Information Technology - Fisher College of Business

advertisement

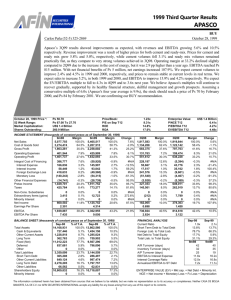

Business Finance 4228/7225 Advanced Investment Analysis The Stock Market Summer 2013 Sector Team Neil Patel Jeffrey Mulac Srinath Potlapalli Overview SIM vs S&P 500 IT Sector Weight As of 5/31/2013 S&P500 Information Technology Consumer Discretionary Consumer Staples Energy Financials Health Care Industrials Information Technology Materials Telecom Utilities 5.16% 3.35% 2.69% As of June 30,2013 0% 11.97% 9.17% 15.65% 10.98% 10.71% IT sector constitutes 18% of the total S&P500 Weight and contains 70 companies 19.34% 10.99% Max market cap: $371,780.10m Min market cap: $2,915.10m Mean Market Cap: $39,179.75m Med Market Cap: $13,139.98m SIM Information Technology Consumer Discretionary Consumer Staples Energy Financials Health Care Industrials Information Technology Materials Telecom Utilities Cash 3.15% 3.27% 1.49% 3.19% 11.78% 17.30% 11.06% 11.48% 9.73% 11.41% 15.96% IT Sector – Industry Classification Broadly Classified into • Application Software - MS Office, Accounting and Financial Software, CAD/CAM/CAE Software, ERP Software etc. • Communications Equipment – Telephone, Radio, Pager, Intercom and Automated Voice Answering System etc. • Computer Hardware – Computer CPU, Monitor, Keyboard, Mouse, Monitor, Printer and Wireless Router etc. • Semiconductor Equipment – Laser Scanning, Microscope Systems, X-ray and CT Inspection. • Semiconductors – Microprocessors, SOC, Ics and Transistors. • System Software – MS Windows OS, Linux OS, RDBMS, Mobile Device OS, Antivirus Software. Five Largest IT Companies Company Industry Market Cap Apple Inc Hardware/Electronic Equipment $391.81b AAPL/$417.42 Google Inc Internet Software & Services $296.43b GOOG/$893.49 Microsoft Corp Systems Software/ Application Software $285.69b MSFT/$34.21 IBM Corp IT Consulting & Services $216.14b IBM/$194.93 Oracle Corp System Software/ Application Software $144.43b ORCL/$31.19 As of July 05 2013, IT sector has performed + 7.68% YTD + 2.09% QTD Ticker/Share Price Share price and market cap as of Jul 5,2013 Business Analysis Business Analysis Phase of the life cycle (Information Technology): • • • • • Inception around Word War II(1946). Significant growth followed in1980’s. Corporate IT Expansion took off in 1990’s. IT sector is highly cyclical. Nevertheless this sector adds value to the businesses and consumers alike and attracts significant investment allocations from Corporations and Government. We consider IT sector is in Growth to Mature phase. IT Sector remains ahead of Market in terms of Risk and Return premium. Information Technology IT Sector is mature but constantly growing with innovation Business Analysis Industry Classification by Business Cycle Communication Equipment Growth but cyclical and irregular. Manufacturing is impacted by foreign markets. Computer Hardware PC Hardware industry is in mature phase and is declining . Smartphone/Mobile devices/Tablets industry is in growth phase and is cyclical. Server hardware is in growth due to demand in cloud computing and data centers. Systems Software Growing with big data and cloud markets as drivers. IT Consulting and Services Mature and cyclical. It’s a globally driven industry. Internet Software and Service High growth and cyclical. Semiconductor Equipment Mature and cyclical. Semiconductors Mature and cyclical. Business Analysis • External factors: Global demand and business cycles, business process outsourcing, government regulations, market volatility, corporate spending, consumer spending and economic trends such as interest rates. • The user and geography: Corporations and government sector, varied consumer demographics, developed economies, emerging markets. • Input/output analysis: Significantly interlinked global economic system. IT sector can be significantly impacted by global resource supply and global product demand. IT industries such as hardware and semiconductors that are heavily dependent on global manufacturing resources are impacted. • New capacity and global supply: Capacity demand in - server/cloud markets, online retailing, Internet software services, wireless networks. Global supply concentrated in manufacturing, software human resources and knowledge capital, manufacture of mobile device/smartphone sector. Business Analysis Profitability and Pricing Higher profit margins are due to : • • • • Growing sector of mobile devices, tablets and smartphones. Data center servers and Cloud computing software markets. Software Services such as big data and BI Analytics. Mergers and Acquisitions activities. Pressure on profits and pricing power due to: • • • • • • • Maturity in Semiconductor industry and electronic components, goods and services. Conglomerates. Ex: HP. Volatility of demand in emerging markets. IP rights infringement in global IT industry. Competition and price pressure from foreign manufacturing goods and software services. Higher R&D costs and manufacturing costs . IT consolidation. Business Analysis Porters Five Force Analysis Industry Barriers to entry Threat of Substitutes Buyer Power Supplier Power Rivalry Application software Low High Medium Low High Communications equipment High Low High Medium High Computer Hardware High High Medium Medium High Semiconductor Equipment High High High Low High Semiconductors High Medium Medium Low Low System Software Medium Medium Medium Low High Economic Analysis CPI Index Real GDP Disposable Income Durables Computer Spending Capital Spending S&P 500 Key Drivers • • • • Real GDP Durables Capital Spending Consumer Spending Financial Analysis Information Technology Sector 5 yr historical growth = 8% Last Qtr = 4% Last 12 Mths = 5% Q1 2012 to Q1 2013 = 4.4% Steady growth Qtr to Qtr and YoY Information Technology Sector 5 yr historical growth = 18% Last Qtr = (1%) Last 12 Mths = 3% Long term Future Growth = 13% Q1 2012 to Q1 2013 = (1.1%) Cyclical sector, positive outlook Information Technology Sector Margins Relative to S&P 500 2 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 EBITDA Net Margin ROE 2003 1 1.1 1 2004 1 1.3 1 2005 0.9 1.3 1.1 2006 0.9 1.2 0.9 2007 0.8 1.4 1.1 2008 1.2 1.8 1.5 2009 1.4 1.9 1.8 2010 1.5 1.9 1.7 2011 1.4 1.8 1.6 2012 1.4 1.8 1.6 2013 1.4 1.8 1.5 Computer Hardware (AAPL) Margins Relative to Sector 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 EBITDA Net Margin ROE 2003 0.6 0.7 1.1 2004 0.6 0.6 1 2005 0.6 0.6 1.1 2006 0.6 0.7 1.1 2007 0.6 0.7 1.3 2008 0.7 0.7 1.4 2009 0.7 0.8 1.6 2010 0.6 0.7 1.2 2011 0.7 0.9 1.3 2012 0.8 0.9 1.5 2013 0.8 0.9 1.3 Internet Software & Svcs (GOOG) Margins Relative to Sector 2.5 2 1.5 1 0.5 0 EBITDA Net Margin ROE 2003 1.3 1.6 0.6 2004 1.1 1.3 0.5 2005 1.4 1.2 0.6 2006 1.7 1.6 0.8 2007 2.3 1.6 0.9 2008 1.6 1.6 0.8 2009 1.9 1.6 0.9 2010 1.5 1.4 0.7 2011 1.5 1.4 0.7 2012 1.3 1.2 0.7 2013 1.3 1.2 0.7 IT Consulting Services (IBM) Margins Relative to Sector 3 2.5 2 1.5 1 0.5 0 -0.5 -1 EBITDA Net Margin ROE 2003 0.6 0.5 1.1 2004 0.5 0.2 0.9 2005 0.4 0 0.1 2006 0.3 -0.6 0 2007 0.2 0.2 0.6 2008 0.9 0.4 1.1 2009 0.5 0.9 1.2 2010 0.8 0.9 2.2 2011 0.8 0.8 2.2 2012 0.8 0.8 2.3 2013 0.8 0.8 2.7 System Software (MSFT & ORCL) Margins Relative to Sector 3.5 3 2.5 2 1.5 1 0.5 0 EBITDA Net Margin ROE 2003 2.4 3.3 1.3 2004 2.3 2.8 1.2 2005 2.1 2.3 1.4 2006 2 1.9 1.3 2007 2 2 1.6 2008 1.9 1.9 1.6 2009 1.8 1.8 1.7 2010 1.6 1.5 1.4 2011 1.6 1.5 1.4 2012 1.6 1.6 1.2 2013 1.7 1.6 1.3 Industry Comparison Net Margin 3.5 3 2.5 2 1.5 1 0.5 0 -0.5 -1 Comp Hdwre Intnt Soft & Serv IT Consult Sys Software 2003 0.7 1.6 0.5 3.3 2004 0.6 1.3 0.2 2.8 2005 0.6 1.2 0 2.3 2006 0.7 1.6 -0.6 1.9 2007 0.7 1.6 0.2 2 2008 0.7 1.6 0.4 1.9 2009 0.8 1.6 0.9 1.8 2010 0.7 1.4 0.9 1.5 2011 0.9 1.4 0.8 1.5 2012 0.9 1.2 0.8 1.6 2013 0.9 1.2 0.8 1.6 Industry Comparison EBITDA 3 2.5 2 1.5 1 0.5 0 Comp Hdwre Intnt Soft & Serv IT Consult Sys Software 2003 0.6 1.3 0.6 2.4 2004 0.6 1.1 0.5 2.3 2005 0.6 1.4 0.4 2.1 2006 0.6 1.7 0.3 2 2007 0.6 2.3 0.2 2 2008 0.7 1.6 0.9 1.9 2009 0.7 1.9 0.5 1.8 2010 0.6 1.5 0.8 1.6 2011 0.7 1.5 0.8 1.6 2012 0.8 1.3 0.8 1.6 2013 0.8 1.3 0.8 1.7 Industry Comparison ROE 3 2.5 2 1.5 1 0.5 0 Comp Hdwre Intnt Soft & Serv IT Consult Sys Software 2003 1.1 0.6 1.1 1.3 2004 1 0.5 0.9 1.2 2005 1.1 0.6 0.1 1.4 2006 1.1 0.8 0 1.3 2007 1.3 0.9 0.6 1.6 2008 1.4 0.8 1.1 1.6 2009 1.6 0.9 1.2 1.7 2010 1.2 0.7 2.2 1.4 2011 1.3 0.7 2.2 1.4 2012 1.5 0.7 2.3 1.2 2013 1.3 0.7 2.7 1.3 Valuation Analysis Absolute Valuation IT Sector Absolute Basis P/Trailing E P/Forward E P/B P/S P/CF High 41.5 30.8 4.8 3.3 17.9 Low Median Current 11.1 19.1 14.0 11.3 17.1 13.3 2.3 3.8 3.2 1.3 2.4 2.3 8.2 13.1 10.6 • IT sector is undervalued compared to its historical valuation • P/E ratios are leaning towards historical lows Relative Valuation IT Sector Relative to S&P 500 P/Trailing E P/Forward E P/B P/S P/CF High 2.1 1.6 1.8 2.1 1.6 Low Median Current 0.9 1.2 0.9 0.9 1.2 0.9 1.2 1.5 1.4 1.5 1.8 1.6 1.0 1.2 1.1 • IT sector is undervalued compared to the market when looking at P/E • IT sector is lower than its historical median for every ratio (relatively at historical lows for P/E) Valuation Current Absolute Basis Industry P/Trailing E P/Forward E P/B P/S P/CF S&P 500 IT Sector 15.3 14.5 2.4 1.4 10.1 14.0 13.3 3.2 2.3 10.6 Apple Microsoft Google IBM Oracle Computer Systems Internet Software IT Consulting Application Hardware Software & Services & Services Software 10.3 12.3 21.1 13.0 12.7 10.8 11.6 18.5 11.8 11.8 3.4 3.5 4.0 10.6 3.2 2.4 3.9 5.3 2.2 4.3 9.1 10.7 16.9 10.2 10.3 • Differences between large companies within sector • Apple undervalued? • Google overvalued? Recommendation Recommendation • Overweight IT Sector in SIM portfolio by 100-200bps above S&P 500 weightage • Positives: – IT Sector is underperforming the market by 7-8% YTD (buying opportunities) – Continued growth in the future – Improving economic conditions in the U.S. • Risks: – Slowing growth in developing countries (mainly China and India) – Economic condition of Europe – Projected slowdown of government spending in U.S. Recommendation • Overweight: – Application and systems software (big data software growing in demand) – Hardware (mobile sales continue to grow) – Internet software and services (cloud computing) • Underweight: – PC semiconductors and equipment (decreasing demand) – PC hardware (decreasing demand) – IT consulting & services Questions?