Support Green Energy Efficiency Fund (GEEF) • Programme supported by German Development Bank (KfW) • To support and promote energy efficiency and renewable energy investments • R500 million facility for energy efficiency and small scale renewable energy projects Conditions: • Financially viable energy efficiency projects • Private sector companies registered and operating in South Africa • Loans ranging from R1 million to R50 million • At a concessionary rate of prime less 2% • Repayments of up to 15 years, depending on the energy efficiency or renewable energy technology • Standard IDC fees, credit policies and procedures apply • Loans available in ZAR Thank you Industrial Development Corporation 13 Bishops Avenue, Kimberley PO Box 808, KImberley 8300 South Africa Telephone (053) 807 1050 Facsimile (053) 832 7395 E-mail kimberley@idc.co.za