CHAPTER

4

Internal Analysis:

Resources, Capabilities,

and Activities

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

LO 4-1 Distinguish among a firm’s resources, capabilities, core

competencies, and firm activities.

LO 4-2 Differentiate between tangible and intangible resources.

LO 4-3 Describe the critical assumptions behind the resource-based view.

LO 4-4 Apply the VRIO framework to assess the competitive implications

of a firm’s resources.

LO 4-5 Identify competitive advantage as residing in a network of firm

activities.

LO 4-6 Outline how dynamic capabilities can help a firm sustain

competitive advantage.

LO 4-7 Identify different conditions that allow firms to sustain their

competitive advantage.

LO 4-8 Conduct a SWOT analysis.

4-2

Chapter Case 4

From Good to Great to Gone:

• Circuit City

A GREAT performer from 1982 – 2000

World-class logistics & customer responsiveness

4S: service, selection, savings, & satisfaction

6 times better investment than GE under Jack Welch!

• Bankruptcy in fall of 2008!

Outflanked by firms like Best Buy and Amazon

4-3

Chapter Case 4

Circuit City

• What are the key issues in Circuit City’s

demise?

Management distracted by other businesses

Insufficient investments in core competencies

Laid-off 3,000 very experienced sales staff

Response to online retailers inadequate

Best Buy also having problems with this recently

4-4

INTERNAL ANALYSIS: Inside the Firm

• Comparing two firms in same industry:

Internal focus

Core Competencies

Unique strengths deep inside that differentiate a firm

Can drive competitive advantage

Strategic Fit

Internal strengths change with external environment

4-5

EXHIBIT 4.1

Creating Strategic Fit to Leverage Internal Strengths

4-6

Internal Analysis: Link to Superior Performance

• Combination of Resources & Capabilities

Builds core competencies

Competencies drive activities

To transform inputs into goods & services

Activities can produce competitive advantage &

performance

Reinvest profits from superior performance

Hone and upgrade core competencies

4-7

EXHIBIT 4.2 Linking Resources & Capabilities to Firm Performance

4-8

THE RESOURCE-BASED VIEW

• Tangible Resources

Visible, physical attributes

• Intangible Resources

No physical attributes

• Google Example

Tangible resources valued at $5 billion

Intangible brand valued at over $100 billion

Googleplex has BOTH tangible and intangible aspects

• Competitive Advantage More Likely…..

From INTANGIBLE resources

4-9

EXHIBIT 4.4 Tangible & Intangible Resources

4-10

Two Critical Assumptions in RBV

• Resource heterogeneity

Bundles of resources and capabilities differ across firms

Southwest Airlines & Alaska Airlines have different

resources

SWA

– Higher employee productivity

– Informal organization, pilots help load luggage

• Resource immobility

Resources tend to be “sticky” & don’t move easily

Southwest Airlines sustained advantage

Several decades superior performance

Competitors have unsuccessfully imitated SWA model

4-11

RBV – Also linked to Human Resources

• Firm Resources that can be part of the

competitive advantage.

Physical Capital Resources (plant, equipment,

finances)

Organizational Capital Resources(structure, planning,

controlling, coordinating, and HR systems)

Human Capital (skills, judgment, and intelligence of

employees)

(Barney & Wright, 1998)

1–12

What is the ultimate quest for the function

of the Human Resources Department in a

firm?

• Developing employees who are skilled and

motivated, who can deliver high quality products

and services.

• Developing and maintaining the culture of the

organization.

• The encouragement of teamwork and trust.

(Barney & Wright, 1998)

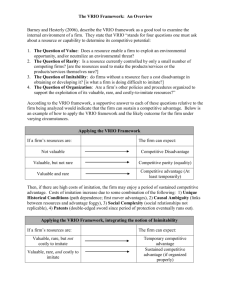

The VRIO Framework

• Valuable

Attractive features

Lower costs (& price)

Higher profits

Honda – design & build

engines

• Rare

Only a few firms

possess

Toyota – lean

manufacturing

Temporary competitive

advantage

• Costly to Imitate

Unable to develop or

buy at a reasonable

price

Apple – Yes

Crocs – No

• Organized to Capture

Exploit competitive

potential

Structure

Coordinating systems

Xerox PARC – No

Nintendo Wii – Yes

4-14

Summary of VRIO, Competitive Implications, and Economic Implications

Valuable?

Rare?

Costly to

Imitate?

No

Yes

No

Yes

Yes

No

Yes

Yes

Yes

Organized

Properly?

Competitive

Implications

Economic

Implications

No

Disadvantage

Below Normal

Parity

Normal

Temporary

Advantage

Above Normal

(at least for some

amount of time)

Sustained

Advantage

Above Normal

Yes

(Barney & Hesterly, 2006)

(Bertsch & Wiseman, 2008)

1–15

THE VALUE CHAIN

• Primary Activities

Add value directly in transforming inputs into outputs

Raw materials through production to customers

• Support Activities

Indirectly add value

Provide support to the primary activities

Information systems, human resources, accounting, etc.

• Managers can see how competitive advantage

flows from a system of activities

4-16

EXHIBIT 4.6 Value Chain: Primary & Support Activities

4-17

Dynamic Strategic Activity Systems

• A network of interconnected activities in the firm

• Evolve over time – external environment changes

Add new activities & upgrade or remove obsolete ones

• Vanguard Example

A global investment firm - $1.4 trillion managed assets

Emphasis on low customer cost and quality service

– Among the lowest expense ratios in the industry (0.20%)

Updated the activity system from 1997 to 2011

New customer segmentation core

Two new support activities

Permits customized offerings: long-term and more active

traders

4-18

EXHIBIT 4.8 Vanguard Group’s Activity System 2011

Legend

Core

Support

4-19

Dynamic Capabilities Perspective

• A firm can modify its resource base to gain &

sustain a competitive advantage

Advantage is gained from reconfiguring a firm’s

resource base

Honda core competency in gas-powered engine

design

Could decrease in value

If consumers move toward electric-powered cars

BYD competency in batteries would gain advantage

• Dynamic capabilities are an intangible resource

• Resource stocks and flows are a useful view

4-20

EXHIBIT 4.10 Role of Inflows & Outflows in Building Stocks

4-21

HOW TO PROTECT A COMPETITIVE ADVANTAGE

1. Better Expectations of Future Values

Buy Resources at a low cost

Real Estate Development - highway expansion

2. Path Dependence

Current alternatives are limited by past decisions

U.S. is the ONLY industrial nation not on the metric system

Honda’s core competency in gas engines took decades to

build

4-22

HOW TO PROTECT A COMPETITIVE ADVANTAGE

3. Causal Ambiguity

Cause of success or failure are not apparent

Why has Apple had such a string of successful products?

– Role of Steve Jobs’ vision?

– Unique talents of the Apple design team?

– Timing of product introductions?

4. Social Complexity

Two or more systems interact creating many possibilities

A group of 3 people has 3 relationships

A group of 5 people has 12 relationships

4-23

Cloud Computing for small businesses

• Can cloud computing boost competitive

advantage?

Outsource hosting server

Less cost in training staff

Scalable resources

Purchased with operational funds

Competition amongst providers

(Truong, D., 2010)

1–24

THE SWOT ANALYSIS

• Conduct a SWOT after external and internal

analysis completed

• SWOT combines external and internal analysis

Internal Strengths and Weaknesses

From VRIO framework

External Opportunities and Threats

From PESTEL or competitive forces analysis (Ch. 3)

Leverage internal strengths to exploit external

opportunities

Achieving such a dynamic fit yields sustained competitive

advantage

4-25

EXHIBIT 4.11

Strategic Questions in the SWOT Analysis

4-26

Healthy Business Annual Check-Up

• Annual company-wide SWOT analysis

Should use 360 degree review

Involving employees will strengthen your relationship

Focus on key areas and assign ratings

Prioritize opportunities and threats

• Use limited SWOT analysis for specific items

New products

Acquistion

Single business unit

(Simoneaux, S. L., & Stroud, C. L., 2011)

1–27

STARBUCKS: Re-creating Its Uniqueness

Create a Unique Experience

• Soft music, comfortable

chairs and sofas.

• Wireless hotspot for

working or surfing the net.

• Handmade specialty drink.

• Fresh ground coffee after

every pot (8 minutes).

• STRONG CORE COMPETENCY

© 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

1–28

STARBUCKS VRIO FRAMEWORK

• VALUABLE

Unique coffee house experience. Work or relax in

coffeehouse ambience. Value chain.

the

• RARITY

Who else offers our product? Who else offers our

experience. How unique is our offering?

• COST TO IMITATE

Can our service be duplicated? Who can compete?

McDonalds, Tim Hortons, Panera Bread.

• ORGANIZED

Can we launch the necessary stores properly? 17,00

stores in 20 years.

1–29

Why and How did Starbucks lose its

uniqueness?

STRATEGIC MOVES

• Opened up 16,000 new

stores across 50

countries.

• Expanded Menu:

Desserts, Sandwiches,

Books, Music.

• Tried to keep up with their

massive growth. Grinding

of beans.

© 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

OUTCOMES

• Strayed from its core

business.

• Forgot what made it

unique.

• WHAT SERVICE DO YOU FEEL VERY

GOOD/COMFORTABLE ABOUT?

• It changed what its

customers loved about it;

The Experience.

1–30

Re-creating what made Starbucks Special

STRATEGIC MOVES

• 2009: Introduced VIA,

instant coffee.

• 2010: Baristas would no

longer multitask. Focus

would be more on the

customers experience.

© 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

CEO Howard Schultz

1–31

Starbucks up’s and down’s.

Strategy Activity Systems

• Network of interconnected

activities within a firm.

• Every decision has an

outcome:

Dynamic Capabilities Perspective

• Intangible resource

• Can be modified to gain

an advantage.

Grinding beans:

Menu:

Retail:

• Internal environment

changes when external

does.

• Starbucks forgot that its

intangible resources were

its core competencies.

1–32

STARBUCKS COFFEE

• Stick to YOUR

business.

• Different flavors,

blends, styles.

• Larger stores.

• Upgrade technology

1–33

Chapter Four Conclusion

• A firms Resources and Capabilities and how

they impact Core Competencies and Activities.

• Resource Based View.

• Tangible vs. Intangible Resources.

• Value Rarity Imitate Opportunity Framework.

• Value Chain.

• Dynamic Strategic Activities vs. Dynamic

Capabilities .

• Protect a Competitive Advantage.

• SWOT Analysis.

© 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

1–34

References

Barney and Hesterly (2006). The VRIO Framework: An Overview. Retrieved from

http://faculty.tlu.edu/fgarza/Applying%20the%20VRIO%20Framework.doc

Barney, J., & Wright, P. (1998). On becoming a strategic partner: The role of human

resources in gaining competitive advantage. Human Resource Management, 37(1),

31-46. Retrieved from http://search.proquest.com/docview/224323931?accountid=28644

Bertsch, T. & Wiseman, D. (2008). Growth for Tiffany & Co. Journal of the International

Academy for Case Studies 10(1), 83-89. Retrieved from

http://search.proquest.com/docview/216297353?accountid=28644

Simoneaux, S. L., & Stroud, C. L. (2011). BUSINESS BEST PRACTICES: SWOT

analysis: The annual check-up for a business. Journal of Pension Benefits, 18(3),

75-78. Retrieved from http://search.proquest.com/docview/860007592?accountid=28644

Truong, D. (2010). How cloud computing enhances competitive advantages: A research model for

small businesses. The Business Review, Cambridge, 15(1), 59-65. Retrieved from

http://search.proquest.com/docview/347569664?accountid=28644

1–35