The Convergence of HR and Finance:

Leveraging HR’s Most Powerful Advantage to

Impact the Business

Mark Ubelhart

October 2014

To Achieve Impact—Functions Transition*

• Professional Practice

• Accounting

• Sales

• Human Resources

Decision Science

Finance

Marketing

Human Capital/Talent Management

• When made:

– Possible by information systems

– Essential by scarcity

Drivers of Future Business Value

Source: Mark Van Cleaf,

Organizational Capital Partners

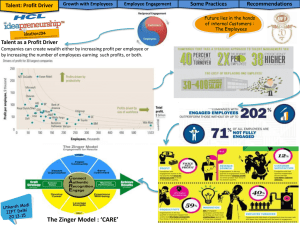

What can we learn from High Performing Companies?

A global study of more than 15,000 performance companies using

30 years of data identified companies which achieved superior CFROI,

Growth and Total Shareholder Returns

“We found that employee engagement and retention was a critical

factor in the ability of companies to achieve superior and sustainable

ROI and Shareholder Value performance.”

Dr. Mark L. Frigo, Director - The Center for Strategy, Execution and Valuation

Kellstadt Graduate School of Business, DePaul University

Co-author of the book DRIVEN: Business Strategy Human Action and the Creation of Wealth

A Strategy Map With Risk Management Embedded

Create and Protect Shareholder

and Stakeholder Value

Financial

Strategic Objectives

Customer

Strategic Objectives

Strategic Themes

Internal Process

Strategic Objectives

Profitable Growth from

New Technologies and

Services

Increase Value from

Existing and New

Customers

Organizational

Efficiency and

Leverage

Cost & Quality

Leadership

Develop Technologies

to Improve Cost &

Performance

Deliver Highly

Valued Solutions

Customer Focused

1- Operational

Excellence

2-Create Value with

Technology

3-Grow High Value

Customer Relationships

4-Organizational

Alignment

Reduce

costs

Disciplined Investment

in New Technologies

Improve Pricing

Discipline

Communication and

Teaming

Improve quality and

costs

continuously

Drive Packaging

Technology

Enable Rapid New

Product introduction

Information Sharing

Leverage

Technology

Leverage an Open

Collaboration

Technology

Transfer Model

Risk Management:

Strategic Risk

Assessment

Improve Productivity

Eliminate non-value

added processes

Licensing

Risk Management:

Liability for Failures

Risk Management:

Protect IP

Risk Management:

Protect Customer

Information

Risk Management:

ERM Initiative

TQ/RRS

TQ/RRS

TQ/RRS

TQ/RRS

Capabilities and

Growth

Strategic Objectives

Roles and Alignment

Organizational Alignment “Create a High Performance Culture and Infrastructure”

Develop Balanced

Scorecard and

Strategy Maps

Retain and Develop

Critical Talent

Develop

Strategic Risk Management

Skills and Culture

Develop Leadership Enable and Encourage

and Execution-Driven Continuous Learning

and Knowledge Sharing

Culture

Source: Frigo, Mark L. and Richard J. Anderson, Strategic Risk Management: A Primer for Directors and Management Teams (2011). Used with permission.

Retention Risk Score

Identifyand

and

Target

At-Risk

Talent

1. Identify

Target

At-Risk

Talent

Creates a common understanding of who is at risk and why…

Employee

Retention Risk Score

Critical Talent

Key Factors Increasing Risk

Jim Smith

726

Yes

Pay history, 6 – 10 yrs tenure

Carol Yu

610

No

New employee, geographic location

Anand Gupta

462

No

Manager tenure, department diversity

Sarah Young

280

Yes

Pay history

Managing Your Talent Risk

Predicting Risk—employee by employee, quarter by

quarter—so that management can:

1. Identify and target at-risk talent

2. Target clusters of risk for group interventions

3. Measure retention performance across units,

across managers

4. Reshape talent sourcing strategies

5. Benchmark your company

Business Framework

to Take Action

Target Clusters of Risk for Group Interventions

Employee

Scores

Segmentation

Methods

Demographic

Segments

• Diversity groups

• Critical talent

• Location

Organizational

Segments

• Business Unit

• Function

• Division

Risk Clusters

Actions

Sales engineers, <2 years experience

in Austin, TX:

High risk but low attrition

Combine

Risk Analysis

with

HR Solutions

Cluster Analysis

• Model-generated

segments

Women managers, age 25-34, in Finance:

Medium risk and high attrition

Manager Training

Compensation

Plan Changes

Alternative

Work

Arrangements

Career

Planning

Workshops

Measure Retention Performance Across Units,

Across Managers

Conventional analysis looks at turnover alone, masking crucial information about “degree of

difficulty”. Talent Guardian offers true performance assessment.

Group 1

Group 2

Predicted

Turnover

40%

Predicted

Turnover

Actual

Turnover

24%

Actual Turnover

+16%

High Retention

Performance

Group 3

22%

Predicted

Turnover

10%

22%

Actual

Turnover

23%

0%

Average Retention

Performance

-13%

Low Retention

Performance

The Message: All three locations had roughly the same turnover. But, Group 1 had the best

performance compared to predicted turnover. And Group 3 the worst.

The Action: Investigate Group 1 for best practices, and Group 3 for root causes.

Talent Guardian™—Actual Client,

Prominent Risk Clusters

“Hired Young Guns”

“Reaching for More”

“Mid-Career Misfires”

3% of population

4% of compensation investment

3% of population

3% of compensation investment

3.5% of population

3% of compensation investment

• Young, though likely not first job

• High performing, relatively high pay

• Tend to live in suburban-like areas

(educated, mid-to-high income,

homeowners, married with

RRS

children)

480

• Average performers

• Recently changed roles/ promoted,

but with relatively small pay increase

• Tend to live in economically

depressed areas

RRS

“Builders”

“Solid Opportunists”

“Struggling Starters”

1% of population

1% of compensation investment

2.5% of population

3% of compensation investment

2.5% of population

2% of compensation investment

•

•

•

•

Young, perhaps first job

Modest pay

Skewed toward Business Unit A

Tend to live in suburban-like

areas

Most Concern

RRS

500

Pivotal/Key Talent Concentration

• Not first job

• Low performers, slow pay

progression

• Tend to live in low income,

relatively uneducated areas

450

•

•

•

•

RRS

490

Average performing

Tend to move between roles

Have relatively high pay

Tend to live in suburban-like areas RRS

• Young, likely first job out of school

• Average to modest performers

• Likely living in relatively low income

areas

RRS

470

460

Secondary Concern

Modest Concern

Retention Risk Complexion Benchmarks

Numbe r of Pe ople

In

Between

21%

Low Ris k

57%

High Ris k

22%

Inv e stme nt in Pe ople

In

Between

29%

High Ris k

24%

Low Ris k

47%

The Link Between…

Retention Risk Scores (RRS)

Talent Quotient and

Business Results

RRS

Pivotal Employees

All Employees

CFROI

All Others

Predicted TQ

Talent Quotient Definition

The people getting the highest total pay increases…

…are they leaving or staying?

The GAAP Equivalent for

Human Capital Reporting

– The relevant information is available

– Standardization within and across companies has

been accomplished

–

Hewitt research demonstrates that a 10% increase

Useinwithin

framework

ofemployees

long-term

shareholder

attractingaand

retaining pivotal

for a company

$10 billionis

in now

capital investment

valuewith

creation

possibleadds an estimated

$70 million to $160 million to its bottom line.

Linkage to Business Results and CFROI

•

Quantifying what has typically been

considered fuzzy—the shareholder

value upside of investing in talent

•

Utilizing "apples-to-apples"

financial results, adjusting for

industry (e.g. financial services)

•

Correcting for “reverse causality"

issues—are pivotal employees

staying (i.e. high TQ) because of

good financial results or does TQ

drive future financial results?

1

Incremental Cost of Talent

versus

Measurable Business Impact

CFROI and Total Business Return

1997 – 2007, N = 115 companies

TQ Uncovers Critical Pipeline Gaps

•

•

Example of Talent Quotient by pay level, highlighting critical future leadership gap for this

company.

Bench strength issue highlighted; TQ not being reported to the Board

TQ RETAIN

160

130

T

Q

120

118

108

100

TQ<100

LOSING

PIVOTAL

EMPLOYEES

70

59

40

BROAD

($50K–

$125K)

MGMT*

($125K–

$200K)

TQ>100

RETAINING

PIVOTAL

EMPLOYEES

EXEC*

($200K+)

TOTAL

($50K+)

Identifying “Stall Points” in Corporate Performance

➤

Nearly 500 executive

interviews

➤

Largest data set

assembled on longterm corporate

performance

➤

Deep analysis of

“stalled companies”

ceburl.com/economist-talent

19

Talent is a Major Factor in Organizational Revenue Stalls

Over 80% of the time, the key controllable factors of revenue stalls in an organization are either

entirely about talent or disproportionately about talent.

Strategic Factors

70%

Premium

Position

Captivity

23%

Regulatory

Actions

7%

Innovation

Management

Breakdown

Premature Core

Abandonment

Failed

Acquisition

10%

7%

13%

Key

Customer

Dependency

6%

Strategic/

Diffusion

Conglomeration

5%

Adjacency

Failures

4%

External Factors

Organizational Factors

13%

17%

Economic

Downturn

4%

© 2014 CEB. All rights reserved.

CEB142868PRINT

National

Labor Market

Inflexibility

1%

Geopolitical

Context

1%

Talent

Bench

Shortfall

9%

Board

Inaction

4%

Organization

Design

2%

Voluntary

Growth

Slowdown

2%

Incorrect

Performance

Metrics

2%

8

Company Specific Results—Big Box Retail

Organization

For each 10 point improvement in TQ…

1.5 – 2.0% improvement in sales per square foot

Can we trust this data?

Relative Sales/ Sq Ft

Growth in Sales/Sq Ft

Controllable Margin

Econometric Methods

to Normalize Store

Performance for

External Factors

Regression Model: Store Performance vs. TQ

Future Sales Sq Ft or Controllable Margin = Function of

Human Capital Metrics, e.g. TQ

(adjusted for reverse causality)

Momentum Building For Human Capital

Accountability Reporting

Many organizations are pursuing such disclosure

• Society for Human Resources Management (SHRM) and its Metrics &

Measures Task Force—suspended

• Sustainable Accounting Standards Board (SASB)

• American National Standards (ANSI) and U.S. Technical Advisory Group

(TAG)

Momentum Building For Human Capital

Accountability Reporting

Many organizations are pursuing such disclosure

• International Standards Organization (ISO) with 42 Nations

participating or observing the development of HR standards

• In the UK, Chartered Institute of Personnel Development (cipd) with

the results becoming law in two years

• CalPERS to engage companies and their external managers on

Governance, Risk Management, Human Capital and Environmental

practices

Human resources measures…

…management and investment information

When will standardized Human Capital metrics become a visible

practice for leading companies? -- 2007 Human Capital Institute Poll:

Accountability Reporting

50%

45%

40%

28%

30%

22%

20%

10%

3%

2%

0%

This Year

Next 2–3 Years

Five Years

Beyond 5 Years

Never

IIRC Guidelines

SASB Approach to Human Capital

•

•

•

•

•

Michael Bloomberg and Mary Shapiro are serving as the Chair and Vice Chair of

SASB

– People of this caliber have the power to change the world

Focus on ESG issues that are material per the SEC

Industry specific approach to human capital metrics

– SASB covers 80+ industries across 10 sectors

Human capital manifests in different ways

– As “Employee Recruitment, Development, and Retention” topics

– As “Fair Labor, Labor Rights, and Human Rights” topics

– As “Employee/Workforce Health & Safety” topics

– As “Employee Inclusion & Diversity” topics

Standards for 5 Sectors available for download at www.sasb.org

Defining Workforce Productivity

• What is our workforce productivity? What is the marginal

return of $1.00 invested in the workforce?

• What is the ROI of our investment in workforce?

• Is our productivity improving? How do we rank?

• Compared to the competition, are we leading or lagging?

© Human Capital

Management Institute

27

Wherefore Human Capital Standardization

• 8/2014 hrfuture.net, by Wilson Wong, the Chair, the Human Capital

Standards Committee at the British Standards Institute; Head of Insights

and Futures at the Chartered Institute of Personnel and Development

(CIPD)

• An aim is to provide a human capital management framework for any

organization where the bulk of the value creation is located in its human

capital

• To enable traditional professional silos of HR, Finance… and so forth to

work instead to best (sustainable) advantage, lower systematic risk to

business continuity and raise professional accountability

Smarter Annual Report

• Descriptive and Prescriptive

• “A Smarter Annual Report—How Companies are Integrating

Financial and Human Capital Reporting” by Laurie Bassi, David

Creelman, Andrew Lambert

• The IIRC has already had a sizable number of large international

companies following its guidelines for integrated reporting on a trial

basis for several years

• The Association of Chartered Certified Accountants survey of 200

CFOs indicates that half of the firms surveyed anticipate adopting

integrated reporting within three years

BSI’s Human Capital Standards

• A diagnostic framework for organizations that are ready to

develop more mature and transparent systems of governance

• 100-day public consultations between Oct 1, 2014 and

Jan 11, 2015

The Center for Talent Reporting

• Home of Talent Development Reporting principles (TDRp)

• Featuring: Securing upfront agreement on expected impact and goal

alignment

• Over 600 measures and 60 sample reports available

A BTS Perspective

• Integrated financial, strategic and human resource planning and decision

making

– model the business—from current state to future state

– capture financial dashboards, employee and customer metrics and

their major interdependencies

– simulate decision making and weighing the risks and returns through

intensive internal training

Source: Dan Parisi, BTS