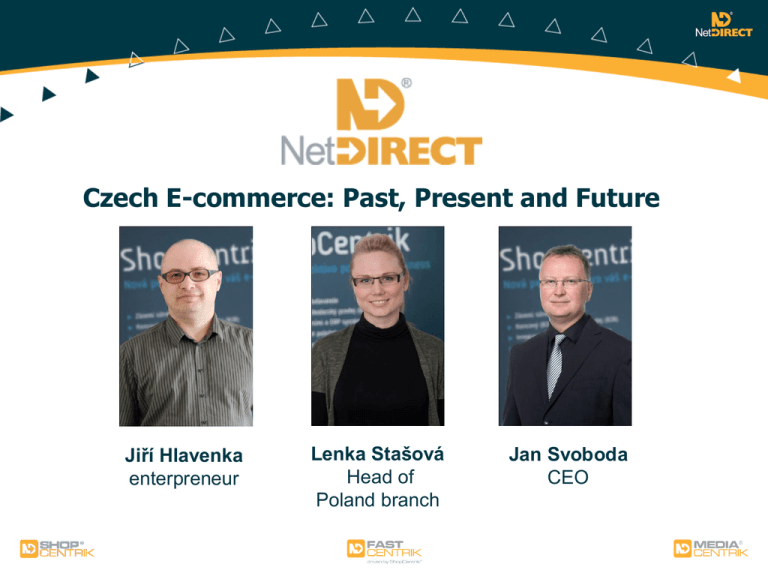

Czech e-commerce: past, present and future

advertisement

Czech E-commerce: Past, Present and Future Jiří Hlavenka enterpreneur Lenka Stašová Head of Poland branch Jan Svoboda CEO Czech e-commerce: past, present and future Agenda 1) History and recent developments, major players and their moves. 2) Is 10 000 e-shops enough for a small country? What´s selling, who´s selling, who´s buying 3) A picture of a Czech e-commerce customer. 4) Future years: growth or quick maturation? 5) What´s behind the scenes: software solutions, leaders, technology for the near future. An early start... • First e-shops: just five months after Amazon.com launch (1995) • Year 2000: hundreds of e-shops, revenue totalling approx 100 mil. EUR • First leaders were unsuccessful; the new leading segment emerged: electronics, PCs, kitchen and home appliances • Auctions: no success until Aukro/Allegro came, even then the growth was slow at the start Who are today´s leaders? • Alza.cz (computers, digital electronics): 200 mil. EUR • Obchodni-dum.cz and Kasa.cz (one owner now, home appliances, digital electronics): 130 mil. EUR • Mall.cz (wide assortment, also in Poland): 100 mil. EUR • CzechComputer.cz and Mironet.cz (both computers): 40 mil. EUR each • Vivantis.cz (health, perfume, wide assortment): 35 mil. EUR • Parfums.cz (successful in Poland): 15 mil. EUR • Aukro.cz: approx. 100 mil. EUR • Total market: 1,2 bln. EUR What sells well and what doesn‘ t? First wave: books, music, video Second wave: PC and home appliances Third wave: apparel, perfume, hobbies, auctions etc. Fourth wave? FMCG? ?? 1995 2000 2005 2010 Prices, margins, competition, marketing • Internet means discount. That´s the rule. • Computers, digital electronics and home appliances: ridicuously low margins (2-5%), customers extremely price sensitive • Other goods: more normal margins (20%), a lot of competitors • Market niches: still a lot of space, low competition • Currently approx. 11 000 running e-shops (+Aukro.cz), every year brings up 1 000 new e-shops. • Marketing effort: only „big5“ make real-world campaigns. The rest rely on SEO/PPC visibility, price comparison engines (Zbozi.cz, Heureka.cz). Local specifics: every country has some • Local portal Seznam (4.7 mio RU/mo, 2.1 mio RU/day) beats Google in search 60:40. Google market share slowly grows. • Seznam.cz owns the key price comparison service Zbozi.cz (1,5 mio RU/mo, 140 th RU/day). Second is Heureka.cz (coowned by Aukro; sophisticated engine), half of Zbozi.cz • Auctions make some 10% of total volume of local ecommerce • 70+% of payments are cash-on delivery; distrust of credit/debit cards (5%), in-store pickup is very popular (20%), online payments are close to zero. • Shipping and delivery: Česká pošta (state enterprise) 80%, PPL (=Deutsche Post) 9%, DPD (French) 9% • Speed of delivery and reliability is very important. A portrait of typical Czech customer: Seasonability: Christmas is not the killer season Monthly revenues fluctuation (Jan = 100%) 2 1,8 1,6 1,4 1,2 1 0,8 0,6 0,4 0,2 0 Leden Jan Únor Feb Mar Březen Apr Duben May Květen Jun Červen Jul Červenec Aug Srpen Září Sep Oct Říjen Nov Listopad Dec Prosinec A portrait of typical Czech customer: Price versus brand loyalty 66%: First I will find what to buy, then I go to the e-shops to compare offers 27%: I go straight to the trusted e-shop and search there 5%: My shopping decision is based on recommendations of friends 1%: Based on advertising 1%: Other reason A portrait of typical Czech customer: Who ships – and how´s the delivery? Shipping company / type of delivery Czech Post Czech Post PPL CoD parcel DPD Czech Post Prague Courier upfront payment A portrait of typical Czech customer: Why do you buy on the Internet? 40% 35% 34% 30% 25% 24% 17% 20% 14% 15% 10% 5% 6% 5% 0% Money saving Time saving Best-quality products A nice way to Other reasons spend time Hard to say A picture of typical Czech customer: How do you pay? CoD Card bank personally! transfer Card At the Reiffeisen PaySec online cashdesk A picture of typical Czech customer: Shopping while at work (is our sport) Ráno, odpoledne nebo večer? Morning, afternoon or in the evening? 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Working hours 16 17 18 19 20 21 22 23 24 A portrait of typical Czech customer: Average order size (in EUR) 35,00% 30,00% 25,00% 20,00% 15,00% 10,00% 5,00% 0,00% 0-500 0-25 501-999 25-50 1000-1499 50-75 1500-1999 75-100 2000-2999 100-150 3000 a více 150+ O lo m a a HK St ře dn íČ ec hy ý ez sk ý Ka rlo va rs ký ěr Pr ah a Pr ům or av sk os l a or av sk ý Li be re ck ý om Pa rd ub ick M ze ňs ký lí n sk ý ou ck ý, Z Pl Jih A portrait of typical Czech customer: Regional differences? None 2000 1800 1600 1400 1200 1000 800 600 400 200 0 E-shop systems for small companies - the Czech market • The Czech Republic and e-shops producers: • General information • Technology and quality differences • Open Source platforms don´t gain strong positions • Customers and e-commerce • Czech e-shops solutions: inShop, ShopSys, ShopTet, OXID eShop, Ready2Go, FastCentrik and others… FastCentrik - CASE STUDY 2008 about Low-cost shopping cart software offered through rental payments. Ready within 24 hours, amazing functionality, custom graphics, free updates and excellent support. • NetDirect is market leader in e-shops for medium and large sized companies in the Czech Republic • September – talk about crises begins • Desicion to create e-shops for smaller companies by the end of the year • December – FastCentrik is introduced to the market 2009 • Product becomes very popular in Czech and Slovak Republics • Turnover increases from 48 mil to 61 mil largely due to FastCetnrik 2010 • E-shop already ordered by nearly 1000 customers and rate of sales continues to grow • English and Polish versions launched, company prepares for entrance into other markets FastCentrik – REASONS FOR SUCCESS • Identification of target market segment and its needs • Market survey showed that some competitors are selling products priced from 100 CZK / month Conclusion • Our product must be superior – 100 CZK / month (15 Zł) is not profitable Strategy • Enter the market with a higher price but overwhelmingly higher quality and service Results goal Fair and friendly communication, the key factor in customers’ motivation to buy this product and stick with it • Price 2290 CZK / month (352 zł) • Free of charge – updates, training, manual, video-manuals, books, top quality support, phone lines and chat, connections to financial systems FastCentrik – CONCLUSION We established ourselves in a market in which we had zero share and where the existing competition provided lower cost products. We managed to convince the market that high quality software and support services were worth paying more for. For more information go to www.NetDirect.pl or www.FastCentrik.pl. Ladies and gentlemen, thank you for your attention. If you have any questions, we'd be happy to answer them now.