Jobs, B`Ham

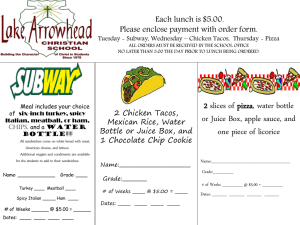

advertisement

Tapered, Challenged, and Changed . (Does anyone remember Curtis Enis?) US Bank Outlook Forum December 9, 2014 Hart Hodges Western Washington University Improved National Forecast • • • • • • • Less Fiscal Drag Employment Gains Net Worth Rebound Real Disposable Income Rising Better Balance Sheets State and Local Finances Better Housing’s Unsteady Climb • But! • Global Growth Worries Intensified-Impacts Through Trade, Exchange Rates, Interest Rates, Commodity Prices Questions & Themes • Why the continued urbanization? – “The World is Flat”… • Related: – Are we more urban or more rural? – Structural change, or just delayed growth? • Getting behind aggregate and average figures – Population – Retail sales Jul-14 Apr-14 Jan-14 Oct-13 Jul-13 Apr-13 Jan-13 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 Jan-10 Oct-09 Jul-09 Apr-09 Jan-09 Oct-08 Jul-08 Apr-08 Jan-08 Oct-07 Jul-07 Apr-07 Jan-07 Percent Employment Growth: • Why the Difference ? 110 105 Seattle 100 95 B’Ham Mt. Vern 90 85 Oct-14 Jul-14 Apr-14 Jan-14 Oct-13 Jul-13 -6% Apr-13 Jan-13 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 Jan-10 Oct-09 Jul-09 Apr-09 Jan-09 Oct-08 6% Jul-08 Apr-08 Jan-08 Oct-07 Jul-07 Apr-07 Jan-07 Uneven Recovery Across Washington Employment Relative to Prerecession Peak 4% Seattle 2% WA 0% -2% -4% B’Ham -8% -10% Washington highlights: • Above-average recent growth in key indicators, including employment, personal income, auto sales. • Boeing backlog at nearly 9 years and still growing. • Led by Amazon.com, Seattle-area economy powers ahead. Copyright © 2014 Michael J. Parks Key risks for Washington: • Global economic slowdown that could erode Boeing’s record backlog. • Hard economic landing in China, Japan or Europe, or all three. • Rising dollar and widened Panama Canal erode export competitiveness Copyright © 2014 Michael J. Parks 1,600,000 Seattle 1,300,000 75,000 70,000 1,200,000 B’Ham 1,100,000 900,000 65,000 60,000 55,000 1,000,000 50,000 45,000 Jobs, B’Ham 1,400,000 Jan-90 Dec-90 Nov-91 Oct-92 Sep-93 Aug-94 Jul-95 Jun-96 May-97 Apr-98 Mar-99 Feb-00 Jan-01 Dec-01 Nov-02 Oct-03 Sep-04 Aug-05 Jul-06 Jun-07 May-08 Apr-09 Mar-10 Feb-11 Jan-12 Dec-12 Nov-13 Jobs, Seattle Looking Back… 95,000 1,500,000 90,000 85,000 80,000 Factors to Consider • Larger industry trends • Population • Number and concentration of jobs in an area – Agglomeration (place matters) • Wealth ? – Mobility – The freedom/ability to make lifestyle choices Larger Industry Trends Two industry sectors accounted for 45.2 percent of the net job growth over the last two years • Professional & Technical Services • Leisure & Hospitality The geography of this job growth has been uneven, with significant implications for wage growth Nov-13 Dec-12 Jan-12 Feb-11 Mar-10 Apr-09 May-08 Jun-07 Jul-06 Aug-05 Sep-04 Oct-03 Nov-02 Dec-01 Jan-01 Feb-00 Mar-99 180,000 6,500 160,000 5,500 B’Ham 140,000 4,500 120,000 3,500 100,000 2,500 Jobs, B’Ham 220,000 Apr-98 May-97 Jun-96 Jul-95 Aug-94 Sep-93 Oct-92 Nov-91 Dec-90 Jan-90 Jobs, Seattle Prof and Business Services 9,500 240,000 8,500 Seattle 7,500 200,000 Population • Variations in population growth in different regions • Different regions appear to have different key cohorts – 25-34 year olds in King County – 35-44 year olds in Whatcom County Variation in Population Growth Average Annual Percent Change 1980 1989 1990 1999 2000 2009 2010 – 2013 2013 King 1.80 1.59 1.01 1.69 1.84 Skagit 2.16 2.96 1.37 0.49 0.66 Whatcom 1.68 2.93 1.96 0.80 0.69 Immigration and Emigration Cohort 25 - 29 30 - 34 35 - 39 Etc. 60 - 64 65 - 69 2002 2007 2012 Cohort Differences 47 35-44 45 Million People 43 41 25-34 39 37 35 1990 1995 2000 2005 2010 Jan-14 Apr-13 Jul-12 Oct-11 Jan-11 Apr-10 Jul-09 Oct-08 Jan-08 Apr-07 Jul-06 Oct-05 Jan-05 Apr-04 Jul-03 Oct-02 Jan-02 Apr-01 Jul-00 Oct-99 Jan-99 Seattle 180,000 6,500 160,000 5,500 140,000 4,500 B’Ham 120,000 3,500 100,000 2,500 Jobs, B’Ham 220,000 Apr-98 Jul-97 Oct-96 Jan-96 Apr-95 Jul-94 Oct-93 Jan-93 Apr-92 Jul-91 Oct-90 Jan-90 Jobs, Seattle Economic trends and demographics 9,500 240,000 8,500 7,500 200,000 Nov-13 Dec-12 Jan-12 Feb-11 Mar-10 Apr-09 May-08 Jun-07 Jul-06 Aug-05 Sep-04 Oct-03 Nov-02 Dec-01 Jan-01 Feb-00 Mar-99 Apr-98 May-97 Jun-96 Jul-95 Aug-94 Sep-93 Oct-92 Nov-91 Dec-90 Jan-90 Jobs, Seattle 6,500 180,000 160,000 5,500 140,000 4,500 120,000 3,500 100,000 2,500 Jobs, B’Ham Wealth ? 9,500 240,000 8,500 220,000 7,500 200,000 No Recovery in Construction Govt Accom Seattle Health Mngt Prof/Tech Info B’Ham Retail Mfg Const -40 -30 -20 -10 0 10 Percent Change, 2005 - 2013 20 30 40 Where the money is Thousands $70 Average annual wage $65 $60 $55 King and Snohomish Counties $50 Rest of state $45 $40 $35 $30 2004 2005 2006 2007 2008 2009 2010 2011 2012 Data: Bureau of Labor Statistics via Washington Economic and Revenue Forecast Council Copyright © 2014 Michael J. Parks 2013 2014 Wage Growth Depends on Job Mix Percent of Jobs King+ Whatcom Seattle Wage Premium 4.5 0.4 $28,500 (48,400 jobs) (255 jobs) Retail Salesperson 4.4 5.4 Cashiers 2.4 3.7 Food Prep & Serv (including Fast Food) 2.2 1.2 Computer Programmers 1.3 0.4 $34,500 Market Research Specialists 1.0 0.3 $25,000 Computer & Info System Mngrs 0.7 0.2 $46,800 Software Developers, Applications Retail $800 Blaine, Sumas, & Uninc.. $700 (Bellingham) $600 Million $ $500 $400 $300 $200 $100 $0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 • Employment – up ~1.5% – Assuming continued strength nationally with lower oil prices and other factors (risks to the downside) – Still trailing Seattle • Population – slight increase in growth rate (~1%) • Retail Sales – up 2-3% – Rising slightly with population and employment; also more even in distribution • Unemployment – continued slow decline • Wages – up 3% – Assuming stronger job growth in Prof. & Tech Services