Aaron Zornes – Best Practices in MDM

advertisement

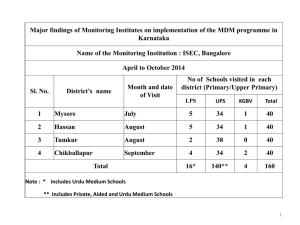

“EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT MDM/DG/RDM… … but were afraid to ask” Presentation by Aaron Zornes/The MDM Institute to TDWI Vancouver Chapter 13-Feb-2015 ABOUT THE MDM INSTITUTE • Founded 2004 to focus on MDM • MDM Market Pulse™ monthly • MDM Advisory Council™ • MDM Fast Track™ one-day business drivers & technology challenges surveys of 150 Global 5000 IT organizations with unlimited advice to key individuals, e.g. CTOs, data architects • MDM Business Council™ website access & email support to 35,000+ members • MDM Road Map & Milestones™ annual strategic planning assumptions – e.g., http://tinyurl.com/MDM-next-gen public & onsite workshop rotating quarterly through major North American, European & Asia-Pacific metro areas • MDM & Data Governance Summit™ annual conferences in NYC, San Francisco, London, Singapore, Sydney, Toronto & Tokyo (**Shanghai in 2015) About Aaron Zornes Leading industry analyst authority on topics of MDM, CDI, RDM & Data Governance Founder & Chief Research Officer of the MDM Institute Conference chairman for MDM & Data Governance Summit conference series Founded & ran META Group’s largest research practice for 14 years M.S. in Management Information Systems from University of Arizona “Independent, Authoritative, & Relevant” © 2015 The MDM Institute www.The-MDM-Institute.com MDM INSTITUTE ADVISORY COUNCIL • Advisor agrees to provide Institute’s consultants with advice & insight regarding the use of MDM software & related business processes at Advisor’s convenience • Advisor agrees to participate in at least one fifteen (15) minute survey teleconference call every sixty (60) days • Optionally, Advisor may respond to the bimonthly survey request via email or Internet-based survey fulfillment • Results of such MDM market research surveys shall be aggregated by the Institute & made available to all Advisory Council members • In no case, shall any Advisor-specific survey information be made available to other parties unless Advisor has specifically agreed to the release of such information in writing Representative Members • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 3M Bell Canada Caterpillar Cisco Systems Citizens Communications Doctors Without Borders Educational Testing Services GE Healthcare Honeywell Information Handling Services Intuit JC Penney McKesson Medtronic Microsoft Motorola National Australia Bank Nationwide Insurance Norwegian Cruise Lines Novartis Polycom Roche Labs Rogers Communications Scholastic SunTrust Sutter Health Visa Westpac Weyerhaeuser 150 organizations who receive unlimited MDM advice to key individuals, e.g. CTOs, CIOs, & MDM project leads © 2015 The MDM Institute www.The-MDM-Institute.com MDM INSTITUTE ADVISORY COUNCIL Representative Members 3M Allergan BCD Travel Bell Canada Caterpillar Cisco Systems Citizens Communications COUNTRY Financials Educational Testing Svcs EMC GE Healthcare Honeywell Information Handling Svcs Intuit Loblaw Mayo Clinic McKesson Médecins Sans Frontières Medtronic Microsoft Motorola National Australia Bank Nationwide Insurance NetApp Norwegian Cruise Lines Novartis PC Connection Polycom Pratt & Whitney Canada Qwest Ralph Lauren Roche Labs Rogers Communications Scholastic Stryker SunTrust Sutter Health TNT Express Telkom South Africa UCB Pharma UK Home Office Visa Europe W.W. Grainger Westpac Weyerhaeuser Woolworths Australia 150 organizations who receive unlimited MDM advice to key individuals, e.g. CTOs, CIOs, & MDM project leads © 2015 The MDM Institute www.The-MDM-Institute.com MORE MDM PROGRAMS GET THEIR SUCCESSFUL START AT MDM & DATA GOVERNANCE SUMMITS THAN ANYWHERE ELSE MDM & Data Governance Summit Europe - London ▪ May 18-21, 2015 MDM & Data Governance Tokyo - Belle Salle Kanda – Tokyo ▪ June 2015 MDM & Data Governance Summit San Francisco - Hyatt Regency SF – July 22-23, 2015 MDM & Data Governance Summit Asia-Pacific - Doltone House – Sydney ▪ July 28-30, 2015 MDM & Data Governance Summit Shanghai - Shanghai Int’l Convention Ctr ▪ Fall 2015 MDM & Data Governance Summit Canada - The Carlu – Toronto ▪ Fall 2015 MDM & Data Governance Summit New York - Sheraton Times Square ▪ October 4-6, 2015 © 2015 The MDM Institute www.The-MDM-Institute.com ALL THE CURRENT *HOT* TOPICS © 2015 The MDM Institute www.The-MDM-Institute.com PAST SPONSORS © 2015 The MDM Institute www.The-MDM-Institute.com MDM MARKET GROWTH = >18% CAGR ** Source: Gartner Research • CDI (MDM of Customer) software • $644 million market YE2012 • $1 billion by YE2015 • PIM (MDM of Product) software -- incl store content info & metadata • $688 million market YE 2012 • $1.1 billion by YE2015 • > 50% of MDM revenue is led by offerings from small & best-of-breed vendors © 2015 The MDM Institute www.The-MDM-Institute.com RECENT EMEA UPTAKE OF MDM Representative Sample 3 Suisses Achmea Accor Al Hilal Bank (UAE) Alstom Argos ASICS Banque Centrale Populaire (MO) Banco Santander BANKART Baumarkt Direkt Belastingdiens (Dutch Tax Office) Belgacom Belgium Post Berner (FI) Bluarancio BNP Paribas Boots (UK) Borough of Camden (UK) Bouygues Telecom Carrefour Credit Agricole Commune di Roma Compagnia Assicuratrice Dalkia Deutsche Telkom DHL (DE) Dubai World DSV Eli Lilly UK Euroclear EADS Feu Vert Gazprombank Hypo Vereinsbank ING LaSer Cofinoga Lloyds Maersk Mitchells & Butlers Мир Книги Network Rail NFU Mutual Norway Post Orange Otto Group Ouest-France Peter Justesen Philips Medical Devices PPL Prisa Digital RTE © 2015 The MDM Institute Rusatom RussiaEnergy Ruukki Sartorius Werkzeuge Sberbank Société Générale Sociale Verzekeringsbank Sogei S.p.A. Sonae Saint-Gobain Stallergenes Syngenta Swisscom SwissGrid Talk Talk Telecom Egypt Tesco Bank The Travel Group Travel Port TUI Van Marcke Veolia Viega Visa Europe Volvo Truck WIND Telecom www.The-MDM-Institute.com ASIA-PACIFIC UPTAKE OF MDM Representative Sample ANZ (AU) Asics (JP) ATO (AU) Alliance Bank Malaysia (MY) Bank Central Asia (ID) Bank Negara Indonesia (ID) Bank of China (CN) Bank of Commerce (CN) Bank Tenaga Negara (MY) Bendigo Bank (AU) BHP Billiton (AU) CBA (AU) Centrelink (AU) China CITIC Bank (CN) China Unicom (CN) Chongqing Changan Automobile Co. (CN) Daihatsu Motor Co. (JP) Dept of Educ - SA Dept of Educ – WA FANCL (JP) Fujitsu (JP) GCG China (mobile) (CN) GE Money (AU) General Dept of Taxation (VN) Huawei (CN) HK Trade Development Council IP Australia (AU) Japanese Research Institute (JRI) Korea Life Insurance (KR) Korea Telecom (KR) Krung Thai Bank (TH) KT&G (KR) Lion Nathan (AU) Macquarie Bank (AU) Ministry of Educ (SG) Ministry of Finance (CN) Ministry of Health (NZ) Ministry of Health (SG) Mitsubishi Motors (AU) Mizuho (JP) MLC (NAB) Mobily (SA) NAB (AU) New Zealand Customs (NZ) NTT (JP) Optus-Singtel (AU) Origin Energy (AU) Perodua Otomobil (ID) Rio Tinto (AU) © 2015 The MDM Institute Queensland Health (AU) RAC Victoria (AU) RAC WA (AU) Samsung (KR) Samsung Life (KR) Shenzhen Development Bank (CN) Shanghai GM (CN) Shanghai Regional Community Bank (CN) Simplot (AU) Suncorp (AU) Sydney Water (AU) Tai Kang Life (CN) Taiping Life (CN) Taiwan Mobile (TW) Telecom NZ (NZ) Telstra (AU) Tongshan Tax Bureau (CN) Tower Australia (AU) Tsingtao (CN) University of Sydney (AU) Westpac (AU) Woolworths (AU) Zhejiang Tailong Commercial Bank (CN) www.The-MDM-Institute.com RECENT NORTH AMERICAN UPTAKE OF MDM Representative Sample AARP ADP Allied World Assurance Co. (AWAC) Apria AutoTrader.com BB&T Belk BestBuy Biogen Idec BJ's Wholesale Club Blackstone Group BMC Software Bombardier BNY Mellon British Columbia Cooperative Canadian Border Security Agency Canada Revenue Agency CarFax Celgene Chartis Chevron Clorox Collective Brands Costco Covidien Desjardins Devon Energy Essilor Federal Reserve Board Federated Co-Operatives, Ltd. FHA Frontier Communications First American Title Fox Global Hyatt Guy Carpenter HCA Hilton Worldwide Home Depot Canada Houghton Mifflin Harcourt Huntington Bank Intact Financial John Wiley & Sons Jones Lang LaSalle JP Morgan Chase KeyBank Kroger Levi Strauss Logitech Maersk MassMutual McKesson MeadWestvaco Men’s Wearhouse Morgan Stanley Nextel Northern Trust o © 2015 The MDM Institute NY Times Oppenheimer Funds Panera Bread Payless PetSmart Pitney Bowes Polycom Prudential PTC RadioShack Sabre Smith & Nephew Sony Pictures Entertainment Spectrum Pharmaceuticals T-Mobile Target Teach for America TELUS Time-Warner Cable TJ Max Toys R Us Travelport Union Bank US Bank Uti Visa Walt Disney Resorts Whataburger Whole Foods Wyndham www.The-MDM-Institute.com MACRO MDM MARKET TRENDS • Market consolidation – MDM+DI+DQ+Apps • IBM InfoSphere MDM = DWL+Initiate+Trigo+Lombardi+ Ascential+Vality+SRD+LAS • Informatica MDM = Siperian+DataScout+Heiler+Similarity+ Evoke+Identity Systems+AddressDoctor • Oracle MDM = Siebel UCM+SilverCreek+Datanomics+Sun MDM+Hyperion MDM+GoldenGate+Sunopsys+Carleton • SAP MDM = A2i+Business Objects+FirstLogic+Purisma+Hybris • “Big Data” - Data volumes + 3rd party reference data + Social network data + Unstructured data • “MDM Duology” - Mega vendor (IBM, INFA, Oracle, SAP) for Customer/Product/Supplier & 2nd/3rd tier for “everything else” (RDM, location, et al) • Explosion of “location-aware services” • Actionable insight vs. data management © 2015 The MDM Institute www.The-MDM-Institute.com 2015-16 MDM PLANNING ASSUMPTIONS • Pervasive MDM • Cloud MDM • Data governance • Social MDM • Business process hubs • Public/Private MDM • Business-critical MDM • Big Data • Universal MDM • Temporal MDM • Reference data • Budgets/skills Strategic planning assumptions to assist IT organizations & vendors in coping with flux & churn of emerging MDM vendor landscape © 2015 The MDM Institute www.The-MDM-Institute.com PERVASIVE MDM (MDM AS A SERVICE) STRATEGIC PLANNING ASSUMPTION • During 2015, enterprise application providers will continue to deploy en masse, the next generation of MDM-innate (as opposed to MDMaware) applications • Concurrently SaaS vendors will struggle to provide integrated/native MDM; select SaaS providers will finesse this issue via strategic partnerships & investments in MDM • Through 2015-16, mega vendors MSFT & ORCL will effectively give away departmental MDM– via Microsoft MDS & Oracle DRM respectively • By 2016, the market for MDM-innate applications will exceed that for MDM platform software MDM-innate (e.g. Fusion MDM) will overwhelm MDM-enabled applications © 2015 The MDM Institute www.The-MDM-Institute.com MDM MILESTONE MASTER DATA MANAGEMENT (MDM) “Top 10” Evaluation Criteria © 2015 The MDM Institute www.The-MDM-Institute.com MDM INSTITUTE FIELD REPORTS – MDM** Formally Presented During Conference Chairman Keynote on Day 2 of Event • Ataccama • Riversand • Dell Boomi • SAP MDM & MDG-EE • IBM InfoSphere MDM • SAS MDM • Informatica MDM • Semarchy • IBI MD Center • Software AG • Kalido MDM • Stibo • Microsoft MDS • Talend • Oracle MDM • Teradata MDM • Orchestra Networks • TIBCO MDM • Pitney Bowes Spectrum • VisionWare © 2015 The MDM Institute ** Persisted CUSTOMER or PRODUCT data hubs www.The-MDM-Institute.com WORKING DEFINITIONS Data Governance (DG) “Passive” Data Governance Formal orchestration of people, process, & technology to enable an organization to leverage data as an enterprise asset across different LOBs & IT systems Data steward consoles & other reactive data management capabilities focused on after-the-fact data compliance; often batch-like & not integrated with MDM “Active” Data Governance “Proactive” Data Governance Metrics-enabled, upstream data policy enablement; replaces manual data admin processes with role-based, real-time SME empowerment Metrics-driven, crowd-sourced capability for business users & IT to actively control their shared data across different lines of business & IT systems Master Data Governance aligns IT-centric viewpoints & businesscentric viewpoints regarding data quality; MDM & MDG are becoming natural way of aligning data with business processes © 2015 The MDM Institute www.The-MDM-Institute.com DATA GOVERNANCE STRATEGIC PLANNING ASSUMPTION • Through 2015, most enterprises will struggle with enterprise DG while they initially focus on customer, vendor, or product; integrated DG that includes E2E data lifecycle will increasingly be mandated as a phase 1 deliverable • During 2016-17, major SIs & MDM boutiques will focus on productizing DG frameworks while mega MDM software providers struggle to link governance process with process hub technologies • By 2017, vendor MDM solutions will finally move from “passiveaggressive" mode to “proactive" Data Governance mode MDG *must* evolve from point products (i.e., to address customer or product MDG only) to enterprise data governance (supporting multiple domains such as customer, product, supplier, location, price, etc.) © 2015 The MDM Institute www.The-MDM-Institute.com MDM MILESTONE MASTER DATA GOVERNANCE (MDG) “Top 10” Evaluation Criteria © 2015 The MDM Institute www.The-MDM-Institute.com MDM INSTITUTE FIELD REPORTS – MDG Formally Presented by Conference Chairman on Day 3 of Event • ASG • Microsoft DG Console • Ataccama • Mike 2.0 • BackOffice Associates • Oracle DGF • Collibra • Orchestra Networks • EMC/RSA/Archer • SAP MDG • IBM MPDM • SAS Data Governance • IBI MD Center • Software AG • Informatica IDD • Utopia • Kalido DGD • Varonis © 2015 The MDM Institute www.The-MDM-Institute.com UNIVERSAL MDM (MULTI-DOMAIN MDM) STRATEGIC PLANNING ASSUMPTION • During 2015, MDM evaluation teams will assume (& insist) that all MDM software platforms targeted for enterprise-level deployment or major role in mission-critical systems fully support both PARTY & THING entity types • Through 2015-16, mega vendors will continue to deploy separate CDI & PIM stacks while nouveau MDM vendors attempt to position this as "legacy MDM" failing • By 2017, all operational CDI hub vendors will add "PIM light" capabilities, & all PIM vendors will add B2C PARTY entity domain Most PIM are multi-domain, not just PIM … always include SUPPLIER; CDI always has entitlements © 2015 The MDM Institute www.The-MDM-Institute.com MDM MILESTONE REFERENCE DATA MANAGEMENT STRATEGIC PLANNING ASSUMPTION • Through 2015, reference data will emerge as a key entry point for enterprises & in turn unduly influence choice of MDM for Customer, Product & other domains; large enterprises will continue to mandate that REFERENCE data be part of MDM platform's native entity types • During 2015-16, MDM vendors will begin to market RDM to apply an MDM approach for centralized governance, stewardship & control; SIs will move into this market via OEMing of Informatica & IBM MDM into "securities master" mkt under pricing umbrella of GoldenSource • By 2017, pervasive, low cost RDM will be commoditized via the efforts of Ataccama, Microsoft & Oracle Managing “simple” reference data will prove to be a key sales entry point for MDM vendors © 2015 The MDM Institute www.The-MDM-Institute.com MDM MILESTONE REFERENCE DATA MANAGEMENT (RDM) “Top 10” Evaluation Criteria © 2015 The MDM Institute www.The-MDM-Institute.com MDM INSTITUTE FIELD REPORTS – RDM Formally Presented by Conference Chairman on Day 3 of Event • Ataccama RDM • Oracle Site Hub, DRM • Collibra Reference Data • Orchestra EBX Accelerator • Profisee • IBM RDM Hub • SAP MDG-R (Reference Data) • Informatica RDM • Kalido • Software AG WebMethods OneData • Microsoft RDM • Teradata LRDM (t.b.a.) © 2015 The MDM Institute www.The-MDM-Institute.com CLOUD MDM (CLOUD-ENABLEMENT, ARCHITECTURE & INTEGRATION) STRATEGIC PLANNING ASSUMPTION • During 2015, single- & multi-tenant Cloud MDM will continue to attract SMBs to achieve MDM benefits without long-term project & major expense; while offering enticing entry point for large enterprises (opex vs. capex, federated architecture for geo-distributed organizations, POCs) • Through 2015-16, integration of on-premise MDM w/ SaaS apps will arrive via SFDC, SAP BBD, et al, however, enterprises will wrestle w/ DI issues btw on-premise & cloud w/ majority of orgs unwilling to house master data about CUSTOMERS/PRODUCTS/SUPPLIERS in public cloud • By 2017, Cloud-innate services for DQ & DG will be more prevalent; however, enterprise MDM will remain “on premise” w/ increasing integration to Cloud applications MDM-enabled apps will migrate to public Cloud, especially for decentralized/geographically distributed organizations © 2015 The MDM Institute www.The-MDM-Institute.com MDM MILESTONE SOCIAL & MOBILE MDM STRATEGIC PLANNING ASSUMPTION • During 2015, 360° view of “X” will take on new meaning due to “data blind spots” of traditional MDM; enterprises will realize need to reconcile social identity with corporate/ household identity to provide authoritative master data to drive e-mktg & commerce within social networks • Through 2015-16, next-gen MDM will address “sphere of influence” to incorporate both extended & non-obvious relationships to grow share of wallet from individual to exo-ego network as disruptive sales strategy (vs. ego-centric mktg) • By 2016-17, mobile location-based services enhanced with locationspecific customer info will raise ante for e-commerce within & outside major social networks Data-related processes need to align with real world intricacies – especially complex relationships & hierarchies of mobile customers & extended social networks © 2015 The MDM Institute www.The-MDM-Institute.com MDM MILESTONE TEMPORAL MDM (REAL-TIME & TIME-TRAVEL) STRATEGIC PLANNING ASSUMPTION During 2015, MDM requirements will increasingly evolve from myriad of batch match/merge processes for evergreening master data into near real-time best of breed data consolidation architectures; mega vendor MDM platforms with RDBMS underpinnings will compete to outperform each other, while next-gen MDM solutions will lag due to overhead of semantic models Through 2015-16, compliance & other corporate functions will increasingly mandate temporal MDM to view & manage entities & hierarchical relationships at a specific point in time (past, present or future) By 2017, temporal MDM will be standard feature of majority of MDM platforms Object/Graph DB-based MDM will dominate in time-travel; RDBMS-based MDM dominates real-time MDM updating © 2015 The MDM Institute www.The-MDM-Institute.com MDM MILESTONE BIG DATA (& IN MEMORY) STRATEGIC PLANNING ASSUMPTION During 2015, performance of all major aspects of base MDM functionality will benefit from performance-enhancing capabilities of big memory configurations — from batch loading of MDM hubs to identity resolution to operational updates Through 2016, Big Data will repatriate itself into MDM fabric via registry overlays as yet another source; mining of Big Data to populate Social MDM & perform entity matching on Big Data stores will help provision 360° view of entity from public, subscription &enterprise data. By 2016-17, very large enterprises (e.g., fin svcs, large gov’t agencies) will look to r/t MDM flows & scaling of MDM solutions via elasticity of Cloud-based solutions, in-memory DBs, & next-generation ETL/MDM Big Data innately requires both MDM & Data Governance to be effective & sustainable © 2015 The MDM Institute www.The-MDM-Institute.com MDM MILESTONE BUDGETS/SKILLS STRATEGIC PLANNING ASSUMPTION • During 2015, the number of IT professionals trained in a specific MDM solution will increase 100% Y2Y, however, IT organizations & consultancies will struggle to recruit and retain MDM veterans who have had a major role in a successful MDM deployment • Through 2015-16, enterprises will continue to spend 3X to 4X in “plan” & “build” services vs. MDM software • By 2016-17, supply of MDM-experienced consultants will catch up w/ demand & SIs will scramble to find new opportunities for their expensively recruited & trained talent Given substantial investment businesses undertake with SI partners, this area must be given scrutiny – not only to contain costs, but to insure success of this vital infrastructure investment © 2015 The MDM Institute www.The-MDM-Institute.com MDM MILESTONE MDM & DATA GOVERNANCE SERVICES • Market for MDM & Data Governance services reached $2.5B during 2012 & will exceed $4 billion by 2015 • Systems integrators are essential to success of majority of MDM projects, yet previously incumbent SIs usually are no longer so • Data Governance assistance from SIs will remain especially critical to success of MDM programs during 2015-16 as organizations deal w/ shortage of tools, experience & tool expertise This area must be given scrutiny – not only to contain costs, but to insure success of this vital investment © 2015 The MDM Institute www.The-MDM-Institute.com FIELD REPORT: MAJOR SI PARTNERS • Accenture • Infosys • BackOffice Associates • Knowledgent • Capgemini • Lumendata • CGI-Logica • Oracle Pro Svcs • Cognizant • SAP Pro Svcs • Deloitte • Stream Integration/Prolifics • IBM BAO/GBS/Lab Services • Tata Consultancy Services • Informatica Pro Svcs • Utopia • Wipro © 2015 The MDM Institute www.The-MDM-Institute.com FIELD REPORT: MDM & DG SPECIALISTS • • • • • • • • • • • • • • • • • Adastra Affecto Arhis Black Watch Data Business & Decisions Clarity Consology Datpro Detica DATUM eCenta Edificio Entity Group First San Francisco Partners GlobalSoft HighPoint Systems Hitachi/Sierra Atlantic © 2015 The MDM Institute IMT Infoverity Information Asset InfoTrellis Jibes Koeus Myers-Holum NorthGate Perficient Platon SDM Serene SapientNitro SITA Sogeti Steria Streevus www.The-MDM-Institute.com FIELD REPORT: MAJOR CONSULTANCIES WITH MINOR PRACTICES • Abeam Fujitsu (Born, DMR) • Atos Hitachi Consulting • Avanade HP/Knightsbridge/EDS • BearingPoint Lockheed Grumman • CSC • Dell/Perot Systems Mahindra Satyam PwC • Fair Isaac / Braun Consulting SAIC SBS (Siemens Business Services) Unisys © 2015 The MDM Institute www.The-MDM-Institute.com BOTTOM LINE: MDM & DATA GOVERNANCE • Invest in DG for long-term sustainability & ROI of MDM • Acknowledge currently marketed DG does not exist as integrated solution • Plan for most MDM vendors to deliver DG during next 6-12 months • Recognize mega vendors (IBM, INFA, ORCL, SAP) focused to deliver MDG capability in 2015 – with resultant partner chaos • Manage SI partner to integration roadmap with MDM platform of choice & to avoid “brain drain” Plan now to realize economic value & competitive differentiation via multi-entity MDM during next 2-5 years © 2015 The MDM Institute www.The-MDM-Institute.com Aaron Zornes Founder & Chief Research Officer www.the-MDM-Institute.com aaron.zornes@the-MDM-Institute.com www.linkedin.com/in/aaronzornes +1 650.743.2278 @azornes Authoritative Independent Relevant © 2015 The MDM Institute www.The-MDM-Institute.com