presentation on SHOW ME THE MONEY

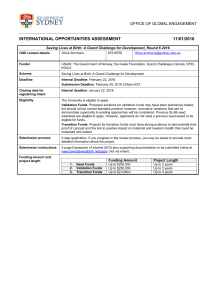

advertisement

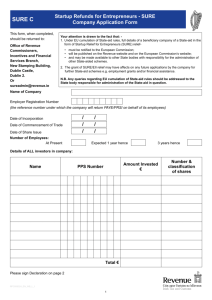

James Hogan Paul McLellan DAC 2011 Is this a system or chaos? Aggregate: “…the properties of components sum to the whole” Expectation of Each Phase • Seed • –System Architecture –Marketing Specification –Proof of Concept (Core Algorithms) • Round A - Validation –Build System Infrastructure (DB, UI, etc.) –Customer validation - Alpha/Technology Partners –Feature focused • Round B - Production –Productization - stability –Beta customer program –Performance and usability focused • Round C - Scalability –Support focused –Broader product proliferation IPO - Growth –Focus - shareholder value –Growth •Revenue +20% • EPS 20% –New follow on products –Global expansion Round Time 0 to 6 years Seed 0 – 18 Tech Validation months $ Invest $ Outgoing Rev Heads R&D Heads Key Hires Marketing Sales 500K to 1.5M 0 - 1M Min 1 Alpha Less than 10 Customers Min salary 20-30 0 Architect, only R&D typically technical founders Round A 12 -24 2 2-5M Feature Validation months To 2 – 3 Beta 1 Bus Dev 5M Customers 2 to 3 FAEs Round B 18 to 36 5 5-10M Stability & performance Months To 10M 10’s of customer logos Round C 12 to 24 10 20-40M Proliferation Months To 20M Multiple sales/year 0 Growth of Channel IPO /Public Continual Growth in shareholder value 48ongoing +20% Revenue & EPS 30 5-10 20-30 1 CEO 1 CFO 1 VP Marketing 5 to 8 FAEs 30 30-40 1 VP Sales 3 to 4 sales 10 to 20 FAEs 30 40 to 60 G&A for public company Customer Support Nominal Return Expectations Companies Expected ROI At Exit Exit Market Value Seed Round 100 Negative N/A $0M Round A 20 1:1 Asset sale $2-10M 3:1 Co. Sale $25 - 50M Negative Asset sale $2-10M 5:1 Co. Sale $50-100M Negative Asset Sale $2-10M 10:1 Co. Sale $100-200M Depends Public $+250M Round B Round C IPO 10 5 2 Success Attributes of Software Start-Up Enterprise • Luck • Raise minimum cash, a low burn – never run out of cash! • Adaptable and scalable founding and executive team – Always better if the team has had prior success – Need for staying power – it might take six + years • Capitalization structure allows room for qualified investors and employee stock option pool. Typical A round target ownership: – Investors 40 to 60% (preferred), typically 50% – Employee pool 15 to 25%(common), depends on the founders backgrounds, typically 20%. – Founders and seed capital 15 to 40%, typically 20 to 30% Success Attributes of Software Start-Up Enterprise • An adaptable business plan – it always changes – Doesn't use a lot of cash to get to technology and market validation • Core competencies that need to be there by Round C – Market specification & solution architecture – Product specification & technical architecture – Product development – Integration & test – Packaging & field deployment • Quality of the investment group that brings : – Marketing and operational expertise – A network that can help recruit and introduce to customers – An ability to funded over multiple horizons Success Attributes of Software Start-Up Enterprise • Discrete and defendable market niche – Technology discontinuity – Supply chain dis-aggregation – Fast growing segment – Market segment not adequately served • A differentiated technology that has a sustainable competitive advantage – Patented where it can add value • Timing – More EDA startups fail by being to early to market than too late – Old technology/methodology often lasts one more process generation than you expect – Being early by one process node is two more years of cash Success Attributes of Software Start-Up Enterprise • Attractive areas for EDA – Analysis of something that was always second-order before – The “ends”: system-level design and software, DFM and yield optimization – IP, chips are not so much designed as assembled • What customers will pay for: – IP, it ends up “in” the chip so it’s mission critical – Optimization, especially power. It shows through to the end-user – Verification and other productivity tools: affects bottom line and can be quantified (ROI easy to establish) – Cheaper: not so much (“cut-rate heart surgeon”)

![[Name of Business]](http://s2.studylib.net/store/data/005439490_1-eb485795b6ab94ac46e88cc0426770e1-300x300.png)