Understanding Food Systems and Their Prospects

advertisement

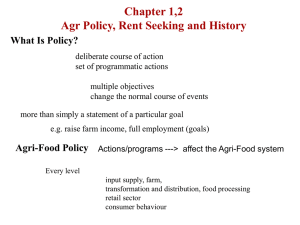

Understanding Food Systems and Their Prospects for Economic Development Stephen Vogel* (svogel@ers.usda.gov) Farm Economy Branch Resource and Rural Economics Division Presentation sponsored by the Russell Van Nest Black Lecture Fund, the Department of City and Regional Planning, the Dyson School of Applied Economics and Management, the Food, Agriculture and Nutrition Group, and the New World Agriculture and Ecology Group Mann Library, Cornell University, Ithaca, NY, April 10, 2014 *The views expressed here are those of the author and may not be attributed to the Economic Research Service or the U.S. Department of Agriculture. Understanding Food Systems and Their Prospects for Economic Development The questions: • View from the farm gate – does ‘local’ matter? • What are dynamic drivers shaping local and regional food systems? • Farm-community linkages – can they become pivots in economic development? Understanding Food Systems (FS): The Basics • Retail Agriculture – Farmers’ response to consumer demand met through innovative marketing channels (Matteson & Hunt, 2012). Regional Food Hubs & E-commerce Aggregators Retailers, Institutions Farmers’ markets & CSAs National markets Large Organic Farms & Cooperatives Roadside stands & pick your own Urban Agriculture? Local (county) markets • Local & regional food systems – specific geographic subsets of retail agriculture. • Shared Values shape market transactions (Feenstra, 1997). Food Systems Agriculture: How large is it? Matteson & Hunt (2012) approach: • 2008: $7.6 Billion = $4.8 Billion in Local Foods + $2.8 Billion in organic sales • Later: $7.85 Billion = $4.0 Billion in Local Foods (2008-11 ave) + $3.5 Billion organic sales (2011) + $355 Million Farm to school sales (2012) Sources: survey based estimates by USDA. • Larger than the 2008 value of production of cotton and rice combined. • National data collection systems not equipped to measure true scope. Food Systems Agriculture: Is this sector growing? Since 2004, growth in -(8,144) Farmers’ Markets Regional Food Hubs (236) School Districts With Farm-toSchool Programs (3,812) 0 200 400 600 Percent Change 800 1000 Sources: USDA, Agricultural Marketing Service, Food Nutrition Service; National Food to School Network Private sector metrics: • • Grocers’ sourcing of local farm products – #1 new trend (A.T. Kearny, Inc., 2013). Seven of the top 10 food retail chains in US now promote local sourcing (Martinez et al., 2010). • #1 trend in restaurants ( National Restaurant Association, 2012). Punch line: emerging sector moving along its product life-cycle path. Research: Shared Values Are Broad and Pervasive Embeddedness – social relationships generating trust and reciprocity. Early studies – face-to-face transactions (Hinrich, 2000); • ‘social’ vs ‘natural’ embeddedness (Murdoch, et al, 2000); • defensive localism (Winter, 2003; Hinrich, 2003). Later studies – Scaling up and preserving FS social capital (Mount, 2011); • Consumerism to consumer empowerment (Dubuisson-Quellier & Lamaine, 2008). Willingness to pay (WTP) – consumer preferences (Adams and Salois, 2010): Early studies – little support for ‘local’ vs organic food viz. credence cues (fairness, ecological & economic viability of farms and communities). Later studies – strong support for local foods’ credence attributes vs ‘organic’; • preferences not dependent on market channel (Toler, et al., 2009); • defensive localism (Costanigro, et al., 2014); • local ownership vs distance (Adams & Adams, 2011). Understanding Food Systems: Conceptual Framework • Propositions in economic history guiding our inquiry: • Institutions govern how markets function -- North (1990). • Macroinventions can drive microinventions – Mokyr (1990). • Institutional change occurs when entrepreneurs reduce the transaction costs of uncertainty in a changing environment – North (1990, 2005). • FS supply and demand system (modified Antle, 1999): XD = D(P, I, N, C, Q, SV(?) ) XS = S(P, W, K, T, Q, SV(?) ) • SV( ) = arguments in the shared values function: The dynamic drivers shaping food systems in the long run. Arguments in the Shared Values Function: Dynamic Drivers 1) Exit, Voice, and Loyalty, A. Hirschman (1971). • • • Exit –dissatisfied consumers exit the market. Voice – consumers express dissatisfaction in social & political spheres. Interaction between ‘exit’ and ‘voice’ can stimulate market/social transformation. 45 40 35 30 25 20 15 10 5 0 2,000 FB Title XXI – Org. Cert. Act of 1990 (27) USDA/SARE (1989) HFHC (2005) NSAC (1994) (39) 1,500 (30) IFS - Kellogg (1993) 1,000 (18) Kellogg Found. (1980) 500 0 1977 1981 FB sections 1985 1990 1996 Farm Bill Years FS stakeholder groups 2002 2008 2014 FB manditory funding Sources: Vogel & Matteson, 2014; Texts of Farm Bills, 1977-2014 - National Agricultural Law Center; Sustainable Agriculture Coalition, 2008; National Farmers Union, 2013. Millions of Dollars Number Alternative agriculture: Farm Bill legislation and stakeholder major groups Dynamic Drivers . . . 2) Information & Communications Technology (ICT) Internet 1.0 (1990s): • Facilitates the growth in the consumer demand for farm products based on non-price characteristics (Streeter, et. al, 1991; Antle, 1999). • Improves efficiencies of scale economies in the agri-food system (Antle, 1999). Internet 2.0 (2000s): • Weakens economies of scale in the food supply chain (Guptill and Wilkins, 2002) : • National Market Maker (Goyal, 2014). • Organic Valley (Stevenson, 2013). • Reduces the transaction costs of organization (Campante, et al., 2013); amplifies ‘voice’ (Know Your Farm Know Your Food Compass). • Diffusion of tacit knowledge through virtual or hybrid innovation communities (Preissl, 2003; Grabher and Ibert, 2014). Dynamic Drivers . . . 3) Social Entrepreneurship and Shared Value Creation. • Social entrepreneurship ventures (Abu-Saifan, 2012) : • Non-profit or for-profit enterprises. • Innovation and diversification built into growth strategies. • DC Central Kitchen • Shared-value creation (Porter & Kramer, 2011) • Companies create new sources of economic value by addressing societal needs. • Redefining value chain productivity leads to local cluster development. • Wal-Mart’s commitment to local sourcing of 10% of fresh food. 4) Extramarket organizations • Nonmarket motivations driving public discourse: • Medical profession – industrial food supply chains are major contributors to the ‘obesogenic environment’ (Swinburn, et al. & Gortmaker, et al. in Lancet, 2011) • Healthy Food in Health Care – consortia of 53 health systems developing farmto-hospital market channels. Public sector initiatives - Response to stakeholders’ ‘voice’ and buy-in? Federal level: • 2008 Farm Bill - watershed legislation (CRS, 2012). • Know Your Farmer Know Your Food Initiative – removing organizational ‘silos’ between USDA programs. • USDA funding of FS projects $337 million, 2009-2012. • Food hub project buy-in 2011-2012 – 76% of federal funds are from Depts. of Commerce, Transportation, Treasury, Health &Human Services, and Housing &Urban Development. Data sources: USDA, Agricultural Marketing Service. State level: • Illinois Food, Farms, and Jobs Act of 2007 (goal) – 20% of fresh food sales to be supplied by the state’s farmers. • Louisiana Buy Local Purchase Incentive Program (2011) – 4% cash rebate to restaurants on purchases of locally produced food. • Virginia First Lady announces local foods initiative promoting healthy food access linked to local agricultural economic development opportunities (governor.virginia.gov, 2014) . The process of economic development, as distinct from mere economic growth, entails dynamic change not only in production patterns and technology but also in social, political and economic institutions . . . – Irma Adelman Farm-Community Linkages in Food Systems Agriculture – Development Pivots? • Structural Linkages – • Structurally adjusted multiplier studies (Jablonski & Schmitt, 2014) . • Confirm case studies finding more value-added income retained locally (King, et al., 2010) . • Flow Linkages – • Direct linkages - food systems farmers collectively spend on average $176,000 more on inputs per $1 million in gross farm sales than non-participating farmers (ARMS, 2008-2011) . • Development focus – indirect household consumption linkages may be more important than direct ones (Mellor, 1976; Haggblade & Hazell, 1989; Vogel, 1994). • Indirect linkages - food systems farm households collectively spend on average $213,000 more per $1 million in gross farm sales than non-participating farmers (ARMS, 2008-2011) . Farm-Community Linkages . . . Dynamic linkages – facilitate ‘virtuous cycles’ in local food system clusters: • Institution/social enterprise collaborating in market channel development. • • Virtual and hybrid enterprises providing aggregation, technical services, and outreach to stakeholders. • • Gunderson Lutheran Health System/Fifth Season Cooperative Local Harvest, FoodHub Stakeholders need to develop their own virtual innovation clusters. Food Hubs – Can they become dynamic anchors? • • Key organizational link sustaining food system shared values? Flexible expansion/diversification of enterprise services addressing bottlenecks arising in the growth process? Local Food Hub (Charlottesville, VA) Conclusion Q: Can food systems agriculture be a source of economic growth? A: It’s too early to tell, but pieces are being put in place. We observe: • • • Food system agriculture is transforming a segment of US ‘farm-to-fork’. Dynamic factors continue to push its innovation envelop. Food systems farmers generate larger local linkages. Research and data needs: • • More – all aspects of local & regional food systems across all of the social science disciplines. More emphasis on the farm family business (enterprise-centric), less on the family farm business (production sector-centric).