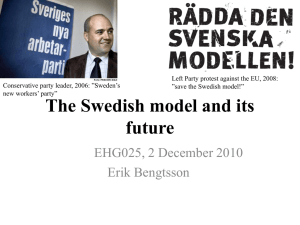

Sweden

advertisement