Martin Moehrle UBS

advertisement

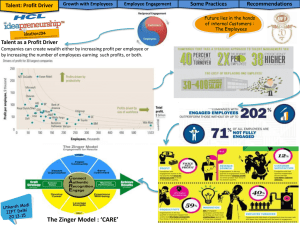

Striving for best practice in corporate learning – the EFMD CLIP experience Hongkong, 4 June 2012 Dr. Martin Moehrle CLIP Value Proposition CLIP = Corporate Learning Improvement Process • International Quality Assurance Scheme • Self-assessment and Improvement Roadmap and Support • Access to Community of Experienced Peers – including Business Schools • Outside-in and Inside-out Perspective through External Peer Reviewers and Participation in Review Teams respectively • Benchmarking/Positioning • Internal Value : Stakeholder Analysis & Validated SWOT Assessment • External Value : Learning Function Branding & Employer Branding • Ever increasing Knowledge Base and growing Maturity of Corporate Learning Organizations www.efmd.org 2 CLIP Quality Framework : 9 chapters • Strategic Positioning • Target Markets • Innovation & Development • International Issues • Programmes, Services & Activities • Participants Positioning, Alignment & Key Interfaces Programmes, Services & Activities Innovation, Development & Internationalisation Resources, Processes and Suppliers • External Suppliers • Corporate Learning Team • Physical Resources & Administration www.efmd.org 3 Positioning, Alignment & Key Interfaces • • • • • • • • Governance system (Strategic orientation, Financial oversight, Stakeholders input) Alignment with Company Strategy Mission, Mandate, Founding purpose Scope of the CU’s Activities (Markets, Target Audiences, …) Interface with Business Units Management of the CU’s client base (Learning Partner function, …) Positioning in the organisation chart, Reporting Lines Interface with HR structures and processes Innovation, Development & Internationalisation • • • • Capacity for Innovation, role as standard setter for creativity in the company Interface with the Academic world, environmental scanning capacity to anticipate future needs and trends International Perspective, support to the company’s positioning in a globalised business context Linkage to knowledge management, integration of new technologies and elearning techniques www.efmd.org 4 Programmes, Services & Activities • • • • • • Internal Structure (departments, schools, sub-units, etc) Structure of the CU’s portfolio of activities (Programmes, Consulting, Coaching, etc) Alignment of the service portfolio with : – The mission – The target markets – The target audiences Coherence of the portfolio Programme Value Chain (Needs Analysis, Design, Delivery, Evaluation, Follow-up, Transfer) Pedagogy (face-to-face, ICT facilitated self-directed, blended learning) Resources, Processes & Suppliers • • • • • • Internal Resources – Deployment of CU staff in programme facilitation – Mobilisation of line managers and experts from within the business Staffing (CLO, Programme Designers, Programme Managers, etc.) External Resoures – Criteria for outsourcing – Criteria for selection of external providers – Management of external providers Management Systems within the CU Funding model (profit centre, cost centre,…) Physical & On-line Facilities www.efmd.org 5 CLIP Flow Chart Apply • Eligibility Visit • Complete Application • Briefing Visit Briefing Visit Report Eligibility • Define Approach Assess • Self-Assessment Self-Assessment Report • Prepare Schedule Review • Peer Review Peer Review Report Accreditation • Build Improvement Plan Maintain • Continuous Development New cycle for re-accrediation Mid-Term Report 3-5 years ReAccreditation www.efmd.org 6 Five roles of corporate learning functions Shared perspective among leadership cadre Structured and accelerated learning for leadership pipeline and prof. development Knowledge management/ learning organization/ business development/ innovation Enterprise change agent informal/ low control formal/ high control Governance of enterprise learning space 7 A look into the crystal ball: 10 trends for corporate learning 1. Human capital planning is becoming an integral part of business development: this is where the organizational learning agenda is defined 2. Learning will be better integrated with talent and performance management processes, so that L&D gets into the performance improvement business 3. The transition to knowledge-based economies requires a broader remit of the learning function to become an architect or enabler of learning, which calls for a totally new set of performance metrics 4. L&D has to cope successfully with the duality of a mature learning context in established markets and an immature context in emerging markets 5. One brand strategies raise market expectations on global consistency of brand experience and the underlying culture and people profiles: a clear mandate for global learning 6. L&D will include informal learning in its provision and transition from learning programs to learning environments that combine, e.g., formal training with e-learning, knowledge portals, web 2.0 features, coaching and job aids 7. The use of an increasing variety of delivery channels will be driven by availability, technological progress, globalization, cost considerations and the preferences of a multi-generational workforce 8. There will be a pronounced accountability for managers to facilitate on-the-job learning and to create a culture of learning, curiosity and mutual coaching within and across their teams, accompanied by a responsibility shift for development from the organization to the individual 9. L&D functions will be subject to the ongoing industrialization of internal support processes which will command more governance, collaboration and sharing across often dispersed L&D teams, and more technology 10. The number one challenge in global learning transformation initiatives is being lean, transparent and cost-effective – and at the same time impactful, agile, business aligned and innovative 8 value creation The three stages of L&D value creation Stage 3: transformational impact Stage 2: strategy enablement Stage 1: service delivery incremental effort adapted from Doug Ready: Building the High Flex/ High Value HR Team, ICEDR 2009 9 Where do we stand at UBS? Launch of UBS Business University in 2010: managing all learning in UBS As part of current HR Transformation, integration of BU into Talent CoE to enable an end-to-end talent framework Broaden Global Learning Delivery to become Global Talent Delivery And further out: merger of Talent Acquisition CoE with Talent CoE Talent CoE 7 Talent Partner Teams 8 Competence Centers (4 of former BU) Global Learning Delivery Learning Delivery teams in all regions Learning operations 10 Integration of talent management practices across the employee life cycle employee value contribution competency model talent reviews, succession, reward & retention employer brand learning and develpment performance management acquisition feedback/ transparency onboarding employee tenure one integrated HR technology platform supporting all TM processes 11