Lecture 9 Slides

advertisement

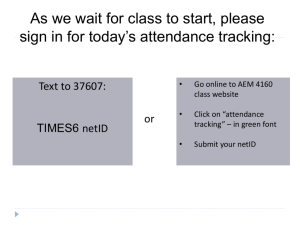

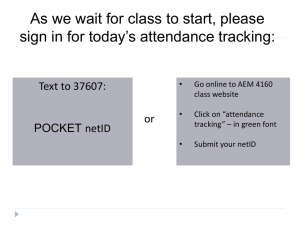

As we wait for class to start, please

sign in for today’s attendance tracking:

Text to 37607:

TREADMILL netID

or

•

Go online to AEM 4160

class website

•

Click on “attendance

tracking” – in green font

•

Submit your netID

Lecture 9: Tacit Collusion;

Pricing Information Goods

AEM 4160: Strategic Pricing

Prof. Jura Liaukonyte

2

Lecture Plan:

Tacit Collusion

Facilitating Practices:

Pricing Information Goods

Price Matching

Cost structure

Network Externalities

Information Laws

Long Tail

Required reading for next class: HBS case “Freemium

Pricing at Dropbox”

HW2

Tacit Coordination

Spontaneous cooperation resulting from strongly

perceived interdependence.

Repeated interaction provides firms with strategic leverage

over each other that may encourage cooperation.

Difficult to achieve with lots of firms.

Hard to find/prove/correct.

Facilitating practices:

Price matching

Most Favored consumer clause

Price leadership

Advance announcement of price changes

Tacit Collusion: Example

Mechanisms

Homogeneous

Products

Industry is an oligopoly

Top four firms dominate almost the entire

market

Same phone (e.g. iPhone from AT&T or

Verizon?), data services (text, e-mail, etc)

Agreement on price is easier to come by

and cheating is easier to catch

Tacit Collusion:

Pre-Announced Rate Changes

Service providers typically pre-announce rate changes

they plan on implementing

Advanced notice gives competing firms time to respond

Can test the market and competitors

Tacit Collusion:

Infrequent High Changes in Rates

Rate changes in the industry have been high and

infrequent, yet coordinated across all four firms

FOCUS: Text Messages

No capacity constraints = unlimited supply => in a competitive

market prices should decrease not increase over time

Since 2005 price per text has doubled. [IBISworld, 2012]

Service providers do not claim that these increases were driven by higher

costs so other methods must be at work.

Price Matching Guarantees

Price matching guarantees

Helps a firm to protect its consumers and charge a high price.

It makes your competitor “soft.”

Takes away the benefit for your competitor to undercut your

price.

Counter-Intuitive?

Price matching guarantee is simply a mechanism for tacit collusion or

competition reduction between firms.

Any offer of the price matching guarantee means effectively taking away any

gains that its competitor might get from cutting price.

If a firm offers a price matching guarantee, then a search consumer will buy

from it because the consumer knows that in the event that there is a lower

price offered in the market the consumer is insured that it will match that

price.

Since price matching takes away the gain from price cutting, no firm cuts price

and price competition is reduced.

Example

Two firms: Firm 1 and Firm 2

Two prices: low ($4) or high ($5 )

3000 captive consumers per firm

4000 floating go to firm with lowest price

Payoffs = revenue

Firm 2

Firm 1

Low

High

Low

,

,

High

,

,

Example

Two firms: Firm 1 and Firm 2

Two prices: low ($4) or high ($5 )

3000 captive consumers per firm

4000 floating go to firm with lowest price

Payoffs in thousands of $ (revenue)

Both low = 5000*4 = $20K

Both high = 5000*5 = $25K

One high = 3000*5=$15K

Another low = 7000*4=$28K

Firm 1

Low

High

Firm 2

Low

20,20

15,28

High

28,15

25,25

Contracting with Customers

The game is a prisoner’s dilemma

Both firms prefer: {High, High}

Only equilibrium: {Low , Low}

Cannot credibly promise to play High

Even if committed to High, other firm would still respond

with Low

How to resolve this?

Third party contracts with customers – e.g. price matching

guarantee

Price Matching

If one firm charges low, it does not gain any additional

customers, since the competitor “automatically”

matches it.

What is the effect on the game?

Price Matching

Firm 2

Firm 1

Low

Low

20 , 20

High

28 , 15

High

15 , 28

25 , 25

Firm 2

Firm 1

Low

High

Low

20 , 20

20 , 20

High

20 , 20

25 , 25

Price Matching

Literature focusing on price-matching guarantee

typically finds that it supports higher equilibrium

prices and profits.

Intuition: This is because when all firms are committed to

match the lowest price, no firm has incentive to undercut

others

In practice, if you read fine print, there are quite a few

restrictions:

price-matching generally applies to products that are

homogeneous across stores

Firms often match lower prices of only some competitors,

typically their close competitors.

Pricing Information Goods

1

6

The Information Economy

Information:

Essentially, anything that can be digitized—encoded as a stream

of bits—is information.

E.g. books, databases, magazines, movies, music and web pages are all

information goods.

Cost of Producing Information:

Information is costly to produce but cheap to reproduce.

Properties of Information goods

1.

2.

3.

4.

Unique cost structure

Properties of experience goods

Properties of public goods

Network effects and externalities

1. Unique Cost Structure

Information goods have high fixed costs of production but

near-zero or zero marginal costs.

Developmental costs of producing the first unit of an

information product are generally high, but producing each

additional unit costs virtually nothing.

the estimated costs of developing the popular computer game

Gran Turismo 5 were around $80 million (DigitalBattle, 2010);

the costs of replicating additional copy range from negligible

(production of DVDs) to essentially zero (downloadable files).

1. Unique Cost Structure

Cost of storing and transmitting stored information

is cheap (and continues to get cheaper)

there are no effective capacity constraints on the

production of digital goods.

Traditional Product

Fixed and Variable Costs

AC

P

AVC

Total Fixed

AFC

Total Fixed

q1

Q

Typical Digital Product

Fixed and Variable Costs

P

AC

AFC

q1

AVC

Q

1. Unique Cost Structure: Implications

Declining average costs imply significant economies of

scale.

Minimum efficient scale can be on the order of the whole

market

We should not expect to see highly competitive market

structures

Natural monopolies may arise

1. Unique Cost Structure: Implications

What market structures should we expect to see?

Markets with a dominant firm

Microsoft, Facebook

Differentiated Product Markets

Commoditized information markets

Digital goods selling at marginal cost

Free information products (maps, telephone information, email

addresses, news, stock price quotes, etc.)

Freemium pricing

2. Properties of Experience Goods

Certain characteristics of a product or service cannot be

observed or verified prior to consumption, but these

characteristics can be ascertained upon consumption.

Problem: Consumers cannot determine their willingness to

pay

Recommendations, reviews, try-before-purchase, reputation

or word of mouth become important.

3. Properties of Public Goods

Non-rival goods:

one person’s consumption doesn’t diminish the amount

available to other people

Non-excludable goods:

one person cannot exclude another person from

consuming the product.

Non-Rivalrly

This has issues for sellers of information goods

Traditional price competition is based on scarcity

If there are a limited number of widgets, people who want widgets more

will pay more for them.

Luxury cars, houses, stock

If there is no limit to the number of widgets available, no one will want

to pay more than the lowest price.

3. Properties of Public Goods

While the non-rival property is inherent to digital

goods, the non-excludable one is the question of

technology or strategy:

Bundling a good with an excludable good (physical means),

DRM - digital rights management (IT means)

Encryption and licensing

Intellectual property law (legal means), can be used to modify

the property.

Auditing and user tracking

3. Properties of Public Goods

While there are ways to limit non-excludability, the

pertinent question is:

Is

sharing of information goods or piracy are actually

always damaging to the revenue of the digital goods

producer?

Embrace copying

Embrace copying and bundle with content that

benefits from wide distribution (e.g. ads)

E.g., Network TV,

YouTube, Free Apps

Directly connected with the next property of

information goods: network externalities.

4. Network effects and externalities

Many digital products increase in value with wider

distribution, as the network of users increases.

Positive network effects and externalities explain a wide

range of empirical regularities common to digital goods:

high quality digital goods are released for free to increase platform

penetration and value of the platform for third-party advertisers

(e.g., Google search engine),

high incidence of technological tie-ins and pricing of one

component at a loss (e.g., digital e-readers and content libraries

specific to those e-readers).

Hardware vs. Content

Amazon and Google sell their

hardware (Kindle and Nexus

tablets) "at cost",

Some analysts say that it can even be

below cost

The point is: hardware is a discounted

tying product with profit coming

from sales of online content.

Increasing Platform Penetration

High definition optical disc format war:

Between Blu-ray Disc and HD DVD (2006-2008)

Why a war? Why not coexist peacefully?

Other format wars?

Laws of the Information Age

Moore’s Law

Metcalfe’s Law

Power Law

1. Moore’s Law

In 1965 Gordon Moore observed an exponential

growth in the number of transistors per integrated

circuit and predicted that this trend would continue

What it means to us today—computing power

doubles about every 18 to 24 months

It is also common to cite Moore's Law to refer to the

rapidly continuing advance in computing power per unit

cost, because increase in transistor count is also a rough

measure of computer processing power

1. Moore’s Law

Information Capacity Constraints (or lack thereof)

2015: 15 GB free space

Future: trend towards unlimited space

(Remember“Your mailbox is full”?

What was that about?)

2. Metcalfe's Law:

Metcalfe's Law: attributed to Robert Metcalfe, originator

of Ethernet and founder of 3COM:

The value of a network is proportional to the square of the

number of nodes;

So, as a network grows, the value of being connected to it

grows exponentially, while the cost per user remains the same

or even reduces.

2. Metcalf’s Law

400

350

Value of network

300

250

Individual network value

Community network value

200

150

100

50

0

1

2

3

4

5

6

7

8

9

10

11

12

Size of network

13

14

15

16

17

18

19

20

40

The Network Effect

The usefulness of information products is often

dependent on the number of other users of that

technology.

For example, e-mail is quite useless if there are only a few

others that use e-mail.

41

2. Metcalfe’s Law

According to Metcalfe’s Law, if there are n users of a

technology, then the usefulness of that technology is

proportional to the number of other users of that

technology (n-1 in this case). The total value of the

network of the technology is therefore proportional

to the usefulness to all users, which is:

n(n-1) = n2 – n.

42

2. Metcalfe’s Law

If n is large, as it will be for most information products, then

n will be small relative to n2 and Metcalfe’s Law becomes:

The total value of the network of a

technology is proportional to n2

43

2. Metcalfe’s Law

The more users of a technology there are, the more

useful it becomes.

Examples:

Facebook,

E-mail

MS Windows/MS Office

44

2. Metcalfe’s Law: Critique

Facebook’s IPO and valuation of a lot of tech

companies is rationalized based on some variant of

Metcalfe’s law of network effects

However recent research suggests that it produces

over-valuation

The real value is closer to Zipf’s law: N*log N

linguist George Zipf: in any system of resources, there exists

declining value for each subsequent item.

3. Power Law

On the Web a few pages have a huge number of other

pages linking to them, and a very large number of pages

have only a few pages linking to them.

In short, the Web has many small elements, and few large

ones.

Power Law

1000

1200

900

1000

800

700

Relative popularity

800

600

500

600

400

400

300

200

200

100

0

0

1

50

Relative popularity

Search referrals

Page views

The Long Tail

The internet vs. brick-and-mortar

Nearly unlimited capacity

Distribution and shelving costs approaching zero

Global distribution channels

A changing economy

Popularity no longer has a monopoly on profitability

Can generate significant revenues by selling small number of

millions of niche products vs. selling millions of a small number

of “hits”

The Long Tail

Wal-Mart vs. Rhapsody

Wal-Mart

39,000 songs on CDs in average store

Must sell at least 100,000 copies of a CD to cover its retail

overhead and make a sufficient profit

Less than 1 percent of CDs sell that much

Therefore, can carry only “hits”

Itunes/Rhapsody/Spotify

Millions of songs in archives

Cost of storing one more song is essentially zero

More streams each month beyond its top 10,000 than in the top

10,000

Therefore, no economic reason not to carry almost everything

Long Tail: Good News for Consumers

Brynjolfsson, Hu, and Smith (2003):

consumer surplus is 10x higher from access to increased

product variety vs. access to lower prices in online stores

Consumers as individuals

Satisfaction of very narrow interests

Mass customization as an alternative to mass-market fare

Long Tail Examples: Travel

Netflix Long Tail

Case: Freemium Pricing at Dropbox

AEM 4160: Strategic Pricing

Prof. Jura Liaukonyte

Freemium Pricing Model

Concept

Importance of Referral

Offer limited access to a

company’s service for free

Increasing the number of consumers is

key for business success

Charge for anything above

Free upgrades for referral increase the

network size and revenue

Industries using Freemium

Apple’s App store – 2013: 77% of top 100 grossing Apps

LinkedIn – 0.8% of users

Evernote – 1% of users

Spotify – 20% of users

Industry Overview

Global Market

Value in 2011: $ 4bn

Expected Value in 2018: $ 46bn

What are value drivers in the industry?

What drives the price in the industry?

Direct Competitors

Provider

Price (per year

per GB)

Platform

Microsoft

SkyDrive

$2

Apple

iCloud

$2

Google

Google Drive

$1.2

Amazon

Simple Storage

$.095

Actual Usage

Others

17%

Apple

33%

Google

Drive

12%

Amazon

18%

Dropbox

20%

DropBox

Overview

Founded by Drew Houston and Arash Ferdowsi in 2007

Provides remote storage and file sharing, accessible online or as folder on your

computer

Total number of users: 200 million – 1.6 – 4 percent actually generate revenue

The company targets both, private consumers and corporations

Freemium

Referral

500 MB storage for both sender and receiver

Maximum of 16 GB

Additional 2.8 million Referrals, which is a referral rate of 70 percent

12 percent conversion rate *

*(individuals who install dropbox/individuals who click on the invitation link)

Approach

Problem

1.

The cloud storage market was fragmented with small competitors

2.

Bureaucracy prevented business customers from purchasing cloud storage

3.

Consumers were not willing to pay for the service, as they have not adapted to

the product at that time

Approach

1.

Faster file backup and retrieval service – Combination between users’ own

storage and remote storage (i.e. dropbox folder)

2.

Focus on individual consumers to avoid business bureaucracy

3.

Freemium Pricing

Result

200 million users by November 2013

Valued at $ 4bn in 2013

After capturing individual consumers, focus on corporate customers

Market to Corporate Customers

Corporate

Price

$800 per year for five users

+$125 for each additional user

Consumer Share (%)

100

90

Unlimited storage

Administrative controls to manage

documents

Product

Single-Sign-On option

14-day free trial period

80

70

60

50

40

30

20

10

0

Business Users all Paid

Impact

40% of 400 million revenue

96-98 % use product for free

Consumer Business Paid

Consumer Business Unpaid